Authors: Wang Puyu, Zou Chuanwei @ HashKey Tokenisation

If we can purchase a standardized small device (such as a wireless router) at a very low cost, which can communicate and network with similar devices in the surrounding area, even with devices purchased by residents from different countries or regions, what kind of changes will it bring to the industry? By owning a standardized small device, everyone becomes a co-builder of the network and also has the right to receive benefits and governance of the network. For users, they can use these networks or data services at extremely low cost, anytime and anywhere without permission. The frequent use of network or data services by users can also bring continuous passive income to network builders. A large-scale infrastructure network is built without the coordination of centralized organizations or complex approval processes. It seems difficult to achieve, but it is happening rapidly around us. This economic activity has a new term called Decentralized Physical Infrastructure Network (DePIN).

1. What is DePIN?

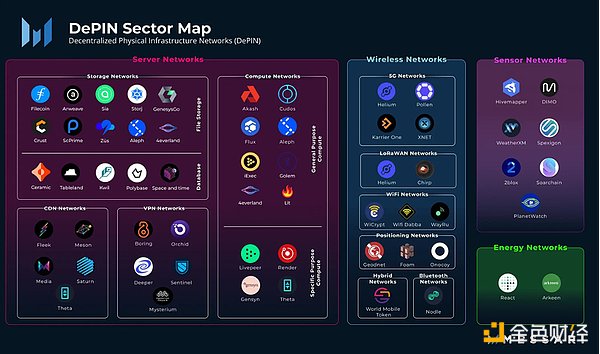

DePIN is a new term derived from physical proof of work (PoPW), MachineFi, and other Web3 concepts. DePIN (Decentralized Physical Infrastructure Network) refers to the construction of various physical infrastructure networks using token economics to incentivize and coordinate community members, following the principle of “the more contribution, the more benefits.” Messari classifies the DePIN track into four major sectors: service networks, wireless networks, sensor networks, and energy networks.

- A Comprehensive Analysis of Arkham Valuation and Alpha Mining Practical Tutorial

- The tragedy of Fantom’s fish pond How big is the vulnerability? Can it be self-resolved?

- DeFi Security Summit 2023 Review What is the Cryptocurrency Security Community Discussing?

Figure 1: DePIN Ecological Distribution Map Source: https://messari.io/report/the-depin-sector-map

2. Why DePIN?

In terms of digital infrastructure construction, DePIN fully utilizes the advantages of crypto economics in distributed organizations, achieving rapid network expansion through a bottom-up, low-cost, and efficient organizational approach, and changing the high expenditure and low efficiency problems of the traditional top-down approach.

1. Traditional Centralized Physical Infrastructure Network (CePIN)

The construction of infrastructure networks is a costly and time-consuming task. Taking the construction of 5G base stations in China as an example, from 2017 to the end of 2021, a total of 1.425 million 5G base stations have been built and put into operation, with a total investment of 184.9 billion yuan.

2. DePIN (Decentralized Physical Infrastructure Network)

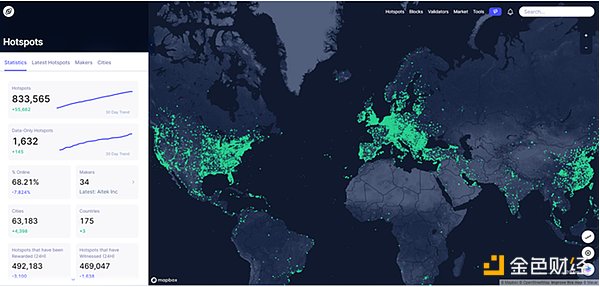

Helium has adopted a distributed approach and has deployed 833,000 small base stations (hotspots) in just 31 months, covering 175 countries and maintaining a growth rate of 30,000 units per month in the long term. Compared to CePIN, the early construction cost of DePIN can be ignored.

