Author: Gyro Finance

From an industry perspective, many people have high expectations for LianGuaiyLianGuail, believing that the entry of large institutions may lay the foundation for regulatory relaxation. However, behind the issuance, the myths of centralization and limitations are also lingering.

Two weeks ago, LianGuaiyLianGuail, known as the Alipay of the United States, announced the issuance of the stablecoin LianGuaiyLianGuailUSD (referred to as “PYUSD”), once again stirring up the storm in the encryption field.

- SEC Chairman Targets AI Artificial Intelligence Tokens Could Face Dual Regulatory Scrutiny Risks

- Hashkey Cui Chen The content and value of tokenizing RWA come from the assets themselves.

- US Alipay LianGuaiyLianGuail seeks survival with stablecoins, saving the cryptocurrency circle?

As the largest third-party payment institution in the United States, LianGuaiyLianGuail’s motive for issuing stablecoins in the midst of the increasingly intense SEC regulation inevitably leads people to speculate. Considering that its stablecoin is issued on LianGuaixos, just two months ago, due to SEC’s lawsuit, Binance urgently delisted the stablecoin BUSD, which was co-launched with LianGuaixos.

From an industry perspective, many people have high expectations for LianGuaiyLianGuail, believing that the entry of large institutions may lay the foundation for regulatory relaxation. However, behind the issuance, the myths of centralization and limitations are also lingering.

The speculations triggered by LianGuaiyLianGuail are constantly fermenting.

01. A Timely Help: The Origin of PYUSD

On August 8, 2023, the American payment giant LianGuaiyLianGuail officially announced the launch of its stablecoin PYUSD, becoming the first enterprise of traditional large financial institutions in the United States to issue stablecoins.

According to the official website, PYUSD is issued in cooperation between LianGuaixos Trust Company and LianGuaiyLianGuail, with a 1:1 anchor to the US dollar. In order to ensure its solvency, similar to Tether, PYUSD is fully collateralized by the US dollar, short-term US Treasury bonds, cash, and equivalents. Starting from September 2023, LianGuaixos will release monthly public reserve reports of LianGuaiyLianGuail USD, detailing its reserve details. LianGuaixos will also entrust an independent third-party accounting firm to publicly verify the value of PYUSD reserve assets, and conduct regular inspections in accordance with the certification standards formulated by the American Institute of Certified Public Accountants (AICLianGuai) to ensure the security and integrity of its assets.

PYUSD introduction, image source: official website

From the perspective of practical application scenarios, PYUSD can support the conversion between the US dollar and other cryptocurrencies, including but not limited to transfers in compatible wallets, peer-to-peer stablecoin payments, and PYUSD payments in actual scenarios. This stablecoin will be used first in LianGuaiyLianGuail, and then be expanded for small payment programs such as Venmo, and gradually promoted to other applications. Currently, this currency is only available to US users, but because it is issued on the Ethereum blockchain, it is open to developers, wallets, and the Web3 community.

It is worth noting that in order to avoid the risk of unregistered securities issuance previously accused of LianGuaixos, LianGuaiyLianGuail publicly stated that it will not provide profits to users of PYUSD stablecoin. Normally, the highest deposit interest rate of LianGuaiyLianGuail is around 4.3%.

For those who are not familiar with LianGuaiyLianGuail, they may be surprised by its sudden entry into the market. However, as early as 10 years ago, LianGuaiyLianGuail has been paying attention to cryptocurrencies.

As early as 2013 when cryptocurrencies first emerged, David Marcus, the then president of LianGuaiyLianGuail, expressed his consideration of incorporating cryptocurrencies into financing tools. In 2014, LianGuaiyLianGuail established its first collaboration with cryptocurrency enterprises such as Coinbase, BitLianGuaiy, and GoCoin.

In 2018, LianGuaiyLianGuail submitted a patent application for “Accelerating Virtual Currency Transaction System” to the United States Patent and Trademark Office (USPTO). In the same year, Coinbase allowed US users to withdraw fiat currency from Coinbase to LianGuaiyLianGuail accounts free of charge.

In October 2020, LianGuaiyLianGuail officially entered the cryptocurrency market and supported US users to trade cryptocurrencies such as Bitcoin, Ethereum, BCH, and Litecoin. At that time, the platform only allowed customers to purchase through internal promissory notes, but did not allow withdrawals or transfers between wallets, resembling internal payment vouchers.

By this year, PYUSD was officially launched. Looking at the timeline, LianGuaiyLianGuail’s entry into the market was not a sudden move, but a result of long-term preparation. As the largest payment institution in the United States with 431 million active users, LianGuaiyLianGuail’s entry into the market at this time undoubtedly provides a much-needed boost to the cryptocurrency field, and gives industry professionals a rare positive signal.

