Today’s News Highlights:

US SEC Delays ARK 21Shares Bitcoin Spot ETF Decision Date to January Next Year

Binance Announces Full Exit from Russia, Selling All Russian Business to CommEX

Shanghai Municipal Science and Technology Commission Issues “Shanghai Blockchain Key Technology Research and Development Special Action Plan (2023-2025)”

- Pudgy Penguin 2023 Report Key Data and Holder Trends

- Interpreting the Next Bull Market from the Perspective of Past Bull and Bear Markets and Economic Cycles When Will It Arrive?

- Binance Co-founder He Yi From Struggle to Confidence, Embracing a New Round of Challenges

Arbitrum Odyssey Event Resumes, First Week’s Task Takes Place on GMX

Celestia Launches Genesis Airdrop: Distributing a Total of 60 Million TIA, Application Deadline is October 17th

Curve Founder Repays All Debts on Aave, Deposits 68 Million CRV and Borrows 10.77 Million crvUSD from Silo in the Past 2 Days

MakerDAO Adds Another $100 Million in RWA Assets, Protocol’s RWA Total Assets Exceed $3.1 Billion

Regulatory News

US SEC Delays ARK 21Shares Bitcoin Spot ETF Decision Date to January Next Year

According to The Block, the US Securities and Exchange Commission (SEC) will delay its decision on the proposed ARK 21Shares Bitcoin ETF, with the new deadline set for January 10th next year. The SEC has also delayed the decision deadline for the Global X Bitcoin Trust to November 21st.

US Bankruptcy Court Approves BlockFi Liquidation Plan

The US Bankruptcy Court in New Jersey has approved BlockFi’s liquidation plan. Bankruptcy Judge Michael A. Kaplan approved BlockFi’s third amended Chapter 11 plan at a court hearing on September 26th. Court documents show that BlockFi submitted its first liquidation plan to the bankruptcy court on November 28th last year, but was subsequently required to submit the first, second, and third modified plans respectively on May 12th, June 28th, and July 31st. BlockFi’s liquidation plan was approved after the company reached a settlement with the creditors’ committee over long-standing disputes with the company’s management. It is estimated that BlockFi owes over 100,000 creditors up to $10 billion, including $1 billion to the three largest creditors and $220 million to bankrupt cryptocurrency hedge fund Three Arrows Capital.

WSJ: US Department of Justice Investigates Binance for Up to a Year, May Initiate Criminal Charges and Billions of Dollars in Fines

According to The Wall Street Journal, insiders revealed that the US Department of Justice has conducted an investigation for up to a year, which may result in criminal charges and billions of dollars in fines against Binance and Changpeng Zhao. Binance and the Department of Justice have been in discussions for several months, and there have been internal discussions within Binance about whether Changpeng Zhao should step down. Earlier this month, during a virtual meeting days before the departure of a Binance.US executive, the then-CEO of Binance.US, Brian Shroder, stated that Changpeng Zhao needs to address “his regulatory issues, put his Binance.US shares in a blind trust, or sell his shares” in order for the US platform to maintain its growth momentum.

In response to the regulatory challenges faced, Binance co-founder and Chief Marketing Officer He Yi vowed to overcome these troubles in a letter to employees last month. He Yi said, “Every battle is a matter of life and death, and the only thing that can defeat us is ourselves. We have won countless times before, and this time we need to win as well.”

In addition, according to insiders, Zhao Changpeng has been quietly hiring new lawyers to handle the case from the U.S. Department of Justice, while he has been staying in his home in the United Arab Emirates, where there is no extradition treaty with the United States.

Testimony of the U.S. SEC Chairman: The crypto industry’s “widespread non-compliance with securities laws” has led to a series of enforcement actions.

The U.S. House Financial Services Committee will hear from the SEC on how it will change its regulations and rules to keep up with technological advancements, including cryptocurrency and artificial intelligence, on September 27. SEC Chairman Gary Gensler publicly delivered his opening remarks before the hearing, outlining the SEC’s broader regulation of U.S. securities and exchanges, and he will directly address two areas of emerging technologies: predictive data analytics and cryptocurrencies.

