Author: Superdao; Translation: Huohuo@Plain BlockchainIn this report, you will find an overview of the Web3 market with a focus on user activity and behavior. It is divided into three key sections: Web3 market size, leader benchmarks, and key roles and behavior patterns, each of which provides a unique perspective and accurate analysis of the Web3 landscape.In this report, we indexed 300 million wallets on the Ethereum and Polygon networks and obtained data on DAO voters from the Snapshot API. For more information on how we calculated the metrics for the report, please refer to the Methods section at the bottom of the report.TLDR:- Despite the crypto winter, the Web3 market remains active, with 9.51 million wallets having made at least one outgoing transaction, of which 5.65 million have spent money in the past 30 days.- The approximate market size for casual Web3 is 10 million, supported by the number of “casual” Web3 users who have been active in the past 30 days, hold 1 token and NFT, and maintain a balance of $100.- The core part of the Web3 market is 1 million, supported by the number of financially active users in the past 30 days who hold various tokens and NFT collections (10 unique assets) and have a balance of $1000. This user cluster includes Web3 native users, whales, and overly active users, as represented in the Key Roles and Behavior Patterns section.- Token adoption speed exceeds NFT adoption speed, with 8.91 million wallets maintaining a balance of $100, and only 5.91 million holding more than 5 NFTs.Section 1: Web3 Market SizeThis section provides an overview of key Web3 metrics as of June 2023, focusing on token and stablecoin distribution, NFT holdings, wallet balances, and recent transactions between Ethereum and Polygon wallets.Key metrics:- There are 360 million wallets on the Ethereum and Polygon chains.- 32.6 million wallets have transferred at least 5 different tokens at some point.- 10.1 million wallets hold at least one of the top 5 stablecoins.- 5.91 million wallets own 5 or more NFTs.- 8.91 million wallets maintain a balance of $100+.- 9.51 million wallets have made at least one outgoing transaction in the past 30 days.

– 5.65 million wallets have made transactions in the past 30 days.

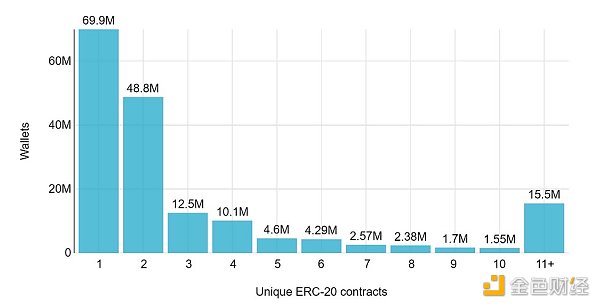

The following chart shows the distribution of tokens between Web3 users (based on transaction history)

Wallet distribution is based on the unique ERC-20 token count transferred. Note: Transfers on the Ethereum chain and the Polygon chain are considered unique tokens. Both outbound and inbound transfers are included.

Key points:

6990 million wallets insist on using a single token, which may indicate that users tend to:

-Prefer simplicity

-Have confidence in a particular token

-New market participants

-Users who use multiple wallets

32.6 million collectors own 5+ tokens, which may indicate:

-Active trading

-Diversified investments

-Institutional investors or traders managing different investment portfolios

-Technological enthusiasts or early adopters experimenting with various tokens

-Participating in airdrops

-Speculation

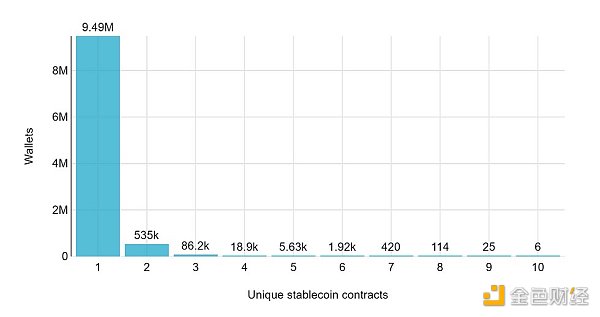

The following chart shows the distribution of stablecoins among Web3 users (based on wallet holdings)

