Author: TokenInsight

With the increasing regulatory pressure, there is a growing demand for a “decentralized Binance” that can satisfy the user experience of centralized exchanges while eliminating the need for fund custody. So, how to build a “decentralized Binance”? Let’s study it together.

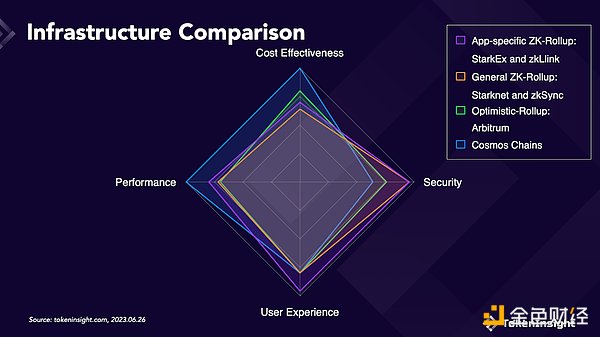

In this report, we will start with Binance and explore why Binance has become the leader among centralized exchanges in the crypto industry. We discuss how the advancement of technology makes it possible to achieve a “decentralized Binance” through decentralized order book exchanges. We provide a detailed introduction to StarkEx, zkLink, StarkNet, zkSync, Arbitrum, and Cosmos, analyze their situations in terms of user experience, security, performance, and cost, and compare them to guide readers to a deeper understanding of these infrastructures.

Here are some key points from the report:

- Analyst Bitcoin will not remain indifferent to the US dollar index in the long term.

- Exploring Energy Tokens The End of RWA is PoW

- Instead of eliminating competitors, we should make the cryptocurrency cake bigger – Solana developer Ferrante

Why do we need a “decentralized Binance”?

Binance is currently the largest cryptocurrency exchange in terms of trading volume in the blockchain industry, with over 120 million registered users. As a centralized exchange, it offers a wide range of assets and abundant liquidity. Its trading experience and performance are also far ahead of its competitors.

However, in the blockchain industry, centralization is considered the “original sin”. As a centralized exchange, Binance carries certain risks in terms of asset security, business transparency, and regulation. This has intensified people’s concerns, and they have started to yearn for a crypto exchange that combines the user experience of centralized exchanges with the self-custody advantages of decentralized exchanges – in other words, a fully decentralized Binance.

The path to a “decentralized Binance”

There have been many attempts to build a decentralized Binance.

-

The pioneer of decentralized exchanges is Uniswap. It was initially deployed on Ethereum and uses the AMM mechanism with a constant price formula and liquidity pools for trading. However, this mechanism has issues such as low capital efficiency, slippage, and impermanent loss. This means that while achieving decentralization, it has to sacrifice some liquidity and trading experience.

-

After the initial attempt of AMM, many high-performance Layer1 solutions emerged. The performance improvement they bring makes it possible for order book mechanism DEX to exist. However, while improving performance, Layer1 solutions also sacrifice the security of Ethereum and its mature ecosystem. At the same time, they cannot support the trading volume of large user bases like Binance.

-

With the continuous advancement of technology, Layer2 scaling solutions for Ethereum have emerged. They help decentralized exchanges further improve transaction speed and reduce transaction fees. These Layer2 solutions, as Ethereum’s scaling solutions, retain the security of Ethereum and inherit its mature ecosystem. However, general Layer2 networks have some limitations in high-frequency trading. They lack seamless interoperability between blockchains other than Ethereum.

-

Recently, a new generation of application-specific, transaction-centric order book infrastructure solutions has entered the crypto market. Each solution can improve users’ trading experience by providing a high-performance and secure trading environment. They have made further innovations based on Layer1 and Layer2 and opened up possibilities for building a “decentralized Binance”.

Overview of Trading Infrastructure

When analyzing the construction of “decentralized Binance” infrastructure, we consider four main factors that affect trading:

-

User experience

-

Security

-

Performance

-

Cost

We analyzed several popular infrastructure examples based on these four dimensions and combined them with examples of decentralized order book trading protocols.