Gensler wrote in his testimony, “Investors and issuers participating in the ‘crypto asset securities market’ should receive the protections provided by securities laws. The U.S. Congress has decided to include a list of over 30 items in the definition of securities, including the term ‘investment contract.’ As I mentioned before, without prejudging any particular token, the vast majority of crypto tokens may well be securities under the investment contract test. The SEC believes that most cryptocurrencies are subject to securities laws, which also require intermediaries such as exchanges, brokers, and dealers to comply with these laws. The broader industry has committed widespread non-compliance with securities laws, leading to a series of enforcement actions. The SEC aims to address issues in the crypto asset securities market through rulemaking.”

In addition, Gensler stated in his testimony that predictive data analytics and artificial intelligence have ushered in an “era of transformation,” driving efficiency throughout the economy. This technology has the potential to improve financial inclusion and user experience, but it also brings risks of exploitation. Gensler’s speech also mentioned a proposal put forward by the SEC in July 2023, which requires companies to analyze and address conflicts of interest arising from the use of predictive data analytics in interactions with investors. It is currently unclear whether Gensler will be asked to comment on the ongoing legal disputes between Coinbase and Binance.US.

NFT&AI

The Wall Street Journal: OpenAI is in negotiations with investors to sell existing stocks, with a valuation expected to reach $80-90 billion

The Wall Street Journal cited anonymous sources as saying that OpenAI is in negotiations with investors for a potential stock sale, with the company’s valuation expected to reach $80-90 billion, nearly triple its value earlier this year. The transaction will allow employees to sell their existing stocks instead of raising new funds through issuing new shares. Insiders said that OpenAI has started pitching this deal to investors, although the terms may still change. OpenAI, co-founded by Sam Altman, has received $13 billion in investment from Microsoft. The company previously stated to investors that it expects to generate $1 billion in revenue this year and increase it by several billion dollars by 2024.

Project Updates

Celestia launches Genesis Airdrop: 60 million TIA tokens to be distributed, application deadline is October 17th

Modular blockchain Celestia announced the launch of the Genesis Airdrop, distributing a total of 60 million TIA tokens, accounting for 6% of the total supply. The application deadline is 20:00 on October 17th, Beijing time. One-third of the airdrop supply will be allocated to 7,579 developers, including: public product and key protocol infrastructure, Eth Research, public contributors to the modular DA layer (such as Avail, EigenLayer, and Solana). Two-thirds of the airdrop supply will be allocated to 576,653 on-chain addresses, including: 20 million TIA tokens allocated to the most active users of Ethereum rollups; 20 million TIA tokens allocated to stakers and IBC relayers of Cosmos Hub and Osmosis.

Franklin Templeton submits 19b-4 filing to initiate Bitcoin ETF review process by the US SEC

ETF analyst James Seyffart from Bloomberg stated that asset management giant Franklin Templeton has submitted a 19b-4 filing to the US SEC for a Bitcoin spot ETF application. After receiving the filing, the SEC will initiate the official review process for the ETF. The 19b-4 filing includes a supervisory sharing agreement with the Chicago Board Options Exchange (CBOE).

KB, NH, and Shinhan securities companies in South Korea form a consortium for tokenized securities

KB Securities, NH Investment & Securities, and Shinhan Investment & Securities have announced the signing of a business agreement to form a consortium for tokenized securities. The three companies plan to establish a joint distributed ledger infrastructure, jointly address tokenized securities policies and establish industry standards, and improve securities issuance and distribution services.

Arbitrum Odyssey activities have resumed, with the first week’s tasks on GMX

The Odyssey activities have resumed, with the first task launched on GMX. The first week’s tasks will take place from early morning on September 27th to early morning on October 2nd Beijing time. Tasks include leveraged trading on the GMX V2 market, sharing GMX referral links on social media, and following GMX on social media.

