Foreword

Coinbase launched the Helium token HNT as scheduled on July 12th, marking the market recognition of Helium after its transition to Solana. The reason why it is considered a second time is because Helium successfully maintained its position as a leading DePIN project after experiencing a drop in token price and complaints from miners.

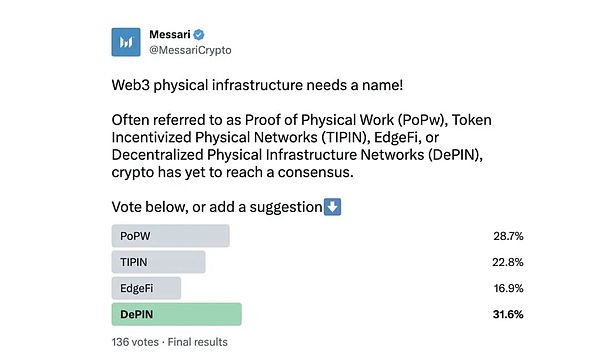

In a Twitter poll initiated by Messari in November 2022, this type of project was officially given the name DePIN. Similar to the relationship between StepN and X2E, there must be specific projects first before summarizing their models with a descriptive term, emphasizing that practice is the only criterion for testing the truth.

- Why does Sui’s on-chain transaction volume surpass Solana and is 20 times that of Ethereum?

- Opinion UniswapX will change the game rules of DEX, MEV, and interoperability.

- Former SEC Official’s Interpretation Is the Ripple Judgment Worth Celebrating in the Crypto World?

By tracing the DePIN naming idea, the following events can be summarized as follows: DePIN practice started with Bitcoin, the first successful project belonged to Filecoin (2014), the representative project of public chain practice is IoTeX (2017), the industry’s first peak was driven by Helium (2021, ATH $54.90), and the formal concept originated from Messari (2022).

If DePIN is defined as a decentralized data market based on hardware devices, then Bitcoin is the project that best fits this definition. Hardware wallets, mining equipment (CPU/GPU/ASIC) all belong to the pattern of hardware generating data that is then recorded on the blockchain. Filecoin and subsequent projects like Arweave mainly deal with data generated by storage media. Whether it is local storage, cloud storage, distributed storage, or decentralized storage, they all ultimately require hard drives to carry the data. IoTex represents the afterglow of the frenzy of “chain reforming” everything, while Helium’s migration has proven that the public chain model is not suitable for DePIN.

Summarizing the core points of past DePIN projects, Messari divides them into four sectors: server networks, wireless networks, sensor networks, and energy networks. It is basically a combination of off-chain data generation and on-chain data confirmation, with a focus on rights confirmation and economies of scale. It does not require high levels of anonymity, decentralization, or extreme “full-chain operation”, so the operation mode of DePIN needs to be reconsidered.

Human Rights -> Property Rights -> Digital Rights Trilogy

DePIN (Decentralized physical infrastructure) is actually an incomplete definition because it focuses on physical devices but lacks the corresponding digital part. Whether it is Bitcoin (PoW) or Ethereum (PoS), the ultimate presentation of value is in the form of binary data. Therefore, the digital part should also be included in DePIN.

Hardware devices are only the source of data generation, but personal data can only have economic value when recognized by others. Following this line of thought, the intersection of DePIN and blockchain lies in the recognition of personal data and the need for new digital rights for individuals. This is the underlying value orientation of DePIN, rather than simply recording data on the blockchain and token incentives.

After the French Revolution, human rights were widely recognized, which led to the distinction between personal private sphere and public domain. The value and destruction generated by individuals can be judged by the public, rather than the preferences of lords or kings.

With the rapid advancement of the Industrial Revolution, humans created more and more material things, such as real estate like houses, as well as economic factors such as factories, mines, and land. Humans often need to combine with these factors to generate economic benefits. Therefore, the property law that emerged is a summary and recognition of the current situation.

Therefore, when various types of data produced by human society are put on the chain, they need to be matched with corresponding economic effects to be widely recognized. The hidden logic here is that blockchain is only needed when the data generated by DePIN is put on the chain for the purpose of rights confirmation, incentive production, and promotion of adoption. Putting data on the chain is just a means to promote decentralization. If putting on the chain is touted as a goal in itself, it is no different from a variant of a Ponzi scheme.

This logic is crucial. The reason for the large drop in the price of Helium is that it cannot generate real customer profits and can only rely on the sales quantity of miners’ hardware equipment. As a result, the token cannot withstand a large amount of selling pressure without a consumption scenario. If the future DePIN project still relies mainly on earning hardware equipment sales, it will inevitably perish.

