Author: HotairballoonCN

Compared with other cross-chain bridges, Orbiter mainly focuses on cross-chain transactions between Ethereum Layer2 networks, as well as between Ethereum Layer1 and Layer2. It inherits the security of the Ethereum mainnet and uses EOA addresses. In addition, Orbiter supports native assets. Therefore, Orbiter has significant advantages in terms of security, speed, and fees.

1. Industry Trends and Current Situation

The emergence of blockchain technology brings many advantages such as distributed ledgers and decentralization. However, it also leads to relatively isolated ecosystems for each blockchain. Different blockchains cannot directly interact, which poses many limitations and challenges for the application of blockchain technology. Therefore, achieving interoperability between different blockchains has become an important issue.

To solve this problem, cross-chain bridge technology has emerged. Cross-chain bridges are a technical means to establish connections between different blockchains and enable cross-chain communication and asset transfers.

- Hackers are relentless in July, with the total amount of money involved in various security incidents reaching 415 million US dollars.

- Messari In-depth analysis of decentralized social protocols Lens and Cyber Connect

- Messari Fantom Q2 2023 Performance

Through cross-chain bridges, users can transfer assets from one blockchain to another and execute cross-chain smart contracts, promoting the integration and development of the blockchain ecosystem.

Therefore, cross-chain bridges are one of the key technologies for achieving interoperability between different blockchains and are of great significance for the practical application and promotion of blockchain technology.

1. Maturing Cross-Chain Bridge Technology, Increasing Demand and Significance

In the past, users generally completed cross-chain operations through centralized exchanges, such as transferring assets to centralized exchanges and then withdrawing them to the target chain.

With the continuous improvement of public chain ecosystems and the popularization and development of DeFi technology, the use cases for digital assets have increased, and liquidity has significantly improved.

For example, there is a growing demand for cross-chain asset transfers when participating in staking and financial management in DApps on different chains. This has led to the emergence of cross-chain bridge applications. Nowadays, people are increasingly inclined to use cross-chain bridge technology directly to transfer assets between different chains instead of relying on centralized exchanges for cross-chain operations.

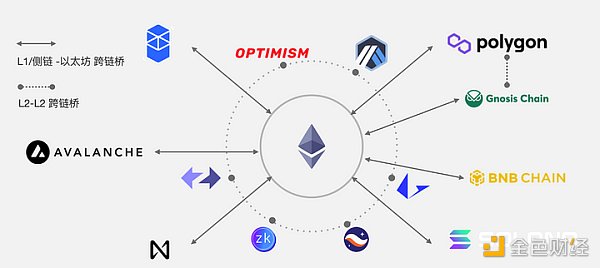

2. Rollup Cross-Chain Bridges for Different Layer2 Solutions

In the current landscape of public chains, the development of the Ethereum ecosystem is still the most mature and complete. More and more DApps choose to develop on the Ethereum ecosystem.

However, Ethereum is often referred to as the “Noble Chain” because it has relatively high gas fees and the transaction speed may not meet the needs of DApps with high real-time requirements. As a result, more and more Ethereum Layer2 solutions have emerged. These solutions not only improve performance but also inherit the underlying security of Ethereum.

For example, Arbitrum, Optimism, Starknet, and Zksync, known as the four kings of Ethereum Layer2, have developed rapidly and formed their own ecosystems, accumulating a large number of users and assets in their respective Layer2 ecosystems.

The prosperity of the Ethereum Layer2 ecosystem has also created a demand for cross-chain assets in the Ethereum Layer2 ecosystem, and Orbiter Finance has emerged in this background.

In the past Layer2 framework, rollups could not be directly transferred between each other.

If a user wants to transfer assets from Rollup A to Rollup B, they often have to wait for a long time.

1) Transfer assets from Rollup A to the mainnet;

2) Transfer assets from the mainnet to Rollup B.