Shanghai Science and Technology Commission issues “Shanghai Blockchain Key Technology Research and Development Action Plan (2023-2025)”

The Shanghai Science and Technology Commission has issued a notice on the issuance of the “Shanghai Blockchain Key Technology Research and Development Action Plan (2023-2025)”. The document points out that by 2025, in the areas of blockchain system security, cryptographic algorithms, as well as blockchain-specific processors, smart contracts, cross-chain, new storage, privacy computing, regulation, and other technical fields, efforts will be accelerated to achieve innovative breakthroughs and form a new generation of open and licensed blockchain technology system and standard specification that can support the development of Web3.0 innovative applications, be managed and controlled, and be open source and open.

The document outlines three main directions: new system architecture, resource scheduling and control, and trust enhancement. The key tasks include breakthroughs in basic software and hardware technology, technical innovation in system architecture, research on resource scheduling technology, research on security control technology, and breakthroughs in trust enhancement technology. The document also mentions Zero Knowledge Ethereum Virtual Machine (zk-EVM), Distributed Digital Identity (DID), and more.

Insider: Sequoia China purchases shares of Xiaohongshu at a valuation of $14 billion

According to sources cited by The Information, Sequoia Capital China recently purchased shares of Xiaohongshu, a Chinese social e-commerce application, from existing investors at a discounted price below the company’s latest equity financing valuation. Sequoia China had previously purchased shares of Xiaohongshu multiple times earlier this year at a valuation of $14 billion, which is 30% lower than the $20 billion valuation from the company’s equity financing at the end of 2021. Prior to this purchase, Sequoia China did not hold any shares of Xiaohongshu.

Mixin: Willing to provide $20 million as a bug bounty as long as the hacker returns the stolen assets

Mixin sent a message to the hacker through on-chain messaging, expressing that the majority of assets on the Mixin platform belong to users and hoping that the attacker can return the stolen assets. Mixin stated that if the attacker chooses to return the assets, they can keep $20 million as a bug bounty.

Mixin also stated today that they have completed most of the asset inventory work, and the situation is much more optimistic than expected.

Binance announces complete withdrawal from Russia, selling all Russian business to CommEX

Binance has announced that it has reached an agreement to sell all of its Russian business to CommEX. All assets of existing Russian users are protected securely and reliably. In the next few months, Binance will cancel all trading services and business lines in Russia. The withdrawal process will take up to a year.

Zhao Changpeng stated that BNB holders on CommEX will continue to enjoy a 25% trading fee discount.

DeFi protocol LianGuaindo on Mixin suspends interest calculation and liquidation services for LianGuaindo Rings and LianGuaindo Leaf

LianGuaindo, the DeFi protocol with the highest TVL on the Mixin blockchain network (including LianGuaindo Swap, LianGuaindo Rings, LianGuaindo Leaf, and Fennec Wallet), announced that its entire suite of LianGuaindo protocols still faces significant delays in transaction processing. To avoid additional asset losses due to asset price fluctuations and transaction processing delays, LianGuaindo MTG has temporarily suspended interest calculation and liquidation services for LianGuaindo Rings and LianGuaindo Leaf.

Chainlink’s cross-chain interoperability protocol CCIP is now live on the Base network

According to LianGuaiNews on September 27th, as reported by The Block, the decentralized oracle network Chainlink has made its cross-chain interoperability protocol (CCIP) available on Coinbase’s L2 network Base. A statement said that this move aims to provide Base developers with a secure way to build cross-chain applications and services that can send messages, transfer tokens, and initiate other transactions across multiple blockchain networks.

Bloomberg: The CEO of a US bank allegedly encountered a cryptocurrency scam of at least $12 million before its collapse.

According to Bloomberg, sources revealed that Shan Hanes, the CEO of Heartland Tri-State Bank in Kansas, USA, allegedly encountered a cryptocurrency scam of at least $12 million before the bank filed for bankruptcy on July 28.

