Author: LianGuaiBitpushNews Lincoln Murr, Mary Liu

On August 7th, LianGuaiyLianGuail announced the launch of its most forward-looking and crypto-positive product to date: PYUSD stablecoin. PYUSD, based on Ethereum, will be available on the LianGuaiyLianGuail website and application, and can be transferred by anyone with an Ethereum address. This release marks the first time a large financial technology company has officially announced the issuance of a token and used a public blockchain. This article will explore what PYUSD means for the future of blockchain.

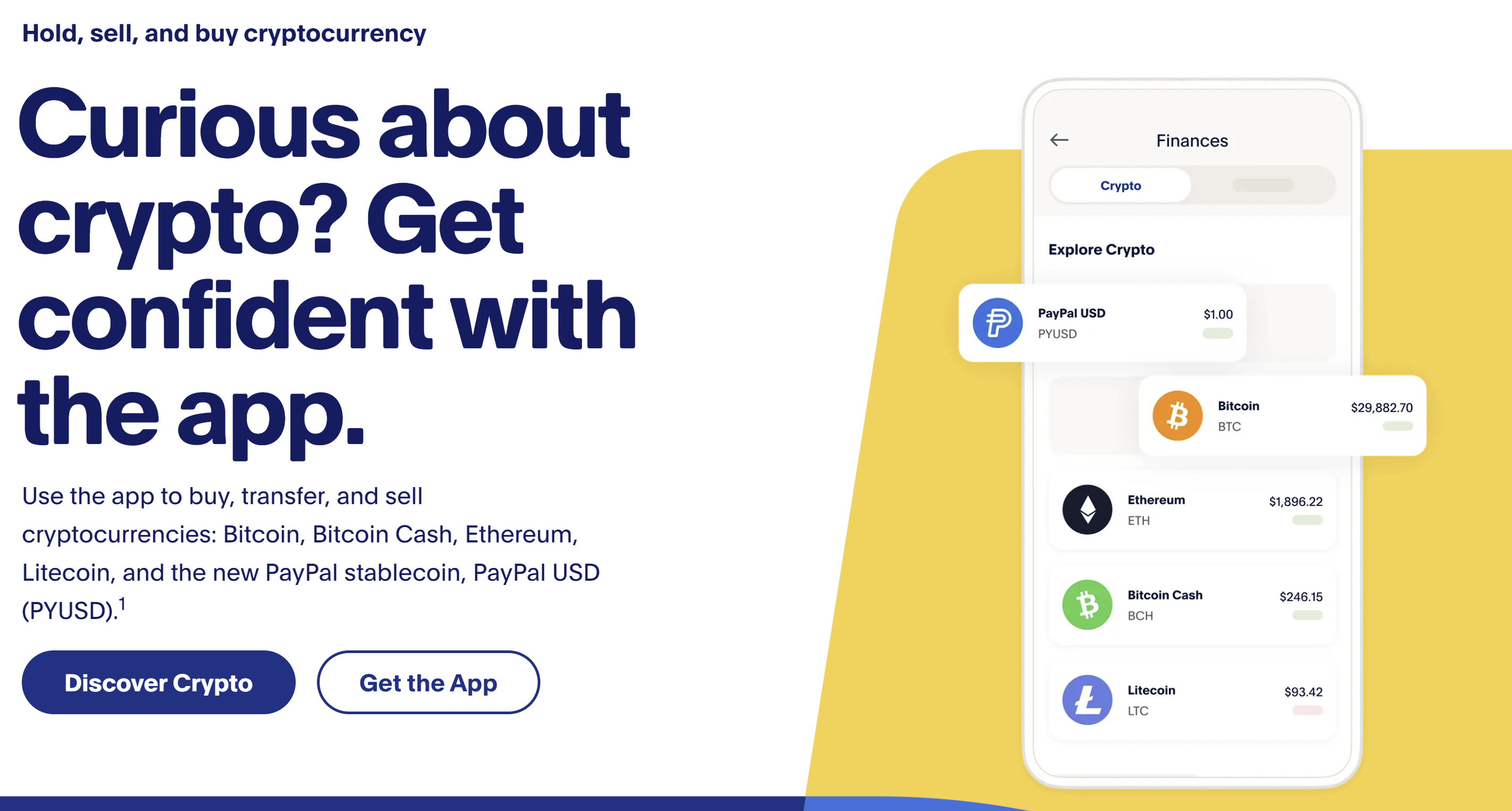

In 2020, LianGuaiyLianGuail first showed interest in and acceptance of cryptocurrencies when it launched crypto trading services supporting Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. In 2021, the company introduced the “Pay with Cryptocurrency” feature. However, neither of these solutions has been widely adopted and does not represent significant investment in reputation or time by the financial technology company.

- In-depth analysis of the LSD track Why is Lido still considered a promising object?

