Encrypted mining companies are “volunteers” for blood chip, “pursuers” for low-voltage chips, and “saviors” for NVIDIA graphics cards.

Written by: Jaleel

Edited by: Jack

The news of the first victory of Grayscale’s battle against the SEC on the other side of the ocean is still fermenting, and the release of Huawei’s new flagship phone, Mate 60 Pro, instantly ignited the technology market. A message about Chinese mining companies “solo savior, promoting the development of 7nm chips in China” spread in the community.

- Analysis of Data on Base Ecology Chain NFT and Friend Tech Dominate, DeFi Development Cannot Be Ignored

- One article to understand the progress and deadlines of all spot BTC ETF applications, which ETF will be approved first?

- Cryptocurrencies need to grow.

The view of the super king of the Benmo community on this matter has pushed the story of China’s 7nm chip to a new climax in the currency circle. There are even online articles claiming that the orders provided by domestic mining companies to China’s 7nm chip have made it a “veteran” of domestic 7nm chips.

On this matter, BlockBeats interviewed several practitioners in the chip industry. Avalon responded that there is an exaggeration in the rumors on the internet, while Bitmain declined to comment. Some practitioners also said that “only 30% of the description in the online article is true.” In addition, an employee who previously worked in Huawei chip sales said that the components used in mining machines are actually not large in size, and the online rumors are somewhat exaggerated. “To be honest, just because a company gives you an order does not mean that you can survive stably.”

Although the orders provided by encrypted mining companies to China’s 7nm chip did not have the decisive role in the development of 7nm chips as everyone imagined, it is undeniable that in the past decade, encrypted mining companies have indeed had varying degrees of impact on the chip industry in various aspects.

China’s 7nm chip emerges, mining companies re-enter the public’s sight

Behind Huawei’s new product release, there are market rumors that due to technical issues with China’s 7nm chip, its final output may be limited. It is not yet clear whether China’s N+1 and N+2 processes are equivalent to the 7nmT process on the market. However, the industry has reason to believe that its N+1 process should be equivalent to the 7-nanometer LPE process, and its N+2 process should be comparable to the 7-nanometer LPP process.

As the only company in China capable of mass-producing 14nm FinFET technology, China’s 7nm chip’s N+1 and N+2 processes are derived from the further optimization of 14nm FinFET technology. By using DUV lithography technology, China’s chip successfully circumvented U.S. technology sanctions. Although the most advanced process currently uses EUV lithography, there are still companies exploring improvements based on the 14nm process, such as Apple, although their experimental results did not meet expectations and were jokingly referred to as “electronic waste” by the industry.

For 5nm technology, although the technological barriers of its process are not absolute, its yield is a huge challenge. Recall that Samsung only had a yield of 60% with its 7nm technology, which means that up to 40% of the products needed to be eliminated. Even if it is possible to directly leap from 14nm technology to 5nm, the challenge of yield may require huge capital and time to overcome.

The choice of technological process determines the upper limit of the product. Although this may not affect market propaganda, for experts in the industry, the choice of process that does not focus on power consumption is no different from deception.

Regarding the question of whether SMIC’s 7nm chips can be mass-produced, BlockBeats also interviewed Maxwell. In the interview, Maxwell stated that the development of 7nm chips is very difficult and is indeed a bottleneck. However, by 2021, SMIC’s N+1 7nm technology has become mature and is preparing for large-scale use. Now, two more years have passed. As Huawei’s foundry and a top domestic chip company, and with orders in hand, SMIC will not have no progress and breakthroughs. So the news of mass production now is based on a solid foundation.

According to the MinerVa Semiconductor website, this IC began shipping as early as July 2021, which suggests that as early as the beginning of 2021, SMIC had the ability to mass-produce 7nm process. After Huawei released the Mate 60 without any warning, the mining companies that had been missing for a long time are once again in our sight.

What impact do mining companies have on the chip industry?

As the tech and digital community’s evaluation blogger said, mining machines are the best orders for fabs to practice on. SMIC’s 7nm chips really have to thank the accidental involvement of miners in the past.

