Author: CryptoVizArt, Glassnode Compilation: Nan Zhi

Key Points Summary

-

Exchanges remain the core of the digital asset industry, with the vast majority of transactions occurring on them;

-

Based on entity-adjusted data, our assessment shows that 54% of BTC activity is related to deposits or withdrawals from exchanges;

-

Learning from the lessons of the FTX crash, we introduce three metrics to assess abnormal exchange activity: internal transfer rate, exchange dependence rate, and whale withdrawal rate;

-

Using this exchange risk framework, we evaluate Binance, Coinbase, Huobi, and FTX to provide an overview of various on-chain behaviors of exchanges.

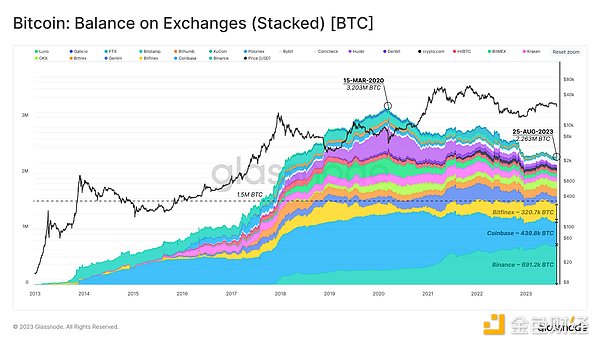

Exchange Balances

CEX holdings reached a peak of 3.203 million bitcoins in March 2020 and have since steadily declined. This week (end of August), the total exchange balance reached the lowest level in five years, at 2.256 million bitcoins. These exchange balances consider wallets directly related to exchanges and do not include custodians or ETF tools (such as GBTC or Microstrategy).

One notable feature of this chart is that the top three exchanges dominate and have held around 1.5 million bitcoins since early 2019. The current estimated holdings of these exchanges are:

– Binance: 691,200 bitcoins

– Coinbase: 439,800 bitcoins

– Bitfinex: 320,700 bitcoins

Excluding the 1.457 million bitcoins considered lost, the exchange reserves account for 11.8% of the circulating supply, reaching 2.31 million bitcoins, while the daily on-chain transfer volume is 122,000 bitcoins (0.6%).

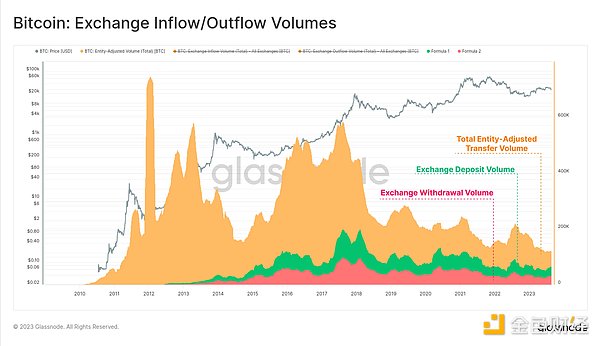

Of this 122,000 bitcoins in trading volume, deposits or withdrawals from exchanges account for over 54% (approximately 67,300 bitcoins per day, with deposits and withdrawals split evenly). Therefore, observing the flow of funds into and out of exchanges usually provides rich information.

Fund Flow Analysis

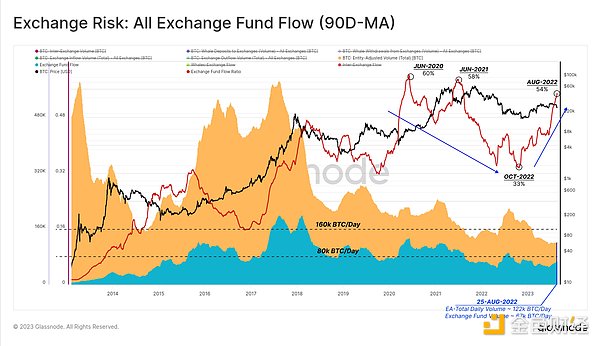

After understanding the scale of flow, we can further investigate the flow of funds between entities and exchanges. In the chart below, we combine the inflow and outflow from exchanges to form a single indicator, namely Exchange Fund Flow (90-day average).

Here, we can see that exchange fund flow accounts for 54% of the total and is in a macro upward trend. The exchange’s share reached 58% in June 2021, then sharply declined as global interest rates rose, liquidity tightened, and the subsequent bear market. In October 2022, as global liquidity and the market recovered from the impact of the FTX incident, the dominance rose again.

