MAV IEO has attracted many losing investors recently. There have been many incidents where investors lost money after buying into LaunchBlockingd/Launchpool on Binance. Although there has been a recent surge, many people have not yet successfully recovered their investment. This article will help you understand the basic valuation logic of various projects to avoid blindly investing at the highest point. We will also review and compare the historical performance of Launchpool and LaunchBlockingd, and provide an analysis of the differences and speculative strategies of the two platforms.

A. Valuation Logic

If it is not a “meaningless governance token” or memecoin, theoretically, it can be compared on a large scale by giving benefits to token holders. But after all, cryptocurrency is a game of attention, and the so-called fundamentals are too small in the face of narratives. Therefore, valuation generally relies on benchmarking against similar projects.

- An Analysis: Pros and Cons of Cryptocurrency and Traditional Investments

- Tether has launched a native stablecoin USDt based on Kava in the Cosmos ecosystem.

- 9 Catalysts to Watch in Q3: Bitcoin ETF, LSDfi, Frax…

For example, MAV belongs to the DEX track of the DeFi category. The common indicators of DeFi are TVL, which is a commonly used evaluation of scale, as well as total fee income and protocol income, which are not often used to evaluate profitability. Specifically, for the DEX aspect, there is an additional trading volume Vol index for evaluating business scale. As for the token itself, there are two indicators: current market value mcap and fully diluted market value FDV, which correspond to short-term and long-term liquidity, respectively.

See the valuation comparison chart made by @BiteyeCN, which uses TVL or fee income as the business evaluation indicator and provides valuation opinions under mcap/FDV. Of course, there are often some tricks behind the data. For example, the problem with using the one-week handling fee to evaluate MAV is that MAV has a clear card airdrop + Binance listing, so there are naturally many scalpers to boost trading volume, which naturally inflates the figures.

Using more detailed logic and common sense to judge is also a good method. A price of $0.5+ for MAV would lead to FDV approaching Blockingncake. Although MAV is closely related to Binance, it is not as close as Cake. Therefore, it is not realistic to expect the price to exceed $0.5 due to Binance’s support. Previously, the DEX Hashflow, which was also launched on Binance launchpool, currently has an FDV of about 400M, corresponding to a MAV price below $0.2.

If someone is going to invest in Binance because they “believe in Binance’s vision,” $0.5 is clearly far beyond what the launch pool can support. The current market price of about $0.45 is already a relatively high position.

DeFi projects are relatively easy to evaluate because of their application-oriented nature and the fact that they have some actual earning potential. In contrast, the important user activity data for public chain projects is mostly generated by sheep farmers, and their reference value is low, leaving only TVL data to be used. Therefore, compared to data, public chains seem to place more emphasis on background, which is one of the reasons why VCs are so prevalent in this field. Apparently, those with good backgrounds seem to be given a valuation of 10 billion without much thought.

Referring to the ARB valuation we estimated years ago, based on TVL and ecology, we gave a valuation of 2 times OP FDV. However, after the ARB token was issued, there was a large difference in price, and it was a complete failure. However, as the price of OP continued to fall after some time, ARB successfully achieved 2 times OP FDV. (7/n)

As for projects like EDU/HOOK that don’t have any well-known competitors in the same arena, and are themselves the leaders in the arena, it’s impossible to compare them, so it’s all based on imagination. The benefit is that the upper limit of imagination for the potential is very high, and the lower limit is zero for everyone.

B. FDV is not just a number

FDV = total token circulation * token price

When evaluating projects, people often prefer to use market capitalization (MCap) rather than FDV for comparison. However, this is mostly because the circulation of new projects with high popularity is low, so using MCap for comparison is advantageous. However, FDV is not just a number.

Take the example of SUI, which was offered through a joint IEO by OKX/Bybit/Bitget and was given a final push by Binance Launchpool with 40M tokens to avoid the fate of Blur. The price has been declining since opening.

It has recently been revealed that the project team has been secretly unlocking and selling tokens ahead of schedule, claiming to have flexible tokenomics. This is a painful process of MCap gradually converging with FDV, and the increment will become selling pressure.

However, even if SUI executes the token unlocking plan honestly, its increase rate is still very fast. With a benchmark and short-term speculation, SUI had an FDV of over 10 billion at the opening, while the MCap was less than 1 billion, and it was barely supported by market heat. However, it is natural for prices to fall as FDV of 10 billion slowly becomes MCap in the long run if there is no improvement in the fundamentals.

For investors, the long-term game value of Launchpool is obviously lower than that of LaunchBlockingd, so it is more important to do valuation analysis and more conservative preparations for Launchpool projects. Blindly rushing in and holding for a long time can easily lead to being trapped.

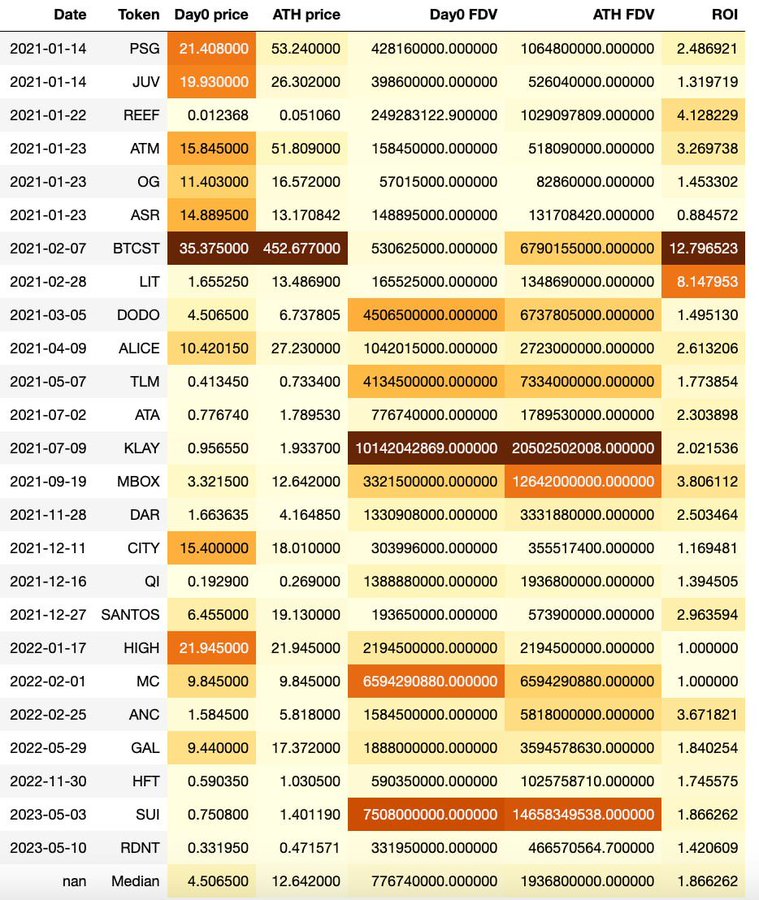

If you are too lazy to do valuation, refer to LaunchBlockingd’s median first-day FDV of 460M. Once the FDV of Launchpool’s application projects exceeds this value, the probability of high returns in the future is not very high.

Summary

Using the same type of project valuation as a benchmark is the most common valuation method. Launchpool’s project performance is not as good as LaunchBlockingd’s, and the coin price often opens high due to liquidity issues, so caution is needed. There are a few cases where Launchpool’s opening price remained at its peak and has been trapped until now, while LaunchBlockingd did not have any cases where it was completely trapped.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!