Then community members also began to reminisce. In 2021, the Federal Reserve started unlimited QE, and virtual currencies began to soar. Mine owners complained that the mining power-to-consumption ratio of traditional graphics cards was too low and ordered dedicated mining machines from specialized manufacturers. At that time, TSMC and Samsung were both supplying to N and A, and they didn’t care about mine orders at all. So the mining machine manufacturers found SMIC, which had just successfully experimented with 7nm, a technology that was far inferior to Samsung’s 8nm at the time and was an improved version of DUV 14nm. But it was in this strange economic environment that SMIC eventually delivered to the mining machine manufacturers (earning enough money to cover the low yield). So, this somewhat accidental move led to continuous updates of 7nm and eventually brought us the K9000s on Huawei Mate 60 Pro today! It can be considered a significant breakthrough.

Since the advent of mining machines, this market, which was basically monopolized domestically, has formed a four-party dominance: Canaan, Bitmain, Bitfury, and Ebon International.

Bitmain was co-founded by Wu Jihan and Zhan Ketuan in 2013. In a short period of time, they launched the Antminer S1 miner based on the 55nm chip BM1380, which marked the beginning of their rapid growth. In 2014, they further introduced the Antminer S3 miner based on the 28nm chip BM1382. In addition, the company also provides a variety of mining-related services and products.

In 2011, Zhang Nangeng appeared on the Bitcointalk forum under the name “ngzhang” and quickly launched China’s first FPGA miner – Icarus and Lancelot. As a result, he was affectionately called “Pumpkin Zhang”. When Butterfly Labs announced the development of ASIC miners in 2012 and claimed to only use them for their own purposes, Zhang Nangeng decided to personally intervene to prevent the monopoly of Bitcoin hash power. He gave up his studies and focused on the development of ASIC miners. In 2013, he founded Canaan Creative and launched the first ASIC miner, Avalon. After various efforts, Canaan Creative successfully listed on NASDAQ in 2019, becoming the “first domestic mining company”.

Bitmicro was established in July 2016, making it the latest entrant compared to the other three companies. Bitmicro’s founder, Yang Zuoxing, actually entered the mining industry as early as 2014. After experiencing the “Kao Mao Runaway” incident and the “Bitmain equity dispute” incident, he decided to start his own company and establish Bitmicro. The company’s mining machine brand, “Whatsminer”, has seen a soaring market share since its launch, and with its high cost-effectiveness, it has begun to compete with Bitmain. In December of the same year, their developed 28nm chip BT1000 was officially produced. In April 2017, Bitmicro’s Whatsminer M3 officially entered mass production, with the first batch of M3 miners generating sales of nearly tens of millions of yuan.

The story of Ebang International began in 2010. Initially, the company focused on telecommunications equipment business, but its founder, Hu Dong, had a strong interest in Bitcoin early on. In 2014, when the telecommunications industry was in a downturn, Ebang International ventured into the mining machine business. After nine versions of improvement, they finally launched mining machine products in 2016. After successfully listing on NASDAQ on June 26, 2020, they became the “second domestic Bitcoin mining company”. Now they have gradually disappeared from the market.

Blood transfusion chips “volunteers”

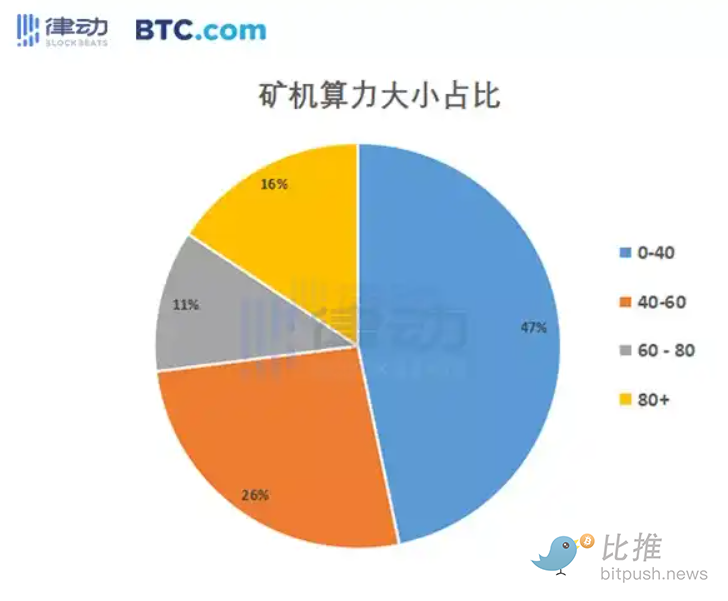

By the end of 2020, BTC.com’s global hash rate statistics revealed an interesting fact: in recent months, hash power exceeding 80TH/s accounted for 16%; and hash power exceeding 60TH/s accounted for 27%. This means that a large number of new-generation 7nm or 8nm Bitcoin miners have been put into use.