The mainnet acts as an intermediary, and both transfers need to go through the Ethereum mainnet, which is not only slow but also incurs gas fees twice, resulting in high time and gas costs.

However, the emergence of cross-chain bridges like Orbiter has built a bridge between different Ethereum Layer2s, greatly improving the interaction efficiency between Ethereum Layer2s and promoting the flow of digital assets, which will release value.

2. What is Orbiter Finance

Orbiter Finance is a decentralized cross-rollup bridge that allows users to cross-chain assets between Ethereum mainnet, StarkNet, zkSync, Loopring, Arbitrum, Optimism, Polygon, Immutable X, and BNB Chain.

Through its unique market-making model, Orbiter Bridge provides users with low fees, fast speed, and other excellent experiences. Currently, it only supports transfers of ETH, USDC, USDT, and DAI.

3. Financing Situation

In November 2022, Orbiter completed its first round of financing. Participants in the financing include Tiger Global, Matrixport, A&T Capital, StarkWare, Cobo, imToken, Mask Network, Zonff LianGuairtners, but the financing amount was not disclosed.

In addition, Vitalik has donated 16 ETH to Orbiter.

4. Features of Orbiter Finance

1. Security

Based on the security of rollup technology, Orbiter does not have the risks of Layer1 Layer1 cross-chain bridges.

Firstly, it is important to understand that Orbiter Finance aims to solve the problem of cross-rollup, not cross-chain (heterogeneous chain).

Strictly speaking, Orbiter is a cross-rollup bridge, not an asset cross-chain between two completely independent (heterogeneous) blockchains (e.g., from the Bitcoin network to the Ethereum network).

When it comes to the asset cross-chain between two independent heterogeneous blockchains (Layer1 Layer1), the security of the cross-chain protocol follows the bucket theory, which means that the security of the cross-chain protocol is limited by the security of the chain with lower security.

Ethereum founder Vitalik has written an article on this topic, in which he proposes a concept called shared security, which means exactly that.

For example, A and B are two heterogeneous chains, with A chain having higher security and B chain having lower security.

So, when assets are transferred between these chains, the security is determined by the security of chain B (the one with lower security).

The main goal of cross-chain projects is to ensure the security of transactions between two unique chains and avoid 51% attacks.

However, cross-rollup projects use the same Ethereum data layer, and each rollup can prevent 51% attacks. Based on this, Orbiter proposes a cross-rollup mechanism that can inherit Ethereum L2 security.

In other words, Orbiter enables cross-chain asset transfers between different Ethereum Layer2 solutions.

For example, Orbiter can facilitate cross-chain transfers between zkSync and Arbitrum, which are homogeneous chains.

Whether it’s zkSync, Arbitrum, or Orbiter, all three are built on top of Ethereum and inherit the security of the Ethereum network, which prevents 51% double-spending attacks.

In addition, Orbiter’s mechanism for preventing malicious behavior and excessive collateral also ensures the security of user assets during cross-chain operations.

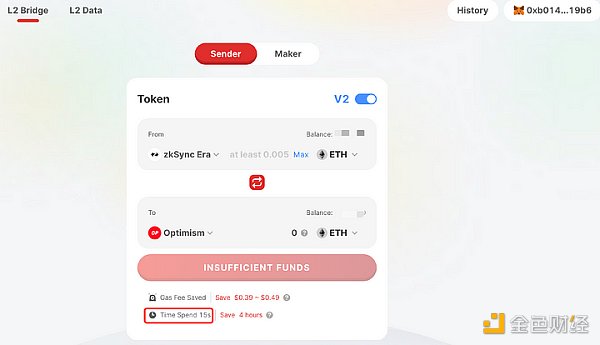

2. Low Cost & Instantaneous

In the Orbiter cross-chain protocol, asset transfers occur between the Sender and Maker’s EOA addresses on the source and target networks, without the involvement of contract addresses. This is a significant difference between Orbiter and other bridging protocols.