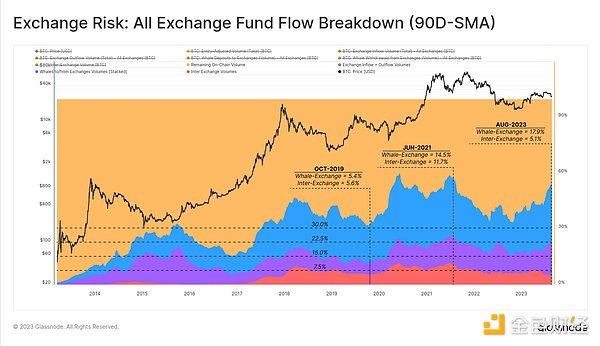

We can decompose the dominant position of on-chain transaction flow into four parts:

-

On-chain transaction volume unrelated to exchanges (entity adjustments).

-

All flow related to exchanges (inflows and outflows).

-

Funds flow between whales and exchanges: transfer of funds between whales (1,000 BTC+) and exchanges.

-

Flow between exchanges: transfer of funds from one exchange to another.

The flow between exchanges has been relatively stable, accounting for about 7.5% of the on-chain transaction volume, reaching a peak of 11.7% in June 2021. Meanwhile, the flow between whales and exchanges has recently reached a new all-time high of 17.9%.

As we can see, flow related to exchanges (54%) is currently approaching its historical high.

Exchange Risk Analysis Framework

The first part of the report establishes the view that exchanges dominate the Bitcoin ecosystem. However, after the FTX incident, exchanges can also become a source of counterparty risk.

In the following sections, we aim to establish a framework for analyzing the relevant risks of individual exchanges. In this section, we will use the FTX dataset as a reference point for future high-risk scenarios. Considering Coinbase’s dominant position and recent market comments about Binance and Huobi, we will provide data related to these exchanges for comparison.

We will use three metrics to construct this framework:

-

Internal transfer rate – the ratio of internal transfers within an exchange over the total reserves.

-

Exchange dependency ratio – the degree of flow between an exchange and other exchanges (transfers between exchanges).

-

Whale withdrawal ratio – a measure of the extent to which large entities accelerate fund withdrawals.

Internal Transfer Rate

The first metric is the ratio of internal wallet transfers within an exchange to the total reserve balance of the exchange. To provide comparable metrics across all exchanges and assets, the output value ranges from 0 to 1.

The core idea is to identify situations where internal transfers within an exchange exceed 100% over a period of 7 days. If this situation persists for a long time and across multiple asset types, it may be a warning sign of improper fund management.

For FTX, we can see that their Bitcoin internal transfer rate remained at 1.0 from March 2021 until November 2022 when it collapsed. We also show a “composite risk” score that takes into account the four largest assets: BTC, ETH, USDC, and USDT.

If compared with other three exchanges, some exchange-specific subtle differences can be observed:

-

Binance (top left): During periods of market volatility, sudden peaks in internal transfer rates occur on all assets, followed by a rapid decrease. This seems to be a market reaction and is not persistent, most likely a result of new deposit and withdrawal processing.

-

Coinbase (top right): Apart from USDC remaining at 1.0 for a long time, there are rarely internal transfer events. This is likely due to Coinbase’s collaboration with issuer Circle and its primary role as the main venue for USDC in and out.

-

FTX (bottom left): The internal transfer rate of Bitcoin entered the high-risk range in the 14 months before the exchange collapsed. In hindsight, this is likely the result of Alameda misappropriating customer funds.

-

Huobi (bottom right): This exchange has similar volatility-related activity to Binance.

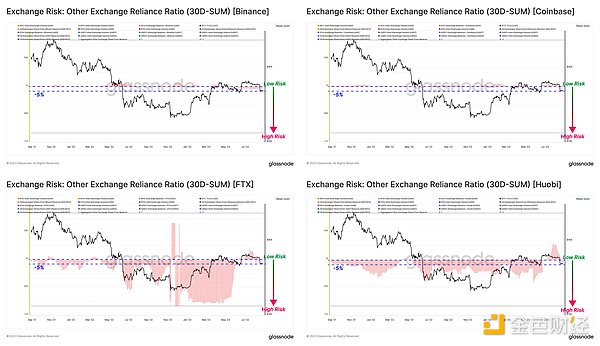

The following figure compares the internal transfer rates of these four exchanges on four assets. Here, we use a threshold of 5% to mark possible high-risk events. From this perspective, Binance and Coinbase have almost no internal “changes”.

As far as we know now, FTX has prominent indicators for various reasons, but they are all negative reasons.

Huobi’s situation is in the middle, its internal transfer rate is similar to Binance, but due to the gradual decrease in exchange asset balance (denominator reduction), the volatility is greater.

