Prior to this, Beosin published an article titled “Friend.tech Exposes Associated Information of 100,000+ Addresses, How to Protect Privacy of Social Dapps?” In the article, we discussed how Friend.tech quickly attracted a large number of users and even caught the attention of top cryptocurrency influencers since the start of its invitation-only beta testing. The article also discussed the impact of Friend.tech exposing the associated information of over 100,000 addresses on users.

Currently, Friend.tech is gaining increasing popularity and has been widely spread and shared on social media platforms. For any hot project, we need to pay attention to its potential risks before participating in order to ensure the security of funds. How long will the popularity of Friend.tech last? What is the pricing model for its Key? What are the potential risks of the product? Today we will sort it out for you.

Introduction to Friend.tech

- Delphi Digital What are intent-based applications?

- An Overview of DeFi Landscape Top Protocols and Their Unique Features Guide

- Shenzhen University’s 50 million yuan gifted donor raises many doubts Suspected of having delusions, claiming to be the FTX trading director and a Stanford MBA intern at McKinsey & Company.

Friend.tech is a decentralized social application built on the Base blockchain. Users need to bind their Twitter and wallet to use Friend.tech and profit from it. The positioning of Friend.tech is to tokenize users’ influence, allowing users to purchase “Keys” (formerly known as Shares) of other users to gain direct communication privileges with them.

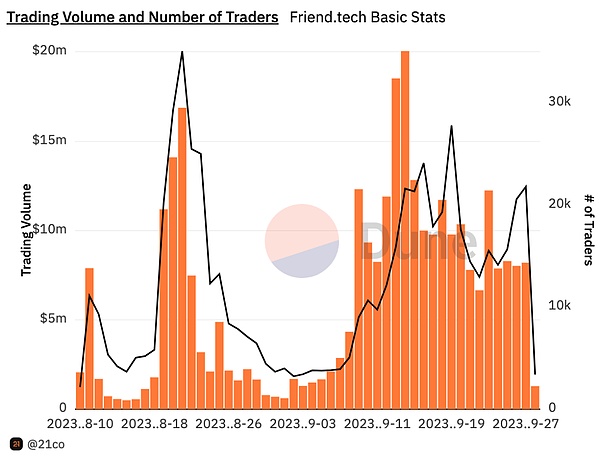

In just the first week of its launch, the trading volume on Friend.tech exceeded 7,000 ETH, demonstrating its strong market appeal. As of September 27, more than 270,000 users have completed 7.927 million transactions on the platform.

Source: https://dune.com/21co/friendtech-analysis

Key Pricing Model

The pricing of Keys does not adopt the traditional order book or the commonly used AMM constant product model in decentralized exchanges. Instead, it adopts a fixed pricing model based on the total number of Keys currently held on the platform, meaning that the price of Keys is only related to the number of holders. In the following text, S represents the current number of holders.

When a Key is purchased, the price of the Key is (S^2 / 16000) ETH. When a user completes the registration of their Friend.tech account, they will hold their own Key. At this time, the number of holders, S, is 1. The price of purchasing the user’s second Key is 1^2/16000 ETH, which is 0.0000625 ETH.

When a Key is sold, the selling price is (S – 1)^2 / 16000. Each additional unit of holders increases the price of the Key by (2S+1)/S^2. It is worth noting that the price increase of Keys is very large in the early stage. If there is a buyer for the second Key, the price of the Key will increase by 300%. However, as the number of holders increases, the price increase will become smaller and smaller. The impact of the 11th buyer on the price is only about 19%, which is not enough to cover the transaction fees (in actual transactions, users need to pay an additional 10% fee when buying or selling Keys), more buyers are needed to make a profit.

