Author: LianGuaicryptonaitive

It can be said that RWA is one of the major crypto narratives in the summer of 2023.

In particular, MakerDAO, after introducing real-world assets, especially US Treasury bonds, MakerDAO has transformed from a classic DeFi success to a leading RWA.

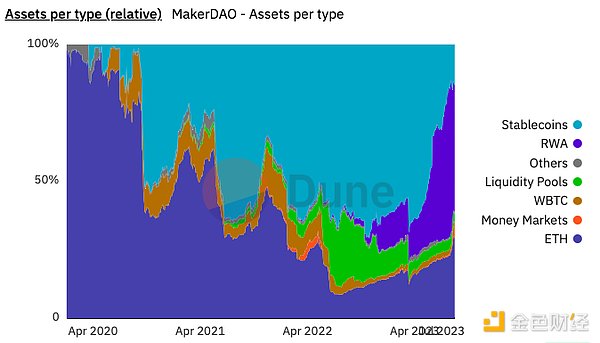

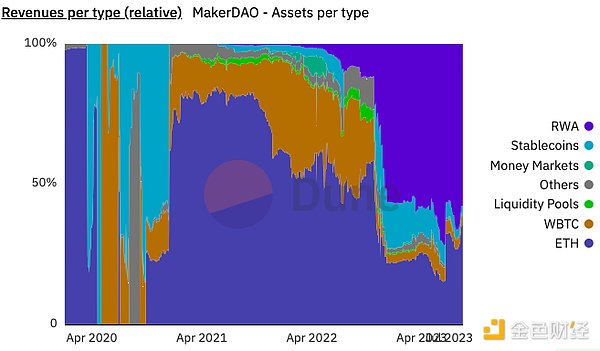

According to the MakerDAO dashboard data on Dune, RWA assets currently account for 47% of MakerDAO, and the revenue generated by RWA assets accounts for 60% of MakerDAO’s revenue.

- US Alipay LianGuaiyLianGuail seeks survival with stablecoins, saving the cryptocurrency circle?

- Jacobi Asset Management Company Launches Europe’s First Bitcoin ETF

- Comparison of Perp DEX LP tokens GLP, GM, VLP, and gDAI What are the advantages and disadvantages?

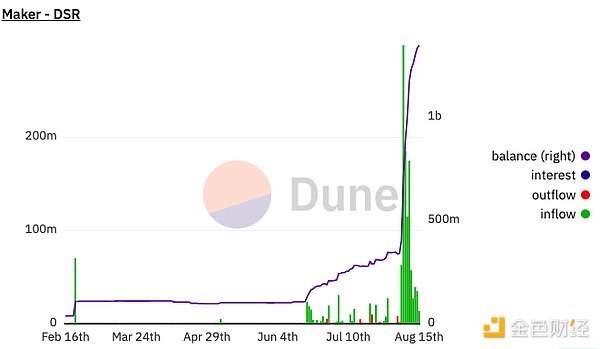

In early August, MakerDAO voted to increase the DSR interest rate to 8%, which resulted in an increase of 1 billion DAI deposited into MakerDAO DSR within 10 days.

The rise of RWA has also driven the growth of RWA TVL data. According to Defillama data, RWA’s TVL has risen to 9th place.

However, RWA assets are a double-edged sword, as evidenced by the recent loan default risk faced by the RWA lending protocol Goldfinch. In October 2021, Goldfinch issued a $5 million loan to the Kenyan motorcycle rental company Tugende. Due to the default risk associated with Tugende’s related transactions, the default amount accounts for about 4% of Goldfinch’s total TVL.

What are the main reasons for the RWA explosion? What kind of RWA assets are easy to be introduced on-chain? What are the main challenges in regulation and technology for the large-scale on-chain introduction of RWA assets?

To answer these questions, LianGuai recently interviewed Cui Chen from Hashkey Tokenisation.

LianGuai: Recently, the RWA track in the crypto field has been very popular, and many classic DeFi projects have entered the RWA field. For example, MakerDAO now earns nearly half of its revenue from RWA. In your opinion, what are the main reasons for the RWA explosion?

Cui Chen: Under the influence of macroeconomics, we can see that the yield of US Treasury bonds is rising, even far exceeding the stable income in DeFi, such as lending rates or stablecoin trading fees on Curve. Therefore, the topic of bringing US Treasury bond yields onto the chain has attracted a lot of attention. Of course, US Treasury bonds are just one type of RWA, but compared to other assets, the yield of US Treasury bonds is more stable, which happens to complement the highly volatile assets on the chain in an investment portfolio.

