Lybra Finance is an LSDfi stablecoin protocol. Its main business model is to collateralize ETH or stETH to mint stablecoin eUSD, and achieve interest-bearing of holding stablecoin eUSD through the repurchase of eUSD with LSD’s income. The annualized interest rate ranges from 7% to 9%. The interest of stablecoin comes from the interest of ETH collateral, so the higher the collateralization ratio, the higher the interest. eUSD is maintained through over-collateralization, liquidation, and arbitrage. The LSDfi track has good fundamentals, narrative value, and user demand. Lybra Finance is currently the LSDfi protocol with the highest TVL. The innovative interest-bearing stablecoin eUSD has certain attractiveness to funds in the market, so this product is worth paying attention to.

Investment Summary

Lybra Finance is an LSDfi stablecoin protocol. Its main business model is to collateralize ETH or stETH to mint stablecoin eUSD, and achieve interest-bearing of holding stablecoin eUSD through the repurchase of eUSD with LSD’s income. The annualized interest rate ranges from 7% to 9%. eUSD is maintained through over-collateralization, liquidation, and arbitrage. The value ratio of collateral to eUSD needs to exceed 160%. When the value ratio of collateral to eUSD does not meet a certain proportion, anyone can liquidate the pledged assets, and the liquidator will receive a reward. When eUSD is higher than $1, users tend to mint eUSD and sell it in the market to make a profit, gradually bringing the price back to $1. When eUSD is lower than $1, users tend to buy eUSD in the market to exchange for ETH in the protocol, driving up the price of eUSD. This arbitrage model is common in stablecoin protocols, but its specific effect is difficult to determine.

LSDfi is a type of Defi protocol based on ETH collateral. Common ETH collateral tokens include stETH, bETH, rETH, cbETH, wstETH, etc., among which stETH and wstETH account for the majority of LSDfi TVL, about $650 million. The main development directions of LSDfi protocols are lending, stablecoins, DEX, etc. In addition to major protocols such as Pendle and Lybra Finance that rely mainly on LSDfi, established Defi protocols such as MakerDAO and Curve have also ventured into LSDfi, weakening the attractiveness of some LSDfi stablecoin protocols to funds. The LSDfi track has good fundamentals, narrative value, and user demand. The user demand for LSDfi comes from the desire of users for collateral to have liquidity exit and leverage to increase returns, and the current LSDfi protocols can basically meet these needs.

The disadvantages of Lybra Finance are:

- LianGuai Daily | Cryptocurrency custody company BitGo completes $100 million financing; Coinbase obtains regulatory approval for futures trading

- Exploring Narrative Trajectories How to Get Involved in Early Alpha Projects?

- How does demand-driven affect the valuation of cryptocurrency assets? Re-examining BTC, ETH, and TRON

1) The project has no risk financing, the team is anonymous, and the disclosure of code information is low, which may pose security risks;

2) The development of the project depends on the development of ETH derivatives;

3) The interest of eUSD essentially comes from the income of ETH collateral, and continuous investment in mining rewards is needed to achieve continuous growth of TVL in the early and middle stages of the project;

4) The appreciation operation of eUSD holders’ balance is not transparent enough, which may pose potential security risks.

The advantages of Lybra Finance are:

1) The issued stablecoin eUSD generates interest automatically, which can attract funds from the market;

2) Currently, it is the leader in LSDfi and has attracted attention from investors.

Therefore, this product is worth paying attention to.

1. Overview

1.1 Project Introduction

Lybra Finance is an LSDFi protocol that focuses on generating interest for stablecoins.

1.2 Basic Information[1]

|

Establishment Time |

February 2023 |

|

Issuance Time |

April 2023 |

|

Country |

\ |

|

Sector |

LSDfi |

|

Token Symbol |

LBR |

|

Market Cap Ranking |

792 |

|

Current Price |

$1.13 |

|

Fundraising Status |

$1.5 million |

|

Circulating Market Cap |

$14,327,436 |

|

Circulating Supply |

12,726,689 |

|

Total Supply |

100,000,000 |

|

Trading Pairs |

1 |

|

Top 10 Exchanges |

0 |

|

Highest Price since 18.1.1 |

$4.48 (May 29, 2023) |

|

Lowest Price since 18.1.1 |

$0.12 (May 8, 2023) |

2. Project Details

2.1 Team

In Discord, the administrators stated that Lybra Finance has an anonymous team.

2.2 Funding

Lybra Finance did not conduct any risk financing and sold 5,000,000 tokens at a price of 0.3U through IDO, with a total value of $1.5 million. 20% of the funds raised from the IDO will be used to provide LBR/ETH LP, 40% will be used to mint eUSD, 20% will be used to provide eUSD/USDC LP, and 20% will be used for market making and operational expenses.

2.3 Code

The Github code page for Lybra Finance is (https://github.com/LybraFinance). The code page has limited information, so a code report cannot be generated. The project has five repositories, and the code for the V2 mode started in May 2023.

