Recently, a friend came to consult him about a blockchain project he had participated in before. The project issued Tokens before September 4, 2017. At that time, he obtained a quota through a friend’s introduction and invested about $300,000 (calculated at the price at that time). He was born in the 1990s. The project went overseas, but did not carry out token refund. He now comes to ask if he can get the investment money back.

Similar situations are quite common in the domestic cryptocurrency circle. After the September 4th announcement, either the coin issuance platforms closed down or they turned to overseas development, with few continuing to operate in mainland China. After consulting professionals, it was found that there is indeed a group of coin issuance projects operating in unknown corners underground, and another part has not refunded the tokens, ignoring the various requirements of the users. Next, let’s discuss the legal issues involved.

What is ICO?

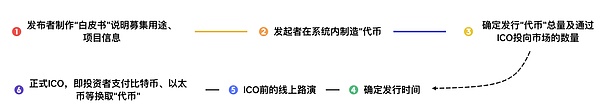

ICO (Initial Coin Offering) originated from the concept of Initial Public Offering (IPO) in the stock market. Unlike IPO, ICO projects issue tokens instead of stocks, and they are blockchain projects. The first token issuance is like buying new shares. Investors use mainstream coins (such as Bitcoin) to buy newly issued tokens and then engage in investment transactions.

- Is NFT collateralized mining a legitimate and profitable business?

- Circle CEO Circle is using over $1 billion in cash reserves to counter competition from non-cryptocurrency companies like LianGuaiyLianGuail.

- Bloomberg Analyst Under L2 Expansion, Ethereum is Building a Deeper Moat

ICO has created many wealth myths, so it has attracted many people in the cryptocurrency circle. However, high-quality projects are ultimately rare and easily provide convenience for various financial and cyber crimes. Therefore, in 2017, the seven departments of the central bank jointly issued the “Announcement on the Prevention of Risks of Token Issuance and Financing” (also known as the “94 Announcement”), which made a qualitative determination of the nature of ICO, i.e., it is an illegal public financing activity without approval, especially involving illegal sales of token vouchers, illegal issuance of securities, illegal fundraising, financial fraud, pyramid schemes, and other illegal criminal activities. As a result, various parties related to coin issuance in China have been affected and none have been spared.

What are the legal risks of projects that have not refunded tokens?

The “94 Announcement” not only ordered the immediate cessation of all token issuance and financing activities, but also required organizations and individuals who have completed token issuance and financing to make arrangements for refunds. For a while, major project parties in Beijing, Shanghai, and Shenzhen all refunded tokens, and the completion rate quickly reached 90%. As for those project parties that have not refunded tokens, they will be subject to different degrees of legal sanctions.

First of all, the “94 Announcement” explicitly stipulates that relevant departments will seriously investigate and deal with illegal activities in token issuance and financing activities that refuse to stop as well as illegal and non-compliant behaviors in completed token issuance and financing projects. This makes various administrative regulations “enforceable by law“. The Office of the Leading Group for the Special Rectification Work on Internet Financial Risks in Shanghai once required relevant ICO platforms to immediately stop relevant business and organize refunds in accordance with the law as soon as possible, reasonably protecting the rights and interests of users. The office will focus on urging various trading platforms to ensure that investors can smoothly withdraw their investments. In principle, relevant platform executives and other personnel are required to stay in Shanghai to assist in the refund work.

Secondly, according to existing laws, if the tokens are not returned, it may be suspected of constituting a criminal offense. The issuing project not only failed to conduct a proper refund as required, but also engaged in various fraudulent activities, which may result in criminal charges: the project itself promised various benefits to deceive users’ investments, which may constitute the crime of illegal absorption of public deposits; if the platform misappropriates or embezzles funds or runs away, it may constitute the crime of fundraising fraud or financial fraud; even if the trading platform (exchange) resumes operation underground and secretly provides matching transactions and over-the-counter transactions for both parties, it may still constitute the crime of illegal business operation. Of course, the above are only possibilities, and the specific criminal charges still need to be determined according to the law. However, once targeted, the project has already lost, isn’t it?

What should users do if the project does not refund?

Notice No. 94 proposes project refunds. For those tokens with a premium, investors obviously do not want to return them because if they exit at the issuance price, the loss incurred by those who bought in at a high position is unacceptable and the loss will become a reality. Therefore, these investors insist on not refunding and instead transfer to overseas trading platforms. Most investors often face a price drop after holding the tokens, and at this time, the refund becomes a good opportunity to escape the loss. However, the project is unwilling to refund.

For users, how can they recover their losses when they cannot communicate with the project (company)? According to lawyer Mankun’s experience, combined with a large number of practical cases, there are two different paths for safeguarding rights.

Firstly, filing a civil lawsuit with the court. Investors (users) can file a civil lawsuit with the court, usually based on unjust enrichment, and request a refund. However, according to the current judicial trend, the court generally determines the contract as invalid and handles the “property” involved in accordance with the legal consequences of invalid contracts. However, the court rarely orders a full refund, but returns a certain amount of virtual currency based on specific circumstances. However, some courts simply refuse to accept the case, which adds significant obstacles to investors’ rights protection.

Secondly, filing a criminal complaint with the public security authorities. This is also a method recommended by lawyer Mankun. Investors can file a criminal complaint with the public security authorities based on the aforementioned charges and provide corresponding evidence to increase the success rate of the complaint. Generally, after the public security authorities accept the case, they will conduct preliminary investigations. After contacting the project, the project may voluntarily refund the funds under the pressure from the judicial authorities. If it meets the conditions for criminal filing, the public security authorities will proceed with the case, and the project will be thoroughly investigated by the national authorities. If necessary, the project may sell assets at a discounted price to return them to the investors, thereby successfully recovering their property. In conclusion, criminal means are always the most direct and thorough way to safeguard rights.

Summary by Lawyer Mankun

Since there are regulations in place, it is advisable to comply with the regulations. Project parties and exchanges operating within mainland China should clear their businesses and can only continue operations overseas. Any project that hasn’t been cleared or operates underground carries significant criminal risks. Users should avoid investing in underground projects. If encountering projects that haven’t been cleared, they should take legal measures to protect their rights. For any legal issues, please consult Lawyer Mankun.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!