Author: Cook Sun Source: twitter, @Cook0x

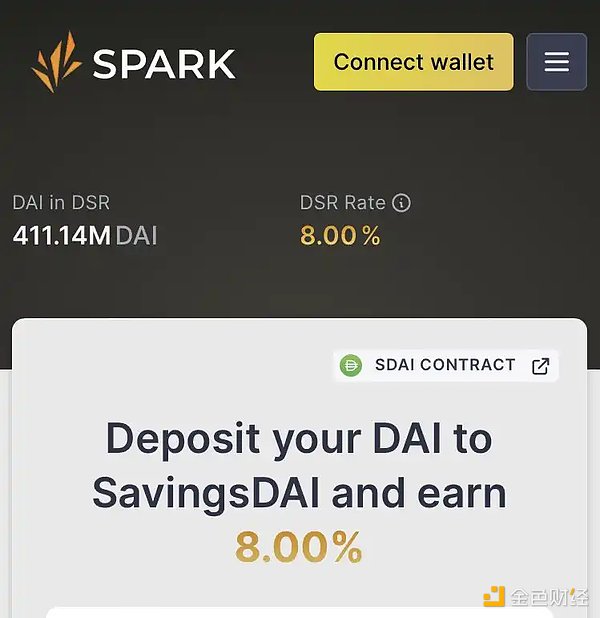

This article will elaborate on the source of the 8% annualized interest rate, what is DSR and EDSR. Since MakerDAO does not have an official deposit page, I will introduce 4 locations and steps to deposit $DAI.

First, let’s have a concept briefing: MakerDAO’s DSR, which stands for Dai Savings Rate, can be understood as the deposit interest rate for the stablecoin $DAI. By depositing $DAI into the deposit contract, you can automatically earn profits, similar to a traditional savings account in the real world.

The 8% interest rate proposed this time is strictly speaking a new mechanism called EDSR, which stands for Enhanced Dai Savings Rate, an enhanced version of the current interest rate model.

- SevenX Account Abstraction – Ethereum Account Evolution with ERC4337

- Open Letter from the Consensus Leader of Matter Labs to Jon Charbonneau Some Thoughts on Rollup

- Nouns proposal requires donating 100 ETH to a non-profit organization for knowledge sharing. Why vote in favor?

First, let’s talk about the source of the profits. We all know that an 8% return rate has already exceeded the returns of US Treasury bonds and other high-quality investment targets, so is it a real profit?

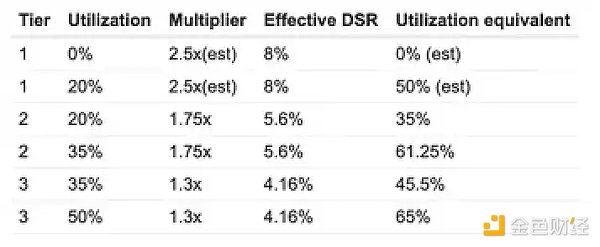

First of all, it is a temporary rate calculated in a stepwise manner. EDSR (Enhanced Dai Savings Rate) is a measure to temporarily increase the incentive for users to deposit when the utilization rate of DSR is low. EDSR is determined based on the utilization rate of DSR and gradually decreases as the utilization rate increases.

What is the utilization rate of DSR?

In simple terms, it is the ratio of the amount of $DAI deposited into DSR to the total amount, which means that as more $DAI is deposited into DSR, the interest rate will gradually decrease.

As shown in the figure below, after the utilization rate exceeds 20%, the interest rate will decrease to 4.16%.

It is also important to note that EDSR is a one-time, one-way temporary mechanism, which means that EDSR can only decrease over time and cannot increase again even if the utilization rate of DSR decreases.

In simple terms, there may only be one opportunity for 8%.

After analyzing the source of the 8% profit above, the principle is that assuming MakerDAO uses 100% of its stablecoin assets to buy RWA, only less than 20% of $DAI is receiving profits, so the overall return rate is the surplus, which constitutes the source of “8%> government bond returns”. (The specific real data needs to be accurately calculated here) It is equivalent to reducing the income of the DAO itself and distributing it to the depositors of $DAI.