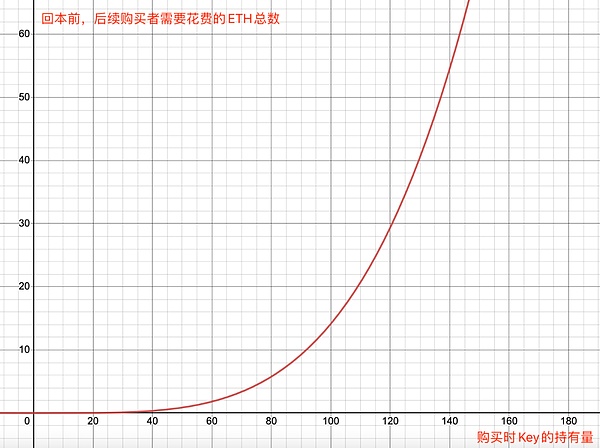

Therefore, in actual transactions, the later the number of units purchased, the more holders are needed to break even. When the number of Key holders reaches 50, the number of holders needs to increase by about 10% compared to the initial purchase in order for users to break even. Before breaking even, the total cost that incremental users need to bear will exponentially increase. If a user purchases the 100th unit of a Key, they will need to wait for subsequent buyers to purchase 11 more Keys (the total cost of the subsequent purchases is about 8 ETH) in order to sell and break even. If it is the 200th unit of a Key, subsequent buyers will need to spend about 68 ETH to break even.

The advantage of Friend.tech’s fixed price model is:

(1) The early Key prices rise rapidly, creating a wealth effect and FOMO sentiment. The price difference between the 1st Key and the 10th Key is 100 times, allowing early players to obtain high multiples and decent returns with minimal investment.

(2) Price increases require the entry of new users, indirectly locking in users. This incentivizes influential KOLs to join Friend.tech, and users also choose to hold the Key of influential KOLs in hopes of making profits.

The disadvantages are:

(1) There is a limit to the number of Keys that can be held. As analyzed earlier, the later Keys are expensive and difficult to earn back, which creates a high barrier for new users to join. Currently, the maximum number of Keys held on Friend.tech is 343, priced at 7.353 ETH. However, there are a thousandth of Key holders who own more than 100 Keys out of a total of 190,836 Keys.

Data Source: https://dune.com/queries/2969074/4920998

(2) The income of Key creators is almost unrelated to the price of Keys and the content generated by Key creators on Friend.tech. This lack of sustainability is a disadvantage for an application positioned in the social field.

(3) There is a proliferation of bots and no effective countermeasures against witch attacks. Because the Sequencer, the sorting mechanism of the Base network, is controlled by Coinbase, other users cannot actively control the transaction ordering of blocks. Therefore, the sniper bots on Friend.tech are likely to use the following strategy:

First, the bots monitor the L2CrossDomainMessenger contract address on Base and check if the interacting address is a new account on Base.

Next, once a new account is detected, the bots immediately start calling the Friend.tech Shares contract (0xcf205808ed36593aa40a44f10c7f7c2f67d4a4d4), passing the new account address and the number of shares in the buyShares() function to attempt to purchase the latest Key of that account.

By submitting multiple transactions with different gas fees but the same content per second, the bots try to buy the Key as soon as possible after the new account creates it. The Sequencer will package and include the transactions on-chain based on gas fees and reception time. This excessive transaction spamming and front-running behavior greatly diminishes user experience and harms the interests of real users.

Reasons for the popularity of Friend.tech

1. Introduction of traffic by Twitter influencers

As a social product, Friend.tech provides substantial income for KOLs by tokenizing influence into Keys. Due to the pricing model of Keys, every time a user purchases Shares, the corresponding KOL receives a 5% transaction fee. Therefore, Friend.tech is very attractive to influential KOLs who can earn profits from the fan economy through Friend.tech, and their presence brings an increase in user numbers and visibility to Friend.tech. During TOKEN2049, many crypto enthusiasts tried using Friend.tech due to its viral and aggregation effects.

2. Progressive Web Application (PWA)

Friend.tech adopts PWA, allowing its web application to run on various devices. For project teams, PWA is easier and has a shorter development cycle compared to native applications. For users, they only need a browser to use Friend.tech, making it instantly accessible.

3. Launching the Points System and Airdrop

On August 19th, Friend.tech announced on Twitter that LianGuairadigm will participate in its seed round financing and will work with LianGuairadigm to build new social tools. At the same time, Friend.tech announced that these points will have special uses (i.e. airdrops) after the 6-month testing phase. With the benefits of the airdrop from Blur, Friend.tech has attracted a large number of airdrop hunters, contributing to the data volume of Friend.tech.