2.4 Product

Lybra Finance is an LSDfi protocol where users can act as mints, holders, liquidators, and redeemers in the protocol. User earnings mainly come from holding eUSD and earning interest, minting eUSD and earning LBR tokens, staking LBR and sharing protocol revenue, and LP rewards. Currently, stablecoins in the cryptocurrency market can be divided into three types: fiat-collateralized stablecoins, such as USDT and USDC, which are usually issued and managed by centralized institutions and maintain a 1:1 collateral ratio, meaning that for each stablecoin issued, one fiat currency needs to be pledged as collateral; cryptocurrency-collateralized stablecoins, which are stablecoins minted by collateralizing underlying assets such as Bitcoin or Ethereum, with collateral ratios usually higher than 100%; and algorithmic stablecoins, which are a class of projects that use algorithms to maintain price stability for stablecoins. These projects have a higher risk of going to zero. One drawback of stablecoins that the Lybra Finance team believes is the lack of interest income. With the upgrade of Ethereum, stablecoins can generate interest income. By using liquid staking derivatives, stablecoins that provide price stability and stable interest rates can be created. Lybra Finance uses ETH and stETH as the main underlying assets to generate the stablecoin eUSD. eUSD is a stablecoin pegged to the US dollar, and the interest comes from the LSD income generated by depositing ETH and stETH. The annualized yield is about 7% to 9%. The interest income of eUSD comes from the staking income of ETH. Currently, the annualized yield of stETH is 3.8%, and the minimum collateralization ratio of LybraFinance is 160%. Therefore, the annualized yield of eUSD is between 7% and 9%. The higher the overall collateralization ratio of the project, the more beneficial it is for eUSD holders and the less beneficial it is for eUSD mints. In the absence of mining revenue, mints may have to repeatedly borrow to increase leverage in order to achieve ideal returns, and the actual returns may be lower than described by the project party.

The stability of eUSD is maintained through three methods: over-collateralization, liquidation mechanism, and arbitrage opportunities.

1) Over-collateralization: Each eUSD requires at least $1.5 worth of stETH as collateral. Over-collateralization helps maintain stability by ensuring that the value of the underlying collateral exceeds the value of the issued eUSD.

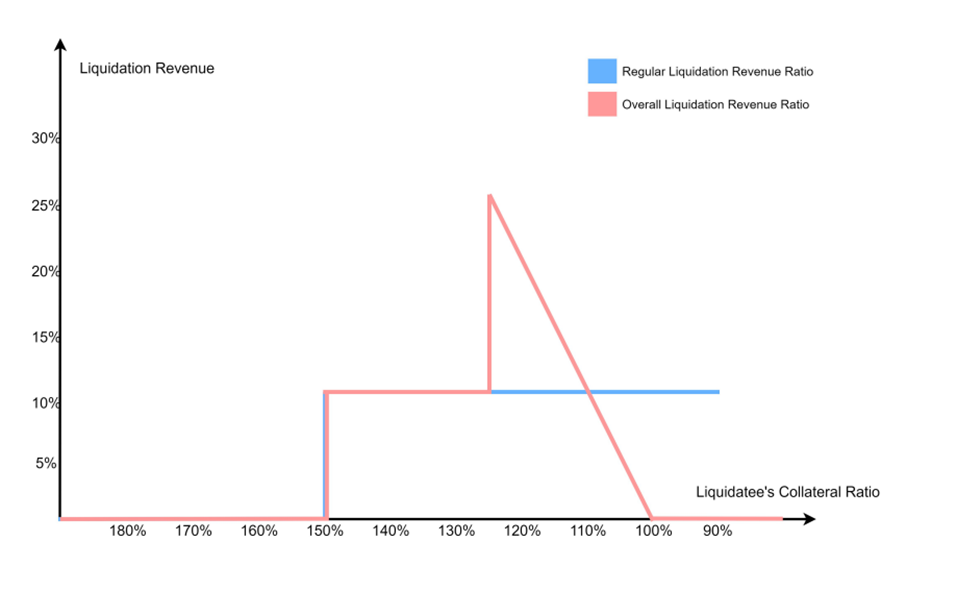

2) Liquidation mechanism: Lybra implements a liquidation mechanism. If a user’s collateral ratio falls below the safety collateral ratio, any user can voluntarily become a liquidator and purchase the liquidated portion of the collateralized stETH. Liquidation can be regular or comprehensive.

3) Arbitrage mechanism: If the price of eUSD exceeds $1, users can mint new eUSD by depositing ETH as collateral and then sell the eUSD. As eUSD is sold, its price gradually returns to $1. If the eUSD price falls below $1, users can buy eUSD at a discounted price in the market and then redeem the equivalent value of $1 ETH in the Lybra protocol. Users’ buying demand increases as the price difference widens, driving the eUSD price back to $1. Due to the interest income associated with eUSD, this arbitrage model may not always be viable, and in practice, eUSD often trades at a premium.

Figure 2-1 Lybra Finance's liquidation curve

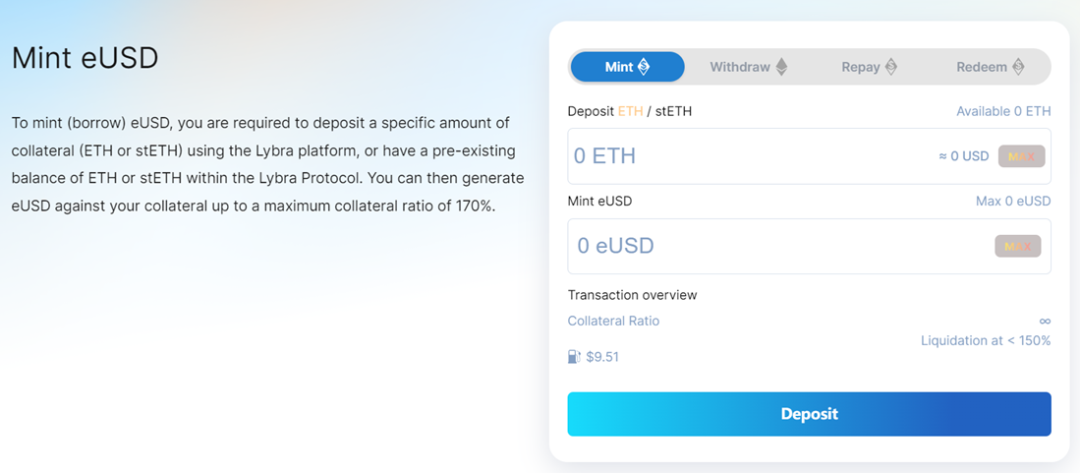

- Minting

Minting requires the user’s collateral ratio to be above the safety collateral ratio of 160%. The collateral ratio depends on the price of Ethereum. If the Ethereum price drops, the account may be at risk of liquidation. In addition, the protocol also has the concept of overall collateral ratio, which refers to the ratio of the total value of all collateral in the protocol to the total supply of eUSD. If the overall collateral ratio falls below 150%, all users with collateral ratios below 125% may be at risk of liquidation.

