Introduction

Recently, the announcement of Compound founder Robert establishing a new company focusing on the tokenization of US debt on the blockchain has sparked a narrative around Real World Asset (RWA) tokenization. As a result, the price of Compound’s token COMP has skyrocketed. In addition, leading RWA protocol MakerDAO and lending protocol Aave have also experienced significant price increases.

Compound and Aave have similar product forms, and we have previously published business data related to MakerDAO. Therefore, this article mainly analyzes the fundamental data of Aave and Compound from three main perspectives: lending business, token emissions, and protocol revenue and expenses.

Summary

- Comprehensive Explanation of Lybra Finance, the Leading Stablecoin Mechanism Risks, Returns, and the Positive Premium Attributes of Interest-bearing Assets

- Both parties in the United States submit a new DeFi bill, facing strong opposition from the crypto community.

- How to build a decentralized Binance? – The most detailed overview of trading infrastructure across the network

Aave has a funding volume 2.6 times that of Compound, making it the largest protocol in the DeFi lending field. Although Compound was the first protocol to propose the concept of a money market pool for lending, its conservative team and lagging business expansion have led to a lack of subsequent development. Aave, on the other hand, seized the opportunity of multi-chain development and has an innovative team, allowing it to rise to the top.

The security of DeFi protocols is fundamental to project development, and reducing potential protocol risks is the most important task for the teams. Both Aave and Compound have risk isolation measures in their product designs. However, Compound’s current approach is more aggressive, directly reducing the complexity of the protocol by isolating each asset pool based on different underlying assets. This also means that Compound has given up some market share of altcoins as underlying assets. Aave, on the other hand, tends to be a universal lending protocol that aims to capture more market share. It isolates new assets from the core asset pool to reduce potential risks associated with new assets as collateral.

In terms of risk control measures, both protocols introduce reserve funds as a remedy in the event of debt losses. In addition, Aave has an embedded safety module, where token stakers provide security for the entire protocol. This not only empowers the protocol token but also locks up a portion of token liquidity, reducing market inflation.

In terms of token emissions, the current emission volumes of both protocols are relatively low, and the impact of token selling pressure on the secondary market prices is minimal. Aave is an early protocol, with a circulating token supply of 90.5%, although some tokens are locked up by the safety module. Compound pioneered the concept of liquidity mining, but the liquidity it brought would be immediately sold when participants obtain substantial profits, which had a significant impact on the protocol. Therefore, Compound changed its liquidity incentive measures and distributed tokens to real users. The current circulating token supply is 68.6%.

The prices of COMP and AAVE tokens have both experienced significant increases due to the recent RWA narrative. However, in reality, the new company founded by the Compound founder is still in the application stage, and the RWA funding scale of Aave is only $7.65 million, which is only 0.3% of the funding volume of leading RWA protocol Maker.

In terms of protocol revenue and expenses, Aave has a more diversified income source, and all the interest from stablecoin GHO loans belongs to the national treasury. From the trend of treasury revenue, we can see that after the last bull market, Aave’s protocol revenue sharply decreased. However, the current protocol revenue is able to cover the protocol expenses, and Compound still needs to be subsidized by COMP token rewards. Compound has a relatively single source of revenue, and Aave’s protocol revenue is about 4 times that of Compound.

I. Basic Product Features

1. Product Versions

The initial version of Aave was peer-to-peer lending, but it was later revised due to inefficient loan matching, taking inspiration from Compound’s money market lending model to provide high liquidity. Aave is currently in version V3, which aims to provide higher capital efficiency, security, and cross-chain lending functionality.

Higher capital efficiency refers to the efficient mode (eMode), which classifies assets and sets risk parameters based on asset types. When the collateral of the borrower and the lent asset are of the same category, a higher loan amount can be obtained. Higher security refers to the isolation mode, where newly added lending assets through on-chain voting will first enter the isolation mode. Assets in this mode will have a debt ceiling, and when they are used as collateral, only permitted stablecoins can be borrowed, aiming to list more long-tail assets on the protocol while ensuring its security.

All of these features are currently available in V3, while the cross-chain lending (Portal) feature has reached a deployable state since the launch of V3 in March 2022. However, due to security considerations, the team has been cautious about the official deployment of this feature. This is because Aave’s cross-chain lending is not controlled by the Aave protocol itself, but introduces a third-party cross-chain bridge protocol.

