Author: Tim Alper, cryptonews; Translation: Song Xue, LianGuai

Japan is advancing cryptocurrency tax reforms, and the country’s top financial regulator will change the way it taxes domestic cryptocurrency companies.

According to Japanese media CoinPost and the Financial Services Agency (FSA), the regulatory agency has submitted a request for legislative changes to the government.

The Financial Services Authority in the UK wants to modify its cryptocurrency enterprise tax system to abolish the current “unrealized gains” system for domestic companies.

- Will NFT, which is no longer being pursued by people, be crushed or will it rise again after a setback?

- The Endgame for zkSync AMA with Alex, Co-founder and CEO of Matter Labs

- Reviewing the NFT winter of the past half year Who is ‘surrendering’ and who is growing against the trend?

Under the current legal system in Japan, if a company holds cryptocurrency assets, it must pay taxes on unrealized gains (the increase in the value of its tokens) at the end of each fiscal year.

In other countries, companies only need to pay taxes on cryptocurrencies when they are sold or exchanged for fiat currency.

The media wrote: “The rule has long been criticized for adding burden to companies and hindering innovation in the cryptocurrency and blockchain field.”

The FSA document states that the Ministry of Economy, Trade, and Industry has also signed this reform.

The Financial Services Authority in the UK stated that it plans to require Tokyo to enact a legislative amendment to reflect its intention.

Most legislators are unlikely to oppose these plans, as the government generally follows the leadership of the Financial Services Authority on cryptocurrency-related policy issues.

The Japan Blockchain Association (JBA), the major industry group for the cryptocurrency sector, has also requested that the Japanese FSA ensure that tax reforms extend to cryptocurrency assets held by third parties.

Sota Watanabe, CEO of Startale, responded to the JBA’s viewpoint on Twitter and warned of a “crisis” in the domestic cryptocurrency industry.

He wrote: “It is very important to carry out these reforms this year. So far, we have seen the outflow of overseas startups. […] I have a feeling that if we don’t do this, companies in Japan will gradually leave next year. I think this will lead to the hollowing out of Japan’s industry.”

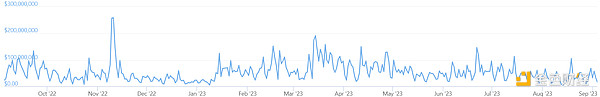

Trading volume of bitFlyer, the leading cryptocurrency exchange in Japan, in the past 12 months. (Source: CoinGecko)

Japanese cryptocurrency tax reform: Why now?

The JBA also calls for the FSA to reform the way individuals are taxed and hopes that regulators will allow traders to defer losses.

The industry association also hopes that Tokyo will exempt individuals from cryptocurrency trading taxes.

Some critics also hope that the government will impose a fixed capital gains rate of 20% on cryptocurrency-to-fiat currency transactions, rather than taxing cryptocurrency as a form of “other income”.

The FSA explained in a press release that the reason for requesting legal reforms is to “improve the promotion environment of Web3 and promote entrepreneurship using blockchain technology.”

The government is working hard to support an industry that has been complaining about excessive regulation in recent years.

Some legislators and business leaders claim that previous governments have been taxing Japanese companies in a way that forces them to withdraw from the domestic market.

They argue that overly eager regulatory agencies are causing promising fintech startups to move overseas.

However, recent events have witnessed the industry’s recovery, especially as Binance attempts to enter a market traditionally dominated by domestic startups and Japanese securities providers.

In July, Japanese Prime Minister Fumio Kishida emphasized the government’s commitment to supporting the country’s Web3 and blockchain industry.

Earlier this year, the government approved the adoption of FATF’s travel rule and enacted a new law in June.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!