Author: Kaori, BlockBeats

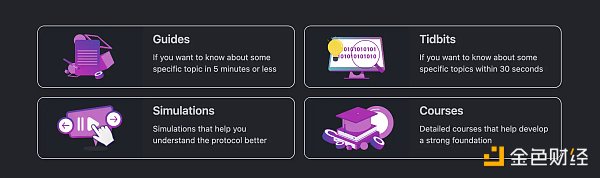

On September 21st, Uniswap Foundation announced its partnership with DoDAO, a blockchain education-focused organization, to launch the educational platform “Uniswap University”. It is described as a comprehensive education platform tailored for everyone, from beginners to experienced Uniswap v3 liquidity providers, providing structured learning paths through four main sections: Guides, Tidbits, Simulations, and Training. The platform aims to enable participants to better engage in the DeFi world.

The last wave of education in the crypto field was sparked by the launch of the Web3 education protocol Open Campus and Binance LaunchLianGuaid. The combination of Web3 and education, as well as the entry and development education of Web3, made their way into the industry’s spotlight for the first time. While both aimed to break down the barriers for ordinary users or developers to enter the Web3 world and become catalysts for Web3’s widespread adoption, Uniswap University differs from Open Campus in that it currently does not have any derivative content such as token economics. From its official website interface, there are only entrances to the four main learning sections, with no official docs or links to other platforms of Uniswap.

- Global AI giants gather What was said at the Salt and Iron Conference of the AI era?

- Understanding Gear Protocol and Vara Network in One Article

- LPDfi The Next Big Event in Unlocking Uniswap Liquidity

Uniswap University does not provide any incentives. After selecting the chapter you want to learn and completing it, there is a simple feedback mode. Yes, just like those learning websites used for practice after class in regular universities, there will be a few practice questions after each section, which is indeed very suitable for beginners to get started.

Uniswap is already the leading DEX, and now with the launch of such a beginner-friendly learning and education platform, there is even more room for exploration. It is worth mentioning that the partner chosen by Uniswap this time, DoDAO, aims to have 1 million people join DeFi, DAO, and NFT by 2025.

Overview of Uniswap University Content

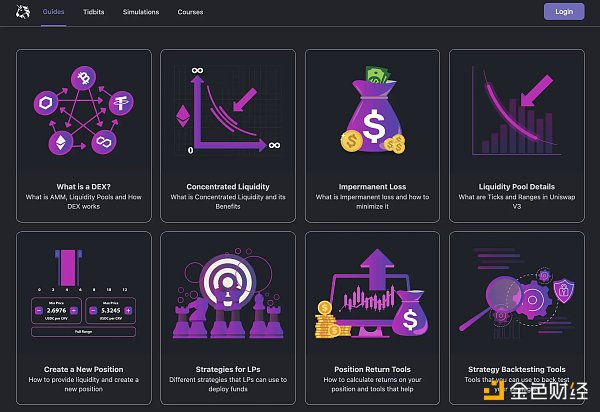

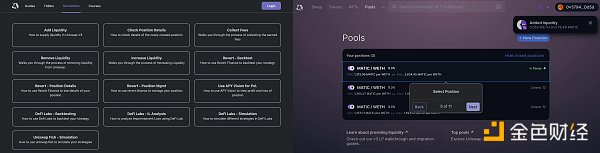

Guides: This section provides easily understandable information, ranging from basic explanations like “What is a DEX?” to advanced topics like “Strategy Backtesting Tools”, supplemented with explanatory videos and visual effects.

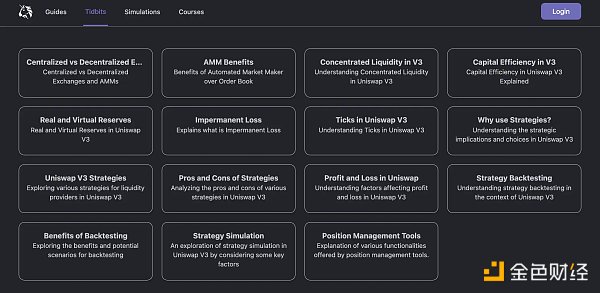

Tidbits: “Not enough time? Master the basic concepts in just 30 seconds.” Compared to the richness and diversity of the first section, the content in this section is very suitable for quick review or brief understanding. With a card-like UI design, it gives a feeling similar to memorizing vocabulary words.

Simulations: This part is where you delve into practical learning. In this section, you can practice scenarios such as adding and removing liquidity, and explore advanced position management tools. It is like a video tutorial, with demonstrations for each step. Compared to textual tutorials, video format is more beginner-friendly for crypto novices.

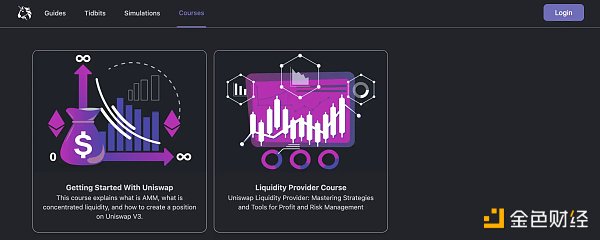

Courses: The fourth part of the website is a two-episode course teaching, which allows you to have a deeper understanding of the structured courses of Uniswap, including basic concepts from “Introduction to Uniswap” to mastering strategies in the “Liquidity Provider Course”.