Wallet distribution is based on the top 5 stablecoin counts held. The stablecoins included are DAI, USDT, USDC, BUSD, and TUSD. Assets on the Ethereum chain and Polygon chain are considered unique stablecoins (e.g. USDC on Ethereum chain and USDC on Polygon chain are considered as two unique stablecoins)

9.49 million single stablecoin holders, which may indicate:

-Preference for simplicity

-Trust in a specific stablecoin

-Limited awareness of other stablecoin options

-Users who use multiple wallets

64800 holders of multiple stablecoins, indicating:

-Diversifying risks to reduce risks

-Utilizing different functions or advantages provided by various stablecoins

-Interacting with multiple platforms

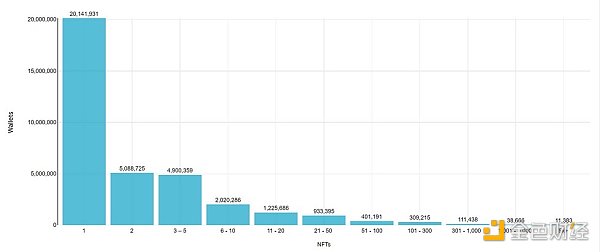

The following chart shows the ownership of NFTs among Web3 users

Allocate wallets based on the amount of NFTs held. Note: include ERC721 and ERC-1155 tokens. Proxy contracts are not included.

30 million hold ≤5 NFTs, which may include:

– Newcomers or temporary participants in the NFT market

– People who received NFTs as gifts or promotional items

420,000 hold 101–1000 NFTs, which may indicate:

– Strong collector or investor base

– Widespread NFT hunting movement

– Early adopters

50,000 hold 1001+ NFTs, which may represent:

– Large collectors

– NFT-centric businesses

– Whales

Note: There appears to be significant overlap between token collectors, stablecoin users, and NFT owners. Detailed cross-sectional analysis may provide deeper insights into user behavior.

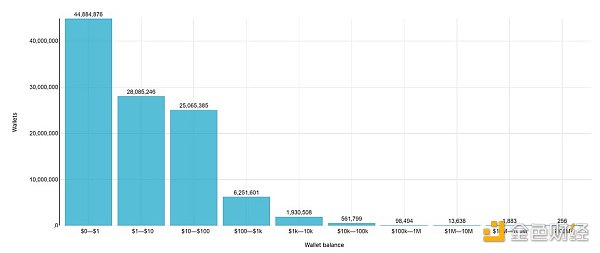

The following figure shows wallet balance distribution:

Based on balance wallet allocation. Note: Balance calculation includes assets held in ETH, USDT, USDC, and DAI on Ethereum, as well as assets held in USDT, USDC, and DAI on Polygon.

44.9 million wallets hold ≤1, which may be:

– Wallets used for free transactions

– Wallets with funds already moved elsewhere

– Inactive or dormant accounts

59 million wallets hold $1-1000, which may include:

– dApp and DeFi users

– Early adopters or tech enthusiasts

– Casual traders

– Users building their crypto assets

– Users diversifying their assets into multiple wallets

676,000 wallets hold $1000+, which may represent:

– Institutional entities

– Large traders

– Whales

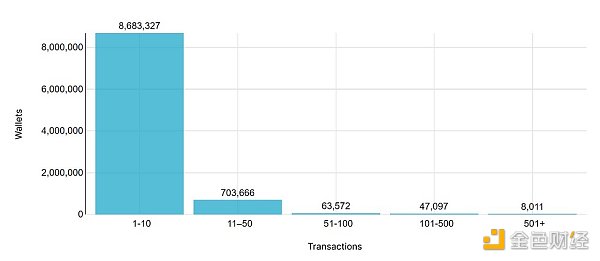

The following figure shows on-chain activity among Web3 users:

Wallet allocation based on trading volume over the past 30 days:

8.6 million users participated in 1-10 trades, indicating occasional or infrequent use. This group may include:

-Long-term holders

-Temporary participants in the Web3 space

55,000 users participated in 101+ trades, representing activities such as:

-Wallets operated by bots

-Professional day traders

-Business entities facilitating cryptocurrency trading

-Liquidity mining or yield farming in the DeFi space

We also noted that:

-Activity levels in Web3 may actually be higher, as 90.7% of wallets with $100-1000 and 87.8% of wallets with $1001+ had no activity in the last 30 days.

-7.8% is the retention rate in Web3 (calculated as the percentage of wallets aged 90-120d that had at least 1 outgoing transaction in the past 30d).

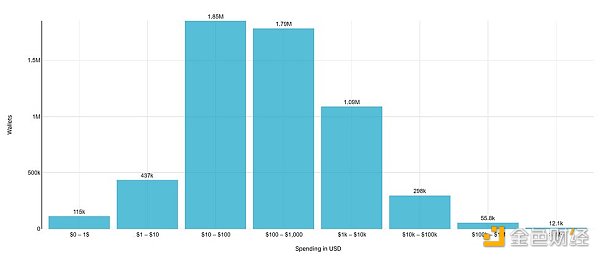

The following chart shows the spending habits of Web3 users:

Wallet allocation is based on money spent by Web3 users (in USD). Note: calculations include trades made in ETH, USDT, USDC, and DAI on Ethereum, as well as trades made in USDT, USDC, and DAI on Polygon. Gas fees are not included.

2.4 million users spent ≤$100 in the last month, potentially being:

-Users with low financial activity

-Low-income users or occasional traders

-Holders

-Users avoiding costs

1.79 million users spent $100-1000, potentially suggesting:

-Intermediate traders or investors

-Regular users using cryptocurrency for daily needs, small purchases, or in-game transactions

366k users spent $1000+, potentially being:

-Institutional investors

-High net worth individuals

-Liquidity providers

-Project founders or developers

Note: This analysis assumes that one wallet is associated with one user, but this may not always be the case as users can operate multiple wallets. Additionally, the nature of trades is not specifically defined and requires further scrutiny.

1 inch, 96.3k holders, market cap $386.1 million

MKR, 93.1k holders, market cap $625.7 million

cETH, 70k holders, market cap $524.2 million

IMX, 53.6k holders, market cap $1.2 billion

HT, 52.5k holders, market cap $1.3 billion

LDO (PoS), 51.2k holders, market cap $1.6 billion

OKB, 59k holders, market cap $11.9 billion

TUSD, 59k holders, market cap $728.6 million

NEXO, 51k holders, market cap $593.3 million

FRAX, 49.3k holders, market cap $1 billion

RNDR, 45.2k holders, market cap $938.8 million

BlockingXG, 31.2k holders, market cap $495.8 million

THETA (PoS), 28.2k holders, $5.3 billion market cap

BIT, 26.8k holders, market cap $4 billion

WOO, 24.3k holders, market cap $495.1 million

FXS, 19.1k holders, market cap $466.3 million

GNO, 17.3k holders, market cap $1 billion

INJ, 15k holders, market cap $559 million

rETH, 14.4k holders, market cap $783.6 million

MASK, 14.4k holders, market cap $336 million

RPL, 9.4k holders, market cap $757.6 million

PEPE, 149k holders, market cap $579.7 million

GUSD, 9k holders, market cap $567.8 million

KCS, 6.1k holders, market cap $1.1 billion

LEO, 2.5k holders, market cap $2.3 billion

frxETH, 1.1k holders, market cap $376.5 million

From the above data, we can see that stablecoins USDT, USDC, and DAI are the top three, indicating that they are the preferred choice due to their stability.

