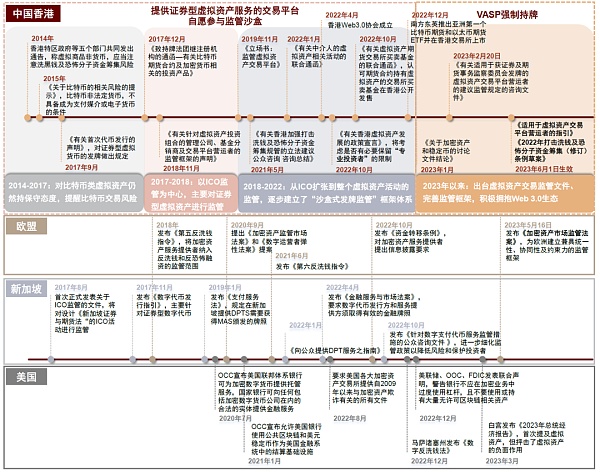

Recently, the Hong Kong Securities and Futures Commission (SFC) finalized the “Guideline for Virtual Asset Trading Platform Operators” (the “Guideline”) and will officially accept virtual asset trading platform license applications after the Guideline takes effect on June 1, 2023. We believe that the implementation of the Guideline marks a further improvement in Hong Kong’s virtual asset regulatory framework and could help promote the steady development of Hong Kong’s Web3 ecosystem in the long run.

Abstract

A new regulatory framework and detailed rules have been introduced to promote sustainable and responsible industry development. Since 2017, the Hong Kong SAR has gradually extended the scope of virtual asset regulation and continued to explore appropriate regulatory rules. We believe that the implementation of the Guideline marks a further improvement in Hong Kong’s virtual asset regulatory framework. On the one hand, it follows the principle of “same business, same risks, same rules,” establishes a dual licensing system for securities-type and non-securities-type virtual assets in accordance with the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance, and requires platforms to operate with a license. On the other hand, it clarifies regulatory details from various aspects such as qualified investor definition standards, virtual asset inclusion criteria, asset custody methods, and insurance compensation intensity, and strengthens investor protection. We believe that this will effectively reduce potential financial risks and losses and promote sustainable and responsible industry development.

Striking a balance between reasonable tolerance for innovation and ensuring financial stability may bring more “compliant” exchanges. We have observed that the SFC has fully considered industry opinions and public opinions before finalizing the Guideline, and has worked to balance industry development needs with regulatory compliance requirements in order to achieve a balance between innovation and stability. Among them, the SFC clearly allows retail investors to trade some large virtual assets, agrees to moderately reduce regulatory compliance costs, and sets up a transitional period for license applications, while continuing to emphasize a series of investor protection measures that trading platforms should comply with, including strengthening customer asset protection, optimizing asset access and information disclosure, prohibiting proprietary trading and lending services, etc. We believe that this may effectively protect investors and promote the enthusiasm of virtual asset platforms to obtain licenses, and may promote the industry to actively embrace regulation.

Leveraging Hong Kong’s advantages as an international financial center to create a globally competitive industrial environment could become a new starting point for the development of Hong Kong’s Web3 ecosystem. Since 2H22, with the occurrence of risks in the virtual asset industry, the global virtual asset regulatory environment has continued to tighten. However, at the same time, we have observed that the Hong Kong Special Administrative Region has actively leveraged its advantages as an international financial center, introduced favorable policies, and continuously explored innovative applications, creating a globally competitive industrial environment from multiple dimensions such as government, industry, and talent. In the long run, we believe that the Hong Kong Special Administrative Region is expected to work with global industry professionals to promote the stable development of virtual asset and underlying blockchain technology applications based on an increasingly perfect regulatory framework and gradually clear regulatory direction. The new regulatory rules are also expected to become a new starting point for the prosperous development of Hong Kong’s Web3.0 ecosystem.

Risk

Regulatory environment uncertainty, virtual asset industry prospects uncertainty, technology development not as expected.

Main Text

Hong Kong’s new virtual asset regulatory rules take effect: new starting point for the development of Hong Kong’s Web3.0 ecosystem

Since the second half of 2022, the Hong Kong Special Administrative Region has successively introduced favorable policies and continuously explored innovative applications for the Web3 ecosystem. At the same time, regulatory agencies such as the Hong Kong Securities and Futures Commission have actively improved the regulatory framework for virtual assets. The new regulatory rules such as the “Guidelines” will officially take effect on June 1, 2023. We believe that this may become a new starting point for the prosperous development of Hong Kong’s Web3 ecosystem.

New regulations fill the regulatory gap for non-securities virtual assets, constructing a comprehensive and balanced regulatory framework

Previously, the regulatory framework applicable to virtual asset trading in Hong Kong mainly consisted of the “Securities and Futures Ordinance” issued by the Hong Kong Securities and Futures Commission in 2017 and the “Position Paper: Regulation of Virtual Asset Trading Platforms” issued in 2019, in which regulatory agencies only put forward regulatory requirements for centralized platforms providing securities-type virtual asset trading services, and included licensed virtual asset trading platforms in the regulatory sandbox.

