This year’s cryptocurrency market has encountered unprecedented difficulties.

Externally, global central banks, especially the Fed, are raising interest rates and shrinking their balance sheets (which have not stopped), reducing off-exchange liquidity and insufficient incremental funds; internally, the US SEC has sued Binance, Coinbase and other leading trading platforms, causing widespread panic, market makers retreating, on-exchange liquidity thinning, and market depth declining. According to data company Kaiko, since the beginning of this year, the market depth of Bitcoin has dropped by 20%.

In the face of internal and external difficulties, all kinds of FUD emerge in an endless stream, intending to stir up the market muddy water and fish in troubled waters. As the world’s largest cryptocurrency exchange, Binance has become the first target of FUD attacks, with rumors like “Binance was sued by the SEC and shut down”, “massive layoffs”, “blacklisting of tokens”, “Binance’s market share decline”, etc. flying all over the sky, including global well-known financial media fanning the flames. Eventually, the fluctuation of market sentiment transmitted to the price performance, with frequent ups and downs, and retail investors becoming the last “buyers” of volatility.

In the face of doubts, CZ, the founder of Binance, often responds in writing at the first time, calling for the market to ignore FUD. At the same time, he also knows that action speaks louder than words, and the best way to fight back rumors is to speak with facts. Binance has always been actively promoting compliance processes in other parts of the world, obtaining the license of digital asset operators from the Thai Ministry of Finance, the compliant exchange in Kazakhstan has been officially launched, and it has successfully acquired a licensed exchange in Japan and plans to make new progress this year.

In addition, in the period of market downturn, Binance still insists on building the cryptocurrency industry, on the one hand, improving the underlying basic development, launching distributed storage solutions such as BNB Greenfield and Layer 2 expansion plan opBNB, and increasing investment to support various Web 3 projects; on the other hand, actively creating new trends in the industry, introducing fresh blood into the market through blockchain education, and expanding the influence of the Web 3 world.

“The crypto winter may last at least 18 months. We are actively preparing for the trading system, to cope with the coming bull market.” In a recent Twitter SBlockingce, CZ revealed that Binance is actively preparing for higher trading activity and also sent a signal that Binance is still strong to the market.

1. Binance Responds to FUD Allegations

“4” has become a new popular “code” in the crypto community. The meme originated from a tweet by CZ earlier this year where he stated that his focus for the year would be on education, compliance, products and services, and ignoring FUD, fake news, and attacks. CZ often tweets just the number “4”, sometimes accompanied by a selfie, as a quick way to convey this message. The meme quickly caught on and has become a new symbol in crypto culture.

However, with a high profile come many rumors and allegations. Binance has been subject to various FUD attacks throughout the year, especially after the SEC allegations in June. The main rumors surrounding Binance currently include the following:

FUD 1: “CZ and Binance have been sued by the SEC for violating securities law, which could lead to imprisonment and the shutdown of Binance.”

First of all, violating securities law is more like a pocket crime, and many crypto projects and their founders, including Kraken, have been accused of it. The final result of these cases was usually a settlement, with only a few being criminally charged for “fraud against investors”. Currently, CZ has not been criminally charged. Binance is actively fighting the lawsuit and has hired former US DOJ Deputy Assistant Attorney General M. Kendall Day to represent them in the case.

Furthermore, after FTX’s bankruptcy, SEC’s enforcement actions against crypto have gradually expanded to 19 times, nearly double the same period last year. Even Coinbase, which claims to be the most compliant trading platform in the US, has not escaped the grasp of SEC. Binance has also been affected due to its position as a crypto leader. This struggle between regulatory agencies and the entire crypto industry, with Binance and Coinbase being the frontline soldiers, is crucial. If they fail, the future of the entire crypto industry is bleak.

“If they really take the time to understand our industry, they will find that there is almost no other global exchange or offshore company that is more compliant than Binance,” said Binance Co-Founder He Yi in an interview with Bloomberg. “We respect the attitude of regulators, whether they support or oppose the development of cryptocurrencies. I understand that the overall intention of regulation is good in order to protect investors. The global trend of regulation is inevitable, and this is not something that can be solved by shouting slogans.”

FUD 2: “SEC lawsuit leads to Binance.US asset freeze and closure”

SEC has attempted to freeze Binance.US assets without success, and there is no evidence that it has misused customer assets. The case is still under trial, and Binance.US is actively defending itself and has hired George Canellos, former co-director of the SEC’s enforcement division, as a lawyer to participate in the defense.

