The following is the regulatory policy and event observation section jointly written by Beosin. Beosin is a leading global blockchain security company, providing one-stop blockchain security products and services including project code security audits, operational security risk monitoring, early warning and interception, recovery of stolen virtual currency assets, and secure compliance KYT/AML.

2023 Q3 Web3 blockchain security situation, anti-money laundering analysis review, and summary of key regulatory policies in the encryption industry.

This article covers the regulatory dynamics and hot event observations of the encryption industry in the third quarter of 2023, including the joint regulatory report on encryption released by the FSB and IMF, the progress of the Ripple case, how GrayScale’s victory affects BTC ETF, regulatory enforcement by US regulatory agencies against the NFT and DeFi industries, the undercurrents and potential of the stablecoin market, and the first regulatory enforcement by Hong Kong regulators on JPEX after the new encryption policy.

The US Securities and Exchange Commission (SEC) raised the most controversial question to the US judiciary and legislative bodies through lawsuits against Coinbase and Binance in June—”What kind of encrypted assets are securities?” Since then, the SEC has gradually shifted its focus from CeFi to NFT. At the same time, the US Commodity Futures Trading Commission (CFTC) has also shifted its focus to DeFi after regulatory exploration. Against this background, the SEC is targeting CeFi, the CFTC is targeting DeFi, and FinCEN is primarily responsible for global circulation of encrypted assets for KYC/AML/CTF. This should be the regulatory landscape of the encryption industry before the 2024 US presidential election.

From the perspective of traditional finance, with the continuous regulation of the market, the clear positioning of Bitcoin as a commodity and the increasing recognition of its value are further promoting the entry of Wall Street capital. Various traditional financial giants are preparing for action, and the approval of the spot BTC ETF by the SEC will be a sign of their charge, so the victory of GrayScale is so eye-catching.

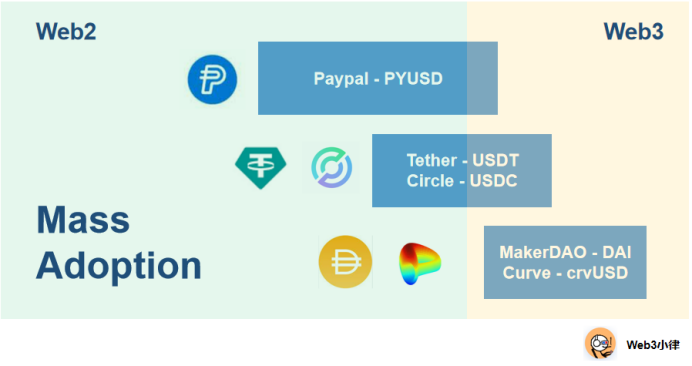

From a higher perspective, stablecoins, as a bridge between the real world and the crypto world, are the inevitable path for traditional capital to enter the crypto world. We already know that the EU’s MiCA legislation includes requirements for stablecoin issuers, the US Congress is also proposing legislation related to stability, the approved new legislation in the UK includes content on stablecoins, Singapore has published its stablecoin regulatory framework, and Hong Kong, China is also hotly discussing the operational path of stablecoin regulation. Currently, USD-backed stablecoins account for 99% of the stablecoin market. It is believed that in the coming years, various jurisdictions and industry giants will inevitably intensify their competition in the stablecoin market.

1. FSB and IMF jointly release global crypto asset regulatory report

(https://www.fsb.org/2023/09/imf-fsb-synthesis-LianGuaiper-policies-for-crypto-assets/)

On September 7, 2023, the International Monetary Fund (IMF) and the Financial Stability Board (FSB) released a joint report on crypto regulation, discussing macroeconomic, financial stability, and other risks related to the crypto market, as well as policy recommendations to address these risks.

The report states that the crypto market has been in existence for over a decade and has exhibited significant volatility. Although the direct linkages between the crypto market and systemically important financial institutions, core financial markets, and market infrastructures are currently limited, they could become a source of systemic risks for specific jurisdictions once they gain attractiveness for payments or retail investments.

Therefore, the IMF outlines key elements for addressing policies, including considerations of macroeconomic, legal, and financial integrity factors, as well as the impact on monetary and fiscal policies. At the same time, the FSB has issued regulatory recommendations and standards to address financial stability, market integrity, investor protection, prudential requirements, and other risks from crypto assets. These recommendations provide comprehensive guidance for addressing risks from the crypto market, helping authorities address macroeconomic and financial stability risks from crypto asset activities and markets, including risks associated with stablecoins and risks brought by decentralized finance (DeFi).

