Author: Web3Brand

Web3 builds incremental assets and rights for users, but ultimately, user rights are provided by brands. Brands must benefit from Web3 in order to allocate more rights to users and form a healthy development flywheel.

In the past two weeks, the market has been extremely bearish, and there has been a lot of discussion about whether “NFT is dead”. It is not an exaggeration to say that NFT has reached the next crossroads.

-

From a pessimistic perspective, the IP-based NFT bubble represented by PFP has burst, and it has almost reached its lowest point in the past 18 months.

-

From an optimistic perspective, the industry will have a clearer understanding of the value of NFT, and past experiences will help future builders avoid detours.

I myself firmly believe in the value of NFT, but value needs time and opportunities to be realized. As an “optimistic pessimist,” my point of view is that this industry needs time (at least 2-5 years), value (not just narratives), and talents who have experience in real business cases. Only when these three factors are present can the next bull market erupt.

10 months ago, I wrote an article titled “Building the Soul of Web3 Brand-Why, What, How,” which analyzed how to build a Web3 brand. Today, the “Why” and “What” are still valid, but unfortunately, many cases in the “How” part have not emerged.

What are the reasons for this? How can more brands participate? What experiences and opportunities are worth considering for future projects?

This is a suitable time to review and summarize, and I hope this article can play a role in “carrying forward and starting anew,” summarizing the problems of the past IP-based NFTs, and at the same time, listing some real value and opportunities to help the builders in this industry.

1. What were the problems with past IP-based NFTs?

TL;DR

-

Conflict between time and value

-

Conflict of blurred investment identity

-

Conflict between revenue and environment

-

Conflict between scale and scarcity

-

Conflict between community stability and price fluctuations

1.1 Conflict between time and value

Ruby has already elaborated on this in her article “Time and Patience are the Scarcest Resources for Brands” two weeks ago.

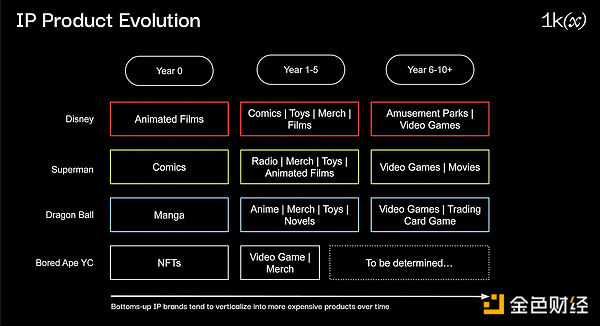

Many IPs (such as BAYC/Azuki) claim to be the “Disney of the new era.” What they see is the value of top-level IPs multiplied by the financial aspect of NFTs and the community attributes, which can create IP with high value and stickiness in a shorter time. However, they overlook the fact that building an IP takes time and cost.

-

Disney’s first well-known IP, Mickey Mouse, made its debut in 1928 and became the main IP in 1937 (producing 12 related films every year), which took 10 years.

-

PoPoMart, a well-known brand in the internet and social media era, was founded in 2010 and gained nationwide recognition in 2015, which also took 6 years.

Let’s take a look at the time and cost required to create different content (from the 1kx report, link attached at the end)

-

Games: Creating a AAA-level video game requires 5-6 years, over 100 employees, and an investment of over 80 million dollars

-

Animation: Producing a 12-episode animated series requires millions of dollars in investment and several years

-

Movies: Producing a high-quality movie on average requires 50-100 million dollars and several years

As we can see, even though NFTs have accelerated the fundraising and dissemination process, the production cycle of content cannot be compressed. We can draw the conclusion that creating IP and content takes a reasonable period of 5 years, as all developments need to comply with the basic laws.

In addition, even with the investment of time and cost, it is worth mentioning the probability of success. For example, the common saying in the film industry is that one film makes a profit, two break even, and seven lose money.