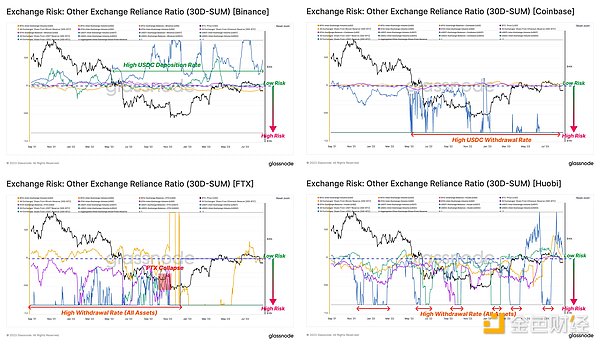

Exchange Dependency Ratio

Another indicator to measure the potential risk of an exchange is that the exchange token frequently transfers in or out from another exchange. This may indicate a higher degree of liquidity dependence between these exchanges.

Similar to the previous section, we calculated this ratio for the top four assets in the market and limited the output values to the range of -1 to 1. We can also examine the direction of funds by whether the ratio is positive (net inflow) or negative (net outflow), and investigate the source and destination of funds.

A large negative value in this indicator indicates that assets are rapidly flowing out of the exchange and into another exchange, which may trigger an alert if this situation persists.

Reviewing the top four assets of the aforementioned exchanges:

-

Binance (top left): All assets have neutral or close to zero dependency ratios, indicating smaller funds flowing in or out from other exchanges compared to Binance’s balance. Since September 2022, the inflow rate of USDC has been high, possibly obtained from Coinbase.

-

Coinbase (top right): Similar to Binance, all assets show neutral dependency ratios. However, the outflow rate of USDC has been high since September 2022. This indicates that a large amount of USDC supply has migrated from Coinbase to Binance in the past 12 months.

-

FTX (bottom left): The dependency ratios for all four assets were significantly negative before the exchange collapsed. This indicates that investors (and Alameda) were transferring all major assets to other exchange accounts.

-

Huobi (bottom right): Evaluating this risk indicator for Huobi, we can see that the dependency ratios for all assets are large negative values, indicating a net outflow from Huobi to other exchanges.

We once again display the comprehensive dependence rate, which shows that the dependence of Binance and Coinbase is very small, at -5% or higher, indicating that their behavior is largely independent of other exchanges.

On the other hand, the comprehensive dependence rate of FTX and Huobi is negative, indicating that entities active on other exchanges have been continually withdrawing funds from these entities.

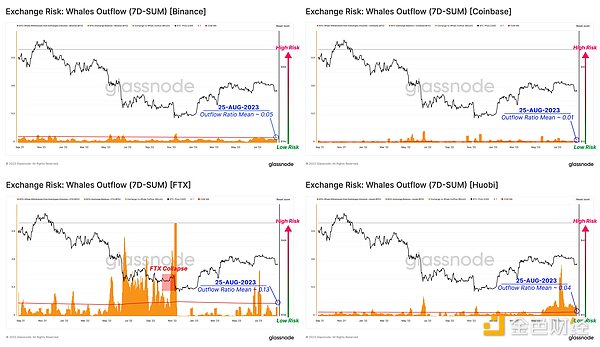

Bitcoin Whale Withdrawal Rate

The last indicator monitors whether Bitcoin whales are accelerating their withdrawals. This parameter is the ratio between the total weekly whale outflow and the exchange’s Bitcoin balance.

In addition to the whale withdrawal rate, we also show the historical average of this indicator as a long-term benchmark.

-

In the past two years, the whale withdrawal rate of Coinbase and Binance has been very low, with a long-term average of below 5%;

-

For FTX, the surge in whale withdrawal rate began with the collapse of LUNA and 3AC and remained at a high level until the exchange collapsed;

-

For Huobi, the risk remained relatively low until June 2023. It is only in recent months that the whale withdrawal rate has continued to rise relative to the Huobi BTC balance. This will to some extent drive the continuous decline of the Huobi BTC balance, making this indicator possess reflexivity.

Conclusion

FTX’s failure serves as a reminder to the digital asset industry that counterparty risk still exists in CEX and custodial institutions. With hindsight as a guide, we have proposed three indicators that provide simple insights into some potential risks within exchanges, using our on-chain data and token clusters.

We found that Coinbase and Binance have similar and secure on-chain data based on internal transfer rate, exchange dependence rate, and whale withdrawal rate. Unfortunately, FTX is a notable risk indicator case, and for Huobi, the continuous decline in the balances of the four major assets (BTC, ETH, USDT, and USDC) will worsen these indicators, indicating the need for a certain degree of caution.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!