The main conclusion of the report is: As the use of crypto assets becomes widespread, jurisdictions should maintain monetary sovereignty, prevent excessive capital flows, and regulate and supervise crypto asset activities comprehensively to address macroeconomic and financial stability risks. The report also suggests that jurisdictions take effective measures to address legal and compliance risks, market integrity, investor protection, and prudential supervision arising from crypto asset activities.

2. Further clarification from the court is needed on whether Ripple is a “security”

On July 13, 2023, the SEC v. Ripple, a major lawsuit in the crypto industry that lasted for 3 years and cost $200 million, finally came to a “brief” conclusion. In this 34-page judgment, the judge pointed out that Ripple’s fundraising activities with institutional investors constituted investment contracts and the issuance of “securities,” while the act of selling tokens through exchange program algorithms did not constitute investment contracts and was not considered the issuance of “securities.”

On December 22, 2020, the SEC filed a lawsuit against Ripple and its founders, alleging that since 2013, Ripple and its founders had repeatedly issued and sold Ripple’s token XRP through various means, raising over billions of dollars. However, Ripple and its founders did not register their issuance and sale of tokens with the SEC, nor did they obtain any registration exemptions from the SEC, thereby violating relevant provisions of Section 5 of the U.S. Securities Act regarding the issuance of securities.

(https://blockworks.co/news/judge-rules-ripple-xrp-not-security)

The judge in this case cleverly avoided the biggest controversy in US regulatory agencies: “whether tokens are securities”. Instead, the judge determined whether the different ways of issuing XRP tokens constituted the issuance of “securities” by examining the economic substance of token transactions. The judge believes that the underlying assets of most investment contracts are simply commodities, such as gold and oil, which may not meet the definition of “securities”. This also applies to Ripple’s XRP tokens.

Regarding the institutional sales of XRP, due to Ripple’s public promotion and the rational cognition of institutional investors, the judge believes that this method of token issuance meets the Howey Test and constitutes the issuance of “securities”. However, for the exchange sales of XRP, the judge believes that the way investors in the secondary market expect to profit may not necessarily be due to the efforts of the Ripple project party, but more likely based on their judgment of the market macro environment and the use of trading strategies. Therefore, it does not meet the Howey Test and does not constitute the issuance of “securities”.

As for other methods of distribution, including payments to employees and payments to third parties (ecosystem participants) in XRP, the judge believes that this method of distribution does not meet the definition of “money input” in the Howey Test, which means there is no evidence to prove the existence of money input or other tangible consideration for Ripple.

This ruling brings significant benefits to the cryptocurrency market. Multiple exchanges, such as Coinbase, Kraken, Gemini, and Crypto.com, have announced the resumption of XRP trading. The price of XRP even rose by about 75% at one point, with a market value exceeding $42.8 billion, ranking fourth in the world. However, it should be noted that this ruling was made by a district court and is not binding. On August 18, 2023, the SEC formally submitted an interlocutory appeal motion to the Southern District of New York, seeking an interlocutory appeal of the summary judgment in this case.

Web3xiaolü Comments:

In this case, we can also see that the judge’s approach is to downplay the definition of the token itself (such as many underlying assets of investment contracts being classified as “commodities”) and focus more on the method of issuing and selling tokens (such as solo staking itself not constituting “securities”, but staking financial products may constitute “securities”). This may be a future regulatory approach.

The judge’s determination that exchange sales (programmatic sales) are non-securities offerings may benefit exchange listing businesses. In addition, the judge’s determination of other methods of distribution differs greatly from the SEC’s revised “Framework for ‘Investment Contract’ Analysis of Digital Assets” issued on March 8, 2023. The SEC believes that in addition to the conventional definition of “money” that we can understand, other definitions of “money” also include, but are not limited to: (1) digital currency rewards obtained by investors through completing specific tasks (bounty programs); (2) digital currency rewards obtained by investors through airdrops. It is believed that there will be more comprehensive debates on this conflicting point in the appeal case.

III. Grayscale’s Victory over SEC Lawsuit, How Far Are We from Bitcoin Spot ETF?

On August 29, 2023, a ruling by the U.S. Federal Court granted Grayscale Investments LLC a victory in its lawsuit against the SEC’s rejection of its application for a Bitcoin spot ETF. This ruling may accelerate the process of traditional financial giants such as Blackrock and Fidelity applying for Bitcoin spot ETFs in the past few months.

In October 2021, Grayscale first applied to convert its closed-end Bitcoin trust fund GBTC into a Bitcoin ETF exchange-traded fund. However, it was subsequently rejected by the SEC, which stated that Grayscale failed to address issues related to preventing market fraud and manipulation. As a result, Grayscale filed a lawsuit against the SEC last year, requesting the court to review the SEC’s administrative actions.

