September 11-16, 2023 – Many Web3 practitioners had an unforgettable journey at TOKEN2049 in Singapore. While marveling at the vigorous development of various tracks, they also lamented the sudden changes in some projects overnight.

JPEX, to be honest, I didn’t pay much attention to it before, and I haven’t used it yet. But because of the large booth in the corridor on Level 4 of Marina Bay Sands EXPO, it’s hard not to notice it.

On the first day of the event, it was bustling. However, after the Hong Kong Securities and Futures Commission released the article “JPEX has no license, beware of precautions” on the evening of September 13, no staff members were seen the next day, and naturally, no one came to consult. At the same time, some bloggers revealed that the exchange charged a fee of 999 USDT to withdraw 1000 USDT, which was truly surprising.

- Exclusive Interview with Celestia Co-founder Without Celestia, Ethereum cannot scale Rollup.

- New Zealand Finance and Expenditure Committee Report A New Milestone in the Development of Cryptocurrencies?

- Why does the autonomous world need digital physics?

Timeline Review

According to the timeline compiled from the security reports regularly published in the Academy section of the OKLink official website:

(The following content is partially quoted from the report and all times are in Beijing time)

Around 5:00 pm on September 13: Hong Kong Securities and Futures Commission warns that JPEX is “unlicensed”

Around 6:00 pm on September 13: JPEX suspends withdrawals

Around 6:30 pm on September 13: JPEX responds with an article, accusing the Securities and Futures Commission of malicious suppression

Around 1:00 am on September 14: According to feedback from social media users, JPEX’s withdrawal limit is restricted to 1000 USDT, with a fee of up to 999 USDT

Around 1:30 am on September 14: JPEX appears to start transferring assets

Around 3:00 pm on September 14: At the TOKEN2049 venue, there are no staff members at JPEX’s booth

Close to 4:00 pm on September 14: In the JPEX user group, some netizens claim that JPEX is still operating normally (meaning users can still withdraw 1 USD, and the app has not been shut down)

At 5:00 pm on September 14: The Securities and Futures Commission informs Hong Kong media that it has referred the case to the police, in response to users’ claims that they were temporarily unable to withdraw funds from JPEX and that the withdrawal limit has been raised to 1000 USDT with a withdrawal fee of 999 USDT, meaning users can only withdraw a maximum of 1 USD

At 7:30 pm on September 14: JPEX responds by allowing users with urgent withdrawal needs to fill out a form for “priority withdrawals” and reduces the withdrawal fee to 980 USDT

At 8:30 pm on September 14: Anonymous leaks claim that the “Blockchain Tower” at JPEX is empty

At 10:00 am on September 15: JPEX users allegedly receive fraudulent messages (after submitting the form for “priority withdrawals,” the platform requires them to “invest 30% before full withdrawal”), and the Hong Kong police launch an investigation

September 15, 1:30 PM: BitoGroup, the parent company of BitoPro Exchange, issued a statement stating that it has no business relationship with JPEX Group and its subsidiaries.

September 15, 5:00 PM: JPEX stated that the withdrawal of funds requires a reply from the Securities and Futures Commission. The Securities and Futures Commission of Hong Kong subsequently stated that they have never been in contact.

September 15, evening: The Hong Kong Police Force’s Commercial Crime Bureau stated that they are investigating the case and urged complaints related to JPEX to be reported through the electronic reporting system.

September 16, morning: Chief Superintendent of the Hong Kong Police Force, Siu Chak Yee, stated that they have received 83 reports related to the JPEX case, involving approximately HKD 34 million.

September 17, evening: JPEX announced the removal of all transactions on their wealth management pages.

September 18, morning: The Hong Kong Police arrested Lam Zuo, who is suspected to be involved in the JPEX case and had actively promoted JPEX to the Hong Kong public.

September 19: The police arrested 4 men and 4 women on charges of “conspiracy to defraud”, and 7 other arrested individuals were granted bail pending further investigation, and they are required to report to the police in mid-October.

Difficulties with JPEX Withdrawals

While facing difficulties with withdrawals, users have been reporting the case to the police one after another, involving more than 1,600 investors, with an approximate amount of HKD 1.2 billion.