Platforms that intend to provide securities-type virtual asset trading services can apply for both License 1 (Securities Trading) and License 7 (Providing Automated Trading Services). However, as of May 31, 2023, the number of licensed institutions in the virtual asset industry is limited, and only two trading platforms (OSL Digital Securities Limited under BC Technology Group and HashKey Pro under HashKey Group) are licensed to operate.

Effective from June 1, 2023, the Anti-Money Laundering Ordinance clearly stipulates that trading platforms providing non-securities-type virtual assets are also subject to supervision by the Securities and Futures Commission of Hong Kong (SFC) and need to be licensed to operate, filling the regulatory gap for non-securities-type virtual assets.

At the same time, the Guidelines, which will come into effect at the same time, further establish the Virtual Asset Service Provider (VASP) issuance system, requiring all centralized virtual asset trading platforms that operate in Hong Kong or provide services to Hong Kong investors to apply for and hold licenses from the SFC. Among them, the SFC will supervise and issue dual licenses for securities-type and non-securities-type virtual asset trading services respectively under the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance.

Additionally, we believe that the Guidelines balance regulatory compliance requirements with industry development needs, and are expected to promote sustainable and responsible industry development. SFC CEO Ashley Alder said the Guidelines will put investor protection first and regulate the prudent protection of assets, the segregation of client assets, and the avoidance of conflicts of interest.

Compared with the Consultation Paper released on February 20, 2023, the summary of consultation on the proposed regulatory requirements for licensed virtual asset trading platform operators of the Securities and Futures Commission, released on May 23, 2023, further clarifies that retail investors are allowed to trade some large virtual assets, and agrees to moderately reduce the compliance costs of regulation, and establish a license application transition period to address obstacles in the industry’s compliance transformation.

Overall, we believe that the Guidelines are expected to promote the stable development of the Hong Kong virtual asset industry and the Web3 ecosystem while effectively protecting investors. In the long run, they may further consolidate Hong Kong’s position as an international financial center.

Chart: Comparison of new and old regulations

Data source: Hong Kong Securities and Futures Commission, CICC Research Department

Overseas virtual asset main market regulation is becoming stricter and the regulatory framework is still in need of improvement. Hong Kong, China may already be at the forefront of international regulation.

Since the second half of 2022, with frequent risk events in the virtual asset industry, the global virtual asset regulatory environment has continued to tighten. At the same time, we have observed that Hong Kong, China is actively leveraging its status as an international financial center and continuously improving its regulatory framework under the premise of effectively ensuring the stability of the financial system and protecting investors. With the implementation of the Guidance, we believe that Hong Kong, China’s virtual asset regulation may already be at the forefront of international regulation.

(1) United States: No unified and coordinated regulatory framework has been formed, and policies are trending towards tightening. Affected by the risk events of virtual assets in 2022, US regulatory agencies have gradually strengthened their regulatory efforts on virtual assets.

Among them, the SEC has sued and fined virtual asset trading platforms such as Coinbase and Kraken multiple times, and proposed new rules for virtual asset custody in February, further raising the threshold for virtual asset custody. In addition, the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation issued a joint statement in January 2023, warning banks not to use excessive leverage in virtual asset business and not to hold large amounts of related risk assets.

(2) Singapore: Has successively issued relevant regulatory rules, emphasizes licensed operations and does not recommend public participation. Singapore classifies virtual assets according to their attributes, including security-type, payment-type, and utility-type virtual assets. Overall, since 2022, Singapore has gradually improved its regulatory rules for virtual assets, and the overall regulatory environment has also become stricter.

Among them, relevant regulatory agencies in January 2022 issued the “Guidelines for Providing DPT Services to the Public” (DPT refers to digital payment token services), pointing out that digital payment tokens are high-risk, not suitable for public participation, and limit the promotion of DPT service providers. The Financial Services and Markets Act, which was released in April of the same year, also proposed that virtual asset issuers and service providers must be licensed.

(3) EU: Recently launched regulatory bill, but regulatory framework still has gaps. On May 16, 2023, the EU Council passed the “Cryptocurrency Market Regulatory Bill”, which will take effect as early as May 2024. Specifically, the bill emphasizes the regulation of stablecoins and does not provide specific regulatory requirements for security-type virtual assets, central bank digital currencies, and decentralized financial services. We believe that compared with Hong Kong, the EU’s regulatory framework for virtual assets still has room for further improvement.