- Dialogue with Mysten Labs Chief Economist How to design appropriate network economic incentive measures?

- IOSG Ventures LLM Empowers Blockchain to Open a New Era of On-Chain Experience

PYUSD is a significant development as it positions LianGuaiyLianGuail as a leader among major financial institutions adopting public blockchain technology. The token has already been launched on the Ethereum blockchain and is issued by LianGuaixos, a veteran in the stablecoin industry who is also responsible for BUSD by Binance and a gold-backed stablecoin called LianGuaiXG. Interestingly, after the New York Department of Financial Services pointed out “several unresolved issues related to LianGuaixos’ oversight of its relationship with Binance,” LianGuaixos was ordered to cease issuing BUSD. Given LianGuaiyLianGuail’s position in the US and its long history in the financial technology field, a similar fate is unlikely in this collaboration. Furthermore, the token is 100% backed by equivalent assets such as US Treasury bills and cash deposits and can be redeemed 1:1 for US dollars.

The smart contract deployed for PYUSD contains interesting information about the stablecoin mechanism, which seems to go against decentralization.

As expected, LianGuaiyLianGuail has the authority to freeze account balances and even forcibly remove PYUSD from Ethereum accounts, even if those accounts are not on the LianGuaiyLianGuail platform. Given the current regulatory guidelines prohibiting LianGuaiyLianGuail from including these features and the similar protective measures taken by USDC, this is not surprising but still disappointing. The token can essentially be seen as a central bank digital currency (CBDC), issued by a technology company instead of the government and settled on the Ethereum mainnet instead of a permissioned or private chain.

Although the centralized core may not satisfy the encryption community, PYUSD is still a bullish signal for the future of blockchain and cryptocurrency.

For the first time, consumers can access tokens from financial institutions, which can be used in DeFi protocols such as Uniswap and Aave if LianGuaiyLianGuail does not prevent it. The deployment of the token on Ethereum clearly indicates that the Ethereum ecosystem is the preferred choice for financial institutions, which is an incredible positive signal. Each transaction with PYUSD

will use ETH as transaction fees, so holders and stakeholders will directly benefit from the adoption of the token. Although ideally the token should be deployed on L2 so that users can enjoy lower fees and faster settlement, it may be implemented on other chains or layers in the future.

In addition, this launch may force other payment companies and financial institutions interested in cryptocurrencies (such as JPMorgan Chase, Mastercard, and Visa) to launch competing products on public blockchains. The current situation is to leverage existing infrastructure rather than creating permissionless, decentralized blockchains.

PYUSD is expected to be fully released in the next few weeks, at which time anyone with a LianGuaiyLianGuail account can buy and sell PYUSD at zero cost, withdraw it to an Ethereum account, or use it to make payments on any website that supports LianGuaiyLianGuail.

So, how might LianGuaiyLianGuail’s stablecoin impact US regulations?

LianGuaiyLianGuail’s move comes at a turning point as Congress has drafted stablecoin legislation and passed the initial committee stage in the House of Representatives for the first time.

Representative LianGuaitrick McHenry, chairman of the House Financial Services Committee, said: “This statement is a clear signal that stablecoins, if issued under a clear regulatory framework, are expected to become a cornerstone of our 21st-century payment system.” He said that LianGuaiyLianGuail’s stablecoin makes it “more important than ever” to continue pushing for legislation, although it is widely expected to face significant resistance in the Senate.

Ian Katz, an analyst at Washington Capital Alpha, commented on LianGuaiyLianGuail’s statement in a report, saying, “We believe this could prompt Senate Democrats to get more involved in stablecoin legislation.” But for forces supporting cryptocurrencies, this may not necessarily be a good thing.

The Democratic-controlled Senate includes Senator Elizabeth Warren (Democrat from Massachusetts) and Senator Sherrod Brown (Democrat from Ohio). The former believes that cryptocurrencies are a financial risk that will empty the pockets of ordinary retail investors, while the latter is responsible for the Senate Banking Committee and has always been highly suspicious of the industry. In addition to concerns about cryptocurrency fraud and hacking attacks, they are also concerned about the potential impact of large-scale stablecoins on the U.S. banking system during major crises and fear that customer runs may destabilize the industry.

But with strong regulatory relationships, reputation in the payment field, and endorsement from its industry history, LianGuaiyLianGuail launching a stablecoin may be more convincing than Meta.

Four years ago, it would have been almost unimaginable for LianGuaiyLianGuail to launch a stablecoin. Now, with government support, they are laying the foundation for the future of Ethereum payments in the United States. While the token has strict centralized control, other stablecoin alternatives are permissionless and can never be replaced. Although the blockchain industry may have its ups and downs, it is undoubtedly maturing and getting closer to fulfilling its promise of a trustless global settlement layer.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!