Author: Blockingcryptonaitive

Under the strict regulation of cryptocurrencies by US regulators, the crypto community may have been too FUDed in the past two weeks.

The latest FUD is USDT. Recently, the New York State Attorney General provided Tether’s financial documents to CoinDesk, including detailed information on customer and bank account statements. The news spread that the market price of USDT deviated from $1, and many people said that USDT was uncoupled again.

But many people who say that USDT has uncoupled are not particularly clear about what they mean by uncoupling. Tether has never guaranteed that the market price of USDT is linked to $1, and it cannot guarantee it. It only guarantees the casting or redemption of USDT in a 1:1 ratio to the US dollar.

- Tether responds to financial documents being made public

- Decoding the MUX derivative agreement: Why is it favored by large capital?

- Is USDT decoupling? Searching for answers through on-chain data analysis

Has USDT “uncoupled” again?

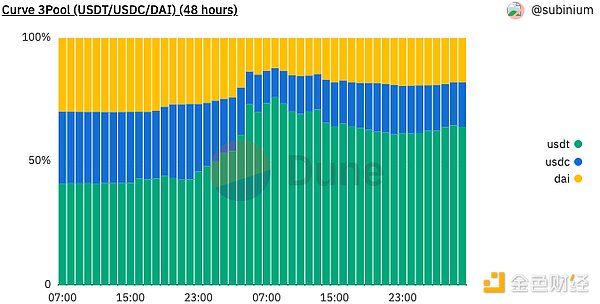

On June 15th, the Curve 3pool data showed that the stablecoin ratio in the 3pool pool was unbalanced, with USDT accounting for 76% at 08:00 on June 15th, and USDT slightly fell to 0.997. In addition to Curve 3pool, Uniswap v3 USDC/USDT liquidity pools have also experienced similar situations. Many people therefore began to claim that USDT had “uncoupled” again.

Curve 3pool is a liquidity fund pool composed of three stablecoins: DAI, USDC, and UDST. Ideally, each stablecoin should account for 33.3% of the shares. When one stablecoin accounts for more than 33.3%, it means that investors are using this stablecoin to swap the other two stablecoins.

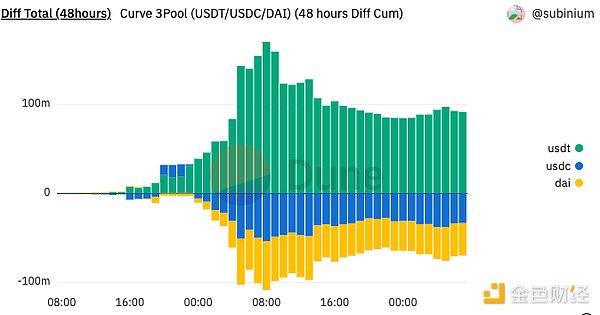

In the USDT case on June 15th, investors sold USDT and exchanged it for USDC or DAI. The inflow and outflow of USDT in Curve 3pool also shows this. In the past 24 hours, about $200 million USDT has flowed into Curve 3pool.

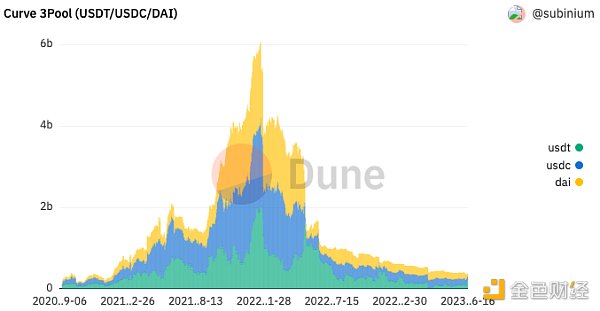

The reason why the crypto community pays attention to the deviation of stablecoins in Curve 3pool may be because Curve 3pool is the largest stablecoin fund pool, and its total locked value is US$410 million. Its reaction price has benchmark significance in DeFi.

Curve 3pool TVL has dropped from a peak of $6 billion to $400 million.

However, from another point of view, the 70% imbalance of USDT in Curve 3pool may not be as important as imagined. There are three reasons: First, although the total locked value of Curve 3pool is $410 million, which is already a decrease of more than 93% compared to the peak of $6 billion, its pricing power has been lost. Second, the selling amount of $200 million is not enough to affect the overall market price of USDT, relative to the total issuance of USDT of $86 billion. Third, as long as Tether maintains the 1:1 redemption of the US dollar, there will naturally be market arbitrageurs to balance its price in Curve 3pool.

What does it mean when people say USDT is decoupled?

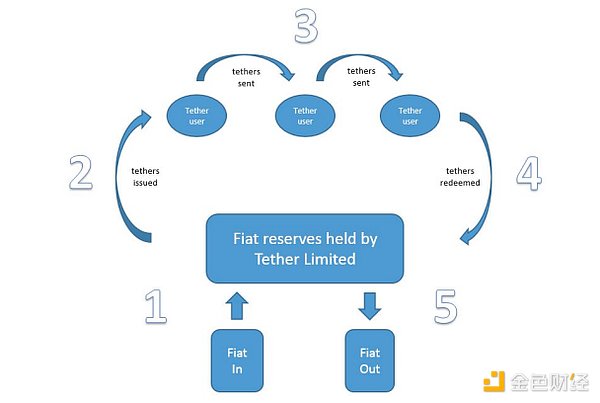

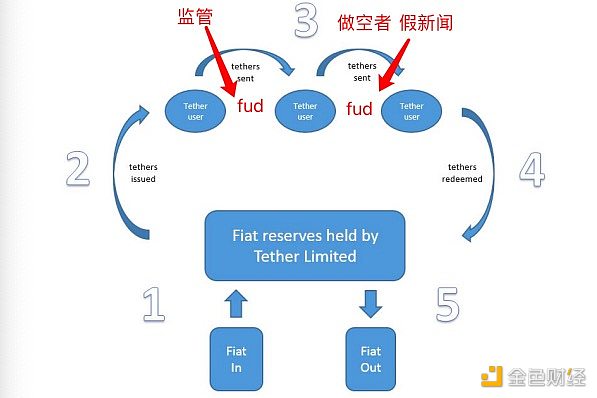

According to the Tether white paper, the operation mechanism of USDT is very simple. Tether will issue 1 USDT for every $1 received from customers, and will return the corresponding US dollar value to customers when they redeem 1 USDT.