After all, the entry of traditional institutions at the current stage is rare, and LianGuaiyLianGuail’s massive payment channels, potential audience, and complete infrastructure undoubtedly have a positive impact on the expansion of cryptocurrencies. In terms of compliance, the strong strength of LianGuaiyLianGuail will also have a closer relationship with regulatory agencies than other companies.

The consensus in the industry is that it is quite delicate for traditional institutions to issue stablecoins at the current stage, especially when Coinbase and Binance have been sued and LianGuaixos has been forced to stop issuing BUSD.

In June of last year, LianGuaiyLianGuail successfully obtained a local cryptocurrency license. LianGuaixos, which it collaborates with, is a legal trust institution under the jurisdiction of the New York State Department of Financial Services. Whether it is from the market size or from the qualification review, the regulation of it can only be cautious. LianGuaiyLianGuail also disclosed that it had extensive discussions with US regulatory agencies and policy makers before the launch of PYUSD.

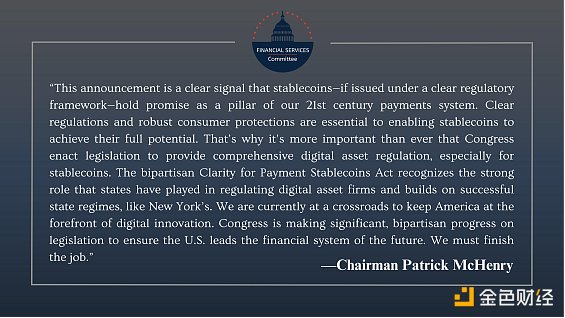

As expected, after its issuance, Maxine Waters, the Democratic leader of the House Financial Services Committee, publicly criticized that the asset anchoring was not under regulation. Ironically, the description of Republican LianGuaitrick McHenry is completely different from that of the Democratic Party. He believes that LianGuaiyLianGuail’s stablecoin shows prospects as a payment system. The political inclination of both parties towards stablecoins and cryptocurrencies is uncertain, which means that the competition between the two parties will directly determine the future of cryptocurrencies, and in this regard, the political attributes of LianGuaiyLianGuail are more evident.

However, regardless of the situation, LianGuaiyLianGuail’s entry into the game is still positive, but it also raises a question: why issue stablecoins at this time?

02. LianGuaiyLianGuail Strategy: Profit Crisis and Stablecoin Survival

In terms of time, LianGuaiyLianGuail’s stablecoin strategy can be described as full of twists and turns. It can be traced back to last year, January 2022, when developers discovered “LianGuaiyLianGuail Coin” in the source code of the iPhone application. LianGuaiyLianGuail reluctantly revealed to the media that it was exploring stablecoins. Subsequently, according to reports from Wu Shuo, LianGuaiyLianGuail attempted to cooperate with FTX last year, but it was suspended due to subsequent bankruptcy incidents. The same scene also happened this year. The PYUSD, originally planned to be released in February, was suspended again due to LianGuaixos’ review.

On-chain data also fully reflects this point. On November 8, 2022, LianGuaiyLianGuail completed the first issuance of a total of 1.1 million PYUSD. On February 1 of this year, it minted 26.4 million coins, but on the 23rd, it destroyed the existing 25.5 million coins. Then, on August 3, it minted 24.9 million coins again.

From this, it can be seen that LianGuaiyLianGuail is actually eager to issue this currency, but due to the delay in regulation, it is likely that the current release is a result of the loosening of regulatory direction. Although there is no absolute evidence to support this point, from the performance of events, the Ripple victory, and the Republican Party’s consecutive introduction of two key bills supporting the cryptocurrency field, all indirectly confirm this.

In terms of the purpose of issuance, according to the description of LianGuaiyLianGuail’s President and CEO Dan Schulman, the purpose is to consolidate its position at the forefront of digital payments by leveraging stablecoins. Although the description is subtle, the fact that can be inferred from the stock price is that LianGuaiyLianGuail, which is experiencing weak growth, urgently needs this new economic growth point of cryptocurrency.

In terms of business composition, LianGuaiyLianGuail is no different from other payment institutions. As an integrated payment service provider covering consumers and merchants, its core products include LianGuaiyLianGuail, Venmo, Xoom, Braintree, Zettle, and Hyperwallet. Among them, Venmo has social attributes, Xoom provides cross-border payments, Braintree provides acquiring services, Zettle provides offline payment equipment, and Hyperwallet provides institutional payment services.

