If software is eating the world, then cryptocurrencies are eating the capital markets.

Tokenization is not a new concept, and prior to 2017, startups, banks, and stock exchanges have been exploring this concept. However, the current moment presents an unprecedented opportunity for mass adoption. With stablecoins proving their effectiveness as a medium of exchange, and DeFi infrastructure proving its reliability after the DeFi summer of 2020, we are standing at the forefront of large-scale on-chain flow of real-world assets.

In the Web3 space, RWA refers to the tokenization of real-world assets such as equities, debt, real estate, etc. Do not confuse this with “RWA” in traditional finance, which stands for “Risk-Weighted Assets.”

In fact, stablecoins currently represent 0.7% (approximately $130 billion) of the US M1 money supply, with a peak market share of about 1.0%. As a comparison, Tesla currently holds a market share of 0.63% in the US automotive market.

- Interpreting the permissionless verification protocol Arbitrum BOLD

- Podcast Notes|In Conversation with LianGuairadigm Research Director How will DeFi 2.0 Change Everything?

- RWA Online Soon An Overview of Frax’s Future Product Plans and Potential Impact

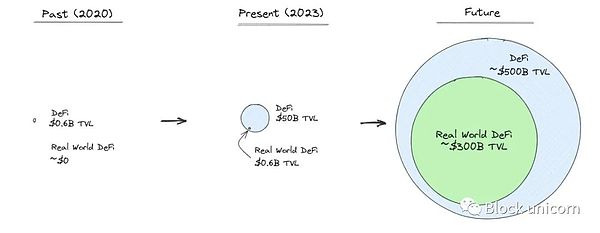

On the other hand, the total value locked (TVL) in DeFi has increased from just $6 billion in 2020 to around $50 billion today, an astonishing 80-fold growth. This remarkable performance surpasses the 8-fold increase in the price of Ethereum.

In the midst of market turmoil in 2022, centralized finance (CeFi) platforms such as FTX, Celsius, BlockFi, and Voyager Digital suffered failures, while DeFi demonstrated strong resilience. DeFi protocols – including Aave, Compound, Uniswap, and MakerDAO – operate seamlessly around the clock and perform exceptionally well.

Therefore, we are ready to usher in an era of bringing traditional financial assets onto the blockchain. With the development of DeFi, we expect “Real-World DeFi” to occupy a larger share within the DeFi space.

3 Arguments for Real-World DeFi

1: Real-World DeFi allows you to unlock all your financial assets and use them as collateral for any DeFi application.

In traditional finance (TradFi), obtaining a loan secured by equities is a long and cumbersome process involving multiple parties. It starts with your custodian sending PDF files to the bank to verify your ownership of the assets in their isolated database. Then, the bank provides collateral for your loan, the custodian transfers your equities to the bank, and you receive a cash transfer. Finally, the loan terms are manually assessed to check for any irregularities, all of which takes several days.

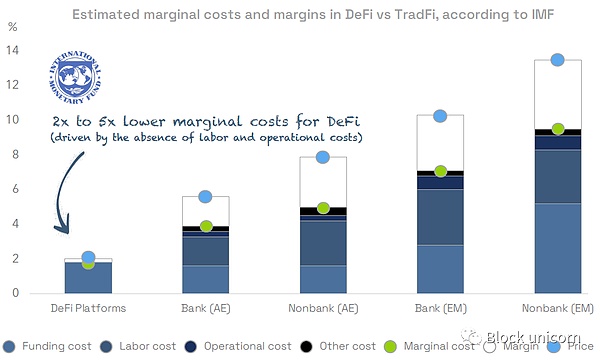

These high operational requirements and costs mean that usually only banks can provide such services to high-net-worth clients.

More generally, the International Monetary Fund estimates that the marginal cost for DeFi platforms is about 2 times lower compared to banks and non-bank institutions in advanced economies, and about 4-5 times lower compared to emerging markets.

In the real world of DeFi, this only takes a few seconds. You press a few buttons, and your equity tokens are encrypted and verified on the public blockchain, then collateralized through smart contracts, and the transaction settles immediately. You will receive digital cash (stablecoins) instantly, and the loan terms will be executed through code.

But it doesn’t stop there. In a world where a person can control all tokenized assets (fiat, equity, real estate, art, etc.) through a wallet, this unlocks a diverse range of potential collateral, improves liquidity through global and 24/7 trading, and enables automated portfolio management, and more.

Take PV01 (a Tioga portfolio company) as an example. They are researching tokenized anonymous bonds issued on-chain. These anonymous bonds can be locally combined on the blockchain, and users can easily use them as collateral.

From an entrepreneur’s perspective, DeFi allows developers to have a global customer base from day one. Entrepreneurs can also leverage existing DeFi infrastructure, which is essentially a locally open API. For customers, the low switching costs drive competition among entrepreneurs, thus promoting the development of the best possible products.