Figure 2: Distribution map of Helium mini base stations (hotspots) Source: https://explorer.helium.com/old-explorer

Without judging the success of Helium’s business model, Helium has maintained a growth rate of 30,000 hotspots per month for the past 3 years, with almost negligible operating costs, proving the feasibility of the DePIN paradigm.

III. How to layout DePIN?

We will explore how to layout DePIN from two aspects: the components of the DePIN ecosystem and the economic model.

(a) Components of the DePIN Economy

The components of the DePIN ecosystem include 6 elements: Physical Hardware DU, Incentive Mechanism, Consensus Protocol, Contributors, Tokens, and DAO Community.

1. Physical Hardware DU

DePIN Unit (DU) is usually an IoT device that serves as the basic unit connecting the physical and digital worlds in the DePIN network. Taking rapidly developing projects in the market as examples, the DU for distributed street map Hivemapper is a standardized dashcam, the DU for low-power wide-area network Helium is a network miner (hotspot), and the DU for renewable energy network Arkreen is a solar photovoltaic panel, etc. In order to ensure that contributors from different regions, backgrounds, and knowledge can participate in the construction of DePIN without friction in a distributed organization, the DU needs to meet the following conditions as much as possible:

-

The DU is standardized and plug-and-play

-

Contributors do not need to perform frequent maintenance on the DU

-

The cost of DU is inversely proportional to the network scale, so the DU cost should be minimized. Currently, the unit price of DUs in different projects on the market is controlled between $200 and $500.

2. Incentive Mechanism

The incentive mechanism is the key to the orderly development of the DePIN project. The project community needs to cleverly apply the incentive mechanism to align the behavior goals of contributors in order to achieve the scale development of the infrastructure network. In addition, the project community needs to first formulate behavior reward criteria suitable for its scale development based on the type of infrastructure. For example, in order to expand the network coverage, areas with low network coverage density will receive higher rewards than areas with high density; to prevent malicious behavior, areas with excessively low coverage density will not receive rewards. In summary, in order to maximize profits, rational miners usually choose to place Helium miners in areas with moderate density. Similarly, Arkreen incentivizes contributors based on their electricity generation capacity and will install miners in locations with ideal sunlight for rational contributors. Overall, the design of the incentive mechanism needs to follow the following principles:

-

The project has clear overall goals and sub-goals. There is only one overall goal, while there can be multiple sub-goals. However, adding more sub-goals will exponentially increase the difficulty of understanding the project.

-

Each type of contributor should have a specific behavior-to-mining reward standard (X to Earn). There should not be too many types of contributors, as each additional X to Earn will increase the complexity of the system.

-

Incentives are also a way of distributing tokens, and the quantity distributed needs to be designed according to the total market circulation to avoid token inflation and price decline.