Figure 2-2 Lybra Finance's main interface

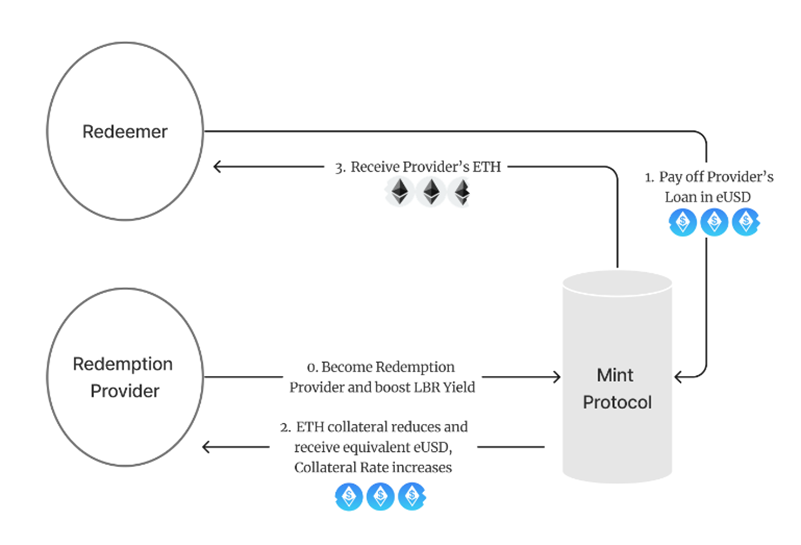

- Rigid Redemption

Directly exchanging eUSD for ETH is called rigid redemption. During this process, users need to pay a 0.5% fee to encourage them to repay their debts rather than redeem them rigidly. However, this may cause eUSD to deviate from $1. Rigid redemption does not equal debt repayment. If redemption occurs, users in redemption mode will lose a portion of their collateral and simultaneously reduce their corresponding debt, while also receiving a 0.5% redemption fee. This means that the collateral in redemption mode becomes the exit liquidity for other users.

Figure 2-3 eUSD rigid redemption process

- Mining

The main reward for mining in Lybra Finance is esLBR. Users can obtain esLBR by staking LBR, minting eUSD, constructing LBR/ETH LP and eUSD/USDC LP on the earn page. esLBR is a synonym for staked LBR and has the same value as LBR. It is also influenced by the total supply of LBR. esLBR cannot be traded or transferred, but it has voting rights and can share protocol profits. Mining rewards are the main source of esLBR. After users unstake esLBR and convert it back to LBR, the conversion will be completed within 30 days. Currently, there are 2,321,792.63 esLBR in the staking pool. Mining is an important means to maintain the growth of project TVL.

- V2

Lybra Finance is about to release V2 mode, with the following main improvements: 1) Adding new LSD assets as collateral, and determining the minting limit for the new LSD assets and using an isolation pool to reduce risk. 2) Enabling the new stablecoin peUSD, which is the LayerZero version of eUSD. Using LayerZero technology, eUSD is bridged from the Ethereum mainnet to the second layer. When eUSD is converted to peUSD, eUSD will be locked in the mainnet contract. The locked eUSD can be used for flash loans to facilitate liquidation and generate profits. 3) Liquidation. The liquidation process of peUSD is similar to that of eUSD in V1. peUSD eliminates the comprehensive liquidation process of eUSD. That is, when the collateralization ratio of the protocol is below 150%, users with a collateralization ratio below 125% will not be liquidated. The new liquidation process applies to both bridged and minted peUSD using LSD assets.

- Is a collateralization ratio of >160% too high?

A higher collateralization ratio leads to lower capital utilization. Among non-LSDfi stablecoin protocols, MakerDAO has the highest collateralization ratio. For the protocol, the higher the collateralization ratio, the more guaranteed the value of the stablecoin, because the price of ETH is fluctuating. A drop of 37.5% in the value of collateral when the collateralization ratio is 160% will make the value of collateral equal to the value of the stablecoin. For a collateralization ratio of 150%, it is 33.3% drop, for 140% it is 28.6% drop, for 130% it is 23% drop, and for 120% it is 16.6% drop. Looking at the past price movements of ETH, it is not impossible for ETH to drop by 20-30% in a period of time. From the calculation results, there is not much difference between the minimum collateralization ratios of 160% and 150%. For the protocol, it may be more reasonable to choose the minimum collateralization ratio of 150%. However, the underlying asset of LSDfi is essentially a derivative of ETH, which may be more unstable than ETH. Therefore, it is not unreasonable to have a higher collateralization ratio. Users who particularly pursue capital efficiency can directly purchase eUSD.

- Where does the interest of eUSD come from?

The deposited ETH is automatically converted into stETH by Lybra Finance. stETH will grow over time, and the income generated from the increase in stETH will be distributed to LBR token holders and eUSD stablecoin holders. For example, when User A deposits $135,000,000 worth of ETH and mints 80,000,000 eUSD, and User B deposits $15,000,000 worth of ETH and mints 7,500,000 eUSD, the current circulation of eUSD is 87,500,000, and the current value of collateral is $150,000,000. The income from stETH after one year (5%) is $7,500,000, and the service fee generated after one year (1.5%) is $1,312,500. The total profit generated by subtracting the two is $6,187,500.