(4) Hong Kong, China: Establish a comprehensive and balanced regulatory framework and actively embrace Web3.0 innovation ecology. Since 2017, the Hong Kong Special Administrative Region has gradually extended the scope of virtual asset regulation and continuously explored appropriate regulatory rules. With the “Guidelines” taking effect from June 1, 2023, we believe that compared with other major overseas markets, Hong Kong, China has established a more comprehensive and balanced regulatory framework, and has provided a clear regulatory guidance for the global virtual asset and Web3.0 industry.

Chart: Timeline of virtual asset regulatory policy development in some overseas countries and regions

Source: Securities and Futures Commission of Hong Kong, Monetary Authority of Singapore, U.S. Commodity Futures Trading Commission, U.S. House of Representatives, Federal Reserve, Federal Deposit Insurance Corporation, European Commission, CICC Research Department

Building a globally competitive industrial environment. The new regulatory rules may become a new starting point for the prosperous development of the Web3.0 ecosystem in Hong Kong, China.

Since 2023, Hong Kong, China has successively launched favorable policies, actively embracing the Web3.0 ecology from multiple dimensions such as capital, industry, and talent.

Specifically, at the beginning of 2023, Hong Kong, China proposed to promote the development of Web3.0 in the “Budget” and provide financial subsidies to Cyberport to accelerate the development of the Web3.0 ecosystem in Hong Kong, China. Subsequently, Hong Kong, China successively launched the “High-end Talent Pass” program, established the Hong Kong, China Web3.0 Association and related industry funds, and actively introduced Web3 from the perspectives of talents, enterprises, and investment.

In addition, in April 2023, Carrie Lam, the Chief Executive of the Hong Kong Special Administrative Region, attended the establishment ceremony of the Hong Kong, China Web3.0 Association and delivered a speech, stating that he is open to virtual asset innovation and allows Hong Kong, China to become the best foothold for virtual asset companies by providing appropriate regulation to the market, conveying a positive signal to practitioners.

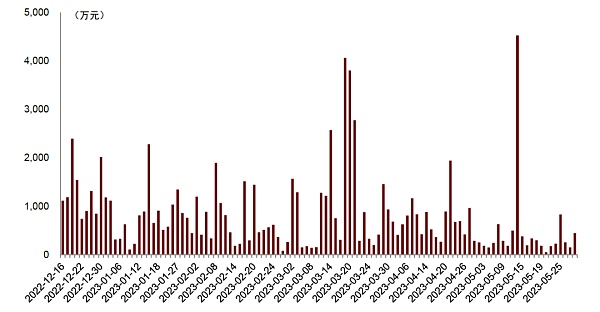

Moreover, we observe that the virtual asset industry in Hong Kong, as well as the Web3.0 ecosystem, had already developed a certain foundation before the implementation of this new regulatory policy. Among them: 1) In terms of funding channels, according to caixin.com, the digital asset service provider HashKey Group, which already held a securities-type virtual asset license, has established partnerships with ZhongAn Bank and Bank of Communications (Hong Kong) before; 2) In terms of product innovation, Asia’s first virtual asset ETF also landed in Hong Kong, China, on December 16, 2022; 3) In terms of ecosystem construction and cooperation, large enterprises had already laid out the Web3.0 ecosystem in Hong Kong, such as China Mobile announcing in November 2022 that it will develop the metaverse digital space and the NFT market in Hong Kong.

Looking ahead, with the regulatory environment becoming increasingly clear and the addition of policy benefits, we believe that Hong Kong, China has the potential to create an industry environment with global competitiveness, and the implementation of this new regulatory policy may become a new starting point for the prosperous development of Web3.0 in Hong Kong, China.

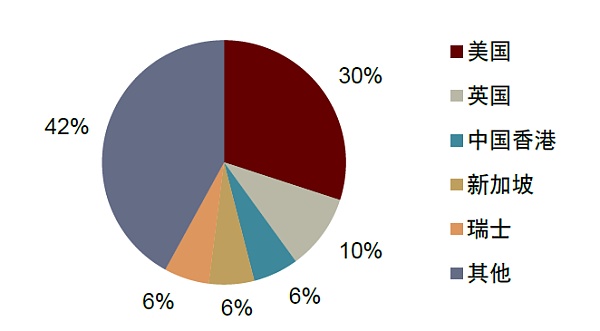

Chart: Distribution of cryptocurrency hedge fund managers in various countries and regions (2021), of which Hong Kong, China accounts for about 6%

Source: PwC’s “Fourth Annual Global Cryptocurrency Hedge Fund Report 2022”, CICC Research Department

Chart: The total daily average turnover of virtual asset ETFs in Hong Kong, China exceeded 8 million yuan from December 16, 2022 to May 31, 2023

Source: Wind, CICC Research Department

This article is excerpted from: “Hong Kong’s Virtual Asset Regulatory New Rules Take Effect: A New Starting Point for the Development of Hong Kong’s Web3.0 Ecosystem”, published on June 1, 2023

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!