3. Consensus Mechanism

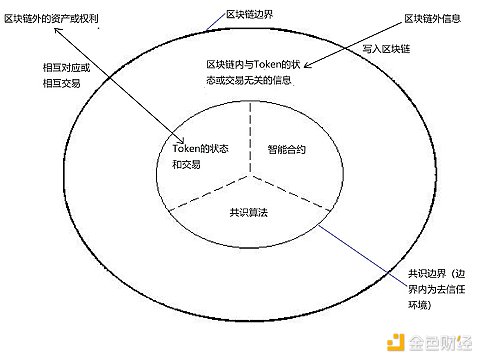

CePIN is deployed and developed under the absolute control of centralized institutions. However, DePIN is distributed, trustless, and anonymous, without the organization and coordination of centralized institutions. Therefore, it needs to achieve consensus among all participants through one or more consensus mechanisms, while ensuring network security and sustainable development. The concept of network security and sustainability includes two levels of meaning. The first level refers to the security and sustainability of the infrastructure network formed by different devices, which means that the devices can form an infrastructure network and operate securely and normally. This is a technical issue that requires the project team to conduct a thorough evaluation before the DePIN project starts. The second level refers to the security and sustainability of economic activities on the blockchain, including verifying the authenticity of physical world DU and the reliability of DU data on the chain. As shown in Figure 3, the economic activity data on the blockchain can only guarantee its immutability after being recorded on the chain, but it cannot guarantee the authenticity of the data recorded on the chain. For example, if the data is attacked and tampered with on the device side, the data can only guarantee that it will not be tampered with again after being recorded on the chain, but it cannot guarantee that the data is authentic. Therefore, before the device data is recorded on the chain, we need to verify the authenticity of the data through a consensus algorithm. Only data recognized by all contributors can be recorded on the chain to ensure the sustainable development of the ecosystem.

Figure 3: Blockchain boundary and consensus boundary Source: “What Blockchain Can and Cannot Do” by Xu Zhong and Zou Chuanwei

In this section, we discuss the consensus mechanism only for the second level, which is the network security and sustainability at the level of blockchain economic activities. It can be divided into two aspects: firstly, the fairness and accuracy of on-chain bookkeeping, which is the foundation and lifeline of decentralized cooperation; secondly, the authenticity of various nodes or data on the network, to prevent malicious actors from changing node positions or sending false data to deceive ecological rewards. The former is a consideration for project teams when preparing to build their own blockchain, such as PoW or PoS consensus mechanisms; the latter is a consideration for all DePIN project teams on how to design consensus mechanisms from a technical and algorithmic perspective. For example, in the Arkreen project, the project adopts the Proof of Green-Energy Generation (PoGG) consensus mechanism, with the following general process: firstly, all DUs sample PoGG data every 5 minutes and cache it locally, and report 12 records to the Arkreen Network every 1 hour. Secondly, after the end of the previous reward cycle, Arkreen Network uses the Verifiable Random Function (VRF) method to generate a random value, and combines it with the current cycle’s DU attributes to select the miners who have the opportunity to receive rewards in this cycle. Then, Arkreen Network verifies the credibility of PoGG data and eliminates the DUs that are determined to have forged data. Finally, rewards are allocated to qualified DUs based on their weights in the current cycle. Arkreen ensures the authenticity and reliability of network data through the above PoGG method. In general, the design of DePIN consensus mechanism needs to follow the following principles:

-

The DePIN consensus mechanism design follows the principle of Proof of Physical Works.

-

Proof is the way of consensus, and Physical Works is the object of consensus, such as the Physical Work of Helium is Coverage, and the Physical Work of Filecoin is Replication and SLianGuaicetime.

-

In order to achieve system self-organization and maintain system sustainability, it is necessary to repeatedly demonstrate which Physical Works are needed for the DePIN project.

-

The Proof design does not have an optimal solution, it needs to be designed from both the technical and algorithmic levels, and the method of verifying Physical Works needs to be iteratively validated in the long term.

-

All consensus rules are embedded in the DU chip, and the consensus process is automated without the need for the DU owner to perform any operations, but the authenticity and reliability of the consensus process can be verified by anyone.

4. Contributors

Contributors are usually divided into the following 6 categories:

-

DePIN project initiator: Usually, DePIN has an institution or several individuals as project initiators, who are responsible for early DU technology development, system development, on-chain contract deployment, and DePIN community development, etc. In the token distribution, the DePIN project initiators will retain a certain proportion of the tokens as rewards.

-

DU owner: DU is a standardized small device purchased through designated channels in the community, and DU owners are also called miners. According to the common goal, DU owners can participate in network construction by installing devices in locations with higher current income, a process known as DePIN mining.

-

DU authenticity validator: In a trustless environment, it is important to ensure that the devices held by different miners are operating normally according to the system rules. This has a significant impact on the stability of the physical infrastructure network. If device data is directly put on the chain, it can only guarantee the immutability of the data after being put on the chain, but cannot guarantee the authenticity of the on-chain data. Therefore, the role of validators is needed to participate in the verification of the authenticity of device data according to special rules.