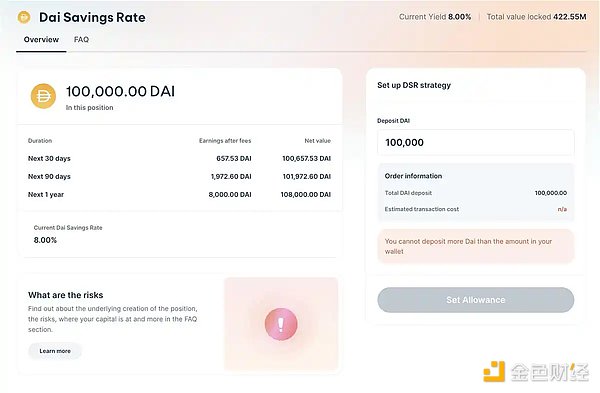

How to operate? – DeFiSaver (Smart Saving)

https://app.defisaver.com/smart-savings

– Choose Maker DSR in [Smart Saving];

– Enter the amount to be deposited in Supply;

– The estimated earnings per week/month/year are displayed on the right side.

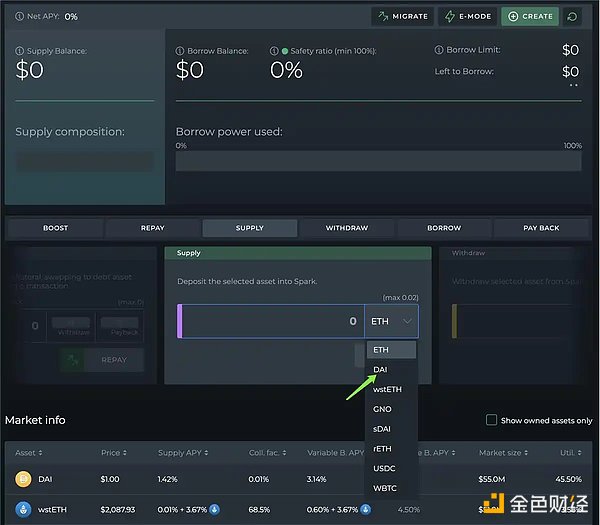

How to operate? – DeFiSaver (SLianGuairk)

https://app.defisaver.com/sLianGuairk

– In SLianGuairk’s Supply window, switch the currency to $DAI;

– After providing DAI, convert it to sDAI, which can be used for collateralized loans;

– SLianGuairk is a lending protocol under MakerDAO, and sDAI is equivalent to aDAI in Aave, which means you can borrow while earning the deposit interest rate of DSR.

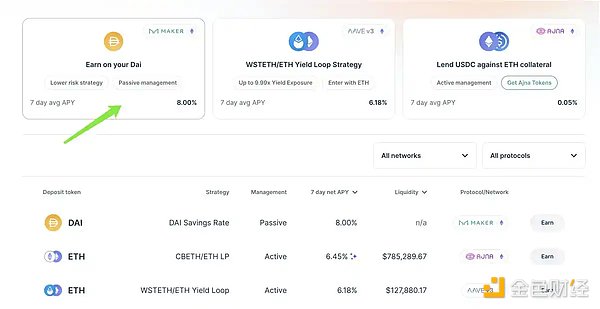

How to Operate? – SummerFi

https://summer.fi/earn

– Select Maker on the Earn page, and the subsequent operations are similar to DeFiSaver.

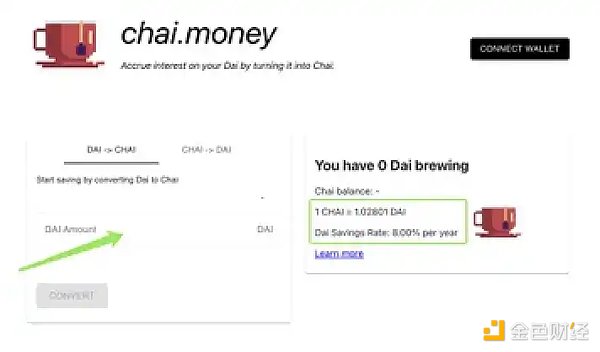

How to Operate? – chai.money

http://chai.money

$CHAI can be understood as a wrapped token that automatically helps you accumulate the principal and interest of $DAI in DSR.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!