Until now, the SEC has not approved a Bitcoin spot ETF, citing concerns about market fraud and manipulation. For all rejected ETF applications, the SEC has invoked securities laws’ reasoning of “designed to prevent fraudulent and manipulative acts and practices.”

Previously, the SEC allowed Bitcoin futures ETF trading for the first time in 2021, stating that futures products are more difficult to manipulate because the market is based on futures prices from the Chicago Mercantile Exchange (CME), which is regulated by the U.S. Commodity Futures Trading Commission (CFTC).

In the lawsuit, the judge stated that administrative agencies must treat their administrative actions equally, which is a fundamental principle of administrative law. The SEC recently approved two Bitcoin futures ETFs and allowed trading on exchanges, but rejected Grayscale’s Bitcoin spot ETF. Grayscale requested the court to review the SEC’s reasons for rejecting the ETF and insisted that its proposed Bitcoin ETF is materially similar to the approved Bitcoin futures ETFs.

In response, Grayscale stated that: (1) its underlying asset, BTC, is highly consistent with the approved Bitcoin futures ETFs, and (2) the fund’s surveillance sharing agreements are also consistent with the approved Bitcoin futures ETFs. Therefore, there should be the same possibility of detecting fraud or manipulation in the Bitcoin and Bitcoin futures markets.

The logic behind approving Bitcoin futures ETFs should be the same as approving Bitcoin spot ETFs; otherwise, all applications for Bitcoin futures ETFs should be revoked.

The judge agreed with this and stated that the SEC’s rejection of Grayscale’s application was arbitrary and without basis, as the SEC failed to explain how it treated similar ETF products differently. Therefore, the court deemed this differential treatment of administrative actions to be in violation of administrative law, agreed with Grayscale’s request, and revoked the SEC’s rejection of the application.

(https://cryptodnes.bg/en/izvunredno-grayscale-specheli-deloto-bitcoin-etf-sreshtu-sec/)

Web3 Laws Comments:

Currently, the court has not ordered the SEC to approve Grayscale’s ETF application. The court document only states that the SEC’s analysis of “fraud and manipulation” is incorrect. So what will the SEC do?

One possibility is that the SEC will choose to fabricate a different reason to reject Grayscale’s application and force them into a longer and more expensive legal battle. This is entirely possible, but it depends on whether the SEC can swallow the bitterness of this defeat and Gary Gensler’s determination to continue fighting against the crypto world. Another possibility is that the SEC will take this court ruling as an opportunity to gracefully withdraw its opposition to a Bitcoin spot ETF. The SEC can write in its press release, “While we disagree with the court’s ruling, we must abide by the law and uphold judicial fairness.”

This is a convenient excuse to cut losses and withdraw from a failed battle. Traditional financial giants have been actively preparing for Bitcoin spot ETF applications, with Blackrock’s CEO Larry Fink exerting his political influence in DC. Moreover, the SEC has been criticized for its opaque regulatory enforcement approach to crypto assets, and this move can change the public’s inherent strict attitude towards the SEC.

4. US Cryptocurrency Regulatory Enforcement

The US has yet to establish a unified regulatory framework for cryptocurrencies. With the absence of legislation and the approaching election year, various regulatory bodies are still further clarifying/expanding their jurisdiction through “Regulation by Enforcement”. In this process, excessive enforcement by regulators will also face challenges from the judicial system, and the scope of regulation and enforcement bottom line will be further clarified.

4.1 SEC Shifts Focus to NFTs, Potentially Affecting the Entire NFT Industry

On September 13, 2023, the SEC charged Stoner Cats 2 LLC (SC2) with the sale of unregistered securities. SC2 raised approximately $8 million from investors by selling NFTs of an animated web series. This is the second major action taken by the SEC against the NFT industry since their regulatory enforcement against ImLianGuaict Theory NFT in August.

This regulatory enforcement action is likely to affect the entire NFT industry, as the operational paths of 99% of NFT projects are similar to Stoner Cats. The key factor is the market promotion and commitments made by SC2 to investors through public channels, which are deemed as “securities”.

SEC officials stated, “Whether the NFTs are packaged as beavers, Totoros, or other animals, under the Securities Act, if they constitute an ‘investment contract’ based on economic substance, such NFTs will be included in the definition of ‘securities’. In this case, Stoner Cats NFTs led investors to believe that they could profit from the resale of NFTs through the aforementioned market promotion activities.”

Due to the broader definition of “securities” in Stoner CatsNFT compared to ImLianGuaict TheoryNFT, this regulatory enforcement is likely to affect the entire NFT industry. The scary thing is: 99% of NFT projects are similar to Stoner CatsNFT, all of which will have a roadmap to tell NFT investors about the future development path and the project party’s experience and resource endorsement. After the project is launched, the project party will promote NFT through a large number of online social media, and the royalty of NFT will also be much higher than 2.5%.

