Author: Bessie Liu, Blockworks Translation: Shannouba, LianGuai

As Chainlink seeks to actively enter the cross-chain bridge field, co-founder Sergey Nazarov claims that most bridges are “absolutely insecure.” Nazarov stated in an interview with Blockworks that there is a pattern in the cryptocurrency industry of investing funds in projects that cannot guarantee ecosystem security.

The systems built by this industry promise a lot, but they cannot ensure value in any way. Creating true security is not that simple. Decentralized bridge infrastructure is particularly difficult. This is because, unlike forked blockchains, cross-chain bridges are not based on blockchain systems, so developers cannot benefit from the experience of security research. They are a new invention, and so far, no one has invented a secure bridging method. Most cross-chain bridges are single servers that transfer information and value between two chains, which is absolutely insecure. Because the simple bridging itself is insecure, some entities may create the illusion of decentralization by providing multiple servers, but in reality, they are still under the control of a single entity.

To avoid this “decentralized performance,” cross-chain bridges may try to create a more comprehensive network. In this case, multiple nodes operated by independent entities will run on a network. However, the problem with network architecture is that if the network encounters problems, all nodes will be affected. It is not scalable because you cannot pass all transactions on all chains to a single network, just as you cannot pass all blockchain transactions in the world through a single chain. As an alternative solution, Nazarov envisions a cross-chain communication platform operated by multiple independent networks that can dynamically respond to risks.

- An overview of 1kx’s investment landscape in encrypted consumer applications, and which areas will be focused on in the future.

- Multicoin Capital Why We Invest in Fhenix

- OP Stack and Superchain Vision What are the existing OP Stack projects?

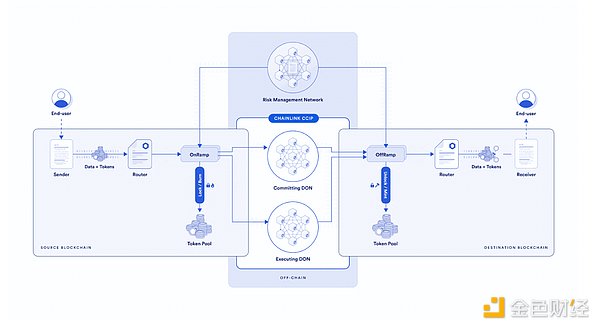

Nazarov uses Chainlink’s own Cross-Chain Interoperability Protocol (CCIP) as an example, pointing out that the protocol includes three different networks on each bridge. He said, “Two networks verify and execute each transaction, and there is a third network called the risk management network, which does not execute transactions but approves or rejects transactions based on risk parameters.”

This means that bridge creators, whether they are banks or decentralized applications relying on bridges, can introduce and set risk parameters without signing transactions or participating in value-related operations. The risk management layer can continue to evolve so that when risks occur, the community and application developers can adapt to these situations very quickly and update the way they manage risks.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!