EOA stands for Externally Owned Account, which is the most commonly used account type for individuals in blockchain. It is different from contract accounts that have interactive capabilities.

What are the benefits of using EOA addresses in the Orbiter cross-chain protocol?

The biggest advantage is that it is cost-effective and fast.

By eliminating unnecessary contract interactions and the need for a dedicated intermediary to mint/burn assets, transfers occur directly between the Sender (asset swapper) and Maker (liquidity provider who fulfills cross-chain exchange demands).

Most traditional cross-chain bridges take around 10 minutes or longer to complete asset transfers, but with Orbiter, users can complete asset transfers on average within 30 seconds.

3. Support for Native Ethereum Assets

In the Orbiter cross-chain protocol, there’s no need to mint assets.

As we all know, Bitcoin, as the highest market value cryptocurrency, has not fully utilized its liquidity potential due to high gas fees and slow transaction speeds.

In order to bring the highest market value cryptocurrency BTC into the Ethereum DeFi ecosystem and promote its liquidity, a common practice is to wrap BTC, for example, by wrapping it into an ERC20 token on Ethereum called WBTC. This allows for the release of BTC’s liquidity potential, and it is also a form of cross-chain approach.

But the Orbiter cross-chain protocol supports native assets of Ethereum and does not require packaging.

How does Orbiter achieve cross-chain? Let’s take an example to understand.

For example, A wants to transfer its 0.1ETH from the zkSync chain to the Arbitrum chain.

The general process of cross-chain using Orbiter (excluding fees) is as follows:

1) A, as a Sender, transfers 0.1ETH from zkSync to the address of B (one of the Makers, which can be understood as a cross-chain service provider). This step only happens on the zkSync chain.

2) B, as a Maker (cross-chain service provider), receives 0.1ETH on zkSync.

3) After receiving 0.1ETH on zkSync, B transfers 0.1ETH to A’s Arbitrum address on the Arbitrum chain. This step only happens on the Arbitrum chain.

4) B receives 0.1ETH on the Arbitrum chain.

Throughout the cross-chain process, there is no need for asset packaging or other steps. It is the transfer of native assets between different addresses.

In this process, the two token transfers occur on the Ethereum Layer2 network, where the transaction fees are very low and the speed is faster.

Let’s take an inappropriate example.

This is like communication between Chinese and American people. Due to different languages, cultures, and religious beliefs, communication between the two parties requires an intermediary translator, which of course incurs higher costs.

However, if it is communication between people from Hunan and Hubei provinces in China, because they have similar cultural backgrounds and beliefs, there is no need for a translator as an intermediary, and communication is much smoother and costs much lower.

5. Operation Mechanism

1. Two Roles

In Orbiter Finance, there are two roles: Sender and Maker.

Sender is the initiator of cross-chain transfer and the demander of cross-chain, while Maker is the liquidity provider and the counterparty of Sender, that is, the recipient of cross-chain service.

When Sender initiates a transfer, Maker provides liquidity, and the smart contract ensures the security of the entire process.

Before Maker provides cross-rollup to Sender, Maker needs to deposit extra collateral in the Orbiter contract and set the fee rules in the protocol.

In the execution process, Sender sends assets to the Maker on the Resource network, and the Maker sends assets back to the Sender on the target network.

If the Maker behaves maliciously, for example, after receiving assets from Sender, the Maker does not transfer to the Sender on the target network.

At this time, the Sender can initiate an arbitration request to the contract with the Maker’s collateral and then receive excessive compensation.

2. Maker Operation Process

In the Orbiter cross-chain protocol, a client will be provided to the Maker. Of course, the Maker can also deploy a client by themselves, so that the automation of the refund process can be achieved, and some backend operations of the Maker can be automatically completed.

In this client of Maker, it will listen to the data of the user’s cross-chain currency, amount, and cross-chain network, and based on the data it listens to, the client can perform corresponding automated operations. This is a normal process.