In addition, Binance.US has not stopped withdrawals from the beginning, but has terminated support for USD deposits and trading pairs. The USD withdrawal delay issue that occurred earlier was resolved in late June, and Binance.US is still operating. However, affected by the lawsuit, Binance.US’s market share in the United States has dropped to 2.7%, the lowest level since December 2020.

FUD 3: “Binance is under investigation again, and executives are resigning one after another”

According to Fortune, Binance’s Chief Strategy Officer Blockingtrick Hillman, Senior Compliance Vice President Steven Christie, and Legal Advisor Hon Ng resigned. The article stated that executives resigned because Binance is under investigation by the US Department of Justice for alleged money laundering, violation of sanctions, and attempts to deceive US regulatory agencies. The news caused panic in the market. The Wall Street Journal reported that Binance has fired some US employees and is planning to reduce the number of local employees in the United States.

However, the fact is not as some media speculated. After the article was published, the resigned executives subsequently responded, stating that the report was untrue and that their resignation was mainly due to personal reasons. Blockingtrick Hillman said: “I still respect and support @cz_binance, and I am grateful for the opportunity to work under his leadership. I have been working here for two years, and it is time to embrace the next challenge. I will continue to support Binance’s colleagues.” Steven Christie also posted on social media, saying: “My departure is far less sensational than any article describes. I had a good time at Binance. I learned more in the past few years than any other period in my career.”

CZ also responded on Twitter, saying that every company will have personnel changes, but the reasons amplified by “news” are completely wrong. “With changes in the market and the global cryptocurrency environment, as our platform develops, and personal circumstances change, every company will experience personnel changes. We appreciate the contributions of all departing team members to our growth and wish them all the best. We also congratulate those team members who grow in new roles. They are all truly high-quality talents. We will continue to Build and continue to recruit.”

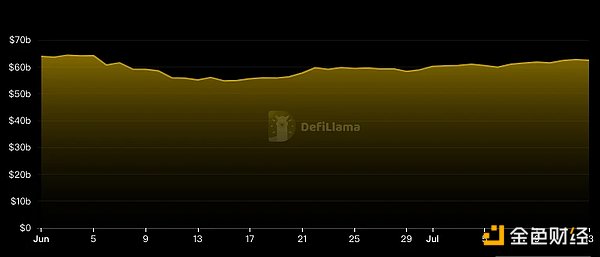

FUD 4: “Binance triggers a wave of withdrawals, its market share drops, and its leading position is no longer”According to data from DeFiLlama, after being sued by the SEC, market panic caused Binance’s outflow of funds to intensify, with total assets dropping from $64.1 billion on June 5 to $54.7 billion on June 15. However, in the following half month, with traditional financial giants such as BlackRock applying for spot ETFs, sparking market sentiment, Binance once again became the first choice for investors, with total assets rising all the way to a high of $62.7 billion (July 12), basically regaining lost ground. As shown below: If we look at the net flow of funds, Binance’s net inflow of assets over the past month reached $2.01 billion, ranking first; Bybit, ranked second, had a net inflow of assets of $280 million, only 14% of Binance’s net inflow of funds. As shown below:

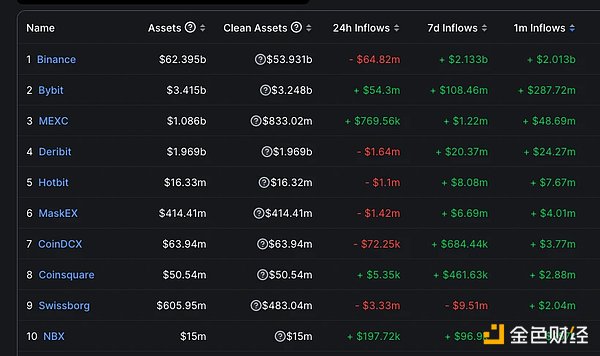

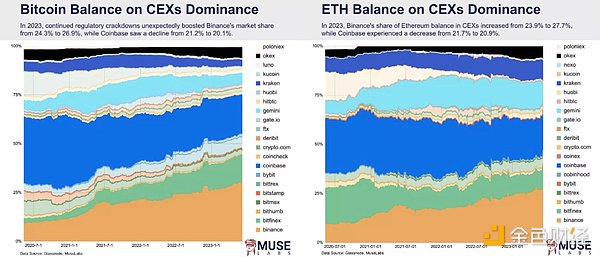

If we look at the net flow of funds, Binance’s net inflow of assets over the past month reached $2.01 billion, ranking first; Bybit, ranked second, had a net inflow of assets of $280 million, only 14% of Binance’s net inflow of funds. As shown below: Data on July 13Of course, the above data is only for reference, as capital flows may sometimes be related to arbitrage activities. Especially in times of violent price fluctuations, many arbitrage traders transfer large amounts of funds between various trading platforms, often several times more than usual. As a reference, Binance had a net outflow of over $7 billion in funds within a day after FTX’s bankruptcy last November, but net inflows of nearly $10 billion in the following days.In addition, data from MUSE Labs shows that the proportion of BTC and ETH held in Binance addresses is gradually increasing in the entire industry, with BTC’s proportion rising from 24.3% at the beginning of the year to 26.9%, while Coinbase’s holding of BTC during the same period fell from 21.2% to 20.1%; ETH’s proportion rose from 23.9% to 27.7%, while Coinbase’s holding of ETH during the same period fell from 21.7% to 20.9%, as shown below:

Data on July 13Of course, the above data is only for reference, as capital flows may sometimes be related to arbitrage activities. Especially in times of violent price fluctuations, many arbitrage traders transfer large amounts of funds between various trading platforms, often several times more than usual. As a reference, Binance had a net outflow of over $7 billion in funds within a day after FTX’s bankruptcy last November, but net inflows of nearly $10 billion in the following days.In addition, data from MUSE Labs shows that the proportion of BTC and ETH held in Binance addresses is gradually increasing in the entire industry, with BTC’s proportion rising from 24.3% at the beginning of the year to 26.9%, while Coinbase’s holding of BTC during the same period fell from 21.2% to 20.1%; ETH’s proportion rose from 23.9% to 27.7%, while Coinbase’s holding of ETH during the same period fell from 21.7% to 20.9%, as shown below: FUD 5: “Controversy over listing, poor performance of new coin launches”In the bear market stage of the entire crypto market, several projects launched by Binance LaunchBlockingd and Launchpool this year have achieved good wealth effects and gained widespread market attention. There are also some illegal elements who falsely claim in the name of Binance founder’s “friends” and “girlfriends” that they can obtain investment quotas or guarantee project launch on the Binance platform, in order to seek profits.

FUD 5: “Controversy over listing, poor performance of new coin launches”In the bear market stage of the entire crypto market, several projects launched by Binance LaunchBlockingd and Launchpool this year have achieved good wealth effects and gained widespread market attention. There are also some illegal elements who falsely claim in the name of Binance founder’s “friends” and “girlfriends” that they can obtain investment quotas or guarantee project launch on the Binance platform, in order to seek profits.

Recently, He Yi clarified the issue of “Little Beauty, her best friend” on her social media platform, warning investors to beware of scams. “Listing on Binance is not decided by a single person, and the logic of listing should take into account the needs of most users,” He Yi further explained that the underlying logic of Binance listing is to try to ensure that the project party can survive for a long time and bring returns to users. “This is actually the gap in investment and aesthetic differences. The platform that can identify suitable listing projects and timing in the long term will enable its users to live longer, which is the core competitiveness of the platform.”

CZ also stated on Twitter, “What Binance values most in listing is whether the project has a real user base and a real application scenario. If not, it will consider factors such as the team and history. Binance does not want the project to have Binance users as seed users, which is very risky.” In addition, CZ also said that instead of spending too much time thinking about how to get listed on Binance, it is better to focus on long-term product development.

Regarding the poor performance of individual currency listings on Binance and the phenomenon of small currencies skyrocketing and plummeting, He Yi said, “The project party’s wallet and market-making accounts are monitored, and the project token currently requires multi-party custody by the project party as part of mutual supervision.” In response to the recent continuous decline in the price of listed tokens, He Yi responded that the market is sluggish, and both large and small tokens have fallen in the near term. The price of most of the market’s altcoins has fallen by 80%-90%, including all the sought-after superstar projects. Some IEO projects have risen to 10 or 20 times after listing, which is not in line with the current market situation. He urged users not to blindly follow the community’s call for high positions.

In addition to the above major FUDs, there are also a series of rumors surrounding Binance on a daily basis, such as “market manipulation” and “employee insider trading.” Binance has also responded to these rumors many times. CZ once said that Binance is particularly strict in internal control. No matter how senior the employee is, they must hold the position for more than 90 days (30 days in the early days) before trading after buying.

Second, the bear market is dormant and constantly deepening

Whenever doubts arise, Binance always responds as soon as possible, calling on the market to ignore FUD, but the best way to fight back against rumors is to speak with facts.