Related reading: “Review of the Mining Ecology in 2020: Changes in the Mining Machine Market”

Behind it, the chip manufacturers have also formed a three-way competition: TSMC, Samsung, and SMIC.

In January 2013, the birth of Avalon mining machines meant a significant increase in computing power, even leading the entire industry into the ASIC era. It was also in this year that Bitmain emerged and quickly gained prominence, forming a close partnership with TSMC.

For a long time thereafter, while the global market faced a shortage of chips and supply couldn’t meet demand, TSMC had an endless amount of business. Behind all of this was the power of Bitmain. As early as the second half of 2017, Bitmain became TSMC’s second-largest customer in China, included in TSMC’s list of major customers, and received a large number of orders from Bitmain every year.

In 2021, TSMC’s fourth-quarter and full-year financial report showed a revenue of as much as 15.74 billion USD, reaching a new high. It is worth noting that in the second half of that year, Bitmain placed orders with TSMC for 50,000 chips, estimated to bring in 1.2 billion USD in profit. At the time, the media reported that TSMC attached great importance to this and even sent senior executives to Japan to purchase key equipment for this order.

However, with the decline in the price of Bitcoin and restrictions on mining in China, Bitmain’s order volume has decreased, causing a certain impact on TSMC’s operations. Nevertheless, Bitmain is still a major customer of TSMC, maintaining its position in the top ten.

Turning back to the behind-the-scenes of Huawei’s new flagship phone, the Mate 60 Pro, it is powered by SMIC’s 7nm chip. In 2020, SMIC formally announced for the first time that its products are being used in mass-produced and shipped cryptocurrency mining machines. According to reports at the time, SMIC’s 14nm mining machine chip, developed in cooperation with Canaan Technology, had completed testing and would enter mass production and shipment in the second quarter of 2020. The specific type of chip may be for a certain small cryptocurrency mining machine. The highest chip manufacturing process that SMIC could provide that year was 14nm, and it was expected to begin trial production of 7nm chips in the fourth quarter of 2020.

According to insiders, 2020 was not the first time that SMIC attempted to enter the mining machine field. As early as the beginning of 2018, SMIC had collaborated with a well-known figure in the Dongguan cryptocurrency circle, but due to the sharp decline in the price of Bitcoin, investors withdrew their funding, and although the chip design was completed, it was not mass-produced. SMIC has always been actively trying to enter the mining machine industry and has collaborated with other mining machine manufacturers, but there have been no mainstream mass-produced models.

Low-voltage chip “pursuer”

The core technology of the mining machine chip at that time was divided into two main directions:

First, the calculation of SHA256 was in full custom mode. Full custom means that instead of synthesizing circuits through hardware description languages, the SHA256 calculation macro modules are directly customized through AND and NOT gates. These macro modules are then replicated tens of thousands or even hundreds of thousands of times within the same chip, achieving high processing power;

Second, low voltage technology. Since Bitcoin chips need to work all the time, clock gating and partial power-off (power domain) are not used. Therefore, low voltage is one of the core technologies of Bitcoin chips. The dynamic power consumption of the chip is proportional to the frequency (F) and the square of the power supply voltage (VCC^2). The frequency cannot be reduced, as it would slow down the mining process. Therefore, low voltage is a core technology of Bitcoin chips.

Jia Nan Technology also stated in a post that they had noticed that process technology is only one factor in determining chip performance. Therefore, Jia Nan Technology has made a lot of efforts in the fields of low voltage, standard circuit unit design and optimization, high-performance computing, and heat dissipation solutions, accumulating a large amount of underlying technology.

Bitcoin miner peicaili (@pcfli) believes that low voltage technology has also been extended to other industries such as mobile phones, benefiting the entire chip industry.

NVIDIA Graphics Card “Savior”

On May 19, 2017, the price of Ethereum broke through the $100 mark for the first time, signaling the beginning of a new round of the cryptocurrency bull market. The most impressive aspect of this bull market was the popularity of ICOs.