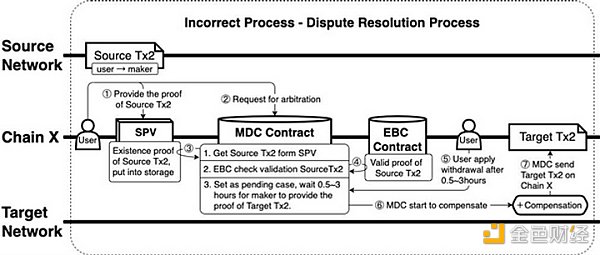

3. Decentralized Anti-Malicious Mechanism

However, Maker is also capable of malicious behavior.

To deal with the problem of Maker’s malicious behavior, Orbiter adopts a solution of “pre-trust + dispute arbitration”.

Orbiter defaults to trusting Maker, assuming that these Makers will handle assets correctly and return the corresponding assets to users. However, Maker has the potential for malicious behavior, such as withholding the user’s assets after receiving the cross-chain user’s assets and not returning the assets to the user on the target chain.

Therefore, Orbiter adopts a set of decentralized mechanisms, mainly implemented through three contracts: MDC, EBC, and SPV, to prevent Maker from acting maliciously.

1) MDC Contract

MDC stands for Market Deposit Contract.

The MDC contract has two functions: safeguarding Maker’s margin and handling the return and compensation of Sender’s funds.

2) EBC Contract

EBC stands for Event Binding Contract.

This contract is used to prove the validity of transactions on the source network and the target network.

3) SPV Contract

SPV stands for Simple Payment Verification.

It is a simple transaction verification contract used to prove the existence of transactions on the source network.

For example, if Sender sends 0.1 ETH to Maker on Arbitrum, SPV is used to prove the authenticity of this transaction.

Then, through these three contracts, a mechanism will be implemented, and Orbiter can ensure that users do not suffer asset losses when Maker acts maliciously.

If Sender transfers tokens to Maker and Maker fails to send the tokens back to Sender correctly, the dispute resolution process will be carried out as follows to help Sender retrieve the tokens:

1) Sender needs to provide the relevant transactions on the source network to the SPV contract.

2) Sender applies for arbitration through the MDC contract of Orbiter.

3) The MDC contract obtains proof of the existence of transactions on the source network from the SPV contract and confirms that the transaction has occurred on the source network.

4) The MDC contract obtains proof of the validity of transactions on the source network from the EBC contract. The MDC contract confirms that the transaction on the source network is legitimate according to Orbiter’s rules and that the transaction was sent by Sender to Orbiter’s Maker with a valid identifier.

5) The MDC contract sets this arbitration as a pending case, and Maker needs to provide transactions on the target network within 0.5 to 3 hours.

If Maker can provide the correct transactions on the target network within the specified time, the MDC contract can obtain proof of the validity of the transactions on the target network from the EBC contract, confirm the matching of transactions on the target network and the source network, close this arbitration, and display the transactions on the target network to Sender;

On the contrary, if Maker fails to provide transactions on the target network within the specified time, the Sender can trigger the MDC contract to arbitrate.

6) The MDC contract starts compensating the Sender.

7) The MDC contract will send the tokens and compensation (about $15) back to the Sender on the deployed domain of the MDC contract. The tokens returned and compensated to the Sender will be deducted from Maker’s collateral.

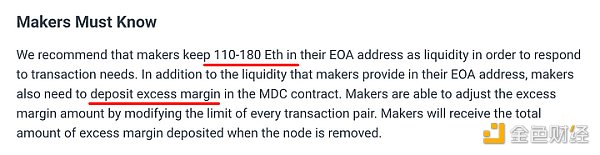

4. Excess Margin Mechanism

In addition, to prevent malicious behavior by Maker, Orbiter Finance has also introduced an excess margin mechanism.

