Author: yyy

The overall TVL of Layer 2 track has recently reached the milestone of billions of dollars, presenting a thriving scene in the Layer 2 on-chain ecosystem. zkSync still ranks third in the L2 track, second only to Arbitrum and Optimism, with an on-chain TVL of nearly 500 million dollars.

Why is the prosperity of zkSync ecosystem considered false?

Before answering this question, let’s take a look at the recent TVL trends of the two leaders in Layer 2, Arbitrum and OP.

According to L2Beat data:

- Advantages of zkEVM Validium Completely changing the scalability and privacy of blockchain

- Who is holding back China’s ChatGPT?

- ETHCC Speech Four Bottlenecks Restricting the Development of Full-chain Games

-

Arbitrum TVL fluctuates around 6 billion dollars;

-

OP has recently received frequent positive news, and TVL has also reached a new high, breaking through 2.5 billion dollars ATH;

The TVL of these two platforms accounts for nearly 85% of the L2 track, occupying absolute dominance.

On the other hand, zkSync has experienced a sharp decline in TVL due to the continuous fermentation of the “random” NFT airdrop incident in the community in the past few days. Funds have been withdrawn, and most of the funds have flowed to another unreleased zk-Rollup StarkNet. StarkNet’s on-chain TVL has grown by nearly 34% in a week.

Let me state the conclusion first: the on-chain prosperity of zkSync is based on the potential expectations of airdrops, brought by airdrop hunters. At least for now.

Next, I will argue the above conclusion from three points: the complexity of on-chain ecosystem, the wide application of infrastructure, and the “random” NFT airdrop incident.

Complexity of on-chain ecosystem

The complexity of the on-chain ecosystem represents the innovation capability that can bring more diversified application scenarios to users, thereby stimulating user demand. For L2, the complexity of the on-chain ecosystem ≈ the complexity of on-chain DeFi. This DeFi Lego with certain Ponzi attributes is particularly important for the prosperity of the on-chain ecosystem.

Let’s first look at the leader, Arbitrum:

The flagship protocol GMX has a TVL of up to 500 million dollars, which is also one of the most outstanding decentralized derivatives trading protocols in the current crypto market and one of the few complex defi protocols that have survived for a long time. In addition, there is the lending protocol Radiant Capital, which has just received financing from Binance, and it is an application scenario for cross-chain lending based on L0 cross-chain infrastructure.

Now let’s look at the second, OP:

The flagship protocol is a 33 DEX Velodrome, which is based on Solidly仿盘 innovation and has now become one of the most important hubs in the OP ecosystem, radiating to other protocols in the ecosystem. Sonne Finance has risen based on Velodrome and is currently the largest native lending protocol in the OP ecosystem. It has created a positive economic flywheel through bribery and lock-up mechanisms, supporting the OP ecosystem.

Summary:

-

Arbitrum: complex derivative trading, cross-chain lending, and other innovative application scenarios;

-

OP Stack: the ecosystem that imitates Ethereum Curve, achieving a positive economic cycle.

It can be said that the complexity of the on-chain ecosystem is a necessary but not sufficient condition for the prosperity of the on-chain ecosystem, and a complex DeFi Lego is the foundation of a prosperous ecosystem.

Now let’s take a look at zkSync:

SyncSwap is the absolute leader, with a TVL of 82 million US dollars, accounting for nearly half of zkSync’s TVL.

Let’s not discuss the leader protocol here, after all, it has been “well-known” recently. The on-chain entrepreneurial market and the “rug” market are full of activity, and the main theme is “rug”. The airdrop hunters have supported half of zkSync’s TVL.

The Extensiveness of Infrastructure Applications

OP/Arbitrum/zkSync have all launched modular stacks for developers to easily launch L2/L3.

-

OP: OP Stack;

-

Arbitrum: Arbitrum Orbit;

-

zkSync: zkSync HyperChain.

Currently, the most widely used is OP Stack.

After Coinbase announced the construction of L2 Base based on OP Stack, more and more projects have joined this camp, including but not limited to: Binance opBNB, a16z, Worldcoin, Zora, Manta Network.

Derivative trading protocol Syndr recently announced the construction of L3 application chains based on Arbitrum Orbit. Protocols like Relative and OthersideMeta also have the intention to build L3 based on Orbit.

On the other hand, there is little discussion about zkSync’s L3 architecture HyperChain in the cryptocurrency market, let alone building zk L3 based on HyperChain.

NFT “Random” Airdrop

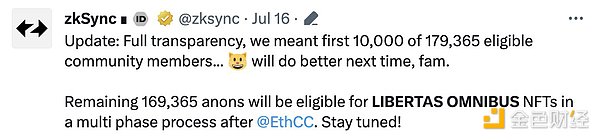

zkSync officially airdropped NFTs to 10,000 “random” addresses in its ecosystem. It was later revealed that the so-called “random” addresses were mostly addresses starting with 0x0, and even included some inactive addresses with 0 transactions or only 1-2 transactions. Later, under public pressure, the official clarified that their definition of “random” was inaccurate, and it was actually the first 10,000 qualified addresses.

This “random” NFT airdrop event became the trigger for the sharp decline in zkSync’s TVL, with a decrease of nearly 80 million US dollars in just one week, a decrease of more than 16%.

At the same time, StarkNet, a potential competitor of zkSync, saw an increase in TVL of nearly 35% during the same period.

There is reason to believe that a large part of this significant change in funds between chains is due to the change in strategies adopted by the “farming” community.

This also indirectly confirms that there are very few users on the zkSync chain with real demand, and the prosperity of the on-chain ecosystem is a “false prosperity” derived from the expectation of issuing coins based on zkSync.

As for the other two giants, Arbitrum and OP, they have both issued coins. Of course, there is also the expectation of retroactive airdrops after issuing coins, but the undeniable fact is that there are more users with real and diversified transaction needs on Arbitrum/OP.

Here, I can say subjectively: without users who contribute to the ecosystem, zkSync is nothing.

In the face of such an on-chain ecosystem and “active” users, dare I ask: can zkSync issue coins now? Without the expectation of issuing coins, it is clear who is more capable.

Finally, it is an old saying: only when the tide recedes can we see who is swimming naked.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!