Author: XIN, Partner at OFR

If you are a rational and objective investor, you should feel that we don’t need more infrastructure projects, at least not at the moment.

The current infrastructure is sufficient for the next bull market or even the one after that (if there is one).

In terms of scalability, we have Solana; in terms of legitimacy, we have ETH L2 Rollups and several zkEVMs that will be launched soon; for those pursuing decentralization, Ethereum mainnet is available; for composability, Cosmos or Polkadot are good choices.

We have all the necessary prerequisites to create DApps, as well as dozens of recently popular Raas or AppChain services. Whether you want to build applications or chains, it’s not because the infrastructure is insufficient or lacks development tools.

But the question is: where are the killer DApps?

In the previous cycle, DeFi saved the cryptocurrency market. The patterns of AMM Dex + asset pool lending + liquidity mining and various projects based on these patterns could be replicated on dozens of new chains.

Now, once these DeFi suites are available on new chains, what else can we do? Will we continue to play with these same old tricks in the new cycle?

Recently, some applications have given me great inspiration, so let’s delve into them:

Meme coins

Meme coins like $Pepe or $Bitcoin(HarryPotterObamaSonic10Inu) are important innovations during bear markets. They have spawned a subculture that, compared to VC-backed projects with valuations in the billions of dollars, has token mechanisms that are more favorable to retail investors. Expensive VC coins often mean distributing chips to retail investors.

Of course, some infrastructure projects can also be considered Meme coins in a certain sense. If Meme coins like Pepe satisfy the emotional value of retail investors getting rich, then infrastructure “Memes” alleviate the investment anxiety of VCs, especially if they feel that they missed out on investing in major public chains (such as Solana, Near, etc.) in the previous cycle and now need to invest in infrastructure in this cycle.

People think that doing ZK is difficult because it requires strong mathematical skills, but doing Meme is not that simple either. Creating a viral cultural symbol is actually a very challenging task because there is no fixed template to reference or apply. To become a successful Meme creator, one must have a thorough understanding of a certain community subculture, such as the degen community or the loser vibe, and also have the ability to design eye-catching promotion materials that appeal to the community.

In my opinion, Meme coins are another form of crypto cultural symbol that has emerged after avatar NFTs.

Friend. tech (hereinafter referred to as “FT”)

In most industry analyses, FT is often referred to as a social product. However, I believe that it is a financial product based on the social user network of Twitter (or X). It does not create new social relationships or introduce any new communication modes. Social products should be like QQ or WeChat, changing the form and manner of conversation and communication between people, but FT has not achieved this and has no intention of doing so.

Based on first principles, this model can actually be used to design some new products. Essentially, it adds token incentives to Twitter’s social network, which is a form of token incentives for the Twitter community before Twitter issues its own tokens (which may never happen). The recent “Tip Coin” project has actually captured the essence of FT’s product and has begun to gain recognition in the community.

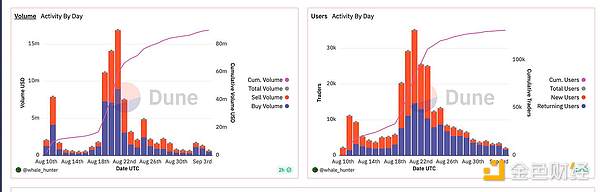

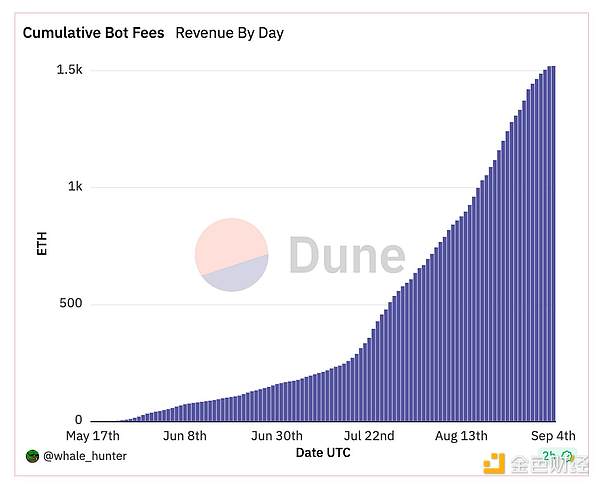

Telegram Bot

The starting point of the Unibot product itself, TG Bot, is very simple. Many teams, such as Uniwhales and Whalesalert, may have already created similar products in the past. However, it has improved in two key aspects:

First, the functionality captures the needs of meme traders in the cryptocurrency circle. Some new features introduced by Unibots include limit orders, copy trading, and privacy transaction routing, among others. Although many teams have been talking about their own “Intents” recently, Unibots has quietly been providing Intents services for tens of thousands of requests every day.