Finally, SC2 reached a settlement with the SEC, (1) agreed to pay a civil penalty of $1 million, (2) established a fair fund to compensate injured investors, (3) destroyed all NFTs controlled by them, and (4) published the regulatory enforcement order on the official website and social media.

Web3 Xiao Lv comments:

In fact, when Azuki launched the Elementals series, there was a risk that Azuki NFT would be considered “securities”: (1) the investment of money (2 ETH); (2) a common business, investors’ wealth is closely linked to the wealth of Azuki NFT project party (not necessarily, their wealth is directly withdrawn to Coinbase); (3) expecting to gain profit from the resale of NFT through the efforts of Azuki NFT project party. What’s more important is that the correlation between the project party and the price of NFT is so significant that the Azuki NFT project party can collapse the price of the entire Azuki NFT series by themselves.

So the remaining question is: which NFT project party will be the next target of the SEC?

4.2 US Department of Justice brings criminal charges against Tornado Cash founders

On August 23, 2023, the US Department of Justice (DOJ) brought criminal charges against Tornado Cash founders Roman Storm and Roman Semenov, accusing them of conspiracy to launder money, violation of sanctions, and operating an unlicensed money transfer business during the operation of Tornado Cash.

Tornado Cash was a well-known mixing application on Ethereum, aiming to provide privacy protection for users’ transactions by obscuring the source, destination, and counterparty of cryptocurrency transactions, thus achieving privacy and anonymous transactions. On August 8, 2022, Tornado Cash was sanctioned by the US Office of Foreign Assets Control (OFAC), and some on-chain addresses related to Tornado Cash were included in the SDN list. Any entity or individual that interacts with on-chain addresses in the SDN list is illegal.

OFAC stated that since 2019, the amount of funds involved in money laundering crimes using Tornado Cash has exceeded $7 billion. Tornado Cash has provided substantial assistance, sponsorship, or financial and technological support to illegal network activities inside and outside the United States. These actions may pose significant threats to US national security, foreign policy, economic health, and financial stability, and therefore are subject to OFAC sanctions.

In a press release on August 23, the DOJ stated that the defendants and their accomplices created the core functionality of the Tornado Cash Service, paid for the operation of critical infrastructure to promote the service, and made millions of dollars in return. The defendants knowingly chose not to implement the Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures required by law, despite knowing the illegality of the transactions.

However, the actions of the DOJ have left unresolved important issues for the future of decentralized protocols. These issues include whether individual actors should be held accountable for actions taken by third parties or decisions made through voting in loose communities. The U.S. defendant Roman Storm, a U.S. citizen, will appear in court for the first time and face trial in the coming days. Afterward, the court may have an opportunity to address these pending issues.

4.3 Uniswap Wins Lawsuit – The First Ruling Under the Background of Decentralized Smart Contracts

In April 2022, a group of investors collectively sued the developers and investors of Uniswap – Uniswap Labs, its founder Hayden Adams, and their investment institutions, accusing the defendants of not registering in accordance with the U.S. federal securities laws and causing damage to investors by listing “fraudulent tokens”, and demanding compensation for the damages.

Presiding Judge Katherine Polk Failla stated that the true defendants in this case should be the issuers of the “fraudulent tokens,” not the developers and investors of the Uniswap protocol. Due to the decentralized nature of the protocol, the identity of the issuers of the fraudulent tokens is unknown to the plaintiffs (and the defendants). The plaintiffs can only sue the defendants in the hope that the court can transfer their claims to the defendants. The reason for the lawsuit is that the defendants provided convenience to the issuers of the fraudulent tokens in terms of issuance and trading platforms in exchange for transaction fees generated by the exchange.

Overall, the judge believes that the current regulatory framework for cryptocurrencies does not provide a basis for the plaintiffs’ claims and, according to existing U.S. securities laws, the developers and investors of Uniswap should not be held responsible for any damages caused by the use of the protocol by third parties. Therefore, the plaintiffs’ lawsuit was dismissed.

Web3law Comments:

This case is the first ruling under the background of decentralized smart contracts. The judge acknowledges the lack of judicial precedents related to DeFi protocols and has not found a way to hold the defendants legally liable under securities laws in the context of decentralized protocols.

The judge believes that in this case, the smart contracts of the Uniswap protocol can indeed operate legally, just like providing trading for crypto commodities ETH and BTC (Court finds that the smart contracts here were themselves able to be carried out lawfully, as with the exchange of crypto commodities ETH and Bitcoin).