- How does eUSD generate income?

The income generated by eUSD is achieved through the increase in the quantity of eUSD. When the stETH balance of the protocol increases due to LSD income or other reasons, the excess income will be converted into eUSD tokens and distributed to existing eUSD holders. The eUSD obtained through the exchange of stETH is equivalent to being destroyed, and the balance of other eUSD holders increases in value due to the increase in total value and the decrease in total shares. Generating income can also be achieved by directly exchanging other stablecoins such as USDT, USDC, and FRAX for eUSD. eUSD only has a trading pair with USDC on Curve, with a daily trading volume of about three to four hundred thousand US dollars. The total circulation of eUSD is 170,468,361.77, which is the only source of liquidity withdrawal for eUSD. The balance of eUSD is dynamic and represents the Ethereum shares held by the holders in the protocol. Regarding the dynamic changes in the eUSD balance, the answer given by the community administrators is that when the protocol earns $1,000 in income from rewards in a day, this $1,000 worth of stETH will be retained within the protocol. In order to distribute the income to eUSD holders, when someone wishes to redeem steth with eUSD, the protocol will give him the appreciated steth and distribute the eUSD used for redemption to the current eUSD holders. There are two doubts about this approach: the interest generated by steth in a day is unlikely to be exactly equal to the redemption demand of the day, and secondly, holders cannot see the holding information of eUSD on Etherscan, so these actions may not happen transparently on the chain every day.

- Is there a risk of eUSD being unanchored?

eUSD may become unanchored when the price of Ethereum drops sharply. On March 12, 2020, due to the congestion of Ethereum and the surge in transaction fees, DAI, which was fully collateralized by ETH, became unanchored and generated millions of dollars in bad debts. The possibility of such unanchoring exists for eUSD. The underlying asset of eUSD, stETH, comes from the decentralized Ethereum staking service provider Lido Finance. stETH experienced unanchoring in June 2022 before Ethereum launched its redemption, with a maximum unanchoring rate of 5%. The impact of such unanchoring on eUSD may be temporary, but it cannot be ruled out that users may consume all withdrawal liquidity due to panic and cause further unanchoring of eUSD. Currently, because buying eUSD directly with equivalent assets can generate more ETH staking income than minting eUSD, eUSD may have a long-term premium.

Figure 2-4 eUSD Trading Chart

- What kind of application scenarios can eUSD generate?

The lifespan of stablecoins depends on the size of their application scenarios, and the biggest problem with decentralized stablecoins is the lack of application scenarios. The pioneer of decentralized stablecoins, DAI, has a total of 661 trading pairs on various centralized and decentralized exchanges, providing liquidity far exceeding eUSD. The main reasons why DAI can achieve large-scale adoption are its early appearance and its collateral assets including centralized stablecoin USDC and ETH, subtly satisfying users’ dual requirements for security and decentralization of decentralized stablecoins. eUSD, with stETH as its underlying asset, clearly cannot meet this requirement. The security of stETH is not as good as ETH itself, and eUSD itself is also limited by the growth of stETH assets. Therefore, it is speculated that eUSD will still primarily serve as an interest-bearing certificate for ETH staking and cannot compete in the stablecoin arena.

Summary: Lybra Finance is an LSDfi stablecoin protocol that pioneered the business model of earning interest on stablecoins. Lybra Finance uses three methods: rigid redemption, over-collateralization, and arbitrage, to maintain the stability of the eUSD price. It achieves stablecoin interest by repurchasing eUSD with LSD revenue, while also attracting funds through token mining. By reducing the token selling pressure through token release vesting, it has become the protocol with the highest TVL in LSDfi. The V2 model will be expanded to L2 through LayerZero technology, and TVL is expected to further increase. The product has no VC investment, anonymous team, and low code disclosure, which may involve certain risks.