There are two key points for a truly reasonable approach: economies of scale and “limiting freedom”. Economies of scale can meet the wide-ranging needs of customers. For example, compared to Motorola’s Iridium system, Starlink has no essential difference, the only advantage is that the quantity is large enough (4000+ VS 66), and the large quantity brings a user coverage increase that is orders of magnitude higher.

Limiting freedom does not mean monopoly, nor is it synonymous with reducing efficiency. When applied properly, it can bring users an ultimate sense of experience. For example, the combination of Apple’s iPhone+iOS can bring users an ultimate user experience, which can in turn promote user identification and even motivate users to maintain the pleasure brought by this partial freedom, and even form a cultural sense of superiority in small circles. Ultimately, this forms the strongest bargaining power for the 30% channel fee, which essentially comes from the excessive profit brought by optimizing hardware to the extreme.

This is also the viable path for DePIN. It provides a virtual identity system for real physical devices, similar to the shadow clone technique in “Naruto”. This kind of clone also has a physical existence and can generate self-awareness, which is extremely compatible with the operating principles of various nodes under the blockchain: physical devices can freely join or leave the network, and any idea is open source. Carbon footprint, power saving, AI, and RWA are all part of our lives and will generate a continuous stream of data.

Seamlessly integrating reality and illusion: ARWEAVE is the best solution for DEPIN

After exploring the narrative logic of DePIN, let’s summarize the main operational logic of DePIN, which involves various aspects of DePIN, most importantly the profit model and the software and hardware technology.

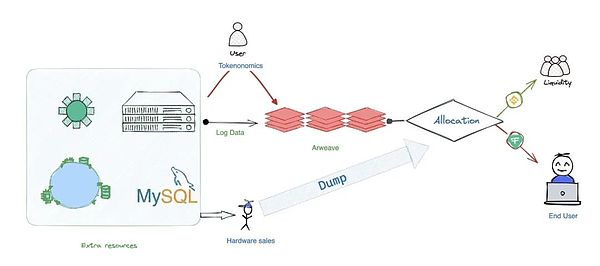

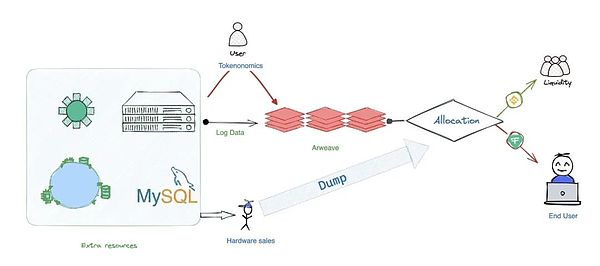

If we abstractly summarize the operational model of the DePIN project, it needs to be divided into the following processes involving the main participants:

Redundant or record-type hardware plugins. People can either rent out their surplus devices, such as Arweave storage space, or record local data uploads to earn incentives, such as DIMO recording smart car operation data.

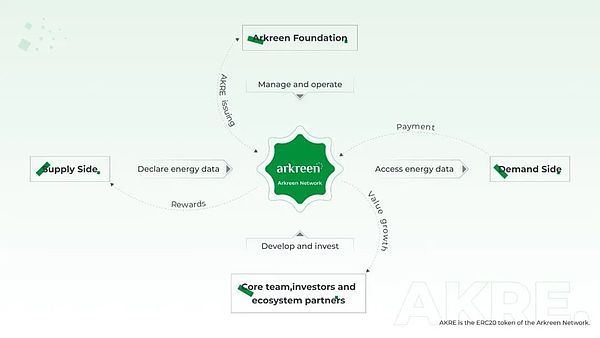

DePIN project party. Strictly speaking, it is difficult for the project party to be completely composed of DAO, because it involves the sale of hardware devices. If it is mainly based on a matchmaking model, such as Render Network matching the supply and demand relationship between its own GPUs and demanders, or conventional storage device networking like Arweave, without the need for custom products, it can gradually move towards the DAO model. However, if custom hardware devices are required, such as Helium or Arkreen, the project party or company entity needs to be responsible for hardware sales or after-sales service.

Distributors or miners. Unlike other blockchain projects, DePIN usually requires hardware manufacturers, project parties, and distributors to cooperate in sales. Of course, it can also adopt a direct sales model to miners. However, regardless of the method, as long as the hardware devices are sold, the manufacturers and project parties will profit. At this time, distributors or miners are not only buying the value of the hardware, but also subscribing to a considerable amount of expected value in advance. The project party will also return it to the miners in the form of tokens, which is also a source of selling pressure on the token price.