However, NFT players nowadays have high expectations and cannot wait for such a long time. They hope that project parties can provide positive news every month or even every week to increase the floor price. Project parties also take advantage of the hype to increase prices.

But after the hype, it often ends up in a mess, and it is the players and the industry who suffer.

Investing in IP is definitely a risky investment. In this industry, the exit cycle for dollar funds is 5-8 years, and innovative companies also need 5-8 years to turn valuation into value. This setting is reasonable.

1.2 Conflict of blurred investment identity

This is the second issue currently faced by IP-type NFTs. Project parties often rely on selling NFTs for the first round of fundraising, and buyers believe that NFTs are a combination of consumption and investment. In fact, NFTs do possess the attribute of “investment.”

However, in terms of functional design, NFTs are almost not directly linked to the value of the project. IP authorization is one example (which most people find difficult to use, but it’s better than nothing), and the realization of value depends entirely on the project party’s “empowerment.” There are 2 problems here:

-

In the “conflict of time and value” mentioned above, project parties do not have enough time to create actual value and often rely on “nested dolls” for empowerment. Once they can’t continue, a collapse will occur;

-

Project parties are not obligated to “empower.” You might think you’re buying stocks, but in reality, it’s just a small picture.

-

Leonidas shared a great insight: the value of art collectibles comes from the past, while the value of stocks is priced in the future. Understand your identity, collector or investor.

Buyers have an “investment identity” without offline legal protection and on-chain contract confirmation. Their rights are not guaranteed, and it has become common for project parties to rug pull.

1.3 Conflict between income and environment / conflict between scale and scarcity / conflict between community stability and price volatility

These three points are elaborated in my article “Companies Need to Build on Things Beyond NFTs”. Here is a direct quote:

1.1 NFTs cannot be the main source of income because they are too dependent on the macroeconomic environment. For example, during a bear market, there are no transactions, and the project cannot generate royalty income.

1.2 NFTs need to have scarcity, but companies/communities need to have scale. These two naturally conflict with each other. If users have to buy NFTs to use the product, it obviously limits the company’s scale of development.

1.3 Communities built on NFTs are not sustainable because when prices drop, people’s attention also decreases. Countless communities are active when prices rise, but lose members and become silent when prices fall.

Azuki’s Elemental release this time also hit these three points:

-

In a bear market, there is no royalty income, so they can only launch new projects.

-

The original intention of launching new projects is to expand the community, but because they are too similar to the OG, it actually affects the scarcity of the first generation.

-

The price fluctuations directly caused the biggest split and loss in the community.

2. Web3 Brand: 3 Questions That Must Be Answered

In order for Web3 brands to be widely adopted, the following three questions must be answered. Only then can a healthy relationship be formed between the brand and the users, promoting the brand’s development and enhancing user experience and rights.

-

What incremental value does Web3 create for users?

-

What incremental value does Web3 create for brands?

-

How can brands better allocate these incremental values?

In a previous article “Building the Soul of a Web3 Brand: Why, What, How”, I mainly analyzed it from the perspective of users. Web3 undoubtedly enhances user rights and creates new assets and identities for users, satisfying the integrated needs of “sovereign individuals” for consumption, assets, and digital identities.

However, in order for the whole thing to work, the second and third questions need to be answered as well, because:

-

Ultimately, user rights are provided by brands. If brands cannot benefit from Web3, naturally they cannot provide users with more rights. When many partners communicate with brands, they face this soul-searching question: Why should I use Web3 and what are the benefits? (This month, I also had intensive discussions with many group members about this question.)

-

Attached is a comment from a big shot: “Why are people more positive about AI than Web3? Because AI is an efficiency-improving technology that benefits everyone. But if Web3 only makes value distribution fairer without adding value, the value of businesses/brands/platforms/governments is reduced. Why would they embrace it?”