Senior Superintendent of the Commercial Crime Bureau of the Hong Kong Police Force, Hung Hing-kwan, stated to the media that the JPEX case is suspected of “conspiracy to defraud”. Through advertisements, social media, various platforms, and popular Key Opinion Leaders (KOLs), they actively promoted so-called services and products to the public, boasting of “low risk and high returns” to attract investors. This incident has attracted widespread attention in society and further highlighted the urgency of compliance and risk prevention in the cryptocurrency industry.

28 Scam Addresses

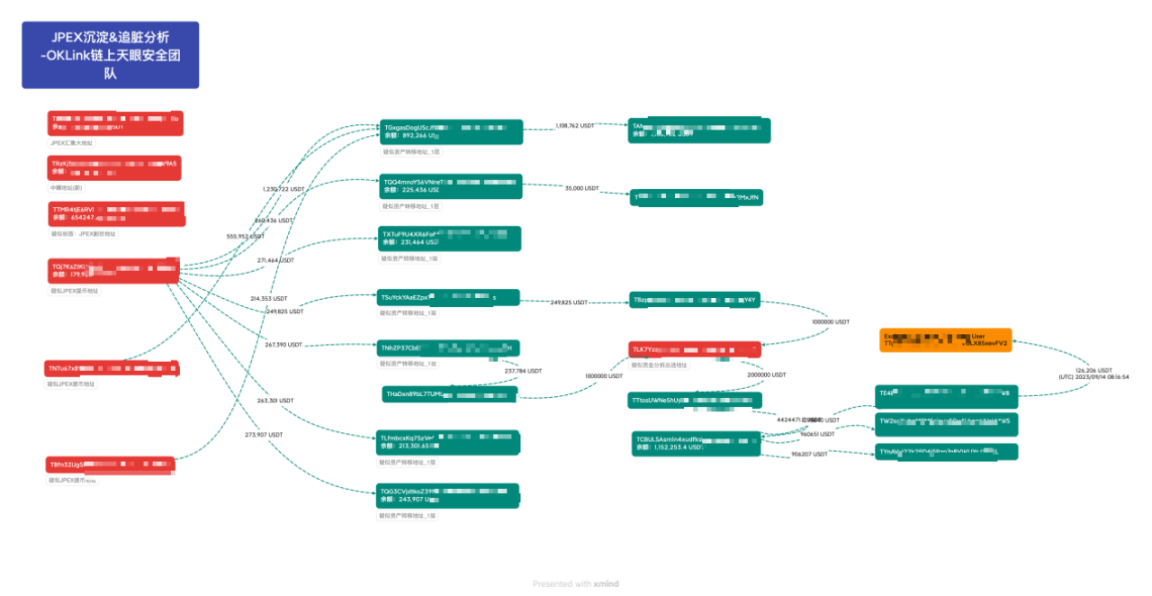

Through comprehensive analysis of on-chain data and user complaints, 28 related addresses have been verified and labeled as “scam” to facilitate the prevention and monitoring of the flow of funds involved in the case.

As of September 19, 2023, the total balance of JPEX on-chain addresses currently known is approximately 9.686 million USDT, distributed among 19 different blockchain addresses. Among them, the top two addresses with the highest amount of funds account for a cumulative total of 5.244 million USDT, accounting for 54% of the deposited funds, which are relatively concentrated.

The situation of funds deposited in addresses with balances greater than 10,000 USDT is as follows:

Based on observations and analysis, JPEX platform users have been unable to withdraw funds normally since September 13. Therefore, after this date, the platform’s behavior may have resulted in a large outflow of funds. After the transfer of funds on JPEX’s on-chain addresses, as of September 19, approximately 5.274 million USDT is deposited on the blockchain. Among them, 5.11 million USDT is concentrated in 8 blockchain addresses, while the remaining funds are stored in multiple blockchain addresses in small amounts, and some funds have been transferred to exchange accounts.

The fund relationship associated with the JPEX platform address is as follows:

Here is a partial fund chain diagram:

According to Senior Superintendent Kong Hing Fan of the Commercial Crime Bureau of the Hong Kong Police Force, the JPEX case is suspected of conspiracy to commit fraud. Through advertising, social media, various platforms, and internet celebrity KOL endorsements, they actively promote so-called services and products, boasting “low risk, high return” to attract investors. This incident has attracted widespread attention in society and further highlights the urgency of compliance and risk prevention in the cryptocurrency industry.

Once again, I would like to remind my Web3 colleagues to be vigilant against risks and not to put all their eggs in one basket. When using various platforms, be sure to keep your eyes open.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!