Author: trevor.btc

Translation: Luffy, Foresight News

Recently, the author @the_LeticiaMelo from DappRadar published a popular article about Ordinals, claiming that Ordinals’ transaction volume has decreased by 97% since May, but this data is not accurate.

Subsequently, this article was reposted by Brian Quarmby from Cointelegraph, further exacerbating the spread of misinformation.

- Researching the behavior patterns of airdrop experts average airdrop earnings reach up to $20,000, what is their next target?

- Laziness is the primary productivity? Inventory of 4 Intent-Centric Cryptographic Protocols

- Interview with the Chairman of Cypher Capital The Cryptocurrency Cycle is an External Factor, Cultivating Inner Strength is the Way to Success

For those who are not familiar, you might think that DappRadar has conducted in-depth research. But DappRadar has made mistakes before. I remember when DappRadar launched Stacks integration in 2022, they made a major announcement and all the data was incorrect. They launched a dashboard that ranked applications based on TVL, active users, and other metrics, but none of the data was accurate.

Unfortunately, this article about Ordinals is another example of DappRadar publishing incorrect information.

Where did DappRadar go wrong?

1. Incorrect transaction volume data

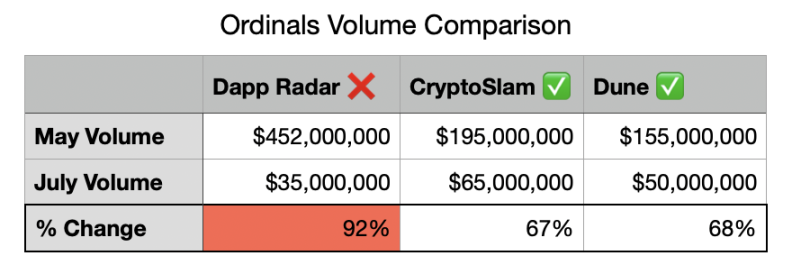

DappRadar claimed that Ordinals had a transaction volume of $452 million in May and $35 million in July. A 92% decrease from July to May. Is this correct? No.

According to @cryptoslamio data, the transaction volume of Ordinals in May was $195 million, and in July it was $65 million.

I know, there is still a significant decrease of 66%, but the story it tells is completely different from DappRadar.

Let’s look at another set of data. The Ordinals Marketplaces Dune data panel from @domodata shows that the sales volume of Ordinals in May was $155 million, and in July it was $50 million. This is almost the same as the 68% decline shown by CryptoSlam.

There is no doubt that the market is experiencing a decline after a period of hype, but as you can see, DappRadar’s data on the extent of the decline is not accurate.

Math geeks know that a 92% decrease is more severe than a 67% decrease followed by another 67% decrease.

So DappRadar’s data is not only inaccurate but also highly misleading.

2. No mention of BRC-20

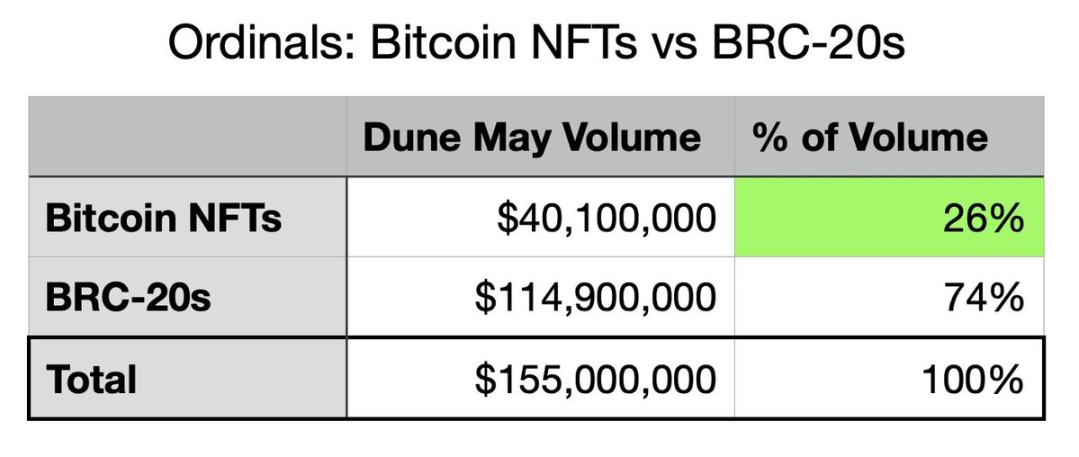

DappRadar’s article did not mention BRC-20.

According to Dune’s data, 74% of the sales in May came from BRC-20, and I believe this is a major oversight.

Why? The article compares the trend of BRC-20 + Bitcoin NFT transaction volume with Ethereum and Polygon NFT transaction volume. When writing an article about NFTs, inappropriate data should not be mixed.

3. Comparing ATH during a hype cycle with mature ecosystems outside the hype cycle is meaningless

Quote from Leticia, the author of DappRadar:

“Bitcoin Ordinals is facing a larger decline, which suggests concerns about the utility of its platform or its NFT products.

It is important to understand that while Bitcoin Ordinals brings innovation, Ethereum and Polygon have longer-standing reputations and wider applications in the NFT field, making them less susceptible to market volatility.”

This raises the question, has Ethereum’s NFT trading volume experienced a significant decline in the past two months?

Yes, they have also been unable to escape the fate of decline.

According to Dune’s analysis:

- From January to March 2023, NFT trading volume on Ethereum dropped by 49%

- From April to June 2023, NFT trading volume on Ethereum dropped by 77%

The decline in trading volume experienced by Ordinals is not uncommon in the NFT hype cycle. In fact, the situation in April 2023 was worse for Ethereum.

Remember, even Bitcoin, which fell from a high of $68,000 to a low of $16,000, a decline of 76%, although the time range of Bitcoin’s decline was much longer.

Conclusion

Did Ordinals accelerate the hype cycle? Absolutely.

Did the trading volume of Ordinals significantly decrease compared to its peak? Yes.

Could it fall further? Of course.

But so what?

The Ordinals market is no different from any other new asset in the field, and it is no different from what we have seen in other NFT ecosystems.

History, in a sense, always repeats itself. Many people know that a decline will happen sooner or later, but that doesn’t change my belief in the technology or the future of the field.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!