Section 12(a)(1) of the Securities Act gives investors the right to sue for damages when the issuer violates Section 5 of the Securities Act (registration and exemptions of securities). Because this claim is based on the regulatory challenge of whether crypto assets are “securities,” the judge stated, “This is a matter for Congress to decide, not this court.” The court refused to extend the Securities Act to the alleged conduct of the plaintiffs and concluded that “investor concerns are best addressed to Congress, not this court,” due to a lack of relevant regulatory basis.

Although SEC Chairman Gary Gensler has so far avoided calling ETH a security, Judge Katherine Polk Failla directly referred to ETH as a commodity (Crypto Commodities) in this case and refused to expand the scope of the Securities Act to cover the alleged conduct in the case against Uniswap.

Considering that Judge Katherine Polk Failla also presided over the SEC v. Coinbase case, her response to whether cryptocurrency assets are “securities” or not was: “This is not a decision for the court, but for Congress” and “ETH is a crypto commodity”. Can we interpret it in the same way in the SEC v. Coinbase case?

Regardless, although laws are currently being formulated around DeFi, regulatory agencies may one day address this gray area. However, the Uniswap case does provide a sample for the decentralized DeFi world to deal with regulations, namely that decentralized exchange DEX cannot be held responsible for losses suffered by users due to tokens issued by third parties. This actually has a greater impact than the Ripple case and is beneficial for DeFi.

4.4 CFTC Shifts Focus to DeFi, Possibly a More Terrifying Regulator Than the SEC

On September 7, 2023, the CFTC once again focused on DeFi and penalized three blockchain companies in the United States, Opyn, Inc., ZeroEx, Inc., and Deridex, Inc., who eventually admitted guilt and settled.

Opyn and Deridex respectively developed and deployed DeFi protocols and websites, providing token derivative trading and perpetual contract trading respectively; ZeroEx developed and deployed the 0x Protocol and DEX application, which allowed investors to trade tokens with leverage/margin characteristics deployed by unrelated third parties on the DEX. These transactions can only be provided to retail users on registered exchanges that comply with the U.S. Commodity Exchange Act (CEA) and CFTC regulations. However, the three companies never registered and illegally provided services, nor did they comply with the KYC requirements of the Bank Secrecy Act.

According to the charges, the CFTC demanded that Opyn, ZeroEx, and Deridex each pay civil fines of $250,000, $200,000, and $100,000 respectively, and required them to cease their illegal activities. Under the settlement agreement, the three companies agreed to pay the civil fines to avoid further legal action.

CFTC Enforcement Director Ian McGinley said, “There was once an inherent idea in the DeFi community that the blockchain was beyond the reach of the law. However, that is not the case. The DeFi industry may be innovative, complex, and constantly evolving, but law enforcement agencies will also keep up with the times and actively pursue non-compliant unregistered platforms that allow U.S. users to trade derivatives.”

Web3 Legal Comments:

In the dissenting statement, CFTC commissioners raised the question: If a DeFi protocol is developed and deployed for legitimate purposes but is used by unrelated third parties for purposes that violate the CEA and CFTC regulations, who should be held responsible? Should the developers of the DeFi protocol be held responsible indefinitely? These questions have actually been answered in the previous Uniswap precedent, where the court tells us from a judicial perspective: The developers and investors of Uniswap should not be held responsible for any damages caused by the use of the protocol by third parties because the underlying smart contracts of Uniswap and the token contracts deployed by third parties are completely different.

There is a huge space here that needs to be fully discussed and debated. Most lawyers have the same perspective as the judge in the Uniswap case, that is, the responsibility should be borne by the malicious third party that caused the damage, not the developers who cannot control the actions of the malicious third party. The developers only release and submit the code.

However, considering the criminal charges against the founder of Tornado Cash by the US Department of Justice, the CFTC v. Ooki DAO case, and the regulatory enforcement by the CFTC, it can be seen that regulators do not think so. The CFTC still attributes the responsibility of the malicious third party to the developers, even if the developers cannot control the actions of the malicious third party. For example, in the regulatory enforcement against ZeroEx, the regulators did not consider whether the protocol developers were associated with the derivatives tokens that were launched, or whether the protocol developers had the ability to control the launch of the derivatives tokens.

Previously, the CFTC, through the precedent of Ooki DAO, established the determination of violations in DeFi businesses and the responsibility of on-chain DAOs and voting members of DAOs. After DAOs can be sued, the on-chain is no longer a lawless place, and regulatory enforcement agencies can use this as a breakthrough to regulate on-chain DAOs, DeFi, and DEX projects. This case is a further expansion of CFTC’s regulatory enforcement in the field of DeFi.

