Decentralized Option Vault (DOV) is a package option strategy that converts the volatility of the underlying asset into an option fee, which is the income of the depositor. Unlike other traditional DeFi products that rely on Token rewards, DOV’s income comes from the real profit and loss generated by transaction volatility. Moreover, the implied volatility (IV) of encrypted assets tends to be higher than TradFi’s IV, so the income is also considerable.

Before DOV, options strategies were offered almost exclusively to institutional investors, who traded over-the-counter or executed on options exchanges like Deribit. However, the characteristic of option strategy is that it is very suitable for quantitative trading, so it can be completely opened to ordinary investors. DOV provides such an investment opportunity, users only need to deposit their assets in the vault, and the contract will automatically execute the strategy.

Below is a comparison of leading DOV applications on ETH, BNB Chain, and Solana.

Ribbon Finance

Currently the most widely used option strategy is Covered Call, which was first used by Ribbon Finance on ETH. An investor buys spot (blue) and sells an equal amount of call options (yellow). The combined position is shown in the figure below:

Source: http://www.option-trading-guide.com/coveredcalls.html

The green line represents the portfolio position. When the underlying price is greater than the option strike price (Strike), the portfolio return is a constant option premium (Premium), and when the price is less than the strike price minus the option premium (Strike – Premium), the portfolio return turns from positive to negative. Covered Call is suitable for investors who are unwilling to sell assets but are not optimistic about the future market.

Ribbon Finance is currently TVL’s largest DOV product, but only core assets such as BTC and ETH are open.

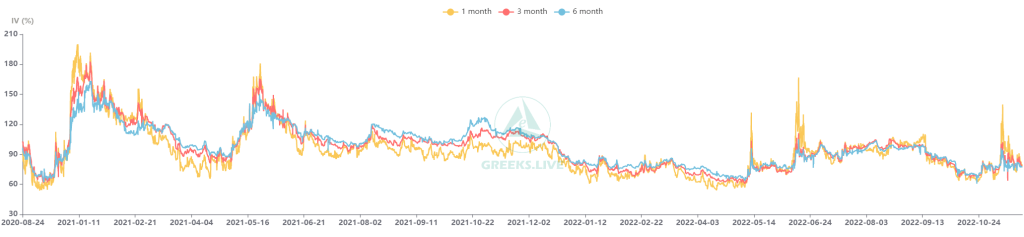

Shield

Shield is currently the DOV with the largest TVL on the BNB Chain, adopting a Delta Neutral strategy. Delta is the first-order influence of the asset price on the option price. Assuming that Delta is 0.5, when the asset price changes by one unit, the option price will change by 0.5 units in the same direction. Since the purpose of DOV is to capture the volatility of an asset, it must be hedged out for the effect of price.

In short, when hedging a short European call option, you need to buy N(d1) assets for every option sold. The assets deposited by users play a hedging role.

However, Delta is for constant change, so another concept, Gamma, needs to be introduced here. Gamma is the second derivative influence of asset price on option price, which measures the change of Delta. Today, institutions that execute option strategies in the TradFi market will not simply hedge Delta, but also need to ensure that Gamma is 0. This part is currently not reflected in DOV’s strategy.

Compared with Ribbon Finance, Shield’s biggest advantage is that it is positioned as a DOV issuance platform, and it is open to any long-tail token (Altcoin) that has liquidity (seeing the online vault, only DEX liquidity > 300,000 US dollars), allowing projects to An option vault where parties or market makers issue tokens through an OTC option hedging strategy without permission.

Compared with mainstream assets such as BTC and ETH, the significance of the project party’s issuance of DOV is that for the first time, through the OTC option market-making service, the project party can provide the community with a sustainable income token without any unilateral subsidies. Scenes. Therefore, the Project Option Vault (DOV) has the opportunity to become a new trend after traditional DeFi incentive methods such as liquidity mining and single-currency lock-up mining.

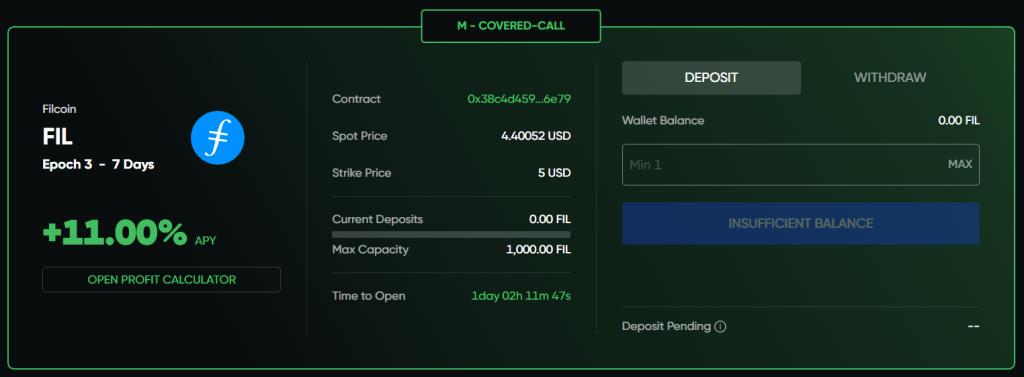

Friktion

Friktion is currently the largest decentralized options application on Solana. More than 70% of the TVL is concentrated on Altcoins. These Tokens usually do not have corresponding option products on CEX, so they will not affect the CeFi market.