1. In terms of compliance, Binance is actively advancing compliance processes in regions outside of the US.

Currently, the US SEC and CFTC are in dispute over regulatory authority for cryptocurrencies, and the lack of a comprehensive regulatory framework in the US is causing compliance and operational costs for cryptocurrency companies to increase, leading to a shift away from the US market. Hong Kong has become a cryptocurrency-friendly city this year, opening up cryptocurrency license applications, which is undoubtedly a good way out for Binance. According to a report by Tencent News’ Qian Wang, Binance has started connecting with Hong Kong regulatory authorities over the past few months and participated in the Hong Kong Monetary Authority’s cryptocurrency and stablecoin regulatory consultations.

This May, Binance also obtained a digital asset operator license in Thailand, which is its first license in Southeast Asia. The license was granted to Gulf Binance, a new joint venture of Binance, which will operate as a digital asset exchange and digital asset broker, with technical support from Binance. In the European region, Binance will register in six EU member states, including France, Italy, Poland, and Spain, according to the MiCA Act’s anti-money laundering requirements, accelerating the transition to MiCA. Furthermore, Binance is making progress and landing in local exchanges in Japan and Kazakhstan, providing cryptocurrency services to the locals.

2. BNB Chain integrates “governance security, smart contracts, storage, and scalability” into one.

In addition, during the market downturn, Binance still insists on building the cryptocurrency industry, improving the underlying infrastructure development, launching the distributed storage solution BNB Greenfield and the Layer 2 expansion solution opBNB, and increasing investment to support various Web 3 projects.

On February 1st of this year, BNB Chain released the BNB Greenfield white paper. The core of Greenfield is a storage chain and storage node network composed of the storage-oriented BNB Greenfield network and the decentralized Storage Providers (SP) network; users upload their data storage requests to BNB Greenfield, and SP stores the data off-chain. According to BNB Chain’s deduction, BNB Greenfield can be used in areas such as website hosting, personal cloud storage, content payment, social media, etc.

“By 2023, through BNB Greenfield, BNB Chain will create a new theme for data ownership and utility. BNB Greenfield will bring utility and financial opportunities to stored data and programmability to data ownership.” said Victor Genin, BNB Chain’s senior solutions architect.

BNB Greenfield meets storage needs, and the Layer 2 network opBNB launched in June of this year completely opens up the performance limitations of the BNB Chain. opBNB is an Ethereum Virtual Machine (EVM) compatible L2 scalability solution based on the Optimism OP Stack, which greatly improves L1 scalability to reduce network congestion and network costs while maintaining a similar level of security to L1. The innovative underlying combination of opBNB, including optimized data accessibility, caching layers, and adjusted submission process algorithms, allows for more parallel operations, enabling opBNB to reach a Gas limit of up to 100M. Based on these comprehensive optimizations, opBNB can support more than 4,000 transfer transactions per second, with an average transfer transaction cost of less than $0.005.

Thus, in the entire BNB Chain ecosystem, the BNB Beacon Chain focuses on BNB governance and security, the BNB Smart Chain provides smart contract computing, BNB Greenfield provides decentralized storage, and opBNB solves scalability problems. The four-in-one, different directions, but all take BNB as the core value of the entire system.

3. Binance expands the industry through infrastructure and education.

Binance actively creates new industry trends and introduces fresh blood to the market through blockchain education, expanding the influence of the Web 3 world.

Today, the on-chain ecology of Web 3 is constantly erupting, and users’ learning needs are quickly showing professional and systematic characteristics. Simple article popularization cannot meet user needs. At the same time, the number of industry participants is showing a explosive growth trend: enthusiasts or practitioners of technology or projects, and the like. These participants’ continuous growth has also brought more demand for Web 3 education. Binance, DCG, a 16z, Sequoia, etc. have successively laid out in this field.

Especially in CZ’s tweet at the beginning of this year, education is ranked first, which shows its weight in his heart. Since then, CZ has repeatedly discussed the importance of Web 3 education in different occasions and AMAs. “Binance is not doing well enough in the education field, so education is what Binance should focus on.” In addition to verbal importance, Binance is also actively promoting Web 3 education. For example, the Binance Academy has been committed to promoting Web 3 and providing users with all content related to cryptocurrency and blockchain. It is one of the largest and most comprehensive online cryptocurrency libraries in the world.

3. Six years of entrepreneurship, starting anew

1. One out of every 66 people globally is a Binance user

From the birth of Bitcoin in 2008 to now, the entire history of the development of encrypted finance is only fifteen years. As the market goes up and down, the vast majority of crypto companies have disappeared before they have crossed the life-and-death line, with an average lifespan of less than three years. For Binance, it has been six years since its inception, not only surviving, but also developing rapidly, with multiple lines of development outside of trading, forming a comprehensive Crypto group with employees covering more than 110 countries around the world.