The sources said that on July 5, Shan Hanes asked a client if he could borrow $12 million so that he could withdraw money from cryptocurrency investments. He promised to repay the money in 10 days and pay $1 million in interest as a return. Hanes claimed that someone he knew was helping him invest in cryptocurrency, but there were problems with the wire transfer, so he needed additional funds, and at least some of the funds were given to an entity in Hong Kong. The client refused to provide assistance and told Hanes that it sounded like a cryptocurrency scam, and he should go to Hong Kong to retrieve the money. A week later, the client informed a board member of Heartland about Hanes’ transfer of $12 million and asked if there could be a risk exposure in the bank. A bank representative then went to the regulatory agency. Currently, Hanes has not been accused of any wrongdoing and has not responded to detailed inquiries.

Binance completes the integration of Ethereum (ETH) on the Base network and opens up deposit services.

LianGuaiNews September 27th news, according to an official announcement, Binance has now completed the integration of Ethereum (ETH) on the Base network and opened up deposit services for the token on the network.

Funding News

Blockchain project Fhenix completes $7 million seed round, led by Multicoin Capital.

According to CoinDesk, blockchain project Fhenix announced the completion of a $7 million seed round of funding, led by Multicoin Capital and Collider Ventures, with participation from Node Capital, Bankless, HackVC, TaneLabs, and Metaplanet. Other individual investors include Tarun Chitra and Robert Leshner of Robot Ventures. The funds from this round will be used to introduce the Fhenix network into the public testnet early next year and support the development of ecosystem applications.

Important Data

Coinbase executive: Binance destroys $524 million worth of BETH.

Conor Grogan, a Coinbase executive, stated on the X platform: “After minting over $500 million worth of WBETH, Binance has destroyed $524 million worth of BETH.”

Curve founder repaid all debts on Aave, deposited 68 million CRV in Silo and borrowed 10.77 million crvUSD in the past 2 days.

Monitoring by Lookonchain shows that Curve founder Michael Egorov deposited 68 million CRV (worth $35.5 million) into Silo and borrowed 10.77 million crvUSD in the past 2 days. He then exchanged the crvUSD for USDT and repaid all debts on Aave. Currently, he holds 253.67 million CRV ($132.52 million) collateral and $42.7 million in debt on 4 platforms.

Beosin: In Q3 of this year, the Web3 sector has suffered a total loss of approximately $890 million due to security incidents, exceeding the total loss in the first half of the year.

Beosin, a blockchain security institution, jointly released the Q3 2023 Global Web3 Security Report with SUSS NiFT and Footprint Analytics, stating that the total loss in the Q3 Web3 sector due to hacker attacks, phishing scams, and Rug Pull events reached $889.26 million. The Q3 losses exceeded the total losses in the first half of 2023 (Q1 and Q2 losses were approximately $330 million and $333 million, respectively). There were a total of 43 major security incidents this quarter, resulting in a loss of $540.16 million. Among them, there were 29 cases in the DeFi sector, accounting for about 67.4%, and the project type with the highest loss amount was public chains. These 29 DeFi attacks caused a total loss of $98.23 million, ranking second among all project types. According to the classification of attack types: 9 incidents of private key leakage caused a loss of $223 million; Mixin Network security incidents resulted in a loss of $200 million; 22 contract vulnerabilities caused a loss of approximately $93.27 million. In terms of funds flow, $360 million (67%) is still in hacker addresses. Only 10% of the stolen funds were recovered this quarter. Ethereum network and Mixin together accounted for 79% of the total losses.

MakerDAO increases RWA assets by $100 million again, and the protocol’s total RWA assets exceed $3.1 billion

According to LianGuaiNews on September 27th, data from makerburn.com shows that MakerDAO has once again increased its RWA assets by $100 million through Monetalis Clydesdale and BlockTower Andromeda. In addition, the current total RWA assets of the protocol have exceeded $3.1 billion.