In addition, Friktion also implemented an early auction mechanism, and sold the next week’s options 6 hours before the option expires to get a higher option fee. The table below is a summary made by the official through historical backtesting. The backtesting shows that the auction 6 hours in advance can significantly increase the implied volatility of Altcoin DOV (but it cannot increase the implied volatility of BTC and ETH, because these two Tokens are listed on CEX There are also options on it, the price is not only affected by DOV).

Then, with the collapse of FTX, Solana’s ecology also suffered a heavy blow.

Impact on CeFi options market

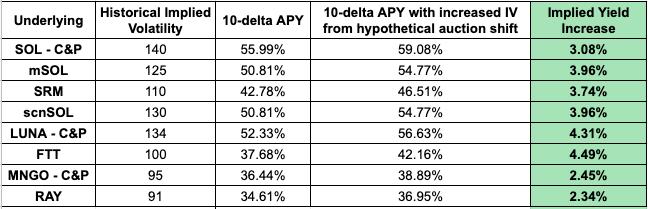

BTC ATM Implied Volatility

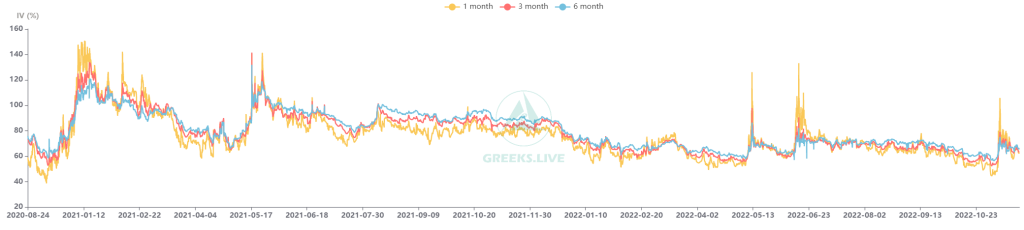

ETH ATM Implied Volatility

Option implied volatility (IV) is a powerful tool to measure investors’ expectations for future market volatility. Usually, when most investors’ judgments on the future market direction are in the same direction as the current trend, IV will decrease, and when expectations are contrary to the current market When IV is elevated.

Observing the IV trend of BTC options and ETH options, it can be found that since the fourth quarter of 2020, the option IV of the encryption market has been declining as a whole, except for the market crashes in May last year and May this year. The fundamental reason is that IV is directly proportional to the option price. When the option market is oversupplied, the option price will drop, which will lead to a decrease in IV.

In the CeFi market, buyers and sellers of options can usually reach a balance, so IV can truly reflect investors’ expectations for the future. However, as the DeFi Option Vault (DOV) market continues to expand, all this seems to have changed.

Since DOV sellers can obtain additional benefits, such as platform rewards or pledge income, etc., there is a large number of retail investors participating in the seller’s market. After all, options are niche products, and buyers are usually institutional market makers. They buy options not for future profits, but to buy cheap IVs within DOV and sell related options on the Deribit chain for arbitrage. As a result, the DOV market is effectively oversupplied, causing IVs to gradually decrease.

The reduction in IV not only affects traditional options markets, but also negatively affects DOV itself. At first, DOV chose to sell options with 0.1 delta, the strike price is farther away from the current price, and the risk is less. However, as the option price continues to decrease, the profit margin of the seller is getting smaller and smaller. In order to maintain the rate of return, DOV has to increase the delta, which leads to the execution price being closer to the current price and thus expanding the risk. In response to the trend of gradually decreasing DOV returns of core assets, most competing products choose to expand their targets to other Tokens.

Summarize of DOV

The core starting point of DOV products is to allow users to give up the possibility of earning unlimited income, and to make users profitable by converting volatility into option fees.

Generally, the APY of DOV is concentrated at 10%-50%, among which Altcoin is higher. The APY of DeFi deposits led by Curve, AAVE or Compound usually does not exceed 10%, which is much lower than that of DOV. Moreover, the income of DOV does not depend on the inflation of Token, but generates profits through arbitrage of combined strategies, so it will not affect the price.

However, the Token we are talking about here refers to the Token with Holder. Even if it is an Altcoin, it must be a Token with application scenarios, not those Ponzi Tokens that attract users to pledge mining with high APY. Because although the APY of DOV is relatively high, it may not be attractive compared to the tens of thousands of APY of “mining Token”.

Among the Ribbon competing products mentioned above, Shield is the most innovative, and its permissionless mechanism can absorb market makers to lock positions on the platform. At present, few DeFi protocols can provide users with pledge income without relying on Token inflation. Shield’s mechanism not only solves the problem of Altcoin’s low liquidity, but also alleviates the impact of DOV on CeFi (migrating a large number of DOV users from BTC or ETH) to Altcoins, increasing the implied volatility of the former).

However, as mentioned above, DOV’s APY is high, but it has no advantage over Ponzi mining’s APY. Therefore, the premise is that the underlying asset must have the potential to rise, otherwise DOV will not be able to save it.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!