-

Community governor: In the process of distributed collaboration, fairness, openness, and transparency are very important in governance. To prevent misconduct by governors, they usually need to pledge a certain amount of tokens. The governance rights are related to the amount and duration of the token pledge, achieving a strong binding relationship between governors and the interests of the ecosystem.

-

Project investors: Like traditional businesses, in the early stages of the project before the token issuance stage, it still relies on external investment institutions to support the project initiators in terms of technology and business expenses. Investment institutions usually take the main equity of the DePIN project initiators or the distribution of DePIN project tokens as rewards. If in the form of main equity, the investment institutions need to wait until the DePIN project initiators exit after IPO, or the DePIN project party exits through future profits or equity tokenization by issuing coins through STO. If in the form of token distribution, the tokens are usually linearly unlocked over a period of 2-4 years.

-

Others: Project parties usually reserve 3-5% of the tokens to reward ecological advisors or organizations or individuals who discover system technical vulnerabilities. Depending on the type of project, the types of contributors may vary.

5. Token

If consensus is the foundation of on-chain projects, then Token is the lifeblood of the economic system. From the creative idea and technical development of Web3 projects to the later stage of operation, ecological development, and community, the value of all these aspects will be reflected in Token. Understanding the DePIN project through Dr. Xiao Feng’s “Three Generations of Token Model”, NFT is the digital proof of DU, utility tokens represent the right to use DePIN, and security tokens represent the equity of physical entities (founding institutions, DU production companies, or others). In the DePIN project, one or two types of utility tokens are usually used to capture ecological value, and these tokens have the following characteristics:

-

Tokens are usually distributed to contributors for free through rewards or airdrops;

-

The issuance speed of tokens needs to match the growth rate of economic activities;

-

Tokens are used as payment tools or governance credentials in the ecosystem;

-

Tokens are circulated back through transaction fees or buybacks by the founding team. A portion of the circulating tokens are burned according to the rules, reducing the total supply and achieving a deflationary state for the economic system;

-

The value captured by tokens comes from real-world assets (RWA) and is affected by high-frequency trading in the secondary market, so their prices will fluctuate. In order to allow participants to focus on economic activities themselves, it is common to separate the asset function and the currency function of tokens to isolate the impact of price fluctuations on market applications. A typical approach is to anchor the US dollar by issuing payment stablecoins, which can only be obtained through utility tokens that burn the asset function.

6. DAO Community

In the decentralized self-organizing DAO model, anyone can initiate various proposals for the development of the DePIN project or participate in decision-making voting on various matters anytime and anywhere. To prevent governance attacks, the interests of the participants in the proposal or voting are usually strongly tied to the DePIN project, which means that any losses resulting from negative governance will be borne by the participants. A typical approach is to determine the rights of the participants based on the quantity and duration of staked utility tokens.

The DePIN DAO community usually needs to govern the following content but is not limited to:

-

Voting for the list of qualified DU suppliers;

-

DePIN technical implementation proposals and voting;

-

Proposals and voting on various parameters that affect the DePIN economic model;

-

Proposals and voting for the iteration of the economic model.

(II) Economic Model

In the Internet platform economy, people are accustomed to discussing business models, and few people discuss economic models. Some even confuse the concepts of business models and economic models. However, in the Web3 economic system, we can see the essential difference between these two concepts because each Web3 project has its own currency system. In Web3 projects, the business model describes how the project creates, delivers, and captures value, while the economic model describes the supply and demand model and monetary policy model of the Token itself. Web3 economic models and business models are not independent, as the economic model needs to be carried by the business model, and the business model determines how to regulate the economic model. Dr. Zou Chuanwei, Chief Economist of Wanxiang Blockchain, divides the design of economic models into the following steps:

-

Think about economic stories;

-

Extract the “scaffold” of economic models;

-

Determine the objects and use cases of tokenization, including payment tools;

-

Determine the investment and financing mechanism for public goods;

-

Develop incentives for participants in decentralized and trustless environments;

-

Determine the effectiveness of value capture;

-

Select secondary markets for tokens and evaluate their impact;

-

Refine economic model details and iterate continuously based on user needs and risk control.