Interestingly, as interest rates rise, ING Bank’s profits have nearly quadrupled, while they continue to pay depositors an interest rate of 0.75%, compared to a yield of 3.4% on Eurozone government bonds. However, this is an extremely profitable business for ING Bank due to high switching costs. Banks are sticky and tend to offer the best rates only to their high net worth clients.

DeFi presents an alternative where you can switch from one service to another with just a click, without any restrictions. Furthermore, DeFi makes a clear distinction between cash (no credit risk) and savings accounts, avoiding the socialization of private losses caused by banks taking on excessive risk.

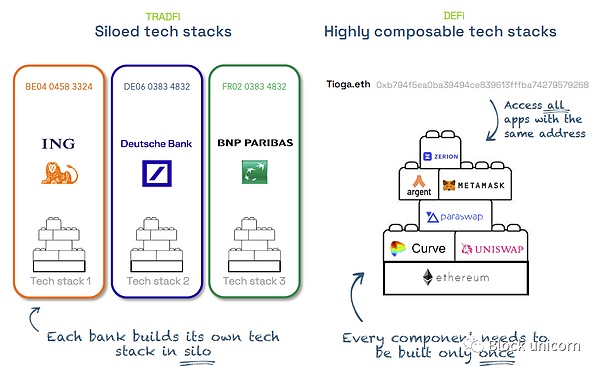

Although traditional finance (TradFi) exists in isolated technology stacks, entrepreneurs can take advantage of the locally interoperable DeFi infrastructure.

II: Real-world DeFi provides an accessible channel for financial products

Today, anyone can start their own private credit fund because of the efficiency gained through DeFi applications (such as Maple or Atlendis, belonging to the Tioga portfolio company) running on the blockchain.

For established companies like Blackstone (operating profit margin of 35%) that already have economies of scale, the cost savings from these backend processes may be small. However, emerging private credit funds can leverage DeFi infrastructure to increase their operating profit margins from around 20% to 35-40%.

In Jeff Bezos’ words, “the profit space of traditional finance is the opportunity for DeFi.”

If you are from Argentina, you do not need to wait for the bank to “support the US dollar” or allow you to buy dollars at the “official exchange rate” due to the rapid depreciation of the Argentine peso. You can simply deposit any tokenized currency (such as USDC) directly into your wallet.

Banks and brokers can no longer act as gatekeepers for financial products because consumers are no longer limited to their systems. Instead, they can make their own decisions using the range of tokenized financial products.

Real-world DeFi allows you to find the best rates within the DeFi ecosystem, thanks to its local composability and the universal verifiability of assets. Unlike in the past, where you had to open accounts at each bank and use their respective independent systems to apply for loans or purchase financial products. Now, anyone with internet access can access any financial product.

Third: Self-custody reduces counterparty risk, transparency enhances risk management

Self-custody is a safeguard against counterparty risk. Although self-custody may still be intimidating at present, account abstraction, social recovery, and mixed recovery methods will make the experience not much different from current online banking logins.

During the Silicon Valley bank crisis (similar to the Lehman Brothers crisis in 2008), there was almost no transparency. No one really knew if they were healthy, and risks were not monitored, let alone externally verified.

Today, if the Silicon Valley bank were to operate on the blockchain, we would have a complete transparent understanding of their assets and liabilities and could create a Dune dashboard to “monitor the chain”. We could also monitor liquidity through risk management suites such as Tioga Investment Group’s Chaos Labs.

The collapse of Terra is a good example. Due to the drop in the price of Luna, Anchor Protocol faced a bank run. Whereas during the Lehman Brothers collapse in 2008, we were in the dark, but now we have minute-by-minute transparency on-chain, and retail users have access to the same information as institutions to make optimal decisions. However, where do we currently stand in terms of adopting the curve?

The Trojan horse of RWA DeFi – private credit and government bonds

In early 2020, the total value locked (TVL) in DeFi was about $600 million, which then soared to over $150 billion. Currently, the TVL in DeFi is stagnant at around $50 billion.

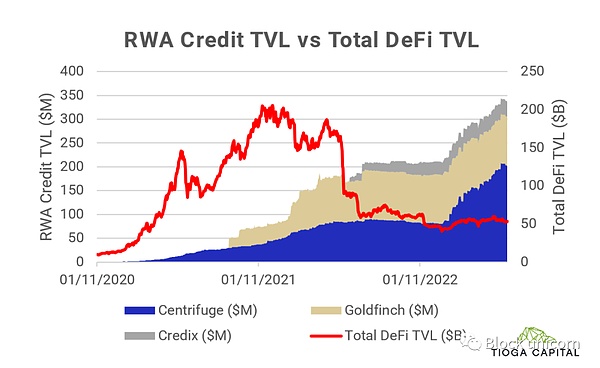

The DeFi of 2020 is the on-chain reality world assets (RWA DeFi) of today. Currently, its TVL has reached a historical high of $600 million, with $340 million coming from private credit and $260 million from on-chain government bonds.