End users. They can be divided into two types. One is users with actual needs, such as individuals, companies, or other organizations with GPU or storage needs. The other is transactional users of the blockchain. Their purchases or sales will affect the expected value of miners, creating the second potential selling pressure on the token price. If the expected mining revenue cannot cover the cost, the equipment will be shut down, which will also affect the use of real users and cause the third selling pressure on the token price.

In summary, DePIN faces three obstacles: hardware sales, sluggish user demand, and insufficient liquidity. In a sense, any DePIN project needs to maintain a fragile balance among the three, and the only way to break through is simple – manufacturing or satisfying the real needs of users, thereby promoting miners’ willingness to hold tokens, and liquidity will become more robust.

The parts related to various projects will be discussed in detail in the following text. This section will focus on how to reduce startup and operating costs and meet the real needs of users at a lower cost.

As mentioned in the initial part of this article, the public chain model is too heavy and not suitable for most DePIN projects. In order to reduce on-chain computing costs, they should be transferred off-chain as much as possible. After the hardware is sold, the management platform and data upload process should be as simple as possible to sell a large number of daily needed devices at a lower price.

It can be summarized as: DePIN = IoT + Edge Computing + Hardware Sales + On-chain Confirmation + Tokenization. This is a combination of centralized and decentralized architecture, involving data ownership and token operation, which requires on-chain transactions.

According to Statista, by 2025, there will be over 75 billion IoT devices installed worldwide. To support the operation of these devices, a large amount of computation needs to be moved to the edge, which is closer to the end terminal itself, in order to reduce server load and improve network responsiveness.

Following the development models of ICT, IoT, and AIoT, hardware devices will become cheaper and more affordable, which is enough to support local computing networks. Only the data generated by these devices needs to be put on the blockchain. As mentioned earlier, DePIN is more suitable for L3 or dApp models to avoid excessive construction.

Arweave has proven its value through its cooperation with Lens, specifically for hosting on-chain social data, which is not only cheap but also fast. The same effect can be achieved by transferring it to the DePIN field. Through Arweave’s Bundle mode, it can act as a similar L2 Rollup and further reduce the cost of on-chain data.

In fact, IoTex has already made some attempts in this regard. It has released a complete DePIN infrastructure and toolkit called W3bstream Devnet, which simplifies the complex process of DePIN project development.

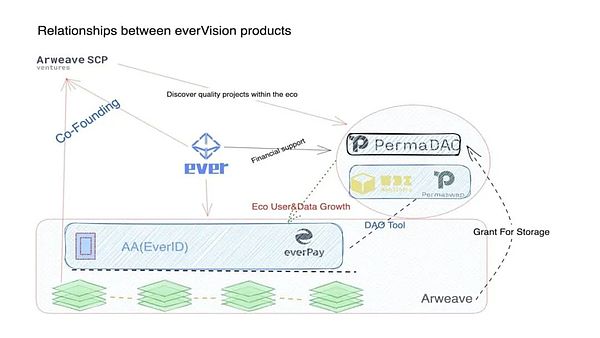

Similarly, everVision provides a one-stop shelf product solution based on Arweave and everLianGuaiy for DePIN:

· Web3Infra provides developers with developer tools that connect with Arweave, supporting one-click uploading of Arweave data. The built-in Arseeding supports multiple mainstream tokens such as AR, USDT, ETH, and USDC for paying Gas Fees;

· EverID supports users to use existing phone numbers or email addresses and other Web2 products or wallets compatible with EVM, such as Metamask, to generate DID and directly build a user identity system;

· everLianGuaiy and Permaswap support asset management, recharge, and transaction capabilities for Arweave and EVM-compatible chains. The distribution of project tokens and asset issuance can be customized;

· Arweave SCP Ventures and PermaDAO will provide storage grants and investment and financing support, further reducing the startup costs and resource consumption of DePIN.

The DePIN project and Arweave naturally complement each other. Arweave itself can be seen as a type of DePIN project, and the derived SaaS services are also more suitable for future DePIN projects. Just remember one thing, the core is not about putting data on the chain, but about asset ownership.

Long-termism: Real utility of DEPIN in niche markets

Similar to the RWA concept and practice report we previously released, there are three ways to implement DePIN. One way is to transition from a Web2 perspective to the blockchain, such as the “User Data Rights Plan” of Zhi-Ji Automobile, which calculates income based on user mileage data, with raw stones as the pricing carrier. However, it can only be exchanged for corresponding income and cannot circulate on the chain.