-

When brands benefit from Web3 and distribute them properly, they naturally become more attractive to users. However, if the distribution is improper, it often backfires. The recent typical case is Azuki Elemental. The project raised 20,000 ETH, but did not distribute matching benefits to holders (especially Azuki OG holders and BEANZ holders), resulting in the largest FUD (fear, uncertainty, and doubt) in the community and directly causing the biggest split and loss in the community.

Over the past 10 months, we have conducted research and interviews with numerous projects. It’s the perfect time to summarize and try to answer these two questions:

-

What incremental value does Web3 create for brands?

-

How can brands better allocate this incremental value?

Due to space restrictions, this article will first answer the question “What incremental value does Web3 create for brands?” and address the question of “How can brands better allocate this incremental value?” in the next installment.

3. What incremental value does Web3 create for brands?

I have summarized 4 solid incremental values:

-

Greater transparency in fundraising

-

Lower cost customer acquisition methods

-

More effective user loyalty

-

Community

Let’s delve into them below.

3.1 Greater transparency in fundraising

For small and medium-sized brands or individual creators, it is always difficult to obtain initial funding. In the past, these roles primarily relied on crowdfunding platforms for fundraising, but encountered the following issues, which raised concerns among users about this form of crowdfunding (thanks to Felix Wu, founder of Elephant Point, for his input):

-

Users do not have any “ownership” through crowdfunding. Their rights depend solely on the project party’s documents, and whether the project party will fulfill their obligations;

-

Without “ownership,” the project party has no obligation to provide sufficient transparency, making it difficult for supporters to understand the use of funds and the progress of the project;

-

Crowdfunding platforms generally have geographical restrictions, and user payment is tied to identity verification, making it difficult to conduct global crowdfunding.

Web3 can better address these three issues:

-

NFT provides ownership of assets, which, combined with tokens and DAOs, can turn project parties into “shareholders” with the obligation to enjoy corresponding rights;

-

Based on ownership + on-chain data, users can have 100% visibility into the movement of each fund;

-

NFT/blockchain is naturally globalized in terms of payments, making it easy to support global crowdfunding.

At the same time, Web3 provides additional benefits to both users and project parties:

-

Users

-

Asset liquidity: Since users own the assets, they can trade them, increasing liquidity. They can also enjoy returns from asset appreciation;

-

Interactivity: Crowdfunding usually only provides access to a single product or service, while NFTs can exist in various forms such as virtual goods, artworks, virtual land, game items, etc., providing more interactivity and practicality;

-

Project parties

Royalties: When NFTs are traded on the secondary market, project parties can receive royalties and benefit from each royalty payment.

2 Typical Crowdfunding Cases

-

The documentary “Ethereum: The Infinite Garden” raised 1035 ETH on Mirror. The documentary has been filmed and is in the editing stage. All supporters will receive NFTs of different levels, and their names will also be included in the list of film producers. The successful fundraising of over 1000 ETH was greatly influenced by the efforts of the community OG and members;

-

In the previously mentioned BlackBird, Gertrude’s, a Jewish community restaurant in New York City, raised $55,000 through membership NFTs. The membership is divided into three levels: Gold, Diamond, and Pearl, providing a range of cool privileges for the restaurant’s future best customers, from concierge services via text messages to personalized pilot jackets and dinner parties personally cooked by the Meme King Eli.

Many project parties issue NFTs, which essentially constitute crowdfunding, but the rights and interests of users are very vague. This is also the main reason why rug and disputes are easily encountered. I will continue to explore this in the next article, “How Brands Can Better Allocate these Incremental Values”.

3.2 Lower-cost Customer Acquisition Methods

What is the most accurate, efficient, and cost-effective way for Burger King to acquire customers?

-

Get customers from the McDonald’s across the street

Thanks to lman for sharing this interesting case

Thanks to lman for sharing this interesting case

Open Loyalty, which we have been talking about, has been implemented by offline merchants in such a super-low-cost manner. There are countless similar cases.