The LianGuaiNews APP Points Mall is officially launched

Hardcore prizes are available for free redemption: imKeyPro hardware wallet, First Class Warehouse research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience it now!

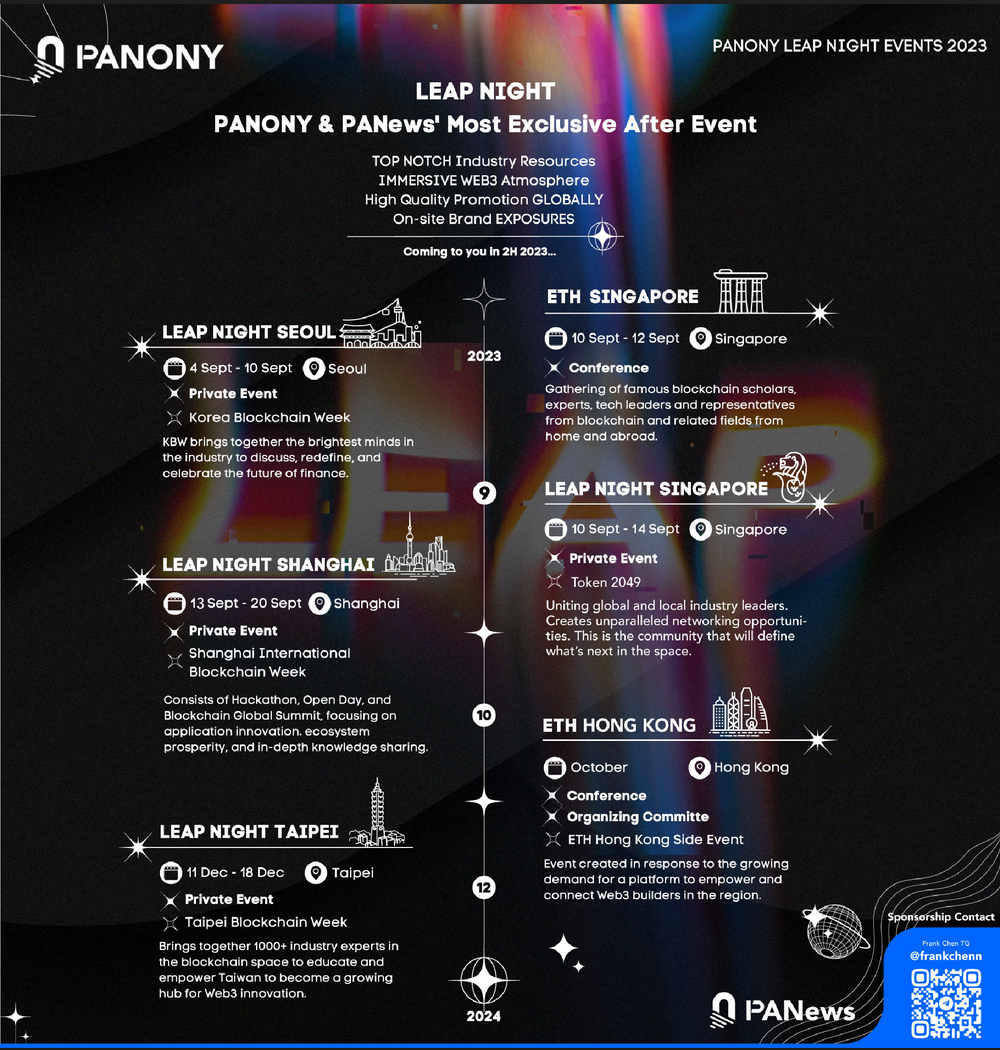

LianGuaiNews launches the global LEAP tour!

South Korea, Singapore, Shanghai, Taipei, multiple locations from September to December, witnessing a new chapter in globalization!

📥Activities are being jointly organized in multiple locations, welcome to communicate!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!