Author: Qin Xiaofeng

Recently, FTX, which has already gone bankrupt, has had a lot of new developments, and combined with the questioning of Binance’s frequent “liquidity crisis,” it has further caused market panic. Under the multiple factors, users’ attention to Proof of Reserves (PoR) on CEX platforms has once again increased.

It has been 10 months since the collapse of FTX, the CEX that once claimed to improve industry transparency and regularly release PoR reports. Are they really fulfilling their promises?

Odaily Star Daily conducted investigations on several platforms, including Binance, OKX, Bitget, Kucoin, Bybit, HTX (formerly Huobi), Gate, and Crypto.com, and found some interesting situations.

- What has Avax done in the RWA field?

- Hydro Protocol The Ultimate Staking Platform based on Injective

- A quick overview of popular opBNB ecosystem projects on L2 networks

1. Platforms like Binance regularly release PoR reports

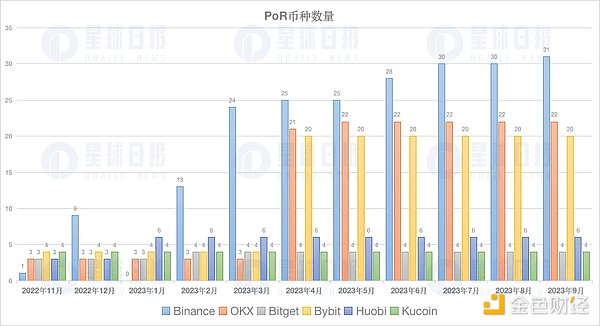

Binance, OKX, Bitget, and Kucoin have been releasing monthly PoR reports since November last year after FTX, and provide users with Merkle Trees for open-source verification. Among them, Binance upgraded its system in January this year, using zk-SNARK technology to upgrade its reserve proof system, and “missed” one issue; Bitget also lacked one report in February due to platform-wide upgrades.

Among the other platforms, Bybit releases one report every two months, with a total of five PoR reports. HTX (formerly Huobi) claims to update data at the beginning of each month, but the official website cannot view past PoR reports. Currently, only data from September 1st is available. The data mentioned later in the statistics are extracted from the official news releases, which may not be complete.

(Gate report)

Gate currently only has “reserve proof” issued by a third-party audit institution, with publication dates in May 2020 and October 2022. There has been no related data since then, and no verification tools are provided; Crypto.com only released an asset proof in December last year, and the promised Merkle Tree asset proof has not been launched yet.

2. Binance has a significant lead in total reserves, and BTC reserves of multiple CEX are rising

From the data reported by various platforms, Binance’s total asset reserves are significantly ahead, ranking first every month, even more than the sum of the reserves of other platforms; OKX ranks second after Binance consistently; Bybit surpassed HTX (formerly Huobi) and ranked third starting from May this year. The changes in reserves of each platform are shown in the video below:

(CEX reserve ranking, click to play the video)

Overall, the asset reserves of each platform have shown significant growth compared to when they were first announced. One important reason is that the number of currencies involved in the reserve announcement is increasing. Taking Binance as an example, the November 2022 report only disclosed BTC reserves, and the December report increased to 9 types. Since then, it has been increasing continuously. The latest September report includes a total of 31 tokens, the highest among all CEX PoR reports.

OKX ranks second in terms of the number of listed cryptocurrencies, starting from 3 and increasing to 21 in April of this year – currently 22; Bybit is second only to Binance and OKX, starting from 4 and increasing to 20. Bitget and Kucoin have remained steadfast, always offering four types – BTC, ETH, and two stablecoins (USDT, USDC).

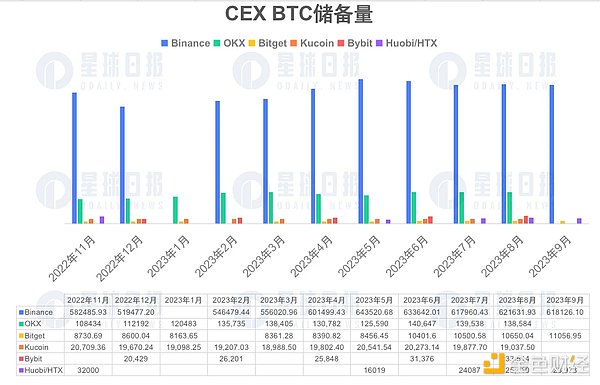

Another consideration is the BTC reserves. According to statistics from Odaily Star Daily, Binance has the most BTC reserves, currently about 618,000, followed by OKX (138,500). The BTC reserves of each platform are as follows:

Binance, OKX, Bitget, and Bybit have all seen significant growth in BTC reserves compared to 10 months ago, with increases of more than 10% across the board. Bybit has the highest increase (64%), followed by OKX (27.7%) and Bitget (26.6%); HTX (Huobi renamed) has the largest decrease, with BTC reserves once halved and currently rebounding to 23,973.

The last indicator is the cleanliness of reserves, that is, the proportion of non-platform coins in total assets. Bitget and Kucoin’s PoR reports do not involve the platform and have been excluded. Among the other four, Bybit has the highest cleanliness of reserves, exceeding 95% in the reports of April, June, and August; Binance follows closely, with the cleanliness of reserves maintained above 85%, reaching a maximum of 87.69%; OKX and HTX (Huobi renamed) have cleanliness of reserves between 50% and 60%, in other words, close to 40% of the reserves are platform coins – when counting HTX platform coins, HT and TRX are included.

III. Analysis of Specific Reserves for Each Platform

Binance’s total reserves started at $9.451 billion in November 2022 when first announced, reaching a peak of $69.905 billion in May this year. However, due to panic caused by SEC’s lawsuit against Binance in June, there was a significant outflow of funds, and the final figure for that month was $65.343 billion.

In the past two months, Binance’s total asset reserves have continued to decline, but its BTC and ETH reserves have not significantly decreased compared to June. One possible explanation is that the overall cryptocurrency market has been in a downturn, resulting in a decrease in the value of total asset reserves.

(Click to play video on Binance’s asset reserve changes)

In the past 10 months, there have been several noticeable changes in OKX: first, the BTC reserves have been constantly increasing; second, the reserves of stablecoins have also been growing, from an initial $3.06 billion to $5.43 billion, with an increase of over 70%. However, the value of OKX’s platform coin reserves has always been above $10 billion, accounting for over 40%.

Both Bitget and Bybit have seen a continuous increase in their BTC reserves and total asset reserves, showing a positive trend. This may be attributed to their strategy of grabbing various new coins to gain higher market attention. Kucoin, on the other hand, has not experienced significant changes overall. Additionally, according to Nansen data, the proportion of platform token KCS in Kucoin addresses is 12.7%, and its reserve asset cleanliness exceeds 85%. Odaily will continue to track the asset reserve situation of various CEX platforms.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!