-

Zhejiang Province: Friends from Sichuan with ID cards can enter XX scenic spots for free

-

Restaurant A: Dine at a 10% discount with a work card from a certain major factory

-

Store B: Enjoy XX discounts with an XX passport

The above McDonald’s Sweetheart Card, ID card, work card from a major factory, and passport are essentially tokens that identify user identities, helping merchants find accurate customers more accurately and at a lower cost.

Offline merchant Open Loyalty: The flow of people outside the store is a public member pool. I use some form of user identity verification to obtain the most accurate users for me.

By turning these physical tokens into NFTs/SBTs, customer acquisition efficiency can be further improved.

-

Users cannot carry McDonald’s Sweetheart Card, ID card, work card from a major factory, passport, etc. with them every day, but NFTs can be directly stored on their phones;

-

If you are an online business, it is very troublesome to ask users for physical tokens;

-

There is also a risk of counterfeiting physical tokens, while NFTs naturally support difficult-to-counterfeit on-chain verification;

-

NFT is the digitization of membership identity, making it easier for brands to manage CRM;

-

NFT itself also has liquidity and can bridge the gap between online and offline, making it more attractive to users;

Of course, brands may also worry that by doing so, their members will be exposed. However:

-

If you are a brick-and-mortar merchant, the moment the customer walks out of the store, whether you open it or not, they are already a “public member”.

-

If you are a restaurant brand, it is not possible to have users consume in your store for all three meals of the day.

-

If you are a small or medium-sized brand, the highest priority is to acquire new customers through cooperation, rather than enclosing existing customers.

-

In the current competitive branding environment, customers cannot be “enclosed”, and improving the competitiveness of your products is the essence.

Moreover, brick-and-mortar merchants are more motivated to try Web3 because:

-

Acquiring users through centralized online platforms is inefficient and costly. There is a steep conversion rate from users receiving coupons online to offline consumption, and the platform also takes a cut.

-

In fact, their customers are right at the doorstep, they just need better equity design and identity verification to obtain them, and Web3 is the best way to do it.

This week, we also had in-depth discussions on this topic with lman:

It’s difficult to go from “centralized” to “decentralized” because it involves the redistribution of interests. However, it is relatively easy to go from “decentralized A” to “decentralized B” due to the increase in value brought about by technological upgrades. Offline commerce is actually a decentralized physical world, and it is also an excellent place to practice digitizing and opening up loyalty on the blockchain.

Writing up to this point, I understand even more why Ben Leventhal wants to create the Web3 “Yelp” BlackBird and establish the “Public Loyalty Points Alliance for the restaurant industry”. It has all the characteristics mentioned above: offline, restaurant, and small to medium-sized brands.

3.3 More Effective User Loyalty

We have written many articles and case studies on user loyalty, and here, effectiveness is reflected in the following three aspects:

-

Creating a win-win situation for brands and users: By using NFTs, brands can open up external positivity and transform points from brand liabilities to user assets, thereby increasing user stickiness.

-

Transforming passive marketing into active exploration: NFT + Learn-by-Doing makes it easier for brands to encourage users to actively engage in certain behaviors through gamification, making content consumption a fun activity.

-

Cost reduction and efficiency improvement through brand cooperation: Tokens are the new API.

Let’s explore each of them.

3.3.1 Creating a win-win situation for brands and users: By using NFTs, brands can open up external positivity and transform points from brand liabilities to user assets, thereby increasing user stickiness.

The more active the user, the more points they should receive and the more benefits they should enjoy. However, in traditional loyalty programs, points are seen as brand liabilities, and brands often limit the quantity and speed at which users can redeem their points, resulting in highly active users not being able to enjoy matching benefits.

Starbucks’ approach is to allow users to convert points into NFTs in the new Web3 loyalty program, Odyssey. At the same time, Starbucks’ brand power brings external buying interest in NFTs, making them an additional asset for users. The transactions themselves also bring fun, and the money earned from selling NFTs can even motivate users to embark on more Odyssey journeys.

