Author: Adam Cochran, Partner at Cinneamhain Ventures Translation: Luffy, Foresight News

Coinbase’s L2 scaling network, Base, has gained popularity due to the success of friend.tech. However, blockchain analytics firm ChainArgos has pointed out that Base may violate US federal laws. In response, Adam Cochran, a partner at Cinneamhain Ventures, wrote an article criticizing ChainArgos’ viewpoint as a misconception lacking technical and legal knowledge. He believes that decentralized L2 is fully compliant with US laws. Foresight News has compiled Adam Cochran’s tweet:

Base, launched by Coinbase, does not violate federal laws.

ChainArgos’ viewpoint is a dishonest legal argument and lacks technical knowledge, attempting to sell more on-chain risk monitoring/reporting software that they don’t actually need for L2. Ultimately, ChainArgos either has a malicious interpretation or lacks technical understanding of the meaning of “custody” in blockchain or the actual meaning of L2.

- Understanding the Correlation between Bitcoin Price and Mainstream Assets such as US Stocks through 6 Charts

- Friend.tech roundtable discussion, how do various parties view this phenomenal product?

- SHIB Investment Experience Sharing A Journey from 30,000 U to 2.6 million U in 52 days

Now let’s analyze why Coinbase’s L2 network does not violate any laws.

First and foremost, in this debate, concepts related to futures, licensed exchanges, over-the-counter brokers, and money transmission entities are often confused.

So we must first clarify the meaning of “custody” in cryptocurrency.

When you hold, control, or transfer user funds, US laws regarding money transmission apply.

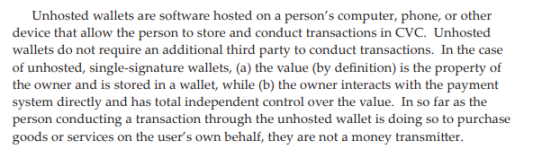

FinCEN (FIN-2019-G001) provides clear guidance, with a key point being key control in the concept of “non-custodial wallets”:

This makes sense, as when you deposit cryptocurrency into a custodial wallet, Coinbase becomes a money transmission entity. However, if your keys are in MetaMask, then MetaMask is not a Money Services Business (MSB); it is merely a tool you use to interact with wallets.

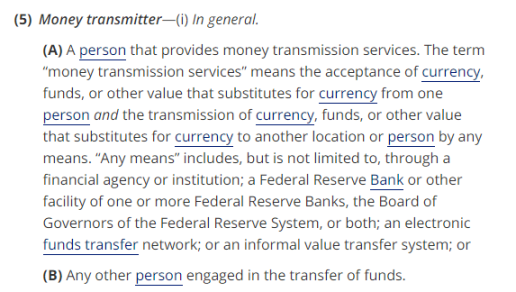

In fact, one of the few explicit laws in the US financial industry is the definition of “money transmission” – if any of the following criteria are met, you are a money transmission entity:

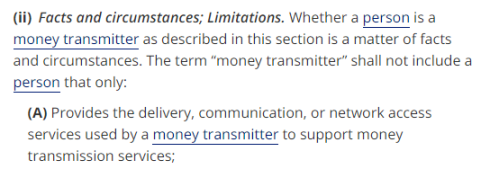

This led some legal enthusiasts in the 90s to believe that internet service providers were actually money transmission entities. It was during that time that the legislature enacted section (ii)(A), which stated that service providers offering communication and delivery networks are not money transmission entities.

Base is a public blockchain network based on the OP Stack, providing communication for self-custodial wallets and DApps that anyone can participate in.

Although its sorter is currently centralized, it does not automatically mean that it is a custodian.

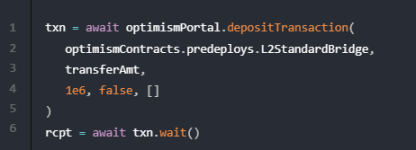

You can use “OptimismPortal” to transfer currency between L1 and L2. The Merkle tree will continue to publish the state back to Ethereum L1, and the underlying bridged assets are stored in the cross-chain bridge of L1.

This means that even if Coinbase closes all servers tomorrow and disappears completely, you can still:

-

Sort by yourself (with a 12-hour delay) to include the transaction in L1 without going through L2.