Another approach is to create new use cases from the perspective of Web3 Native, such as Arweave’s permanent storage, which can maintain storage efficiency for at least 200 years and can be replicated up to 781 times, creating a globally circulated data rights market.

The last approach combines Web2 and Web3. For example, integrating DePIN as a plugin into traditional Web2 products. Imagine a future scenario where Alice wakes up one morning in 2030, opens everLianGuaiy to check her earnings, then makes a transaction on Permaswap, and starts preparing for work by launching Helium to provide communication support for pedestrians and devices nearby. On her way to work, she opens DIMO to record her vehicle device data and continuously contributes the latest map data to Hivemapper, and then arrives at the office, which is a solar energy company. Alice skillfully installs Arkreen collection devices for various solar energy components, making it easy for users to record their carbon footprint.

The aforementioned projects have already covered various aspects of human life. In fact, many current products have their Web2 counterparts, such as Tesla’s vehicle information system. However, the interconnected data built on automotive hardware like DIMO is open, cross-enterprise, and cross-platform, with ownership belonging to users rather than companies.

Compared to high-precision map service provider Navinfo, Hivemapper is more similar to crowdsourcing and sharing economy models. It distributes various map data collection tasks to independent vehicles through driving recorders. Although it may not match the accuracy and professionalism of Navinfo, it can have a complementary effect in less explored areas like suburbs and deserts, while commercial companies may face cost issues in performing these tasks.

The crowdsourcing model is very conducive to the expansion of segmented markets. For communication service providers, it is economically unreasonable to extensively deploy telecom base stations, but there is indeed some demand. The opportunities lie in the DePIN market.

In addition, DePIN can also expand into more service scenarios, such as Spexigon’s drone collection. Compared to traditional aerial or space photography, costs can be significantly reduced, and it can provide a three-dimensional perspective in daily life scenarios.

All of these efforts aim to address the problem of insufficient end users. Existing mainstream service scenarios are already covered by technology companies and governments. The areas and fields that are less frequented and have poor economic benefits are more suitable for DePIN to enter.

Furthermore, in the future AI era, DePIN will also bear the responsibility of providing more data for AI. The current human language corpus, whether it is classic books or internet data, has already been unified by AI for retrieval and inclusion. If it cannot provide more fresh data, AI will fall into a state of “talking to oneself” and become intellectually disabled. DePIN’s behavioral data can take over human data and expand the boundaries of AI to external scenarios of human life, thus creating a more intelligent living environment for humans.

For example, AI can learn driving data and road data from multiple car brands. The more data AI learns, the more accurate its accuracy will be. This will improve the advertising effectiveness for advertisers. However, for road safety, even a one-meter-per-second error can be a matter of life and death.

Another example is Arkreen, which is creating a more fair global carbon trading market. By connecting solar energy devices to the global network, users can not only obtain green energy but also generate certificates for reducing carbon footprint, thus extending the profit curve of passive income.

In previous carbon trading, the main entities were either countries or large enterprises. For example, Tesla earned more than $5.4 billion in revenue from selling carbon credits in 10 years. However, after Arkreen is formed, individual users can also share a portion of this revenue, changing the current situation of unequal access. Under the incentive mechanism, it will also promote the participation of global users and truly create a green economic development model.

Currently, DePIN’s real situation is that there are too few end users, and the scale effect of device nodes has not yet exploded. However, in the future, as more real users enter both the supply and demand sides, each user will be both a producer and an active consumer, truly exerting the positive effects of DePIN.

Conclusion

After Arweave updates to version 2.6, the barrier to entry for mining has been further lowered. The current problem with DePIN lies in the lack of a sustainable and reasonable operating model, resulting in a huge selling pressure on the asset side. However, with the continuous growth of network nodes, the real usability of the network is also gradually increasing, although not as steep as StepN’s development curve.

Arweave’s network scale only exceeded 100 PB on its fifth anniversary. Similar infrastructure construction will have a high investment period in the early stages. The development cycle of DePIN will also be similar. After years of development, it will gradually begin to enter the stage of acquiring real users. However, it is important to ensure that the data on it is based on real demand, as real demand is a driving force that covers miners’ selling pressure. Token incentives should promote the use of DePIN products, rather than mapping the value of the product to the token, so that the liquidity ultimately cannot bear the pressure.

Arweave will also take this opportunity to declare its continuous commitment to the construction of DePIN and hope to work with more DePIN projects to create a truly decentralized living scenario, surpassing the simple imitation of existing Web2 products and truly demonstrating the revolutionary significance of blockchain technology.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!