(https://cryptoslate.com/cftc-settles-charges-against-comLianGuainies-behind-0x-zrx-two-other-defi-protocols/)

5. Hidden currents and potential in the stablecoin market

5.1 Stablecoins from payment giant LianGuaiyLianGuail expected to lead the crypto industry into the mainstream

On August 7, 2023, American payment giant LianGuaiyLianGuail announced the launch of its stablecoin, LianGuaiyLianGuail USD (PYUSD). The PYUSD stablecoin is fully collateralized by US dollar deposits, short-term US government bonds, and similar cash equivalents, and qualified US users can exchange 1:1 with the US dollar through LianGuaiyLianGuail. As a result, LianGuaiyLianGuail becomes the first tech giant to issue a stablecoin.

As the only supported stablecoin in the LianGuaiyLianGuail ecosystem, PYUSD leverages LianGuaiyLianGuail’s over 20 years of experience in the global payment industry and combines the efficiency, low cost, and programmability of blockchain to connect LianGuaiyLianGuail’s existing 431 million users, providing a seamless bridge between fiat currency and digital currency for consumers, merchants, and developers of Web2.

LianGuaiyLianGuail CEO Dan Schulman said, “The transition to digital currency requires a stable tool that is both digital and easily linked to fiat currencies such as the US dollar. PYUSD provides the necessary foundation for the growth of digital payments.”

Eligible US customers can use LianGuaiyLianGuail to:

- Transfer: Transfer PYUSD between LianGuaiyLianGuail and compatible external wallets.

- Send: Make peer-to-peer payments using PYUSD.

- Fund Purchases: Choose PYUSD as a payment method during checkout.

- Convert: Convert PYUSD to any cryptocurrency supported by LianGuaiyLianGuail.

LianGuaixos Trust Company, which issued PYUSD, was established in 2013 and primarily provides services such as cash custody, cryptocurrency services, digital asset issuance, and securities and commodities settlement. The company holds the New York BitLicense for operating cryptocurrency assets and is regulated by the New York Department of Financial Services (NYDFS). Although LianGuaixos received regulatory requirements from NYDFS in February this year and delisted the Binance-Peg BUSD stablecoin, as well as received a Wells Notice from the SEC considering BUSD as a security, it is believed that the cooperation with LianGuaiyLianGuail is cautious in terms of market size and qualification review.

Web3小律 Comments:

In the current stablecoin market with a total market value of $120 billion, USDT and USDC account for approximately 68% and 21% of the market share, respectively. PYUSD, which is currently only available to eligible LianGuaiyLianGuail customers in the United States, aims to carve out a niche in the existing market and will directly compete with USDC and BUSD, as these American customers tend to use regulated onshore stablecoins.

According to a report on August 21, Coinbase is acquiring a portion of Circle Internet Financial’s shares, which means that Coinbase and Circle will have greater strategic and economic consistency in the future development of the crypto financial system to compete with competitors such as USDT and PYUSD. At the same time, Coinbase will be able to explore broader use cases for USDC, which will extend beyond trading scenarios to areas such as forex and cross-border payments through Web3.

5.2 Singapore First to Introduce Stablecoin Regulatory Framework

On August 15, 2023, the Monetary Authority of Singapore (MAS) announced the final version of its regulatory framework for stablecoins, making Singapore the first jurisdiction globally to include stablecoins in its regulatory framework. MAS conducted a public consultation on stablecoins in October of last year.

Stablecoins are digital payment tokens designed to be pegged to one or more specified fiat currencies and maintain a stable value. When properly regulated to maintain this value stability, stablecoins can serve as trusted means of exchange to support innovations, including the “on-chain” purchase and sale of digital assets.

The Monetary Authority of Singapore’s (MAS) regulatory framework for stablecoins will apply to single-currency stablecoins (SCS) issued in Singapore, pegged to the Singapore dollar or any G10 currency. Issuers of such SCS, both banks and non-banks, must meet the following key requirements:

- Value Stability: The reserve assets of SCS must meet requirements in terms of composition, valuation, custody, and auditing to ensure high value stability.

- Capital: Issuers must maintain minimum base capital and liquid assets to reduce bankruptcy risks and orderly wind down operations if necessary.

- Redemption at Face Value: Issuers must return the face value of SCS to holders within five working days after redemption requests.

- Disclosure: Issuers must provide appropriate disclosures to users, including information on SCS value stabilization mechanisms, SCS holder rights, and audit results of reserve assets.

MAS states that only stablecoin issuers who meet the regulatory framework requirements can apply to MAS for their stablecoin to be recognized and labeled as “MAS-regulated stablecoin”. This unique classification will help users differentiate regulated and unregulated stablecoins, enhancing user trust and confidence. MAS emphasizes the importance of compliance and notes that falsely representing tokens as MAS-certified individuals or entities will face the penalties outlined in the framework. These consequences include fines, possible imprisonment, and being listed on an official alert list.

