DeFi Data

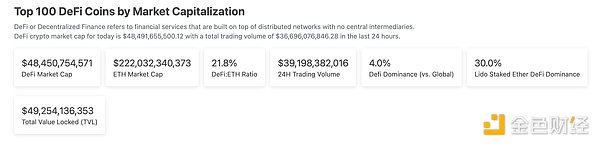

1. Total Market Cap of DeFi Tokens: $48.45 billion

DeFi Total Market Cap and Top Ten Tokens Data Source: Coingecko

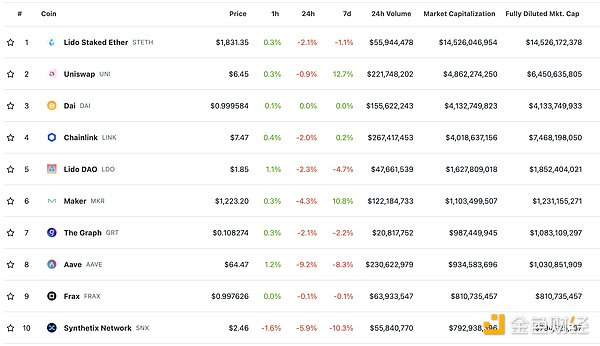

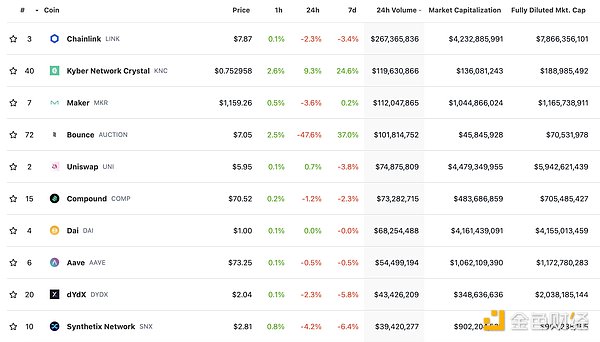

2. 24-hour Trading Volume of Decentralized Exchanges: $3.9198 billion

24-hour Trading Volume of Decentralized Exchanges Data Source: Coingecko

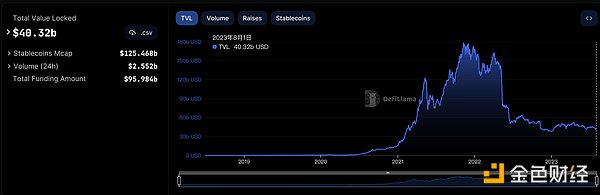

3. Locked Assets in DeFi: $40.32 billion

Data Source: Defillama

NFT Data

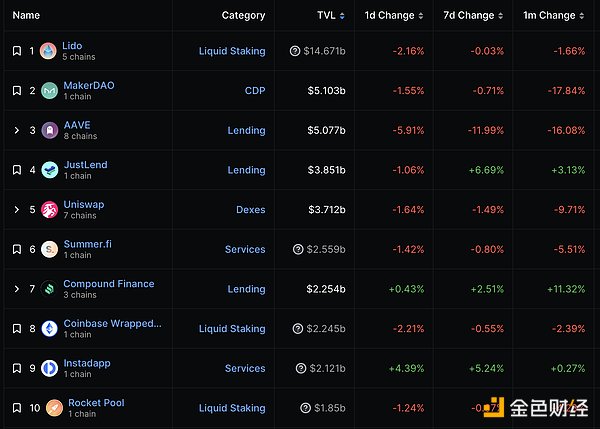

1. Total Market Cap of NFTs: $16.422 billion

Total Market Cap of NFTs and Top Ten Projects Data Source: Coinmarketcap

2. 24-hour NFT Trading Volume: $1.186 billion

24-hour NFT Trading Volume and Top Ten Projects Data Source: Coinmarketcap

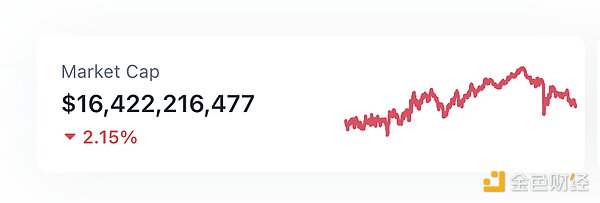

3. Top Ten NFTs in the Past 24 Hours

Top Ten NFTs Sold in the Past 24 Hours Data Source: NFTGO

Headline News

FTX Submits Restructuring Plan to Restart Offshore Exchange to Compensate Customer Losses

On August 1st, FTX User Alliance tweeted that FTX has submitted a restructuring plan, with key points including all non-customer claims (such as IRS) to be dealt with later, FTT claims to be reset to zero, and the restart of the offshore exchange to compensate customer losses.

NFT/Digital Collectibles Highlights

1. NFT Trading Volume on Ethereum Blockchain Hits Nearly Two-Year Low Over the Weekend

LianGuai reported that NFTstats.eth, the research director of the Web3 community Proof, stated that the trading volume of NFTs on the Ethereum blockchain over the weekend was about 11,900 ETH, valued at approximately $22.1 million. This number represents the lowest total volume since July 2021. Prior to this, the lowest trading volume on weekends this year was about 15,400 ETH, which is 29% higher than the volume of the just-passed weekend.