It can be seen that LianGuaiyLianGuail is very similar to Alipay in China, but unlike Alipay’s absolute leading position, LianGuaiyLianGuail faces more intense market competition. The payment landscape in the United States is particularly complex, with intense competition between LianGuaiyLianGuail, Square, and Stripe. Tech giants like Amazon and Google are not far behind and are grabbing market share through their own payment networks. Therefore, as a third-party player, LianGuaiyLianGuail needs to collect network fees from upstream, and aggressively occupy the market of merchants, institutions, and consumers downstream. The control over market marketing, research and development, and management expenses is particularly passive. Under this premise, the company’s profit margin disadvantage is highlighted.

LianGuaiyLianGuail has high transaction fees, with a regular fee of up to 4.4%, which is almost the highest among similar competitors. However, due to high operating costs, the profit margin has been continuously declining. In the entire year of 2022, LianGuaiyLianGuail’s net profit margin was 8.79%, lower than 16.43% in 2021. The total operating cost was 21.151 billion, accounting for 76% of the total revenue. Comparing horizontally with VISA, which has similar total revenue, the operating cost is only $2.7 billion, and the net profit is as high as 50%. In terms of TPV, LianGuaiyLianGuail’s total payment amount is 1.36 trillion, compared to a net revenue of $27.056 billion, the commission rate is approximately 1.98%. The commission rate for the same type of Alipay in China is as low as 0.11%.

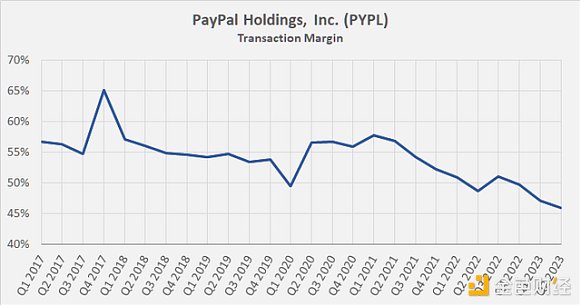

Since the beginning of this year, LianGuaiyLianGuail’s transaction profit margin has been continuously declining, source: Deep Value Ideas

In short, LianGuaiyLianGuail is expensive because of its high costs, but the profits are very low. The dilemma caused by this is that the business has high fragility and requires more costs to maintain this expensive rate, otherwise it will fall into a negative cycle.

Data and actual performance are consistent. Although LianGuaiyLianGuail’s second-quarter business performance is still good, the reduced profit has attracted more attention from investors. The report shows that in the second quarter of 2023, LianGuaiyLianGuail’s net revenue was $7.3 billion, a 7% increase compared to $6.8 billion in the same period last year. However, the transaction profit margin continued to decline to 45.9%, compared to 47.1% in the previous quarter and 49.7% in the previous year. The decline in the moat can also be seen from the number of users. As of June 30, 2023, the total number of active accounts of LianGuaiyLianGuail was 431 million, lower than 433 million on March 31, and a consecutive second-quarter sequential decline.

Affected by the lower-than-expected profit margin in Q2, LianGuaiyLianGuail plummeted by more than 9.2% on the same day, with a current market value of $6.327 billion, a year-on-year decrease of 37.67%. Rating agencies such as Susquehanna and Raymond James have downgraded LianGuaiyLianGuail’s rating. In this context, LianGuaiyLianGuail, whose revenue is highly dependent on Venmo, has shifted its focus to other areas. Loans, cross-border payments, and buy-now-pay-later (similar to Huabei) have all originated from this. The profitable and already laid-out cryptocurrency field naturally emerges in the field of vision.

LianGuaiyLianGuail’s stock price trend over the past year, source: Google Finance

As we all know, stablecoins are the most lucrative industry in the cryptocurrency field because, under economies of scale, the marginal issuance cost of stablecoins approaches zero, and their 1:1 fiat currency exchange business model can be described as extremely profitable.

In simple terms, during the exchange process, users exchange real U.S. dollars for costless U.S. dollar stablecoins. After the issuing institution obtains costless dollars, it can appreciate by purchasing Treasury bonds, cash equivalents, and other means. It can at least obtain a risk-free interest rate, which is almost equivalent to making money effortlessly. This does not even include transaction fees, service fees, and stablecoin buybacks due to market fluctuations, all of which contribute to its income.

Using Tether, the issuer of USDT, as an example, in its 2023Q2 attestation report, Tether’s operating profit exceeded $1 billion from April to June 2023, with a quarter-on-quarter growth of 30%. It can be said that Tether is making money hand over fist. Comparing with the Q1 data, Tether’s net profit in the first quarter of this year was $400 million, even surpassing China Unicom, one of the three major telecom operators in China, by a difference of about 600 million yuan.