3. Development

3.1 History

Table 3-1 Major Events of Lybra Finance

|

2023.04.20 |

Lybra Finance launches IDO, planning to sell 5% of tokens |

|

2023.05.27 |

Lybra Finance TVL approaches $100 million |

|

2023.06.04 |

Lybra Finance introduces collateral ratio monitoring function |

3.2 Current Status

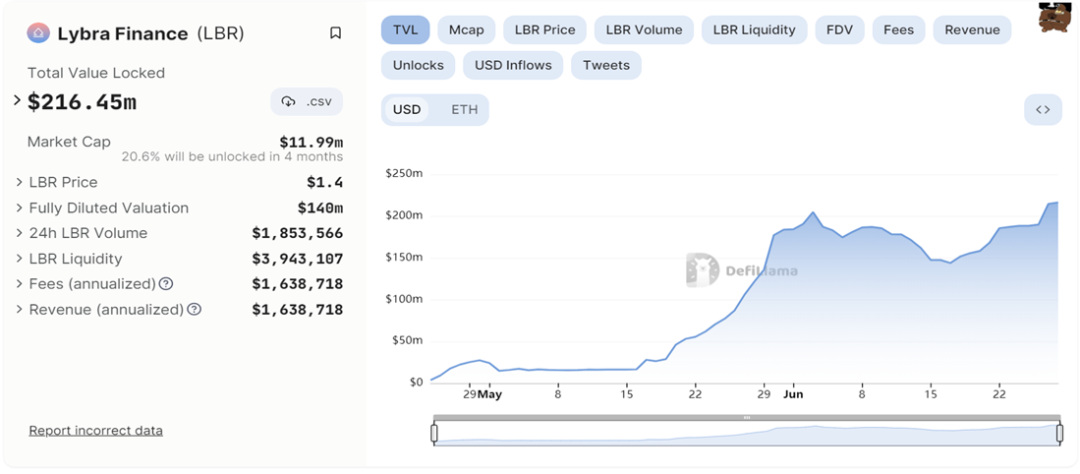

Figure 3-1 TVL change curve of Lybra Finance

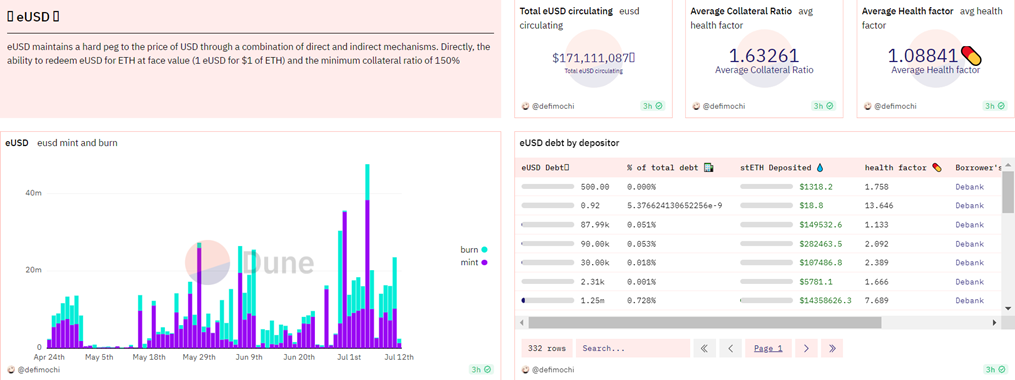

Lybra Finance’s TVL has grown from over $3 million in April 2023 to $236 million currently. There are 170 million minted eUSD tokens, with an average collateral ratio of 1.63 and an average health factor of 1.088. If a 1.5% fee is charged, the current annual fee of the protocol is $2.566 million.

Figure 3-2 Minting status of eUSD

3.3 Future

The team’s work plan for the third quarter of 2023 includes:

1) Establish a secure multi-signature wallet; 2) Integrate with LayerZero protocol; 3) Deploy on Arbitrum; 4) Deploy lending function; 5) Full-chain deployment; 6) Explore more composable DeFi; 7) Develop more features based on community suggestions from Lybra DAO.

4. Economic Model

4.1 Token Distribution

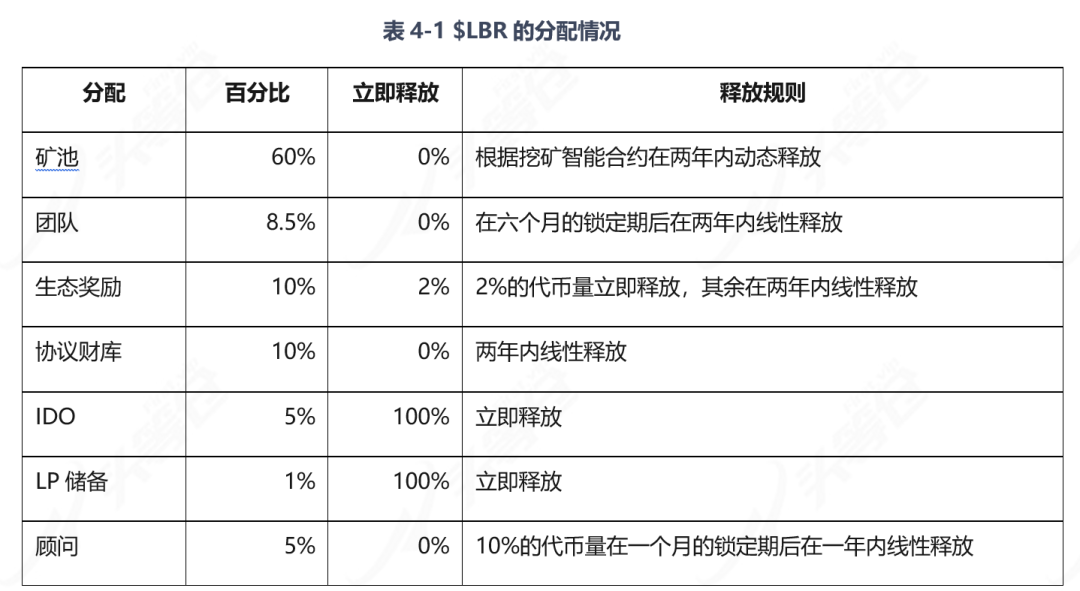

$LBR is the native token of Lybra Finance with a maximum supply of 100,000,000. $LBR holders can participate in voting and governance while sharing protocol revenue. Lybra Finance’s revenue comes from a 1.5% service fee on the total eUSD supply, and the service fee collected by Lybra Finance will be distributed proportionally based on the LBR holders’ stake in the LBR staking pool. esLBR is a custodian of $LBR, and its use cases include 1) governance; 2) receiving service fee revenue; 3) distributing rewards to target audience; 4) receiving treasury and protocol revenue distribution. The existence of esLBR is primarily to reduce selling pressure on $LBR.