Friend.tech Derivative Tools

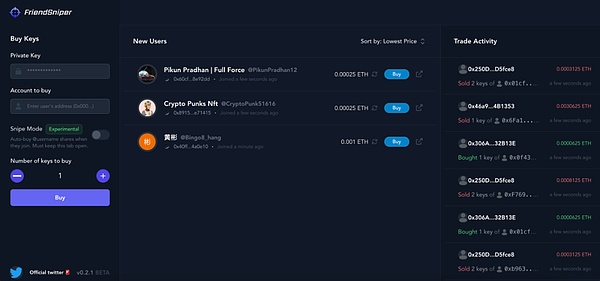

1. FriendSniper

A Telegram bot that provides Friend.tech new user reminders, key sniper buying, copy trading, and limit price stop loss services. The sniper feature of FriendSniper is currently in the testing phase and the code is not open source, so users should be aware of the risks when using it.

https://www.friendsniper.io/

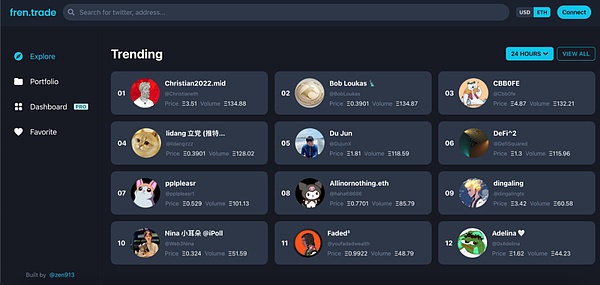

2. FrenTrade

FrenTrade is an information aggregation platform for Friend.tech. Users can view information such as currently popular trading keys, newly listed keys, and the latest traded keys on this platform.

https://fren.trade/

3. FriendMEX

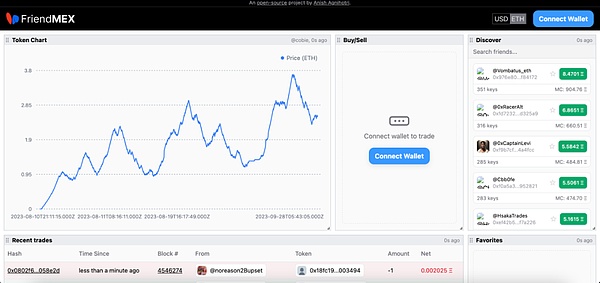

FriendMEX offers services such as buying keys, viewing key price trends, and displaying real-time trades. It is a project developed specifically for trading keys by Anish Agnihotri, a former researcher at LianGuairadigm.

https://friendmex.com/

4. Hyperliquid

Hyperliquid has launched the FRIEND-USD perpetual contract, a index perpetual contract for Friend.tech. The index selects 20 accounts’ keys based on multiple criteria and tracks the median buy-in price of each key. The index updates the proportion factor of each key every Wednesday.

https://app.hyperliquid.xyz/trade/FRIEND

Potential Risks of Friend.tech

Through Beosin VaaS tool scanning of Friend.tech’s business contracts, combined with the analysis of Beosin’s security audit experts, we have identified the following risks of Friend.tech:

1. Centralization Risk: The owner can adjust the transaction fee without limitation, thereby charging high transaction fees. They can even set a 100% transaction fee to prevent users from receiving the money from selling, or set a transaction fee rate exceeding 100% to disable the buy and sell functions.

2. Business Logic Risk: The sharesSubject address, which is the initial equity issuer, can initially obtain 1 share for free and cannot sell the last share. Assuming a user buys 1 share, if the issuer sells, the user will be unable to sell and will suffer losses.

3. As the total number of shares increases, both the buying and selling prices will increase. There may be a situation where early large holders buy a large number of shares and can profit from selling as the total volume increases, while later users who purchase shares may incur losses. Participating in the investment requires attention to capital risks.

4. After registering with Friend.tech, a new wallet is generated by Friend.tech. Friend.tech claims that the newly generated wallet is an MPC wallet, and the private key can only be fully accessed by the user. However, Friend.tech has not undergone any code audit, and the process of private key generation and storage is still a black box.

Summary

Friend.tech is currently in a very early stage, with a focus on high financial transaction attributes and relatively simple social functions. It uses a points airdrop to achieve user retention, and users should be aware of related risks. The Key pricing model is suitable for early startups, but there is an obvious upper limit. How Friend.tech will continue to acquire new users in the future is a challenge. For users who are interested in Key transactions, trading tools and projects built around Friend.tech are gradually being launched, allowing these users to conveniently engage in Key-related transactions using derivative tools.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!