Compound was the first DeFi protocol to propose money market lending, allowing for mutual borrowing between mainstream crypto assets. However, in V3, it deviates from the previous general lending approach and separates each asset pool based on the underlying assets. The purpose is to isolate the risk of the money market at the architecture level, avoiding irreversible losses to the protocol due to potential risks of individual assets.

Specifically, in Compound V2, the protocol allows users to freely deposit (collateralize) or borrow the supported assets. Collateral assets are self-explanatory, and the underlying assets are the assets that users borrow. In Compound V3, each pool will have only one unique underlying asset, but collateral assets are not restricted. Currently, the first underlying asset pool launched in V3 is USDC, which allows users to pledge mainstream crypto assets to borrow the stablecoin USDC.

2. Lending Business

When users choose a lending protocol, the primary consideration is the security of the assets. Under the premise of asset security, users usually prefer protocols with larger capital size because a larger capital size usually means better liquidity. In addition, other factors such as which side has more advantageous interest rates, supports more asset types, lending incentives, etc., will be compared between the two protocols from the above dimensions.

TVL data comes from defillama.com. After the last bull market, the overall scale of DeFi protocols has experienced a significant retreat. Compound and Aave are the leading protocols in the DeFi lending field. Currently, Aave’s capital is 2.6 times that of Compound, making it the largest protocol in the lending field.

Both Aave and Compound are currently deployed on multiple chains. However, Aave entered Polygon and other chains as early as 2021 and is in a leading position on other chains, occupying a larger market share. Compound, on the other hand, only started deploying on other chains this year. However, the Ethereum chain is still the main lending platform. Aave supports more types of altcoins, but due to potential risks associated with some tokens, they are frozen. Currently, the number of tokens supported by Aave is similar to that supported by Compound V2. Compound V3 supports very few asset types. The USDC basic market collateral includes ETH, WBTC, COMP, UNI, and LINK, while the ETH market collateral only includes wstETH and cbETH. Aave has supported stETH as collateral since February 2022, but Compound only started supporting wstETH and cbETH in January of this year. From this perspective, Compound’s progress in multi-chain development is slow, while Aave is more aggressive in business expansion, gradually widening the gap between the two.

Both use dynamic interest rate lending, with Ethereum blocks as the interest calculation unit, and Compound proposed it first. The core of the interest rate model is the utilization rate of funds, which is calculated based on market lending demand through algorithms, with little difference between the two. When the utilization rate of funds is high, the interest rate will also be higher. Both also introduce optimal interest rates, meaning that when the utilization rate of funds reaches a certain threshold, the borrowing interest rate will increase sharply, limiting borrowing and preventing liquidity depletion. Both stablecoins and altcoins in Aave have higher capital utilization efficiency than Compound.

In terms of the funding pool model, both have risk isolation measures. However, Aave’s funding pool still follows the whole-pool risk model. However, for the sake of protocol security, newly listed assets will enter isolation mode first, reducing the risk of these assets as collateral by setting specific risk parameters and specific underlying assets. Compound V3 isolates each asset pool based on different underlying assets, isolating risk from the system architecture level. However, this also means that Compound has given up some market share of altcoins as underlying assets.

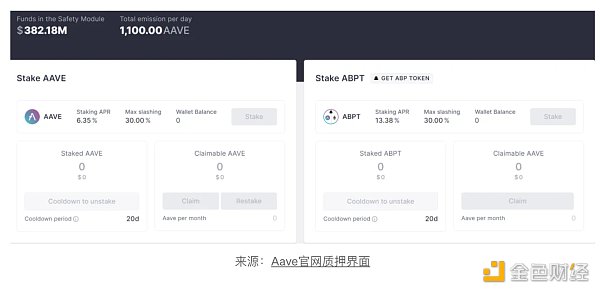

To address potential risks that may occur in the system, Compound introduces the concept of “reserve”. The system will allocate a portion of the loan interest as reserve according to the reserve factor to cope with protocol losses. In addition to charging reserves, Aave also uses a safety module to backstop the protocol. AAVE token stakers bear up to 30% of the protocol’s security risk. In return, stakers receive AAVE token rewards and protocol revenue dividends.