Utility tokens such as BNB, LINK, MATIC, and UNI represent a wide range of utility tokens in the list. The potential reason for their high adoption rate is their key role in the blockchain ecosystem, supporting decentralized trading platforms, oracle services, and transaction fees.

Meme tokens: It is clear that online trends and communities can create real-world value in the crypto market through the combination of SHIB and PEPE.

Low holder count but high market cap: Tokens like LEO and OKB have high market caps despite having fewer holders, indicating wealth concentration and potentially lower decentralization.

2) Largest NFT collectors

Collections with the largest user base (Collections are ranked by largest, wealthiest, and most active user bases in this section.)

-Anicube Origin NFT Collection, 1.3 million holders, 2,100 people with a balance of $100 or more, 5,700 transactions in the past 30 days

-Anicube Origin Collection (ANICUBE), 1.3 million holders, 1,600 people with a balance of $100 or more, 3,800 transactions in the past 30 days

-N/A, 1.2 million holders, 78,100 holders with a balance of $100 or more, 222,500 transactions in the past 30 days

-CryptoTab JackBot, 891,500 holders, 568,700 holders with a balance of $100 or more, 261,700 transactions in the past 30 days

-SMART DIVING GAME, 775,400 holders, 247,700 holders with a balance of $100 or more, 184,100 transactions in the past 30 days

-Galxe OAT, 719,100 holders, 57,000 holders with a balance of $100 or more, 210,600 transactions in the past 30 days, on-chain achievements

-ENS, 698.1k holders, 253.5k holders with a balance of $100 or more, 242.1k transactions in the past 30 days, name service

-Lemon Nation, 581k holders, 3 people with a balance of $100 or more, 1 person with a transaction in the past 30 days

-YBNFT, 533,700 holders, 364,400 holders with a balance of $100 or more, 119,300 transactions in the past 30 days

-Series 0 Claw Collectible Blockingtch, 379,300 holders, 329 people with a balance of $100 or more, 478 transactions in the past 30 days, gaming

3) Collections with the wealthiest users

-CryptoTab JackBot, 891,500 holders, 568,700 holders with a balance of $100 or more, 261,700 transactions in the past 30 days

– ENS, with 698.1k holders, 253.5k holding $100 or more, and 242.1k transactions in the past 30 days, name service

– N/A, with 1.2 million holders, 78,100 holding $100 or more, and 222.5k transactions in the past 30 days

– Galxe OAT, with 719.1k holders, 57k holding $100 or more, and 210.6k transactions in the past 30 days, on-chain achievements

– SMART DIVING GAME, with 775.4k holders, 247.7k holding $100 or more, and 184.1k transactions in the past 30 days

– Orbiter Trainee Pilot NFT, with 162k holders, 27.2k holding $100 or more, and 162k transactions in the past 30 days

– Mainnet Alpha, with 124.1k holders, 71k holding $100 or more, and 124k transactions in the past 30 days, giveaways

– YBNFT, with 533.7k holders, 364.4k holding $100 or more, and 119.3k transactions in the past 30 days

– Verifiable Credentials, with 371.3k holders, 18.2k holding $100 or more, and 112k transactions in the past 30 days, on-chain achievements

– SLINGSHOT-USER-2022, with 230.3k holders, 37.9k holding $100 or more, and 106.6k transactions in the past 30 days

Key Observations:

DeFi Prevails: Many of the top-ranked collections in terms of user count, wealth, and activity are DeFi-related, reflecting its popularity and usage.

“Healthy” Collections: CryptoTab JackBot and ENS are consistent across all categories, with large user bases, a large number of wealthy users, and high levels of activity, indicating a healthy and active community, and/or perceived utility and value among users.

Rapidly Growing NFTs: Orbiter Trainee Pilot NFT and Mainnet Alpha have both added over 100k users in the past 30 days since launching in May 2023. However, there are not many users among them who hold $100 or more, indicating that these NFTs may still be growing or targeting less affluent audiences.