According to CCData’s report, in June of this year, the spot trading volume of CEX increased by 16.4% to $575 billion, with Binance accounting for 41.6% and ranking first. In June, the trading volume of CEX derivatives increased by 13.7% to 213 trillion US dollars, and Binance is still the largest crypto derivatives trading venue, with a trading volume of 1.21 trillion US dollars in June, accounting for 56.8%. According to official data from Binance, as of July of this year, Binance supports 18 service languages globally, with more than 120 million users who have been KYC certified, equivalent to one out of every 66 people globally being a Binance user.

After trading business became the top flow, in order to meet users’ demand for more innovative blockchain products, Binance has also continuously expanded its business boundaries, exploring new growth points, developing multiple lines, and has developed into a comprehensive blockchain group, mainly focusing on investment, technology research and development (public chain), wealth management, stablecoins, NFT, payments, charity, and other dimensions. Taking investment as an example, since 2018, Binance Labs has invested in and incubated more than 200 projects globally, focusing on infrastructure, decentralized finance (DeFi), gaming and metaverse, social finance (SocialFi), crypto fintech, and developer applications and tools, among other key areas. Binance Labs’ investments cover multiple aspects including infrastructure, product applications, Web 3 tools, and other areas, with representative projects including Polygon, GOMBLE, SafeBlockingl, and Sui, among other high-quality projects.

2. The ecosystem breaks boundaries and never sets limits

After achieving success, Binance always keeps in mind the principle of user supremacy, putting user interests first.

Recently, the Rug Pull project XIRTAM transferred the raised 1909 ETH to Binance exchange, and Binance assisted in freezing the funds for the first time. In the following more than a month, Binance security team has been working hard to communicate and continuously solve the problems related to the XIRTAM project. Finally, Binance announced that Binance users affected by the XIRTAM incident can apply for the return of XIRTAM assets by submitting specific information through a form before August 2, 2023. After verification, the Binance security team will return the corresponding ETH assets to eligible users through a smart contract address.

“All our achievements today come from the trust of our users. We have always taken the core value of putting users first. Everything we do tells users: we live up to your trust over the years. We must promote the industry in a sustainable and responsible manner, and protect users while promoting innovation,” CZ said.

Especially after the bankruptcy of FTX last year, the asset reserve issue of CEX has attracted much attention. Binance also released the exchange account address for the first time, showing its own reserve status. In addition, the Merkel Tree reserve proof promoted by Binance has also been recognized by other centralized platforms, and all have used this solution for auditing and publicized it on their official website. It is worth mentioning that Binance’s reserve proof only involves 8 major assets including BTC, ETH, BNB, LTC, USDC, USDT, XRP, and BUSD, and it is currently the one that covers the most asset categories among exchanges – other platforms basically only involve BTC, ETH, and USDT. According to Binance’s 8th reserve proof released on July 1, the reserve ratios of the above 8 assets are all over 100%.

Currently, the scale of the cryptocurrency market is only 1 trillion US dollars, which has strong growth potential compared to the traditional market. Many people still do not understand Web 3 and its impact. How to attract users to this new field and bring incremental value to the cryptocurrency market is a problem that all Web 3 practitioners are thinking hard about. From beginning to end, Binance has insisted on expanding the industry, because CZ and other founders believe that the larger the industry, the more opportunities there will be.

“For us, it is very important to develop this industry, and the market is still very young. The more people participate, the more opportunities will appear in this industry. If you are the only participant, then you are in the wrong industry. We hope that Binance will become the gateway to the Web 3 world, and provide a series of simple, accessible, compliant, and trustworthy tools for billions of users entering the new world of Web 3.”

Conclusion

The external regulatory pressure currently faced by Binance has not knocked it down. CZ believes that external pressure is an important tool for honing the team and enhancing cohesion and combat effectiveness.

“I am often asked what the best way to build a close and powerful team is, and the secret is some external pressure. Fighting side by side is the best way to build a close team, which establishes dependence, alliances, resilience, and most importantly, trust between team members. We have always faced external pressure, FUD, etc., so we continue to fight together. This in turn makes us more determined to move forward with our mission and increase financial freedom for people around the world.”

Regarding the future direction of the cryptocurrency market, CZ said that in the long run, he still favors cryptocurrencies. He expects that cryptocurrency trading volume will increase in the next 6 to 18 months, and Binance is making a lot of preparations. “The crypto winter may last for at least 18 months. We are actively preparing for the trading system to cope with the arrival of the bull market later.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!