In the Orbiter protocol, Maker needs to provide two parts of funds, one for liquidity, which is the funds exchanged for users, and the other part is excess margin.

If Maker’s dishonesty prevents the Sender from receiving tokens on the target network as scheduled, all losses incurred by the Sender will be paid from the excess margin, and the Sender will also receive compensation, which is also from Maker’s excess margin.

So, does Maker have enough motivation to provide better services in the Orbiter protocol?

Firstly, in the Orbiter mechanism, Maker can obtain considerable income from each cross-chain service (without impermanent loss risk).

Secondly, if Maker fails to send the correct information to the Sender in a timely manner, Orbiter’s MDC contract will send it back and compensate the Sender with Maker’s margin.

Therefore, Orbiter’s design can not only prevent malicious behavior by Maker, but also incentivize Maker to provide better services.

5. Fees

For the Sender, Orbiter’s fees include transaction fees and prepayment fees.

Transaction fees: paid to the platform and Maker, charged as a percentage of the transfer amount.

Prepayment fees: prepaid fees to Maker, used for gas fees when Maker makes transfers on the destination network.

Due to the volatility of gas fees, Orbiter will adjust the fees based on the Gwei of the destination network to ensure that Orbiter’s fees are lower than the average level, but this adjustment is not frequent.

Six, Orbiter Advantages

1. Cross-Chain Speed and Fees

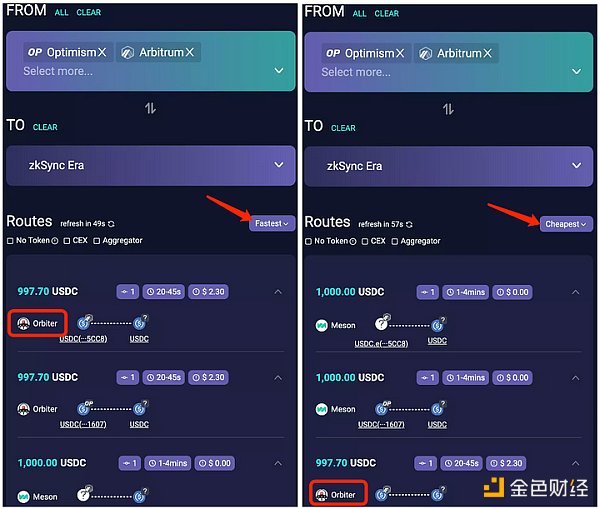

We can check the speed and fees of some cross-chain bridges on Ethereum L2 through https://chaineye.tools/bridge.

Suppose we transfer 1000 USDC from OP chain/ARB chain to ZK chain, let’s take a look at the fees and speed of these cross-chain bridges:

As we can see, Orbiter is the fastest, completing the cross-chain transaction in about 20-45 seconds, while the second-ranked Meson takes 1-4 minutes.

And in terms of transaction fees, Orbiter ranks second, but the top-ranked Meson has a fee of 0. Meson has a daily quota of 5 transactions/$5000 free of charge.

In the same scenario, let’s take a look at the time required by other cross-chain bridges:

-

Layerswap: 2-5 minutes, fee: 2.44U

-

bungee: 2-10 minutes, fee: 4.77U

-

cBridge: 5-20 minutes, fee: 4.62U

When performing cross-chain operations, speed and cost are both important factors. By comparing, we can see that Orbiter is excellent in terms of overall speed and transaction costs, especially its cross-chain speed is much faster than other cross-chain bridges.

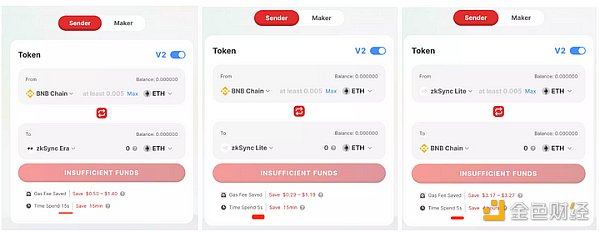

In the Orbiter cross-chain bridge, the time required for cross-chain transactions is usually around 30 seconds. The slowest is the Ethereum mainnet, which takes about 45 seconds to cross to the Layer 2 network or vice versa. The fastest is the cross-chain between BNB chain and ZK chain, which can complete asset cross-chain in just 5 seconds. Other Ethereum Layer 2 cross-chain bridges generally require more than 2 minutes.