Second, Unibot’s token design has some cleverness to it. Its revenue is tied to the overall prosperity of the ecosystem and is related to the product’s functionality. The token distribution is relatively reasonable.

Unibots also leverages the traffic on Telegram that is essential to cryptocurrency users and creates user-friendly products that flow back from Telegram’s traffic.

What conclusions can we draw from the above examples?

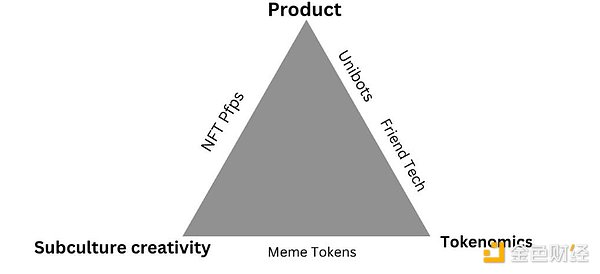

If we consider product strength, subculture creativity, and a good token model as a triangle (you guys in the cryptocurrency circle love all kinds of triangle metaphors), successful projects typically have at least two of these elements. It is necessary for a project to attract customers, survive in the long term, and possess all three elements.

Using the examples mentioned earlier, Meme coins have sparked subcultural enthusiasm and have a well-designed token mechanism, but currently lack usable products.

FT’s product launch has been exceptionally successful, although the UI/UX of the product itself has problems, the overall product strategy can be considered successful. The token model for the product’s initial launch has been well executed, but a lack of follow-up motivation has yet to be resolved. As for subcultures, FT has not yet entered that realm.

Unibots has a strong product and well-implemented features, with a reasonable token model. However, the users of their own product have not yet formed a sense of cultural belonging to the product itself, but are more focused on the product and the token itself. How to make users like Unibot as a cultural symbol is definitely a subject worth studying for the Unibot team.

What kind of products and builders do I look forward to?

-

Product and growth strategy: From day 0, a well-planned user acquisition strategy should be in place, such as how to leverage Twitter or Telegram traffic for user growth, how to prevent the product from being blocked by Twitter, how to iterate the product quickly, and how to lower the user entry barrier. It must be said that FT also has some clever ideas in this regard, such as using PWA to avoid the hassle of getting listed on the Apple App Store, and so on. In terms of product form, it does not necessarily mean creating a Twitter plugin or Telegram bot, but finding a suitable way to attract users from these two largest user groups of applications.

-

Token design: Design a well-balanced token distribution structure that benefits both sellers and buyers. The value of the product’s token should be tied to the product’s revenue and value, allowing users at different stages of participation to have opportunities to make money.

-

Creativity and subculture shaping: The team itself needs to understand some subcultural language symbols and conscious representations in the community. Similar to Pepe and Doge, they are enduring memes on Reddit. New meme shaping and joining, including the use of AI in creation, can be factors for growth.

Based on these standards, I expect more DApp builders to join the DApp development community. I don’t want to label it as just another buzzword or category. If I have to, I might use general industry terms like “TwitterFi,” “TelegramFi,” or “MemeFi.”

I am also very optimistic about other earlier areas, such as the recently discussed on-chain games or autonomous worlds, and I believe that very successful products will emerge from the community. However, it takes time. There are already many young and creative developers active in the Onchain Gaming community. The current problem is that the atmosphere in this small circle is a bit intense, and the learning curve for non-hardcore gamers, especially those unfamiliar with Crypto, is too steep.

I am willing to collaborate with the builders of Onchain Gaming to explore more user-friendly and concise ways to acquire users. Another thing that I feel is lacking is Token design. There are very few discussions about Token design in the Onchain Gaming community, but I believe that an economic system is an essential part of successful user acquisition.

The best time to invest in Web3 is now!

The characteristics of the bottoming out of the primary and secondary markets in the bear market are very obvious. For example:

-

Many projects that started at the end of the last bull market failed because they couldn’t establish enough competitiveness or didn’t have enough operational funds. They either failed outright or shifted to other areas, such as artificial intelligence.

-

Traditional VCs and investment institutions that hesitated in the last bull market peak have basically stopped looking at Web3 now. They are rushing to invest in AI projects.

-

There are already enough ZK and Infra narratives in the market, and many application developers have transformed into Infra projects. I think this also indicates that Infra projects are saturated. So how do those large projects that raised billions of dollars in the last bull market issue tokens? Is it enough to rely on PUA wool parties to generate data? The key is that more than one project has done this, and there are still double-digit projects to issue tokens. Each one needs to enter the secondary market to suck blood. The current crypto market is already lying in the ICU. There is not enough blood to suck.

-

Only innovative applications can bring new narratives, new traffic, and new blood.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!