4.2 Holding Situation

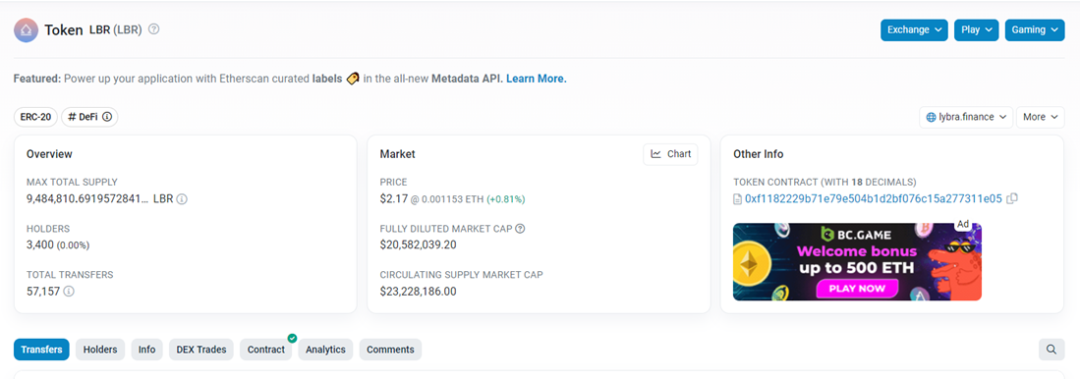

$LBR has a total of 3,400 holders and has experienced 57,157 transactions. Compared to other projects, the number of holders is relatively small. If the number of holders can further expand, the token may rise further.

Figure 4-1 Basic information of $LBR on the blockchain explorer

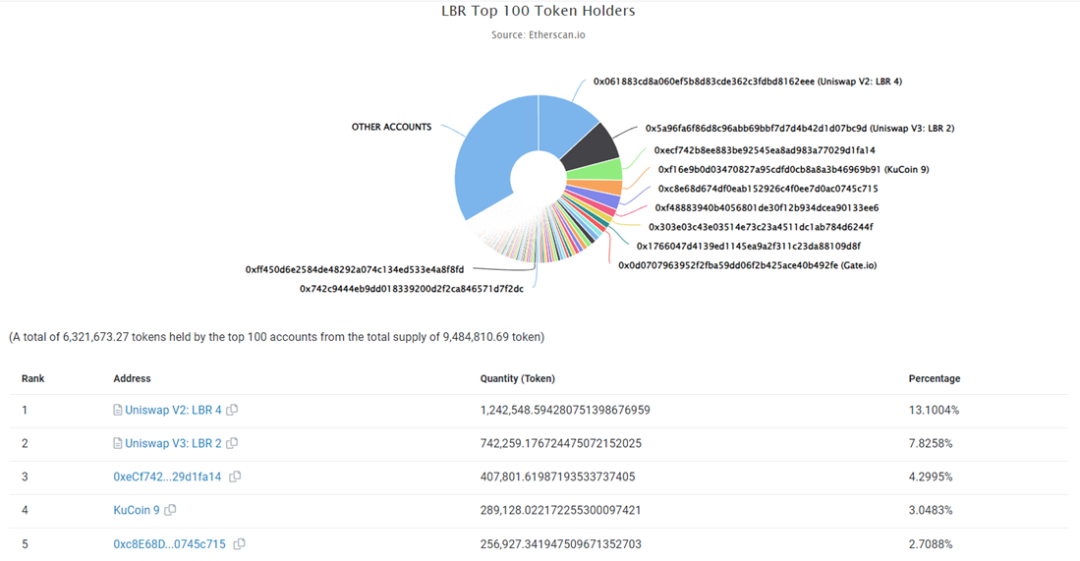

The top 100 holders of $LBR hold 66.6% of the total token supply, which is relatively low compared to other project tokens. The addresses of the top five holders are mainly centralized and decentralized exchanges, and the main trading place for $LBR is Uniswap.