2. Security

In the Orbiter cross-chain protocol, decentralized anti-fraud measures and over-collateralization mechanism prevent market makers from being inactive after receiving funds, ensuring the security of user funds and enhancing the protocol’s security.

In addition, Orbiter is built on Ethereum and inherits the security of Ethereum, so Orbiter has advantages in ensuring fund security.

3. Active Users

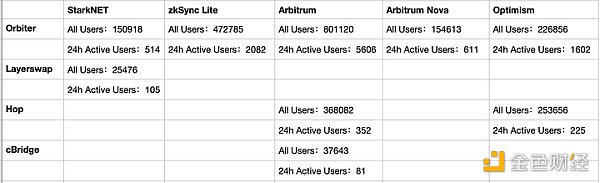

You can check the active users of some cross-chain bridges at https://www.orbiter.finance/data.

According to data statistics from the Orditer L2 Data platform, Orbiter has advantages in terms of active users and user breadth.

4. Official Endorsements and Recommendations

Orbiter cross-chain bridge is recommended by the official website of StarkNET and is ranked first.

Zksync’s official website also recommends Orbiter in the cross-chain bridge section.

Optimism also recommends Orbiter cross-chain bridge in its ecosystem’s cross-chain bridge subprojects.

With official endorsements, Orbiter naturally gains trust and is likely to attract more users.

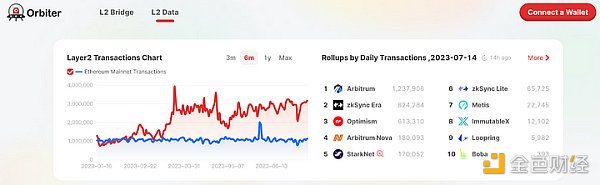

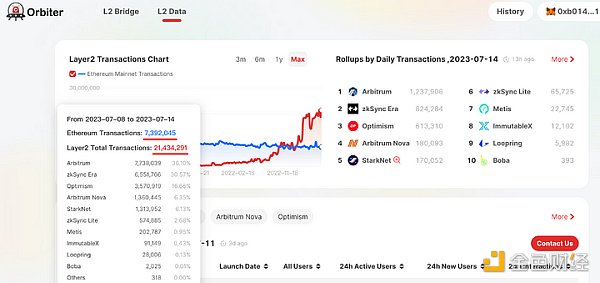

5. L2 Data

In addition to cross-chain functionality, Orbiter has also launched an L2 Data (data dashboard).

L2 Data supports Arbitrum, Optimism, Starknet, and zkSync data, including metrics such as accounts and transactions, TVL, users and user age, active user ratio, new user ratio, interactions, new contracts, etc.

Orbiter L2 Data is committed to providing more comprehensive, scientific, and effective Rollups on-chain data for individual investors, institutions, and developers.

L2 Data is also a unique feature that sets Orbiter apart from other cross-chain bridges.

Seven, Future Outlook

1. Cancun upgrade, L2 explosion, increased cross-chain demand

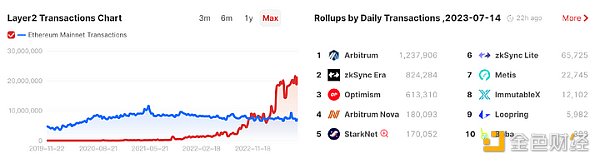

According to the statistics from Orbiter L2 Data (https://www.orbiter.finance/data) platform, since the end of last year, the total number of transactions on Ethereum L2 has surpassed the number of transactions on the Ethereum mainnet.