StarkEx

StarkEx is a trading infrastructure designed for specific application services. It runs as an Ethereum Layer2 scaling engine based on STARK zero-knowledge proof technology developed by StarkWare. It provides specific ZK-Rollup services for independent applications. StarkEx was officially launched on the Ethereum mainnet in 2020. Its services are currently used by many well-known decentralized derivatives trading protocols such as dYdX v3, immutableX, and ApeX.

zkLink

zkLink is a multi-chain middleware based on ZK-Rollup technology that focuses on transactions. Its main feature is the ability to connect multiple Layer1 and Layer2 blockchains and aggregate liquidity from different ecosystems, making it possible to trade and combine native DeFi assets on different chains. It achieves multi-chain functionality and extends classical ZK-Rollup through the mechanism of “ZK-Rollup + oracle network”.

StarkNet

StarkNet, developed by StarkWare, is a general-purpose Layer2 scaling solution based on ZK-Rollup. StarkNet supports the deployment of arbitrary smart contracts, allowing developers to create different types of decentralized applications on it, which can be combined with each other. It uses Rollup based on STARK technology to execute transactions, with high scalability and low transaction costs.

zkSync

zkSync is a series of general-purpose Layer2 Ethereum scaling protocols based on ZK-Rollup, mainly consisting of two products: zkSync 1.0 (later renamed zkSync Lite) and zkSync 2.0 (later renamed zkSync Era). zkSync Lite uses SNARK proof programs, but is not compatible with EVM, meaning it does not support smart contracts, only basic transactions such as transfers. zkSync Era is based on zkSync Lite and implements EVM compatibility.

Arbitrum

Arbitrum is an Ethereum Layer2 scaling solution based on Optimistic-Rollup, which currently includes two products: Arbitrum One (general-purpose) and Arbitrum Nova (dedicated to gaming/social applications). Arbitrum One is the main product of Arbitrum, and most DeFi applications are concentrated on Arbitrum One.

Cosmos

Cosmos is a network of Layer1 blockchains with a mesh structure based on the Tendermint consensus mechanism. Each blockchain in its network is an independent and fully functional PoS blockchain. Cross-chain communication can be achieved between chains through the IBC protocol, while sharing security and liquidity. In addition, Cosmos provides a custom blockchain development toolkit – Cosmos SDK, which allows developers to use existing modules to meet different blockchain development needs, providing a high degree of freedom.

Infrastructure Comparison

Application-Specific ZK-Rollup

Application-specific ZK-Rollup infrastructure, StarkEx and zkLlink have obvious advantages in terms of technical availability. And due to the use of ZK technology, they also have certain advantages in transaction security compared to the Cosmos network and Optimistic solutions. However, application-specific infrastructure may be subject to greater limitations in terms of feature development. In comparison, the applications of StarkEx are currently deployed on Ethereum, which has better basic security. zkLlink, on the other hand, supports native multi-chain, providing richer transaction assets and liquidity sources.

General-Purpose ZK-Rollup

Representatives of general-purpose ZK-Rollup infrastructure are Starknet and zkSync. They both support Turing-complete programming languages, so they have higher flexibility in terms of feature development and can deploy order book applications. However, as a general Layer2 solution, there may be many applications running simultaneously. Therefore, Ethereum still faces expensive gas fees and on-chain congestion issues, which Starknet and zkSync will also face in the future.

Optimistic Rollup

The representative of Optimistic Rollup infrastructure, Arbitrum, has advantages in terms of flexibility in feature development and compatibility with Ethereum. It is highly compatible with Ethereum and supports Solidity language, making it developer-friendly and facilitating feature development. Compared to ZK-Rollup infrastructure, Arbitrum has some advantages in terms of cost because it eliminates expensive zero-knowledge proof computation fees; however, compared to ZK-Rollup, it lags behind in terms of transaction finality. And in terms of security, it is slightly inferior to ZK-Rollup infrastructure with multi-chain functionality.

Cosmos Layer-1

Cosmos, as a mature Layer1 infrastructure, has significant advantages in terms of transaction performance and cost. Its Tendermint consensus can provide faster transaction confirmation speed for order book applications. At the same time, its other two core technologies, Cosmos SDK and IBC protocol, greatly help improve user transaction experience. However, in terms of decentralization and security, Cosmos performs relatively average. And because the entire Cosmos ecosystem is still in its early stages compared to Ethereum, it has certain disadvantages in key indicators that affect transaction experience, such as asset class and liquidity.

Above are some key contents of this report. For detailed information, please download the full report for reading.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!