MAS official Hern Shin said, “MAS’s regulatory framework for stablecoins aims to promote the use of stablecoins as trusted digital transaction media and as a bridge between fiat currencies and the digital asset ecosystem. We encourage SCS issuers who wish their stablecoins to be recognized as ‘MAS-regulated stablecoins’ to prepare for compliance as early as possible.”

5.3 Call for the Launch of Hong Kong Dollar Stablecoin

Wang Yang, Vice President of Hong Kong University of Science and Technology and Chief Scientific Advisor of the Hong Kong Web3.0 Association, stated in a policy proposal on August 22 that with the rapid development of the digital asset field, Hong Kong has unique advantages to lead this revolution. However, this prospect depends on whether Hong Kong can issue a stablecoin (HKDG) backed by foreign exchange reserves in a timely manner. If Hong Kong lags behind major US entities that are ready to issue large amounts of US dollar stablecoins, Hong Kong will miss the opportunity.

Although the Hong Kong dollar can be exchanged for other currencies at any time, it is rarely used in international trade or as a global reserve currency, possibly due to its peg to the US dollar. If Hong Kong seizes the opportunity of tokenizing RWA by issuing HKDG, the potential of the Hong Kong dollar as an international currency will be greatly enhanced, and it may even challenge the dominance of the US dollar in certain areas.

The timely issuance of HKDG can enhance the international status of the Hong Kong dollar, especially in the field of digital assets. In addition, the upcoming tokenization of real-world assets (RWA) can lay the foundation for the internationalization of the Hong Kong dollar and provide a way to challenge the dominance of the US dollar. Although the stablecoin market is currently relatively small compared to the global economy, with the momentum of RWA tokenization, the stablecoin market will prosper. If HKDG can occupy a favorable position and stand firm before major financial giants in the United States enter the market, it can maintain a leading position even after the rapid growth of the stablecoin market. If the market value of the RWA tokenization market reaches trillions of dollars and HKDG can capture 10% of the stablecoin market, it will be a significant victory for the internationalization of the Hong Kong dollar and a substantial challenge to the dominance of the US dollar.

Regarding stablecoins, the Securities and Futures Commission of Hong Kong previously stated in the “Consultation Conclusion” that: The Hong Kong Monetary Authority has issued a “Consultation Conclusion on Cryptographic Assets and Stablecoins” in January 2023, indicating that regulatory arrangements for stablecoins will be implemented in 2023/24, including the establishment of licensing and licensing systems for activities related to stablecoins. Before stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading.

Web3 Xiao Lu’s Comments:

As the most important medium of exchange between the real world and the crypto world, stablecoins have always played a crucial role in the crypto market. Governments around the world are gradually realizing the enormous potential of stablecoins. Major jurisdictions have successively launched consultations and legislative activities related to stablecoins, such as the EU’s MiCA proposal, which includes requirements for stablecoin issuers, the US Congress is also proposing legislation related to stablecoins, the UK has approved new legislation that includes stablecoins, Singapore has published its stablecoin regulatory framework, and Hong Kong, China is also vigorously discussing the operational path of stablecoin regulation.

In the current stablecoin market with a market cap of over 120 billion US dollars, 99% of stablecoins are backed by US dollar assets. We see that Tether, which occupies more than 65% of the stablecoin market, already holds 72.5 billion US dollars in US Treasury bonds and has become the 22nd largest holder of US Treasury bonds in the world. So how to issue stablecoins backed by other fiat assets to counter the US dollar stablecoins is a key issue that various jurisdictions need to focus on.

Sixth, the Hong Kong government’s first regulatory enforcement after the crypto new policy

On September 13, 2023, the Securities and Futures Commission of Hong Kong (SFC) named JPEX, a self-proclaimed virtual asset trading platform, in its first regulatory enforcement action by the Hong Kong government after the crypto new policy.

The SFC stated that JPEX actively promoted its services and products to the Hong Kong public through social media influencers and OTC channels. The JPEX entity did not obtain a license from the SFC and did not apply for a license to operate a virtual asset trading platform in Hong Kong. JPEX responded on its official website: “We have been unfairly suppressed by the SFC, and the SFC should bear full responsibility for undermining the prospects of cryptocurrency development in Hong Kong.”

In the following days, users found that the platform was indirectly restricting withdrawals. JPEX’s booth at Token2049 was empty, and there were unusual fund activities on the chain involving 190 million USDT. The Securities and Futures Commission (SFC) stated that it has referred the case to the police for further investigation. Subsequently, the police received multiple reports and arrested several individuals, including KOLs and internet celebrities, on suspicion of conspiracy and fraud.