DeFi was able to take off thanks to a unique combination: the liquidity surge brought by COVID stimulus checks, people having time to experiment during the COVID outbreak, and new cryptographic primitives (such as AMM and liquidity mining) being ready for alpha testing.

We believe that the current TVL of $50 billion provides strong evidence that DeFi can become a blueprint for the next paradigm shift in the financial industry.

The stable growth of RWA credit is not related to the fluctuation of cryptocurrency prices, which indicates that blockchain technology can be used not only for speculation but also as a simple technology for value transfer. Hence the term “internet money” – for the first time, we are able to transfer self-sovereign value over the internet.

Centrifuge is a pioneer in RWA, and they have been closely working with MakerDAO since 2020, funding RWA credit in areas such as financial transactions, structured credit products, revenue-based financing, and emerging market credit. Goldfinch and Credix primarily focus on emerging market credit in Latin America, Africa, and Southeast Asia.

Meanwhile, many other credit protocols have also been launched, with a focus on African and Southeast Asian credit, such as Atlendis (a Tioga portfolio company), Bluejay Finance, and Jia.

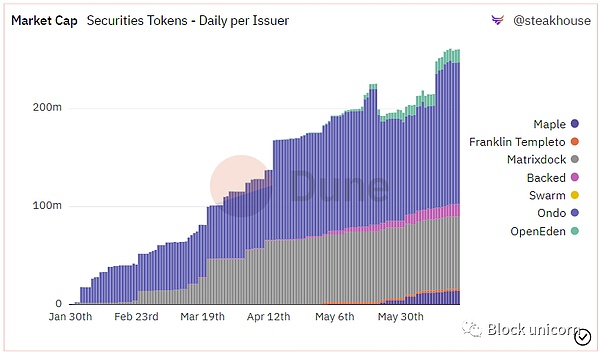

Recently, tokenized national debt has emerged as another asset category that has gained attention. In the first half of 2023, several protocols for tokenized national debt have emerged, such as Ondo Finance, Matrixdock, Backed Finance, Swarm Markets, Franklin Templeton’s Benji application, OpenEden, and Maple’s cash management pool.

There is a strong driving force behind this momentum, as approximately $135 billion in on-chain stablecoin funds may be seeking a more convenient way to access risk-free interest rates in the traditional financial field, without the need for complex withdrawal processes. This is driving the vibrant development of the national debt field.

Tokenized national debt has grown from zero to a $260 million asset class in just 5 months (source: Steakhouse Finance on Dune)

Some may question the reasons for using tokenized national debt – can’t I, as a high-net-worth individual, purchase national debt through traditional brokers? The answer lies in two subtle differences.

Firstly, tokenized national debt is not designed for regular users (although it allows anyone to purchase national debt from any country), but rather for high-net-worth individuals (HNWI), traders, or hedge funds who prefer to avoid friction costs incurred in the process of moving from the on-chain world to the off-chain world.

Tokenized national debt is also beneficial for DAOs and startup companies, especially those located outside the United States and DeFi protocols that require permissionless composability to realize RWA.

For example, Ribbon Finance recently placed an order for $2 million worth of Backed tokenized national debt to purchase ETH options with the generated income. On the other hand, Angle Protocol is working on a proposal to use Backed tokens as collateral for their Euro stablecoin.

Secondly, for many traditional institutions, government bonds are very attractive as a market promotion strategy due to the current interest rate arbitrage between DeFi and CeFi. They demonstrate the feasibility of tokenized assets at the technological and legal levels.

In essence, tokenized government bonds may be the “Trojan horse” for introducing traditional bonds and other financial assets onto the chain.

Summary

The real-world DeFi has matured and is experiencing disruptive opportunities

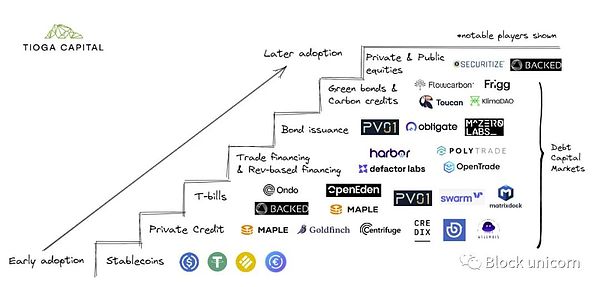

The real-world DeFi field is still in its early stages, but signs of early product market adaptability are beginning to emerge. We see adopters starting to seek low-risk returns (government bonds) from on-chain capital (cryptonative users, non-U.S. crypto companies, unbanked individuals), and then gradually increasing risk (trade financing, bonds, private credit).

Next, we expect capital from the traditional financial world to be attracted by the unique features of blockchain technology, such as collateralized loans for fully tokenized assets, better liquidity and capital management, and new investment products (bond issuance). Finally, institutions will also join in as they improve efficiency and provide these blockchain-based services to customers.

Gradient overview of the trend of real-world DeFi adoption

The real-world DeFi is still in its early stages. Before the inflection point of DeFi adoption arrives, we still have many aspects to improve in terms of blockchain scalability, privacy, and security.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!