During this period, from 2016 to 2018, NVIDIA’s market value increased from $14 billion to $175 billion, with the value of this Silicon Valley giant increasing tenfold in just two years, astonishing all investors. In 2017 alone, NVIDIA’s revenue reached $9.714 billion, a 40.58% increase compared to the previous year. It is not an exaggeration to say that the cryptocurrency bull market of 2017 brought considerable and substantial returns to NVIDIA.

Ethereum uses the Ethash encryption algorithm, which requires reading and storing DAG files during the mining process. Since the bandwidth of computer memory read operations is limited, and it is difficult for existing devices to make breakthroughs in this technology, no matter how much the mining power is improved, the mining efficiency will not be significantly improved. This also makes Ethereum’s PoW mechanism “resistant to ASICs”.

It can be said that Ethereum, the world’s largest decentralized development network, created an incredibly huge market for Huang Renxun’s graphics card sales and even helped completely rewrite NVIDIA’s trajectory.

Nvidia has launched the GTX 1060 6GB graphics card specifically for Ethereum mining, which eliminates the output interface. The first batch of supply was 300,000 units, and later even stopped the normal supply of graphics cards with output interfaces. At the end of the year, the performance of the graphics cards was optimized, and a series of professional “mining cards” with stronger computing power and lower prices, such as P106 and P104, were introduced. This series of graphics cards even do not have IO output interfaces, and users cannot even use them to play games.

In order to seize the chip supply in the mining market, Nvidia even spared no effort to cooperate closely with its number one rival AMD to accelerate the research and development and production of “mining products”.

In 2018, Nvidia’s CFO publicly disclosed the fact that they make money by selling “mining cards”, and Huang Renxun revealed his “interest” in the mining industry in his speech: “Nvidia actually has some control over the purpose of users buying GPUs… We must pay attention to its existence (users buying graphics cards for mining) and ensure sufficient inventory to cope with it.”

When Ethereum ushered in the second mining boom, Nvidia did not disappoint and did not miss the start of the new bull market. Under the pressure of global chip shortages and player demand, they developed the CMP series mining cards for graphics card miners. In order to achieve the highest mining efficiency, CMP directly abandons the graphics processing function. Later, under pressure, they announced that the newly launched GeForce RTX 30 series graphics cards would limit mining performance, causing the prices of graphics cards to rise again.

Huang Renxun displaying the RTX 30 series graphics card, image source: internet

At this time, the price of Ethereum had approached $3,000, and PoS merge was no longer seen as a potential threat in the face of rising prices. Huang Renxun became a staunch advocate of cryptocurrencies, publicly expressing his long-term optimism about the market boom and the value of blockchain. Miners also bought into it, and the graphics cards were quickly sold out. According to insiders, some large mining farms even directly placed orders with Nvidia without going through the secondary market.

For a while, the rising prices of graphics cards became the repeated focus of CCTV and self-media reports. According to reports from institutions, in 2021, Nvidia generated approximately $3 billion in revenue by selling graphics cards to miners. In the same year, Nvidia’s market value exceeded $500 billion. In the February financial report of the next year, the company achieved a record annual revenue of $26.9 billion, a year-on-year increase of 61%, and achieved continuous revenue growth for 7 consecutive quarters.

What is the significance of mining?

There are some misunderstandings and prejudices about the relationship between mining companies and chip manufacturers. Many people question “what is the significance of mining?” or believe that “mining machine chips are low-end industries”. But in fact, the story behind it is far more complex than imagined.

Chinese mining machine companies have taken the lead globally, similar to the dominance of the United States in the operating system field. However, the perception from the outside world is often contradictory. On the one hand, they acknowledge this fact; on the other hand, there seems to be a sense of disdain.

The orders provided by the cryptocurrency mining industry serve as a testing ground for chip companies, helping the rise of chips. The research and development achievements of mining machine manufacturers, such as low-voltage chip technology, have been widely used in mobile phones and other industries. The rescue of the undisputed king of graphics cards, NVIDIA, is evident to everyone in the industry. These facts prove the enormous contribution of the mining industry to technological progress.

The mining industry uses cutting-edge chip technology and employs top research and development personnel. If the mining industry is considered “useless”, then many other industries should also be considered “useless” for the critics who use them.

Although mining companies may not be the entirety of semiconductor research and development, and may only account for a small part, their influence is indispensable. Cryptocurrency mining companies drive the progress of chip manufacturers and graphics card vendors in the wave of technology and bring significant commercial value. This is the significance of mining.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!