The decline in the latest trading volume of NFTs on Ethereum reflects a broader downward trend in the entire NFT sector. According to a report released by CoinGecko on July 18th, the trading volume of NFTs decreased by 35% compared to the first three months of 2023, dropping from $4.84 billion to $3.15 billion in the second quarter.

2. Former Vice President of Polygon Labs Joins OpenSea as Vice President

On August 1st, Kelly DiGregorio, former Vice President of Polygon Labs, joined OpenSea as Vice President. Previously, DiGregorio was responsible for a series of transactions between Polygon Labs and brands such as Starbucks, Disney, Master Card, Reddit, and Salesforce.

DeFi Hot Topics

1. Coinbase: SEC Did Not Request Coinbase to Delist any Assets

On August 1st, a spokesperson for Coinbase stated that the SEC did not request Coinbase to delist any assets, contrary to the inaccurate report by the Financial Times. The spokesperson stated that before the lawsuit, the U.S. Securities and Exchange Commission never required Coinbase to delist any specific assets, which was also acknowledged by the SEC in the same article.

2. Curve Finance: Best to Migrate to the Latest Version Contract of Vyper 0.3.7+

According to LianGuai’s report, Curve Finance reminded on social media that Vyper 0.3.7+ has undergone good refactoring and auditing. Although there are no guarantees (nor any guarantees), it is best to migrate to the latest version contract. Previously, as of now, Curve Finance has confirmed that four liquidity pools have been affected by Vyper compiler versions 0.2.15-0.30, namely: crv/eth, aleth/eth, mseth/eth, and peth/eth. Additionally, a liquidity pool for tricrypto on Arbitrum “may” be affected. Auditors and Vyper developers have yet to find the vulnerabilities, so investors are advised to withdraw as soon as possible.

3. Volatility Shares Plans to Launch Ethereum Futures ETF

According to LianGuai’s report, Volatility Shares plans to launch an Ethereum futures ETF product. The proposed Ethereum strategy ETF will invest in cash-settled Ethereum futures contracts traded on the Chicago Mercantile Exchange (CME), without directly investing in Ethereum (ETH). Previously, companies such as Grayscale Investments and Bitwise abandoned their plans to launch Ethereum futures ETFs in May after being requested by the SEC. Concerns about the liquidity levels of Ethereum futures and the uncertainty of whether Ethereum is a security or a commodity are seen as potential reasons.

4. U.S. Federal Judge Allows Terraform Labs to Issue Subpoenas to FTX Regarding Shorting Terra/Luna

According to LianGuai’s report, U.S. Federal Judge John Dorsey has allowed Terraform Labs to issue subpoenas to FTX regarding the shorting of Terra/Luna. Terraform claims that FTX possesses information and related documents that are relevant to its defense against SEC enforcement actions. The company argues that the shorting of its Terra/Luna tokens led to the crash in May 2022, and FTX has the requested information and documents.

Reportedly, Dorsey has granted special permission to Terraform Labs, compelling the now-bankrupt trading platform FTX to provide documents and information related to Terraform’s arguments. FTX’s lawyer (also a representative of FTX US) has also agreed to this order, and FTX will provide the requested records as long as they are limited to Terraform’s defense against the SEC case.

5. MakerDAO Co-founder: Curve Bug Could be the Last Crash Before a Bull Market

LianGuai reports that Rune Christensen, co-founder of MakerDAO, tweeted that the bug in Curve Finance over the weekend has raised widespread concerns in the decentralized finance sector, which could benefit the industry. He wrote, “This seems like a moment of exclamation ‘it’s over,’ but maybe it’s just the Black Thursday of this cycle, the last crash before a bull market, and everything will come back in a hundredfold strong way.”

LianGuai previously reported that multiple liquidity pools of the DeFi protocol Curve Finance were exploited due to errors in the smart contracts using the Vyper programming language version. Due to a reentrancy bug, the attacker exhausted multiple stablecoin pools, resulting in the withdrawal of $24 million.

AI Highlights

1. Meta to Launch Personalized AI Chatbots

LianGuai reports that Meta, the parent company of Facebook and Instagram, plans to release artificial intelligence chatbots with human-like personalities. Insider sources said that prototypes of the chatbots are already in development, and the final product will be capable of engaging in discussions with users on a human level. This series of chatbots will be able to showcase different personalities and are expected to be released as early as next month. The company has already developed a chatbot that speaks like former US President Abraham Lincoln and a travel advice chatbot that speaks like a surfer.

2. OpenAI Files Trademark Application for “GPT-5” with the US Patent and Trademark Office

LianGuai reports that US trademark lawyer Josh Gerben announced on social media that OpenAI submitted a trademark application for “GPT-5” to the US Patent and Trademark Office (USPTO) on July 18. The trademark application indicates that GPT-5 provides offline/online versions of “computer software for the generation of voice and text by artificial means” as well as offline/online versions of “computer software for natural language processing, generation, understanding, and analysis.”

Disclaimer: LianGuai, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish the correct investment concept and be sure to increase risk awareness.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!