One user who earned $79 stated that it was just enough for him to buy gift cards and coffee on another Starbucks Odyssey trip. When the points reached 500, he converted them into NFT stamps, forming an endless collecting game.

Starbucks also tested the sale of paid NFTs called Siren Collection, with a mint price of $100, a quantity of 2,000, and sold out within 18 minutes. The floor price even exceeded $600 at one point.

The value anchor behind these NFT prices is:

-

The market recognizes the value of Starbucks members, which attracts external partners (such as Michelin-starred restaurants, Burger King, or Netflix) to create a new game layer on top of the traditional loyalty program, rewarding user participation in a different and unique way. The first external cobranding is Aku, and Starbucks Odyssey will launch “Aku Adventure” on July 17th. Odyssey members will complete tasks with Aku and receive NFTs designed by Aku.

-

Starbucks itself can create more gamified gameplay based on NFTs, empowering NFTs and creating value. For example, when releasing the second paid NFT, First Store Collection, users with 2 Starbucks stamps (NFTs) can mint 3 hours in advance, which encourages users to actively collect stamps.

-

NFTs are also a type of “collectible,” and users who enjoy collecting stamps are also part of the buying interest.

3.3.2 Transforming passive marketing into active exploration: NFT + LianGuairticiLianGuaite-to-earn, more conducive for brands to encourage users to actively engage in certain behaviors in a gamified manner, turning content consumption into a very interesting thing.

Directly quoting Joe, co-founder of Forum3:

When you enter the first Starbucks journey, it takes you to visit their coffee farm in Costa Rica and answer questions to earn points and rewards. This experience is really cool and super fun. The feedback is also great: people say, “I didn’t know I wanted to learn about this or needed to watch this video, but it’s really cool, and I feel like I’ve learned something and have developed a liking for the Starbucks brand.” Interestingly, these content snippets existed before Odyssey, but no one paid attention, interacted, or communicated. When you package it with incentives instead of just feeling like promotional marketing, the whole experience completely changes.

3.3.3 Brand collaborations reduce costs and increase efficiency: Tokens are the new API.

3.3.3 Brand collaborations reduce costs and increase efficiency: Tokens are the new API.

In the Web2 or traditional business world, user data is stored in centralized servers of various brands like isolated islands. When two brands want to cooperate, they need to achieve it through API integration. The biggest obstacle here is that there are only a few brands that can develop and access APIs due to limited development and business capabilities, which also results in limited choices for users and data privacy issues.

Take the Rewards Together Program released by Starbucks at the end of 2022 as an example. The first partner is Delta Airlines. If you are a member of Starbucks or Delta Airlines, you can connect your Starbucks account and Delta Airlines account together. Every time you complete certain actions in Starbucks or Delta Airlines, you will receive rewards from both sides. For example, every time you spend $1 at Starbucks, you will accumulate stars, and at the same time, you will receive 1 mile of mileage rewards from Delta Airlines. After customers book Delta Airlines flights, they can receive double star rewards in eligible purchases at Starbucks stores.

This is a typical joint loyalty system, where “your members are my members”. However, it took them many years to establish this joint loyalty system. Because different companies have their own databases, technology stacks, and infrastructure, and they need to build APIs to allow external access to their data. This requires time, manpower, and funding, and the design and interaction of the APIs also require a lot of discussion and communication between the two parties.

Starbucks is already a very powerful international brand in terms of IT capabilities, and yet it is still difficult for them. Other brands will only find it even more challenging.