Take MakerDAO as an example. Initially, the reserve assets were mainly ETH-based crypto assets. In order to avoid the impact of black swan events on the protocol, stablecoins such as USDC were gradually introduced as reserves. However, holding USDC does not generate income, and the increase in US Treasury bond yields has allowed the issuer of USDC, Circle, to generate more income. MakerDAO may consider replacing the reserve stablecoins with US dollars to purchase real-world assets. In the future, we may see more on-chain protocols’ treasuries purchasing RWA.

LianGuai: In fact, there has been a large-scale RWA already, which is centralized stablecoins. And recently, RWA mainly comes from high-yielding US Treasury bonds, which can be seen as the tokenization of US dollar interest rates. Is the category of RWA assets important? What kind of assets are easy to be introduced on-chain?

Cui Chen: The asset category of tokenized RWA determines its nature and affects the people who hold it. For example, US Treasury RWA is itself a safe and low-risk investment, making it a good choice for investors seeking stable income.

There are different ways to bring US Treasury onto the chain. Currently, the US Treasury Department has not issued tokens representing US Treasury on the chain. The discussion on US Treasury RWA can be summarized into three ways: First, tokenizing mutual fund shares. Mutual funds hold US Treasury, and investors can invest in the funds. Second, investors lend stablecoins to an entity (e.g., SPV), which purchases US Treasury and returns the income from US Treasury to the lender in the form of interest. Third, a structure similar to MakerDAO, where the protocol uses the treasury to purchase US Treasury and returns the income to DAI holders through deposit interest rates. Theoretically, all types of RWA can bring income onto the chain through the above methods, regardless of the type of RWA assets, but the risks and returns of these methods may vary and require careful consideration.

The above are indirect ways to bring RWA income onto the chain. If RWA is directly packaged into tokens, intangible and easily standardized assets will be easier to introduce onto the chain. However, the content and value of tokenized RWA still come from the assets themselves.

LianGuai: What are the main challenges in the future for the large-scale on-chainization of various RWA assets in terms of regulation and technology?

Cui Chen: For regulators, the requirements for tokenized RWA should be consistent with those for non-tokenized RWA. Tokenizing RWA should not lower the regulatory requirements just because RWA becomes tokens. For example, if a bond is only issued to qualified investors, tokenizing that bond will not lower the investment threshold to retail investors. Therefore, compliant tokenization of RWA will have many restrictions. In order to meet the requirements of anti-money laundering and counter-terrorism financing, investors need to undergo KYC procedures. If the investment product has requirements for the investor’s identity, the on-chain holders also need to prove that they meet the corresponding requirements.

In terms of asset issuance, technology can achieve whitelist management for token holders to meet regulatory requirements, and the problem of private key loss by holders can be solved through smart contract wallets. However, issues such as investors’ assets being controlled by hackers and on-chain applications being attacked are more difficult to solve technically, especially for activities on public chains, which can be complemented by certain management systems.

LianGuai: What are Hashkey’s thoughts or actions regarding asset tokenization?

Cui Chen: In April of this year, Hashkey released a whitepaper on “Web3 New Economy and Tokenization.” Interested readers can read it through the link https://group.hashkey.com/cn/insights/web3-new-economy-and-tokenization-whitepaper. We focus on functional tokens representing usage rights, equity, and digital tokens, equity tokens, and non-fungible tokens (NFTs). In the distributed network of Web3, value will be deposited into tokens. For example, functional tokens can capture the value of network effects.

Token economics is the research direction of the Hashkey Tokenisation team, in which monetary policy, mechanism design, and financial engineering form a “trinity” relationship. The goal of monetary policy is to regulate token supply and demand, the goal of mechanism design is incentive compatibility, and the goal of financial engineering is risk-reward transformation. The research goal of token economics can be summarized as: through the rational design of token supply mechanisms, application scenarios, and related financial products and markets, to incentivize stakeholders to actively participate in Web3 new economic activities, thereby promoting the growth of token value.

LianGuai: With the arrival of a new cycle, besides RWA, what other tracks or narratives do you think are worth paying attention to?

Cui Chen: I believe that the large-scale application of Web3 cannot be separated from infrastructure. The competition between public chains has gradually evolved into competition between Layer2 solutions on top of public chains. The technological progress of Layer2 and AppChain solutions related to Layer2 are worth paying attention to.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!