1. Robots

Wallets with fast transaction speed, large balance fluctuations, and strong balance capacity have increased in a short period of time. Robots account for 5.29k wallets with a total balance of $204 million.

Note: In your promotion strategy, distinguish between real user wallets and non-human wallets such as robots or algorithms. This is crucial because automation-driven non-human wallets may distort your engagement metrics and understanding of real user behavior.

2. Idles

Wallets that have been active at least once in the past and have been dormant for the past 12 months. Idles contains 16.9 million wallets with a total balance of $32.7 billion.

Note: Use retargeting ad campaigns with targeted notifications or emails. Show recent updates and offer return rewards. Use retargeting ads to emphasize the value of the product.

3. The Casuals

Medium-aged wallets (6 months or more) holding fewer than 100 NFTs and maintaining a balance of less than $1,000. The Casuals game contains 46.9 million wallets with a total balance of $565 million. On average, each person’s wallet holds $12, has 3 NFTs, and has made one transaction in the past 30 days. Only 4.6% of people made at least one transaction last month.

Note: Use success stories and community benefits to attract casual gamers. Implement rewards for frequent transactions and partner with platforms they love to stimulate activity.

4. Newcomers

Relatively new wallets created in the past 6 months with fewer than 100 NFTs and balances of less than $1,000. Newcomers account for 17.6 million wallets with a total balance of $180.1 million. On average, each person’s wallet holds $10, has 1 NFT, and has made a transaction in the past 30 days. 20% of them made at least one transaction last month.

Note: Provide beginner-friendly educational content for this group, with a focus on blockchain and NFT basics, product value and usability, and step-by-step guides on how to participate. Provide incentives such as rewards or bonus features for first-time transactions to encourage participation.

5. Enthusiasts

Established wallets (6 months or more), holding a large number of 100 NFTs, and with a balance of less than $1,000.

Enthusiasts have 719,000 wallets with a total balance of $56 million.

The average wallet holds $78, an impressive 713 NFTs, and has conducted 13 transactions in the past 30 days.

42% of them have made at least one transaction in the past month.

Tip: Enthusiasts invest moderately but value the experience and community of NFTs. Platforms that prioritize collector-centered services and community participation can attract them.

6. Natives

Established wallets (6 months or more) with balances between $1,000 and $10,000.

Natives have 942,000 wallets with a total balance of $3 billion.

The average wallet holds $3,200, 59 NFTs, and has made 3 transactions in the past 30 days.

14.7% of them have made at least one transaction in the past month.

Tip: To attract locals, prioritize in-depth and professional content and provide high-quality services. Remember, they seek to optimize and maximize the value of existing assets.

7. Whales

Wallets with balances over $10,000 and not marked as wealthy wallets. Whales have 118,000 wallets with a total balance of $257.5 billion.

The average wallet holds $2.2 million, 1300 NFTs, and has conducted 76 transactions in the past 30 days.

19.4% of whales have made at least one transaction in the past month, meaning that 80.6% of whales are passive traders with a total balance of $210 billion.

Tip: For whales, prioritize exclusive opportunities and personalized services to stimulate further investment. Get them involved in quality projects and use their community influence to increase platform visibility and growth.

8. Hyperactive

Wallets that made at least 101 transactions in the past month.

There are 55,100 wallets with a total balance of $11 billion. On average, each person holds $185,000, has 1,900 NFTs, and has made 981 transactions in the past 30 days.

Tip: To attract Hyperactive wallets with active trading needs, provide advanced digital asset management tools, exclusive access to NFT drops and digital asset IPOs, tailored financial strategies, personalized support, and advanced trading features.

IV. Conclusion

The purpose of this report is to accurately describe the current state of the cryptocurrency landscape with support from real data. Remember, effective market navigation in Web3 is based on the DYOR (Do Your Own Research) principle. The insights in this report can be best utilized when complemented with your own market understanding.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!