Figure 4-2 Distribution of $LBR holders

5. Competition

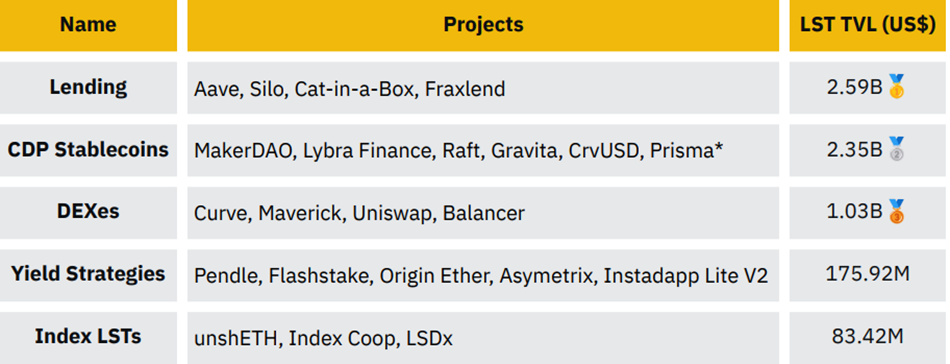

5.1 Industry Overview

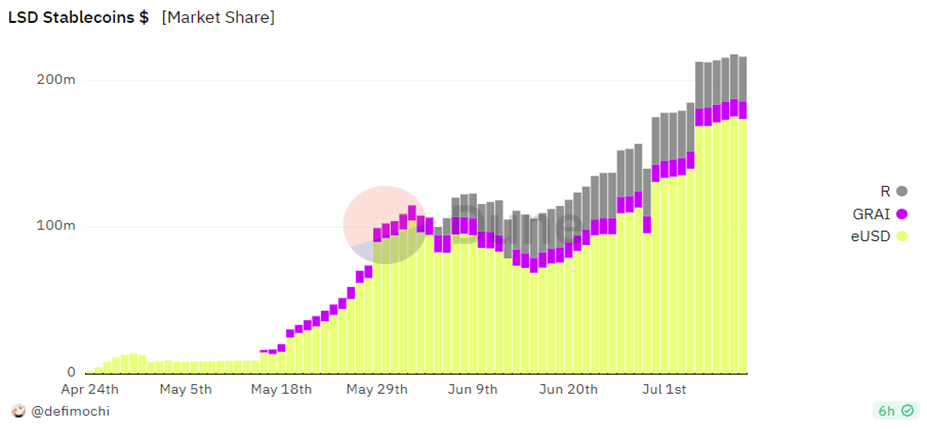

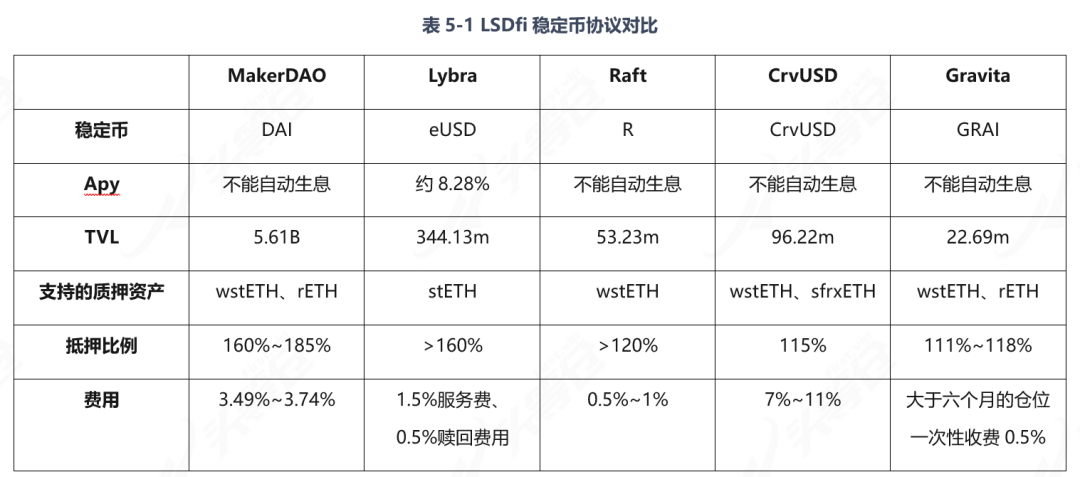

LSD refers to the liquidity staking derivatives built on Ethereum Shapella upgrade. DeFi built on LSD is LSDfi, and the goal of LSDfi is to provide higher yields for LSD. According to the data from Dune made by @hildobby, a total of 23,413,761 ETH has been staked, accounting for 19.66% of the total circulating supply of ETH, with a total value of $43.78 billion. The highest staked project on Ethereum is Lido, accounting for 31.7% of the total staked amount, followed by Coinbase, accounting for 9.6% of the total staked amount. The staked amount of ETH has been steadily increasing from 2020 to the present. How to activate the market value of this hundreds of billions of dollars market is an important issue for various LSDfi projects. The main development directions of LSDfi are lending, stablecoins, and DEX. The top three new projects in terms of LSDfi market share are LybraFinance, raft.fi, and pendle, accounting for 48.3%, 7.679%, and 7.549% respectively. Projects that do LSDfi in the form of stablecoins currently include Lybra Finance, Raft, and Gravita, with LybraFinance’s stablecoin eUSD accounting for over 70% of the LSDfi stablecoin market.

Binance Research pointed out in a research report that the total TVL of established LSDfi and newer LSDfi is 6.35 billion, and the TVL of established protocols is approximately 8.76 times higher than that of newer protocols. The TVL of newer protocols has increased by approximately 66.1% since May 2023. Almost all protocols are integrated with stETH, and excessive reliance on a single collateral may lead to an unhealthy growth pattern.

Figure 5-1 Ranking of LSDfi tracks

Lending is a product of the economic development of human society, with its history dating back to ancient times. In the modern financial system, lending is an important financial activity that can promote economic development and social progress. In the Web3 industry, the lending track is also very important. The development history of the lending track can be divided into three stages: 1) The first stage was around 2017, when projects represented by MakerDAO began to explore decentralized stablecoins and lending protocols based on Ethereum; 2) The second stage was from 2018 to 2019, when projects represented by Compound began to introduce concepts such as liquidity mining, governance tokens, and peer-to-pool, incentivizing users to participate in the lending market and enjoy returns and governance rights; 3) The third stage is from 2020 to the present, when projects represented by Aave began to innovate various lending models and functions, such as flash loans, credit delegation, fixed interest rates, etc., improving the efficiency and flexibility of the lending market.

Loans and stablecoins can be combined. Loan agreements can be divided into protocols that issue stablecoins themselves and protocols that do not issue stablecoins. If a loan agreement issues stablecoins, then the main focus of this agreement is stablecoins. The earliest loan agreement to issue stablecoins is MakerDAO. In the description of MakerDAO, it is obvious that the loan model is only used to collateralize stablecoins with underlying assets, and loans are not its main purpose. Stablecoins are a huge business in the industry. Firstly, the US dollar can generate interest when held in banks. Secondly, centralized stablecoin institutions can purchase government bonds and commercial bills. Even MakerDAO has purchased government bonds under the guise of doing RWA. This allows the issuers of stablecoins to raise a large amount of available funds through the “fake money for real money” method, and use these funds to generate many low-risk profits. With a large amount of capital, the returns are very considerable, which is an important reason why teams are attracted to do stablecoins.