In the DePIN economic model design, the following 9 questions help project teams and professionals think about how to design an economic model:

-

What is the project’s roadmap?

-

What goods are supported for circulation on the network?

-

Who are the providers and demanders of related goods? What are their goals for maximizing benefits?

-

What is the role of tokens in the circulation of goods?

-

How are tokens issued? How does it reflect the principle of Proof of Physical Work?

-

What are the uses of tokens? And how do they flow back?

-

How to incentivize early contributors?

-

What goals are expected to be achieved through DAO?

-

What are the unstable factors in the network?

4. Summary

DePIN captures the physical infrastructure value of real-world assets (RWA) through tokens. By attracting users through economic mechanisms in a bottom-up self-organizing manner, it fully leverages the economies of scale of distributed economy. Compared to other projects, DePIN is still in its very early stages, with its business model and economic model undergoing rapid iterations. Although DePIN has shown us many possibilities, it is not a panacea. Through studying early projects like Helium and Filecoin, we can see that there are still boundaries in terms of business and technology, and it is not suitable for all scenarios. To summarize, the following aspects should be considered:

1. DePIN is suitable for single infrastructure scenarios, avoiding multiple scenario iterations, i.e. avoiding “wanting both”. Since DePIN involves interactions between physical world devices, project goals and participation rules should be simplified as much as possible to reduce the cognitive threshold for contributors. This can prevent contributors from misunderstanding complex rules and behaving in a way that deviates from the overall project goals.

2. In the construction of physical infrastructure networks, if there are elements of human management and operation, the DePIN model is not applicable. Explained from the perspective of the four flows of the supply chain (goods flow, information flow, fund flow, and logistics flow), only the logistics flow is involved in on-chain activities, while other flows can be completed on the blockchain. This can reduce friction in the construction of distributed physical infrastructure networks. Each additional off-chain activity requires centralized solutions, which may weaken the scale effects of distributed businesses.

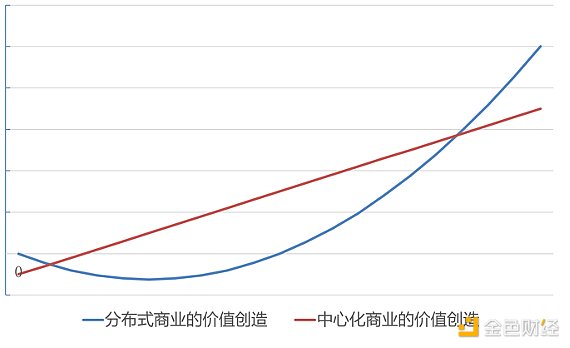

3. In the initial stage of project development, it is difficult to demonstrate the scale effect of a distributed economy. Only when the network exceeds a certain scale (referred to as the “critical scale”) can the advantages of relatively centralized commercial institutions be reflected. As shown in Figure 4, the advantages of distributed organizations in scale expansion and value creation can only be demonstrated after reaching the critical scale (the intersection of the two lines for the second time). Therefore, before reaching the critical scale, the DePIN project still needs to rely on the core team to deploy DePIN nodes and promote the network in a weakly centralized manner. After reaching the critical scale, the core team usually exits, and network governance is handed over to community governance, thereby improving network effects through a distributed approach.

Figure 4: J curve of distributed business

In addition, the current stage of DePIN’s development is only at the network construction stage and has not yet opened up universal applications on the demand side. In the future, it is still necessary to observe the various problems and bottlenecks encountered by the DePIN project in promoting the demand side in order to truly establish a commercial and economic closed loop for the DePIN ecosystem.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!