From this perspective, it is understandable for LianGuaiyLianGuail to target the stablecoin field. Looking at the unbinding of other cryptocurrencies in this event, the functionality of future Swaps can also be expected. Swap has a high-frequency trading scenario and a relatively stable commission rate, which can contribute sustainable revenue. Taking MetaMask as an example, the commission rate is 0.875%, and its revenue in 2021 reached as high as 250 million yuan.

03. Subsequent Impact: Stablecoin Landscape and Regulatory Oscillation

After discussing the reasons, let’s look at the impact. The general belief is that PYUSD will directly impact the current stablecoin landscape.

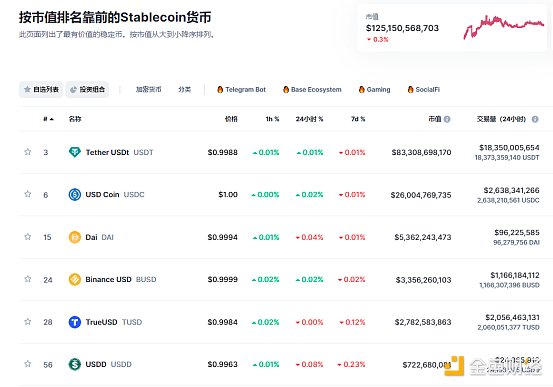

According to Coinmarketcap, the current total market value of stablecoins is about $125.2 billion. Among them, USDT issued by Tether has the highest market share, accounting for 66.53%, approximately $83.3 billion; USDC issued by Circle accounts for 20.77%, approximately $41.5 billion; BUSD, after ceasing issuance, has dropped to the fourth place, and the third place is taken by the decentralized stablecoin DAI, accounting for 4.28%, approximately $5.36 billion. It can be seen that the top three stablecoins occupy 90% of the total, showing a high concentration.

Stablecoin market value ranking, source: Coinmarketcap

Compared to other centralized institutions, LianGuaiyLianGuail has considerable strength. Its services are globally distributed, and more importantly, due to the compliant and trust nature of the issuer, customer assets do not depend on the survival of the issuer, making its endorsement advantage more apparent. Currently, the market value of stablecoins is already declining. Not only is the total market value at a historical low, but in the past week, the market value of the top four stablecoins has dropped by $419 million, with USDT alone falling by $325 million due to negative impacts from lawsuits.

Mainstream institutions have already started to respond to the emergence of PYUSD. Tether’s CTO, Ardoino, stated that since PYUSD is launched in the United States, while Tether is mainly focused on emerging markets, the two do not interfere with each other. However, other competitors are not the same, implying that USDC, a stablecoin based in the United States, is more susceptible to impact.

USDC is also not backing down. Circle’s CEO, Jeremy Allaire, responded with a tweet, stating that it is estimated that about 70% of USDC is used outside of the United States, with the fastest-growing markets being emerging and developing markets.

Apart from stablecoin institutions with vested interests, the industry has mixed opinions about PYUSD.

Since PYUSD is currently only used in LianGuaiyLianGuail and Venmo, it is not yet integrated with the DeFi ecosystem. Some industry insiders believe that it is more like a virtual point and a derivative of traditional finance, rather than a true cryptocurrency. Even if it is recognized as a cryptocurrency, stablecoins issued on LianGuaixos, except for BUSD, are not particularly popular, so PYUSD is more likely to follow the same path.

In addition, due to the outdated code version and expensive costs of PYUSD, all variables related to the currency can be controlled and changed by LianGuaiyLianGuail, which also leads the crypto community to believe that it has a high degree of centralization issues.

However, it is widely believed in the industry that the launch of this currency will push for regulatory relaxation. LianGuaitrick McHenry, the Chairman of the House Financial Services Committee of the Republican Party, has repeatedly stated that LianGuaiyLianGuail plays a positive role in the already passed “Payment Stablecoin Transparency Act” in the House of Representatives.

McHenry released a statement about the announcement of the launch of payment stablecoins by LianGuaiyLianGuail, sourced from the official website of the House Financial Services Committee.

At present, it is still too early to assess the impact of industry and regulation as PYUSD has not yet been listed on an exchange. However, mainstream institutions have taken defensive actions despite their relaxed verbal expressions. Circle claims to have prepared over 1 billion USD in cash reserves to compete with LianGuaiyLianGuail, and MakerDAO has adjusted the deposit interest rate of the SMark Protocol’s DAI to 8% to reduce the risk of capital outflow. On the other hand, LianGuaiyLianGuail is progressing aggressively, stating recently that prioritizing the launch on CEX and integrating with the DeFi ecosystem are top priorities.

Therefore, it is evident that the battle between stablecoins is about to begin, and the partisan struggle of regulatory authorities will once again enter deep waters, stirring up ripples in the stagnant waters of the crypto world.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!