Tether claims that its stablecoin USDT is backed by the US dollar 1:1, which means they guarantee the 1:1 issuance and redemption of USDT and the US dollar. Tether does not, however, guarantee that USDT will always be equal to $1 during circulation.

Therefore, USDT has two prices, the market price and the issuance/redemption price. Tether has never guaranteed that the market price of USDT will be pegged to $1, nor can it guarantee it. It only guarantees the issuance and redemption of USDT at a 1:1 ratio, plus a 0.1% deposit/withdrawal fee (charged both ways).

That is to say, the market price of USDT is completely unrelated to Tether. Tether or its related interests even hope that the market price of USDT is lower than $1, so that they can buy back USDT at a lower price. Of course, for long-term interests and stable operation, Tether may not do so.

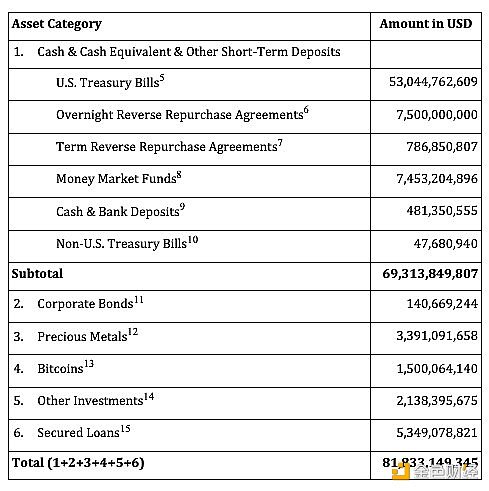

Because Tether’s business is a simple and beautiful business. Tether takes the US dollars deposited by users and invests these dollars in nearly risk-free and highly liquid revenue products such as US Treasury bonds, overnight repurchase agreements, term repurchase agreements, and money market funds. Tether’s reserves are “the goose that lays the golden eggs” and truly “lying and earning”.

According to the latest data from Tether, the issuer of USDT, Tether’s profit reached $1.48 billion in only the first quarter of 2023, and its excess reserve reached $2.44 billion.

Various factors in the market, such as short sellers, fake news, or regulation, can cause FUD in the market, causing investors to sell USDT and causing the USDT market price to deviate from $1.

However, as long as Tether maintains a 1:1 exchange rate between the issuance and redemption of USDT and the US dollar, it can claim that USDT is always pegged to the US dollar at a 1:1 ratio. As for issuance, if you give Tether the reserve, he will definitely accept it and give you 1:1 USDT.

Can Tether guarantee the 1:1 redemption of USDT?

According to Tether’s reserve proof report for the first quarter of 2023, if Tether’s report is credible, Tether’s direct holdings of national debt exceed $53 billion, accounting for more than 64% of the total reserves. These national debts, together with other reserves in the cash and cash equivalents category (such as overnight repurchase agreements, term repurchase agreements, money market funds, cash, and bank deposits), account for nearly 85% of Tether’s total reserves, and these high-quality, highly liquid assets provide Tether with collateral that can be quickly sold to process redemptions.

After the USDC reserve was affected by the Silicon Valley Bank’s bankruptcy, Tether reduced its cash and bank deposits by 90%, and currently has a total of $480 million in cash and bank deposits.

The rest is some high-risk investments, such as Bitcoin, other investments, corporate bonds, and mortgages. If there is a problem with this part, what should be done? Tether said that its excess reserve is $2.44 billion.

Furthermore, Tether has made sufficient preparations in its service terms. Tether reserves the right of “physical return” in the USDT stablecoin service terms. When there is a liquidity shortfall, Tether can return bonds, stocks, or “other assets held in reserves” to users, without returning US dollars. “If any reserve held by Tether to support Tether Tokens has a liquidity shortfall, is unavailable, or is lost, this will cause a delay in redemption or withdrawal of Tether Tokens. Tether reserves the right to delay redemption or withdrawal of Tether Tokens, and Tether also reserves the right to redeem Tether Tokens physically, including securities and other assets held in reserves. With regard to whether Tether Tokens previously traded on the website can be traded at any time in the future (if any), Tether will not make any statements or guarantees.”

So, will Tether’s reserve proof be falsified? First, numerous regulatory agencies are watching Tether, and the cost of falsification is too high. Second, as mentioned in the previous section, Tether’s reserve is a “golden goose” and a truly “lying” product. The return/risk ratio is too small. Unless all of the following collapse, such as US Treasury bonds, overnight repurchase, term repurchase, money market funds, cash, and bank deposits, this major problem is not something Tether can control.

Perhaps because of this, Tether’s CTO, Paolo Ardoino, directly stated on Twitter: “Tether is ready as always, and we are ready to redeem any amount of funds.”

Conclusion

Therefore, as long as Tether’s USDT reserves are not a problem, the “decoupling” of the USDT market price is not a problem at all.

If there is a problem with the USDT reserve, it is the real decoupling of USDT. Tether’s USDT reserve is the most critical and core issue.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!