-

Force withdrawal after a 7-day delay.

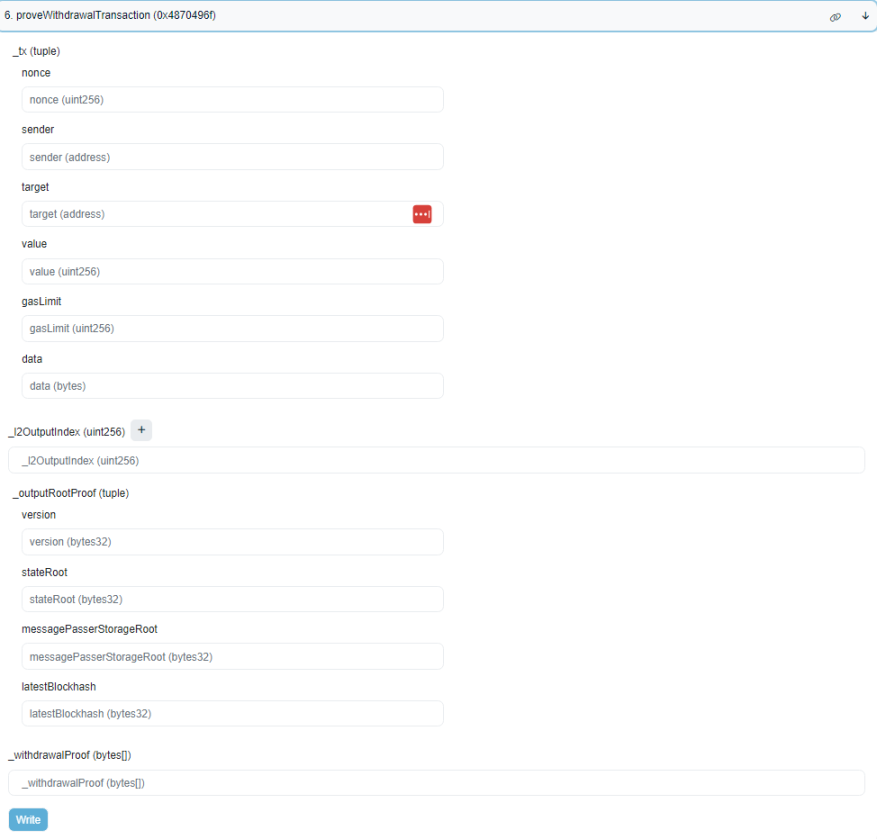

You sort the following transactions yourself, and after the transactions are included, you call the following transactions on the Ethereum L1 Base bridging contract and publish the Merkle proof of your withdrawal transaction.

Then, even if Coinbase closes the Base network tomorrow, you can still regain control of your assets.

So, let’s review and summarize:

-

Coinbase does not operate a marketplace on Base.

-

Coinbase does not control your keys on Base.

-

If Coinbase closes all infrastructure tomorrow, you can still trade.

-

And you can withdraw your assets from L1 at any time.

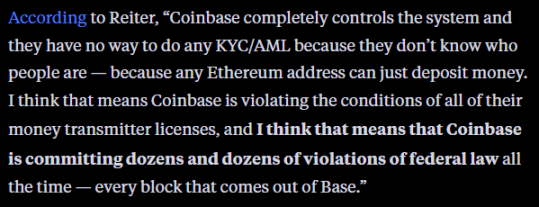

The ChainArgos team said that because any address can deposit funds into Base, this may bring legal troubles to Coinbase.

On the contrary, it is precisely because it is an open and permissionless network layer that such behavior is legalized.

Coinbase performs KYC/AML for transactions conducted through Coinbase and also has on-chain monitoring tools.

But legal responsibility does not extend to their Base chain or the DApps running on it.

Although there is still more work to be done in terms of security and robustness for decentralized L2, in terms of legality, they are decentralized enough, and their simplest form is just a smart contract.

It is this fundamental technological difference that defines the boundary between L2 and centralized L1 sidechains, which is also why Coinbase did not establish some PoA private operational networks.

If L2 is considered an MSB, then all blockchain networks and all smart contracts are de facto currency transmission organizations.

This is foolish and ridiculous, and anyone who proposes such a view should have their legal and technical expertise questioned.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!