Author: NingNing, Independent Analyst Source: Twitter, @0xNing0x Translation: Blocking, Shanooba

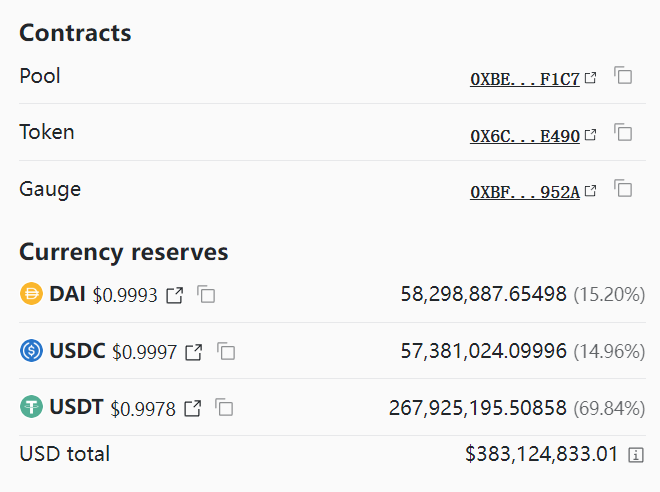

Curve 3Pool LP Ratio Imbalance Is Commonplace, Only Extreme Imbalance Will Cause Unpeg A chart of the asset ratio imbalance of Curve USDT-USDC-DAI 3Pool began to circulate on Twitter and WeChat, causing market concerns that USDT would become unpegged. As of now, DAI accounts for 15.20% of 3Pool, USDC accounts for 14.96%, and USDT accounts for 69.84%, indicating a certain degree of asset ratio imbalance. However, asset ratio imbalance is almost a norm for Curve stablecoin LP pools, and we randomly checked two other stablecoin LP pools.

The results are as follows: FRAX-USDC: FRAX accounts for 75.08%, and USDC accounts for 24.82%; alUSD-FRAX-USDC: alUSD accounts for 62.83%, USDC accounts for 9.21%, and FRAX accounts for 27.91%. Due to Curve’s unique AMM automatic market-making function, asset ratio imbalances of this degree or even higher do not affect the proportional exchange of stablecoins.

- Over $100 million borrowed: analyzing the lending situation of Curve’s founder

- Comprehensive analysis of zkSync Era: the pioneer of zero-knowledge proof scaling solution

- Understanding Uniswap V4: Cost Reduction and Efficiency Enhancement, Personalization and Aggregation

It’s all over, the Curve War has become a thing of the past, and 3Pool has long lost its stablecoin pricing power Those who have experienced the last bull market still have a fresh memory of the algorithmic stablecoin war and the Curve War. Back then, whoever got Curve got the world of stablecoins. Stablecoins are even recognized as one of the core tracks of the cryptocurrency industry. In order to obtain Curve’s LP pool liquidity, stablecoin project parties tried every means to bribe Curve’s LPs, thus giving birth to the famous Curve War. At that time, Curve held the pricing power of stablecoins, and even the pricing power of stETH. But now, the total TVL of Curve 3Pool is only about $383 million, with USDT holdings accounting for only $268 million, which is only 0.3% of the total USDT circulation, while the top holder, Binance, accounts for 18.33%. Even Kucoin has a share of 0.81, higher than Curve 3Pool.

USDT On-Chain Bulk Capital Flow Has No Abnormalities In 24 Hours. Large Net Inflow Of USDT May Be The Direct Cause Of 3Pool Imbalance Using @ArkhamIntel to observe the 24-hour on-chain bulk capital flow of USDT, it is found that it is mainly the capital movement of CEX and MEV robots, and the inflow and outflow of bulk capital are basically balanced. Specifically for Curve 3Pool, USDT flowed in $381 million in 24 hours and flowed out $254 million, with a net inflow of $127 million. We know that the total amount of USDT in 3Pool is only $268 million. Such a large net inflow in 24 hours may be the direct cause of the asset ratio imbalance of 3Pool.

The selected text contains HTML code that displays two images. The first image is of a person holding a sign that reads “Happy Pride” and the second image is of a rainbow flag with the words “PRIDE” written in white letters.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!