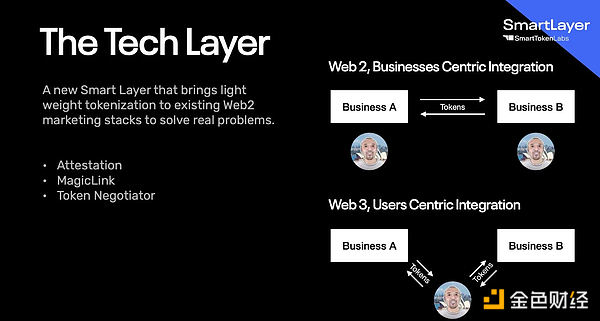

Victor, the CEO of Smart Token Labs, shared an interesting story that inspired him to achieve “user-side integration” through Web3, using tokens as integration points, and accessing various third-party services at almost zero cost.

A few years ago, Victor’s wife was the Partnership Manager at Booking.comALianGuaiC LianGuair, and at that time, she wanted to cooperate with some tourist attractions in Singapore to provide discounts on hotel bookings for users who had already purchased tickets to the attractions. However, these attractions had no ability to open their data, so this cooperation could not proceed. If these tickets were NFTs, this cooperation would be very simple. In other words, Booking.com could directly open benefits to these users in a permissionless manner.

NFTs have brought about a paradigm shift in “integration”, transforming API integration centered around brands in Web2 into Token integration centered around users in Web3. Based on the open models, open data, and open consensus mechanisms of NFTs or blockchain, everyone can play the same game, making collaboration exceptionally simple. It is even possible to establish one-sided cooperation without the need for communication because data retrieval does not require permission (permissionless).

Token integration centered around users brings at least two benefits:

- The threshold for brand cooperation is greatly reduced;

- Since it is user integration, the brand must provide user benefits, leading to an improved user experience.

In our previous article “Zero-Cost and Permissionless Perks through Off-Chain NFTs”, we also shared corresponding cases. At Ethereum EDCON 2023 held in Montenegro from May 19th to May 23rd this year, conference attendees were able to verify ticket ownership at extremely low cost (using off-chain NFTs provided by Smart Token Labs) and receive various privileges offered by third parties through the conference’s official website and offline, achieving Open Loyalty. For more details, please refer to the article in the appendix.

Another case is the recently concluded EDCON in Montenegro. By tokenizing the tickets, participants received at least 25 perks, ranging from free minting ability of the Cool Cat merchandise derivative called EDCON to the opportunity to obtain 50 ‘Njegusi Prosciutto’ from one of the famous local Montenegrin restaurants.

3.4 Community

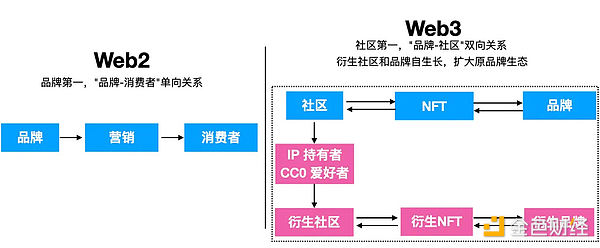

In an article I wrote 10 months ago titled “Building the Soul of a Web3 Brand: 3 Questions – Why, What, How,” “community” was the key difference between web3 and web2 brands, as well as the core competitive advantage of web3 brands.

However, looking back, the majority of projects have received more benefits from the community than they have given back to the community. Combined with the excessive price volatility of NFTs, a series of community problems can arise, including backlash against the projects.

But it is undeniable that the community is the biggest leverage that web3 brands can use. In this article, I separate the two and answer the questions of “the benefits the community brings to brands” and “how to distribute benefits and operate the community in a healthier way.”

The greatest benefit that the web3 community brings to brands is the incubation and dissemination of brands/IP.

-

Based on the community, brands/IP can be incubated quickly: by issuing NFTs, funds can be raised on one hand, and the stickiness and audience of the IP can be quickly tested and iterated on a wider range of products and experiences on the other hand.

-

Compared to web2 IP, web3 IP has a lower number of initial participants, lower cost of funds, higher efficiency of fund utilization, faster iteration, and lower time cost (IP-like NFT projects have all benefited from this, with Yuga Labs/BAYC derivative brands being typical examples);

-

Even incubation does not need to be completed by the official party. The brand side no longer needs to rack their brains for ideas. They only need to provide a good toolkit and reasonable incentive mechanisms, and the community will spontaneously create and even turn them into new physical products (such as the FWB x Taika we previously introduced);

-

Based on the community, the dissemination of IP and brands can be done more quickly.

