Author: Future3 Campus, Compilation: Huohuo/Baihua Blockchain

Recently, more than half of the content on Twitter seems to revolve around Friend.Tech. After in-depth research, I have discovered some interesting points that can provide inspiration for future social entrepreneurship and incubation:

1) Advantages of Friend.Tech

2) Disadvantages of Friend.Tech

3) Better entrepreneurial paths based on Friend.Tech

1. Advantages of Friend.Tech

Firstly, Friend.Tech is in a track that is very suitable for the cryptocurrency market, which is the fan economy. Although its slogan is “your connections are your assets”, it seems to target ordinary users, but its business model and promotion strategy are rooted in the fan economy. Therefore, Friend.Tech is more suitable to position itself as a fan economy platform.

1) The fan economy is very suitable for the cryptocurrency market.

Social media has always been a favored direction, but existing social track projects with a large user base are more infrastructure-oriented, such as social graphs and wallets. Why aren’t there applications? Due to the high moat of Web2 applications, users lack the motivation to migrate, and venture capital firms are hesitant to invest, so applications have been struggling.

Although the essence of the cryptocurrency market is financial, which is “fi”, as seen in successful applications such as DeFi and GameFi, overemphasizing “fi” can lead to unsustainable results. This is because most users attracted by such projects are speculative investors seeking profits, rather than the real target users.

Therefore, it is crucial to make users willing to pay for your product. Most social scenarios are not economically driven because users will not pay for everyday chatting. The social scenarios where users are willing to pay are making friends and the fan economy. The fan economy is ideal – real willingness to pay, users are willing to pay directly to internet celebrities, as reflected in the trends of star products and live rewards.

Moreover, the fan economy brings built-in traffic. For startups in the Web3 field, traffic is crucial. In just 13 days since its launch, Friend.Tech has accumulated a trading volume of nearly 40,000 ETH, with approximately 100,000 active addresses, protocol inflows exceeding 66 million U, and protocol revenue of 3.34 million USD.

Especially after LianGuairadigm announced its investment on August 19th, the data surged. Why? Because LianGuairadigm now acts as a market traffic guide.

The target audience of Friend.Tech is numerous KOLs who have their own audience, which is very compatible with the platform’s marketing methods. Utilizing KOL promotion has become an effective strategy.

2) Friend.Tech’s Impressive Business Model

However, does every project involving the fan economy guarantee success? Obviously not.

Friend.Tech has gained support from Coinbase, using it as a key application to attract users to use Base.

In addition, their business model is also noteworthy. It is common for applications to use token rewards, benefiting both KOLs and users from the increase in token price. However, this requires strict control of token circulation, as a future drop in token price could seriously harm the product.

Friend.Tech does not issue tokens, but allows users to directly purchase stocks using ETH. The transaction fees for KOL stock trading go directly into their wallets. This direct reward mechanism is highly attractive to KOLs and generates substantial appeal.

For users who purchase KOL stocks early on, they can sell them later at a higher price and make a profit. Friend.Tech uses a bonding curve to ensure that prices rise with increasing trading volume and the number of token holders, thereby incentivizing early purchases. Especially when new KOLs join, users anticipate their influence and buy their stocks.

Holding stocks not only comes with the expectation of selling them, but also allows users to interact with KOLs and enter their communities, adding value beyond profits.

This logic is similar to NFTs, where creators earn royalties and users purchase NFTs not only for resale but also to become part of a community.

3) Other Clever Features of Friend.Tech

In addition, Friend.Tech incorporates clever features. For example, it directly links Twitter accounts, effectively redirecting Twitter’s traffic. This feature can also help users discover early investment opportunities, further driving user growth.

Furthermore, the application runs as a web version but can generate desktop applications, bypassing app store issues while retaining the app experience.

In addition, the application integrates cross-chain bridges, allowing ETH to be transferred from the mainnet to Base within the application itself, without the need for separate bridge transfers.

2. Disadvantages of Friend.Tech

1) Poor User Experience

Many users criticize Friend.Tech for being difficult to use, such as slow page loading speeds, frequent errors, and inability to access it on desktop.

In addition, a new wallet address is generated for each new user registration. While this may lower the entry barrier for users unfamiliar with cryptocurrencies, it still requires users to have their ETH mainnet addresses. For crypto users, they cannot bind an existing address and need to manage an additional one. This setup seems confusing, and I suspect it is related to the stock trading functionality.

2) Limited and Inappropriate Features

Currently, the only feature of Friend.Tech besides buying and selling stocks is chatting. If a user does not purchase any stocks, the application remains unusable. This presents a barrier for potential users who may want to explore the platform’s functionality. Offering some free browsing content will increase user engagement and activity.

3) Excessive emphasis on financialization

In my opinion, the most significant issue with Friend.Tech is its excessive financialization. Firstly, the financial functions of the application account for a disproportionately high proportion, resulting in limited functionality as mentioned above. Although the platform targets the fan economy sector willing to pay, it does not provide means to cultivate fans.