Figure 5-2 Stablecoin Ratio of LSDfi

5.2 Comparison with Competitors

- Gravita

Gravita is an interest-free lending protocol with LSD as collateral. It provides users with interest-free loans guaranteed by Liquid Stake tokens and the Stability Pool. The loans are issued in the form of stablecoin GRAI, which is a token with a similar volatility suppression mechanism as LUSD. The maximum debt value generated can reach 90% of the value of the user’s collateral. Gravita is built on the loan protocol LiquityProtocol’s model. If the user repays the loan within six months, the interest will be proportionally refunded, with the minimum interest equivalent to only one week’s interest. To reduce the volatility of GRAI, GRAI holders are allowed to redeem 1 GRAI for collateral worth $0.97, incurring a 3% redemption fee.

- Raft.fi

Raft.fi is a stablecoin protocol called Lsdfi. Using Raft, each Ethereum wallet address needs to open a new position, and each address is only allowed to have one position. Wrapped stETH needs to be deposited in the address as collateral to borrow R. It allows users to deposit stETH to generate stablecoin R. Raft combines the design features of SAI and LUSD, aiming to maintain the stability of R. Users need to hold wstETH in the position, and the collateral-to-debt ratio must be at least 120%. Users need to borrow a minimum of 3000R. Raft uses the loan interest spread to maintain the stability of R price. The loan interest rate is the sum of the base interest rate and the loan interest spread, with an upper limit of 5%. The loan fee is calculated by multiplying the loan amount by the loan interest rate, and this fee is paid in stablecoin R. The debt that users need to repay includes the loan and the loan fee. When R is repaid, it will be immediately destroyed through a smart contract. [2]

There are three ways to destroy R, namely: 1) repayment, the borrower repays the borrowed R stablecoin in Raft and retrieves the pledged wstETH collateral. When users make repayments, they can choose to partially or fully repay the R token debt, but the remaining debt balance cannot be less than 3000 R. 2) redemption, R stablecoin holders exchange R for other borrowers’ wstETH, the redemption function allows R stablecoin holders to convert it into an equivalent amount of wstETH collateral at any time. When users use R to exchange for wstETH, the protocol will use R to partially repay the existing debt of each position, and the repayment ratio is allocated according to the ratio of the collateral. In order to promote repayment instead of redemption, the team has enabled the redemption spread, which is a component of the redemption interest rate. The redemption spread needs to be higher than the zero interest rate for repayment. 3) liquidation, liquidators repay the debts of borrowers whose collateral falls below the minimum collateral ratio, and receive the pledged wstETH and liquidation rewards as compensation. When the value of the collateral is between 120% and 100% collateral ratio, the account is eligible for liquidation. The liquidator reward is to encourage users to support the protocol liquidation and compensate the risks borne by the liquidators during the liquidation process. Raft also adopts a benchmark interest rate, which is used to regulate borrowing and redemption behavior and reduce the volatility caused by borrowing and redemption. When the benchmark interest rate increases, both borrowing and redemption will require more money. Raft also has a flash minting function, which allows users to mint 10% of the total supply of R at one time. Flash minting can be used for leverage, with a maximum leverage of 11 times.

Summary: The proportion of LSDfi tokens is ranked by stETH, wstETH, and sfrxETH. Users need to be aware that wrapped tokens like wstETH can retain the staking rewards of ETH directly, while storing stETH cannot. The TVL of LSDfi depends on the total market value of ETH and the number of derivatives generated by ETH. As MakerDAO, Curve, and other well-established DeFi protocols begin to enter the LSDfi field, the competition in the relevant track is becoming increasingly intense. The main development directions of LSDfi include lending, stablecoins, DEX, yield strategies, LSD indices, etc. Overall, the development of lending and stablecoins is good, with total TVL exceeding 2 billion US dollars. Conventional stablecoin protocols like Raft and Gravita have no advantages over MakerDAO except for some operating space in collateral ratios and fees. Moreover, MakerDAO’s stablecoin DAI has more use cases and liquidity, so the development of such conventional LSDfi protocols may be average.

The highlight of Lybra Finance is that the stablecoin eUSD can generate interest and the protocol token LBR can be obtained through eUSD mining, effectively attracting most of the funds in the LSDfi market. Currently, it accounts for 48.3% of the entire LSDfi market. The project is about to launch V2 mode to further expand to Layer 2 networks, and the project’s TVL may further increase, making it worth attention.

6. Risks

1) High leverage risk: LSDfi is a second-layer system for ETH staking. Users’ profits come from the interest generated by staking ETH and minting eUSD stablecoin with collateralized stETH. By using the second-layer system, users can increase the yield of ETH staking, but at the same time, it also increases their leverage level, bringing potential risks to the protocol’s security.

2) Risk of stETH becoming unanchored: There have been instances where stETH became unanchored. Although ETH was not yet available for withdrawal at that time, it is still not possible to immediately unstake stETH for ETH, so there is a certain degree of risk of becoming unanchored.

3) Centralization risk of Lido: Lido currently has 354,339 stakers, but there are only about fifty node operators. This leads to centralization of the network, which may have adverse effects on stETH assets.

— END —

References:

Data Insights: Liquid Staking and LSDFi Heat Up, https://research.binance.com/en/analysis/data-insights-liquid-staking-and-lsdfi-heat-up

Analysis of LSDFi leader Lybra Finance: How stable is it? What are the risks of the “second-layer system”? https://www.odaily.news/post/5187800

LSDFi Summer is Coming, Quickly Understand 6 LSDFi Projects Worth Paying Attention to, https://foresightnews.pro/article/detail/34356

A List of 9 Decentralized Stablecoin Protocols Using LST as Collateral, https://foresightnews.pro/article/detail/37070

Analysis of LSDFi leader Lybra Finance: How stable is it? What are the risks of the “second-layer system”? https://www.odaily.news/post/5187800

[1]https://www.coingecko.com/en/coins/lybra-finance, data as of August 8, 2023

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!