Currently, the total number of transactions on Ethereum L2 is more than three times that of the Ethereum mainnet, including a large number of interactive behaviors for airdrop purposes.

However, even if some transactions are for airdrops, the data at least reflects the current development status of Ethereum L2 ecosystem. After all, Layer2 networks have lower fees and higher scalability. More and more projects choose to build their own projects on Ethereum Layer2 or migrate from other chains to Ethereum Layer2.

With the completion of the Ethereum Cancun upgrade (probably by the end of the year, there is no exact time at present), the transaction fees on Ethereum Layer2 network will be significantly reduced. When the transaction fees on Layer2 network approach zero, it is likely to bring about a major explosion in the Ethereum Layer2 ecosystem.

As the Ethereum Layer2 ecosystem becomes more and more prosperous, the demand for cross-chain bridges will also increase significantly. With the advantages of the cross-chain bridge Orbiter, it will certainly gain a larger market share.

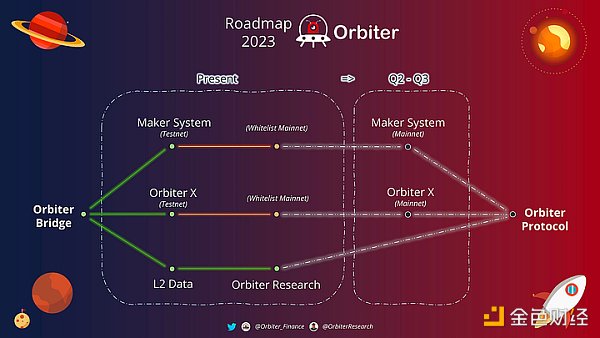

2. Huge potential of Orbiter X and Orbiter Protocol

According to Orbiter’s Roadmap, the Maker System and Orbiter X will be released in Q2-Q3, but the specific dates have not been determined yet.

Orbiter X is an enhanced version of Orbiter, providing a simple and secure platform for executing cross-chain and cross-asset transfers. Supported by a powerful Maker system and decentralized cross-rollup bridge, these features make Orbiter X the ideal choice for anyone who wants to transfer assets between different networks quickly, safely, and cost-effectively.

According to the introduction on Orbiter’s official Medium, Orbiter’s goal is not only to serve as an L2 cross-chain bridge but also to act as the infrastructure for Ethereum’s expansion. Orbiter aims to become a universal Ethereum protocol.

Orbiter Protocol, centered around Ethereum expansion, is driven by a series of cutting-edge features such as zero-knowledge algorithms, EIP-4337 (account abstraction), recursive proof, and message synchronization. These features are designed to promote better scalability, interoperability, and security, thereby improving the overall usability and adoption of the Ethereum network.

The transition from Orbiter to Orbiter Protocol reflects the platform’s commitment to enhancing the Ethereum ecosystem.

At that time, Orbiter will not only be a cross-chain bridge protocol, but also a general Ethereum underlying protocol, which undoubtedly expands our imagination space for the future of Orbiter.

3. Expectations for the issuance of platform tokens

As we all know, although Orbiter has been online for more than two years and the project has developed quite well, Orbiter has not yet issued its native tokens, and the official has not disclosed any information about token issuance.

However, there have always been rumors about Orbiter issuing native tokens, and many users use Orbiter for airdrops in anticipation of token issuance by the project party.

In short, with the explosion of Ethereum Layer2, the demand for cross-chain bridges will also increase significantly. As a leading player in the Layer2 cross-chain bridge segment, Orbiter, coupled with the project’s ambitious vision (to become an Ethereum underlying protocol), will definitely continue to develop better in the future. It is likely to become the leader and standard setter in the Ethereum L2 cross-chain bridge field. In addition, since the project has not yet issued native tokens, Orbiter is a project that is worth our continuous attention.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!