-

The founders of Degods and Moonbirds, Frank and Kevin, mentioned in an interview that they believe NFT holders are more like advocates and promoters (affiliates) of the brands. The emergence of de-ids is also based on this thinking;

-

Daniel, the new CEO of Yuga Labs and former Blizzard executive, also believes that achieving low marketing costs and promotion through a close-knit community is crucial in the gaming industry: “If influencers don’t give you a high rating on social media, it’s hard for your game to have a future”;

-

1KX research report: “We believe that when consumers have ownership of their assets in a cooperative and reciprocal environment, they are incentivized to promote intellectual property because it becomes a place where holders feel valued, ultimately leading to deep loyalty, commitment, and promotional drive.”

In addition, based on NFT, brands can establish a more direct relationship with users, especially for categories with long chains, without relying on any third-party platforms.

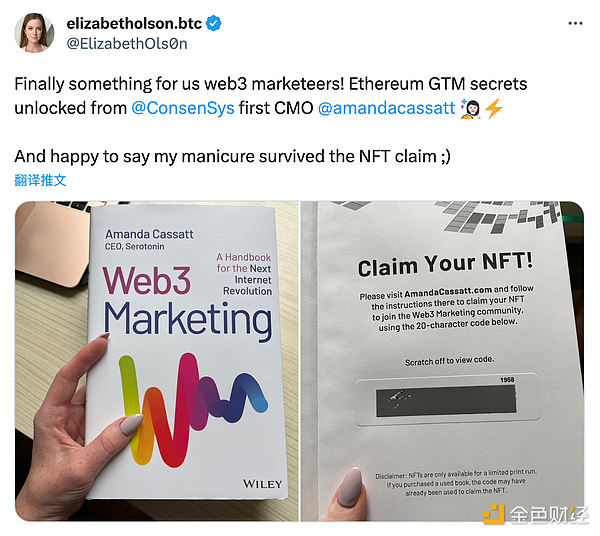

For example, the publishing industry has a very long chain, author → publisher → channel agent → channel distribution, and the author is almost impossible to know who their readers are. Of course, attaching a WeChat QR code in the book is one way, but the efficiency of manual verification is very low, and it is almost impossible to do co-branding. Moreover, if any keywords trigger WeChat to block the account, it is almost impossible to recover.

The method used in “Web3 Marketing” is that each book has a scratch card code, and readers can spend gas to mint an NFT on the official website. After verifying this NFT through collab land, they can enter the official Telegram group, which currently has 197 members. Since the identity of the reader is identified by the NFT, it does not depend on any IM platform and is also very convenient for future co-branding collaborations.

The film and television industry also has the same pain point, with a longer distribution chain. Last year, Netflix’s “Love Death + Robots” had a QR code to receive NFT Easter eggs, making it easy to create an audience group (but I’m curious why nothing was done eventually).

Summary

I have compiled the above 4 incremental values of Web3 to brands, as well as corresponding cases, into a Notion page. In the future, I will continue to update and iterate this page. Please feel free to bookmark and share. I hope this long article of 10,000 words can help colleagues communicate with brands and onboard smoothly 😉

A bear market is suitable for building, and we look forward to seeing more and more brands enter the Web3 exploration and expand the Open Loyalty ecosystem.

After answering the question “What incremental value does Web3 create for brands”, the next step is to answer the last question “How can brands better allocate these incremental values”, so that brands and users can form a healthy relationship, promote brand development, and enhance user experience and rights.

In the next article, I will further explore how Web3 brands can better share incremental value in a healthy way, as well as the characteristics of brands in the next cycle that we have observed. Stay tuned.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!