“User Education Experience” Vital for Cryptocurrency CEX

Currently, the main personnel behind the establishment of Uniswap University have not been found, but as a decentralized DAO organization and DEX, launching an educational platform that requires centralized resources and energy is definitely a commendable thing. In comparison, CEX has a greater advantage in this regard.

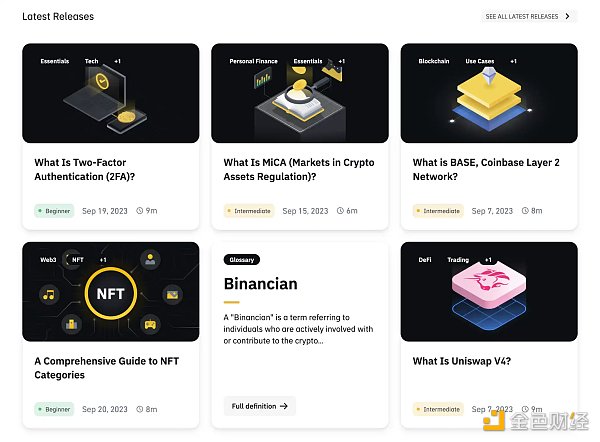

As the leading CEX in the crypto world, Binance also has its own educational platform – Binance Academy. Here, courses and teaching content are also launched, but from the website’s navigation bar “Learn & Earn” and LianGuairtnership, it can be seen that the biggest difference between Binance Academy and Uniswap University lies in a more complex ecosystem and more diverse demands.

In April of this year, Binance launched an AI-based cryptocurrency knowledge assistant, Binance Sensei, which covers over 1,000 articles and courses on Binance Academy, helping users learn about cryptocurrencies, blockchain, and Web3.

Image source: Binance Academy official website

Binance has been focusing on education and user trading tutorials for a long time. In 2022, CZ and other executives of cryptocurrency companies collaborated with the online education platform Masterclass to launch cryptocurrency courses, covering topics such as the history of cryptocurrencies, decentralization, Web3, DAO, NFT, and the volatility of niche markets.

In addition to Binance, another major CEX is also making efforts in cryptocurrency education. On May 17th, Coinbase launched the education platform Base Camp for Web3 developers. Previously, it was an internal education platform developed by Coinbase to accelerate the onboarding speed of developers, running on the Ethereum Layer2 network Base infrastructure.

Different from multi-functional learning platforms like Coursera and edX, Base Camp includes on-chain exercises to provide developers with practical experience. At each learning milestone, developers will receive NFT badges. It also has a community organization that can connect to everyone using Base Camp for development.

Coinbase CEO Brian Armstrong once divided the company’s mission into four stages in a not-so-secret “Secret Master Plan”, and the goal of each stage is to increase the number of employees tenfold compared to the previous stage. Now, from the third stage to the fourth stage, it is necessary to attract 1 billion users. Coinbase believes that this requires 1 million developers to build useful dapps that these users will like. Jesse Pollak, the head of the Coinbase protocol team, said in an interview that this means bringing a small portion of the global 30 million Web2 developers into Web3, and that’s where Base Camp comes in.

Returning to Uniswap University, its mission is also to bring more people into the Web3 world.

Will Education be the Breakthrough for DeFi Liquidity?

Uniswap University’s mission is to “make liquidity accessible and understandable for everyone.” This mission tells us the “What” and “How” of Uniswap University, and the underlying message is the “Why” behind the launch of this platform.

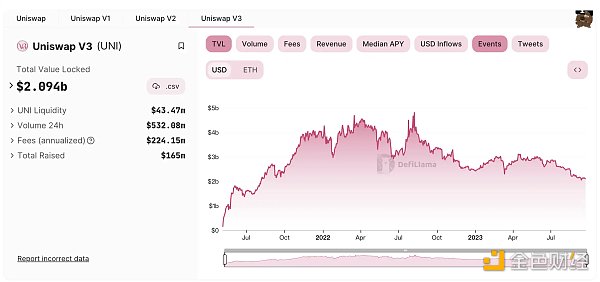

Uniswap has benefited from the DeFi Summer of 2020 and has grown to become the largest DEX today. It has successfully saturated its current accessible market, with Uniswap V3 accounting for 46.5% of all decentralized exchange trading volume. In addition, it set a record of accumulated trading volume reaching $1 trillion in May 2022.

However, as more and more growing DEXs compete for market share, being the dominant player is not sustainable. This means that continuing to optimize DEXs and squeeze the growth of the existing market will not be enough to continue on its current trajectory. The most direct manifestation of this is the ongoing lack of liquidity in Uniswap.

Image source: DeFiLlama

Related reading: “CEX VS DEX: A Comparative Study of Uniswap V3 and Binance Liquidity”

According to Coingecko data, Uniswap accounted for 64% of the DEX market share in the first half of 2023, but in the first half of 2022, this figure was 89%.

There are over 13,000 liquidity pools on Uniswap V3. For example, in Uniswap liquidity pools, approximately 1,500 pools use wETH as the base or quote asset, accounting for about 11% of the total pools. Surprisingly, for small tokens like CRV, Uniswap has lower liquidity compared to the top 5 most liquid CEXs that provide the CRV-(w)ETH market.

Compared to centralized trading platforms, Uniswap’s transaction complexity and entry barriers are somewhat higher for newcomers. Perhaps this is the greatest significance of Uniswap University. Attracting more people into the world of DEXs, rather than bringing people from Web2 into the crypto world, is more urgent for Uniswap.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!