The Securities and Futures Commission (SFC) issued an announcement on September 20, 2023, stating that JPEX, claiming to be a virtual asset trading platform, was operating without a license in Hong Kong and may have engaged in fraudulent activities targeting investors. As of the 23rd, the police have received 2,305 reports, with the total amount involved reaching 1.43 billion yuan. The incident has had a wide impact and attracted widespread attention in society.

(https://www.scmp.com/news/hong-kong/law-and-crime/article/3235185/jpex-cryptocurrency-scandal-hong-kongs-mtr-corp-removes-outdated-online-ad-trading-platform-amid)

On September 25, the SFC stated in a press conference on virtual asset trading platforms that it will optimize regulation in four aspects, further strengthen the release of information on virtual asset investments and investor education, and enhance public awareness of virtual trading platforms.

In view of this, the SFC will take the following measures: (1) publicly disclose a list of four types of virtual asset platforms online, including licensed platforms, closed platforms, platforms with issued licenses, and platforms with new license applications; (2) to make it easier for the public to recognize and be vigilant, the SFC will publicly release a list of suspicious platforms on its website; (3) the SFC will collaborate with the Investor and Financial Education Council to carry out a series of public awareness campaigns to enhance investor education; (4) increase efforts in information collection, timely track suspicious illegal trading platforms, and impose judicial sanctions on them.

In addition to the above measures, the SFC will continue to strengthen cooperation with the police, explore the establishment of dedicated channels to exchange information on suspicious activities and regulatory violations of virtual asset trading platforms, and work together to bring offenders to justice. At the same time, the SFC will continue to review the existing regulatory system and make supplementary and improvement measures based on actual circumstances.

Carolina Leung, the CEO of the SFC, emphasized that Hong Kong has already implemented multiple measures to protect investors and will not change the virtual asset development policy that has already been announced due to suspicions of illegal activities.

Web3 Xiao Lu Comments:

In fact, from the perspective of the entire incident, some of JPEX’s deceptive methods are considered child’s play in the crypto circle. Examples include endorsements by KOLs and celebrities, claiming to have partnerships with JPX and Visa, and using pyramid schemes with referral rewards. These methods are commonly seen in previous P2P scams and are not even comparable to FTX.

But why are there still so many victims trapped in it? The SFC’s call for strengthening investor education at the press conference provides us with the answer, which is the need to educate newcomers and new “leeks” in the industry and accompany it with profound lessons. This is actually one of the goals often mentioned by Gary Gensler, the SEC’s “protecting investor interests”. The purpose of SEC’s regulatory enforcement is more focused on traditional financial market investors rather than cryptocurrency market investors.

This first regulatory enforcement by the Hong Kong government after the new cryptocurrency policy shows that there is still a long way to go for cryptocurrency regulation in Hong Kong. Although we see many victims involved in the cases, the ones who are truly deeply affected are the cryptocurrency community in Hong Kong, which is still in its infancy.

End of the article.

This article is for learning and reference only. I hope it can be helpful to you. It does not constitute any legal or investment advice. Not your lawyer, DYOR.

REFERENCE:

[1] IMF-FSB Synthesis Paper: Policies for Crypto-Assets

https://www.fsb.org/2023/09/imf-fsb-synthesis-paper-policies-for-crypto-assets/

[2] CFTC Issues Orders Against Operators of Three DeFi Protocols for Offering Illegal Digital Asset Derivatives Trading

https://www.cftc.gov/PressRoom/PressReleases/8774-23

[3] DOJ, Tornado Cash Founders Charged with Money Laundering and Sanctions Violations

https://www.justice.gov/opa/pr/tornado-cash-founders-charged-money-laundering-and-sanctions-violations

[4] SEC Charges Creator of Stoner Cats Web Series for Unregistered Offering of NFTs

https://www.sec.gov/news/press-release/2023-178

[5] MAS Finalises Stablecoin Regulatory Framework

https://www.mas.gov.sg/news/media-releases/2023/mas-finalises-stablecoin-regulatory-framework

[6] Policy Suggestions/Seize the Opportunity to Issue Government-backed Hong Kong Dollar Stablecoin/Wang Yang, Wen Yizhou

http://www.takungpao.com/opinion/233119/2023/0822/884381.html

[7] Uncovering the Exchange JPEX: Pyramid Schemes, Fraud, and the First Case of Hong Kong’s Cryptocurrency Regulations by Internet Celebrities

https://mp.weixin.qq.com/s/9KcYsTuow3NhTtrsdFadWA

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!