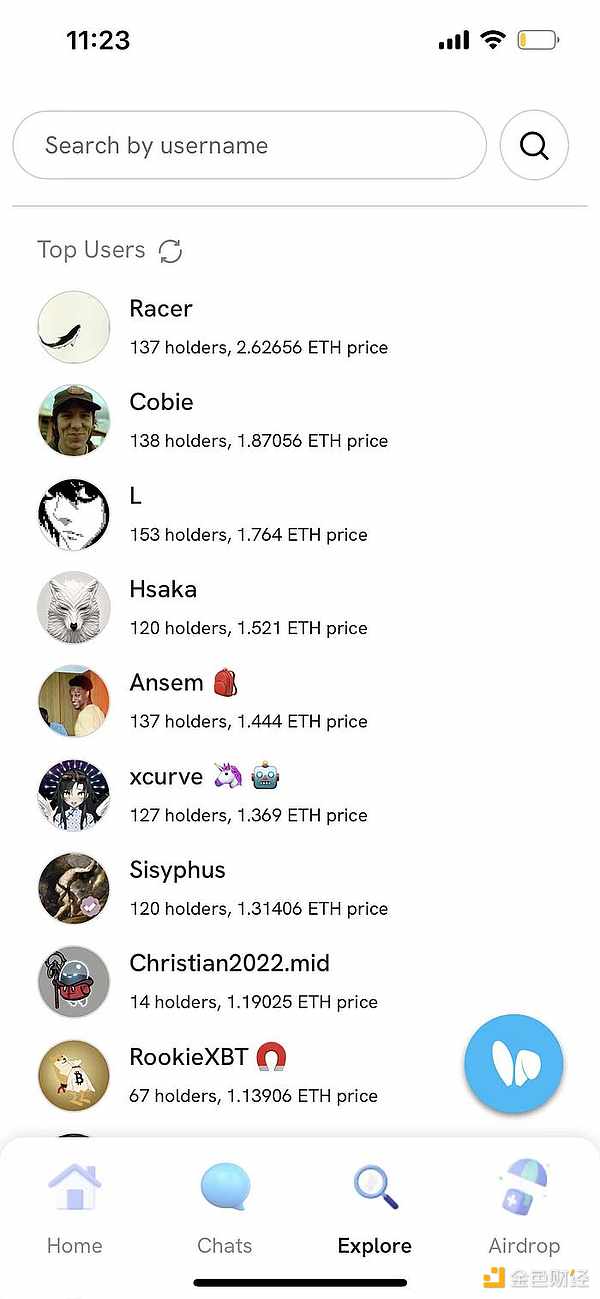

Secondly, Friend.Tech’s stock trading bond curve is steep, with the stock price soaring to 1-2ETH and over 100 holders. This will limit the attraction to a large number of users, coupled with the lack of content to cultivate fans, Friend.Tech is like a new territory where mature KOLs charge for private domain traffic.

These concerns have made many people skeptical about the prospects of Friend.Tech, viewing it as a new Ponzi scheme on the verge of collapse. However, I expect the bubble will not burst. Since it has not issued tokens yet, the worst-case scenario might be gradual disappearance. As a dapp that brings traffic to Base, it has achieved tremendous success. If subsequent data becomes less optimistic, it is likely due to the aforementioned issues.

3. A better entrepreneurial path based on Friend.Tech

The emergence of Friend.Tech may rekindle interest in the social sector, attracting many entrepreneurs and investors to focus on this direction.

I have always believed that the fan economy is the most potential breakthrough point in the Web3 social field. Whether it is the inherent traffic it brings or the consumption ability of target users, it can more easily help users grow and platforms develop. The challenge lies in how to accumulate the first wave of KOLs. Friend.Tech introduces a promising business model that can start a growth flywheel, and it needs a suitable scenario.

Group chat is an ideal core function of the fan economy platform. Traditional economic scenarios such as live streaming, short videos, long and short content sharing, and group chat are also applicable.

However, platforms like Twitter already exist in the textual aspect of the fan economy. After Elon Musk’s involvement, Twitter’s enthusiasm for creators has increased, and the expectation for airdrops is also strong, much like Web3 applications. Therefore, for another platform, it is challenging to break free from Twitter’s dominance.

Live streaming is also a suitable scenario. Traditional platforms in these scenarios have strict content regulation, while Web3 products offer more freedom.

Furthermore, in terms of product design, providing some free content to attract and cultivate users is essential. For quality content, trying a model similar to Friend.Tech can gradually increase user engagement, incentivize users to build influence and benefit from it. Additionally, to expand the user base, allowing KOLs to determine the form of combination curves can match different content quality and target user preferences.

Finally, Web3 social platforms should cater to a wider user base, not just Web3 users. This requires a significant reduction in entry barriers, focusing on wallet and payment functionalities. By achieving a user-friendly product experience and providing sufficient incentives for KOLs, it is possible to attract numerous traditional KOLs to the platform and create a new fan economy paradigm, thus creating truly groundbreaking applications.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!