Compound is a protocol that pioneered the concept of liquidity mining, with COMP tokens as rewards, which are currently gradually decreasing. The Aave protocol launched relatively early, and its tokens are basically in full circulation. Currently, it can only collaborate with other project parties to incentivize liquidity, such as its collaboration with Polygon in June 2021, providing over $85 million worth of token rewards for Aave Polygon market liquidity mining.

3. Other Businesses

Stablecoins: Aave’s stablecoin GHO went live on the mainnet on July 15th. With a borrowing interest rate of 1.5%, it has a competitive advantage over other stablecoins. All GHO interest income will go to the treasury. Within two days of its launch, the total amount of GHO borrowed reached 2.21 million. The large-scale minting of GHO needs to pay attention to the team’s subsequent measures to promote liquidity. Compound currently has no plans to issue stablecoins.

RWA: Aave is the second DeFi protocol to introduce RWA assets after Maker. It collaborates with Centrifuge Tinlake, and the RWA market operates separately from the Aave lending market. The current capital size is approximately $7.65 million, far from Maker’s $2.3 billion scale. Currently, only the USDC market provides deposit and borrowing APY, while other markets no longer provide them. Users who have successfully passed KYC only need to deposit USDC in the USDC market to earn a basic annualized return of 2.83% and a 4.09% wCFG liquidity mining yield.

On June 29th, the founder of Compound announced that they had submitted the establishment documents for Superstate, a bond fund company, to the U.S. Securities and Exchange Commission. However, it is currently still in the application stage.

In terms of the development of lending businesses, although Compound was the first to open the capital pool lending protocol, its team is relatively laid-back, and its subsequent development is weak, with relatively stagnant business expansion. On the other hand, Aave seized the opportunity of multi-chain development, and its team has innovative awareness, gradually pulling ahead of Compound. The later one takes the lead.

II. Token Demand and Issuance

Aave released a new version of its economic model in July 2020, replacing the original LEND tokens at a ratio of 100:1 with AAVE tokens. LEND tokens are in full circulation. The total supply of AAVE tokens is 16 million, of which 13 million are available for the replacement of original LEND tokens, and the remaining 3 million are protocol issuance used for Aave’s ecosystem reserve.

The main use cases of AAVE in the protocol are governance and staking. The Aave protocol has a built-in Safety Module (SM) component, where token holders can stake their funds to serve as a backstop when there is a debt gap in the Aave protocol. In return, stakers can receive AAVE token incentives and share protocol revenue.

From the official website’s staking interface, it can be seen that the current daily emission of AAVE tokens is 1,100, which, based on the Coingecko price of $80.56 on July 15th, is worth approximately $886,000. The current circulating supply of AAVE tokens reaches 90.52%.

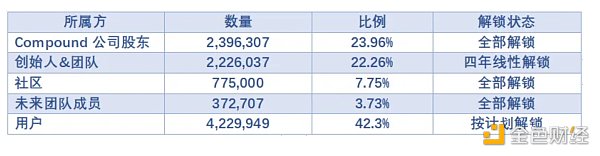

The Compound token is called COMP and was officially launched in June 2020 with a total supply of 10 million tokens. COMP is the governance token of the Compound protocol and is mainly used for protocol governance (proposal voting) and as liquidity incentives in the lending market. The initial allocation scheme for COMP is as follows:

Currently, the continuous unlocking pressure on the token mainly comes from the founders and the team, as well as the portion allocated to users. The allocation plan for the founders and the team is unclear, while the portion allocated to users is mainly used as incentives for lending activities.

According to a proposal passed on July 15, 2023, the incentives for users participating in the V2 market for borrowing and lending with USDC and DAI have been reduced from 161.2 COMP to 111.2 COMP. The total reward for borrowing and lending in the V2 market is 111.2 * 4 = 444.8 COMP per day (0.015 COMP per block for borrowing and lending market incentives respectively). A simultaneous proposal has also reduced the borrowing reward for the V3 lending market from 481.41 COMP to 381.41 COMP, while increasing the supply reward from 0 to 100 COMP per day. This transfers a portion of the borrowing incentives to the supply market, so the total reward for the V3 market remains at 481.41 COMP.

Based on the above proposal, the current daily emission of COMP is determined to be 926.21 tokens, with a value of approximately $685,000 based on the price of $74 on July 15th according to Coingecko. The circulating supply of COMP tokens currently accounts for 68.56%.

As relatively early DeFi protocols, both Compound and Aave have relatively low token emissions, and the selling pressure of tokens has a relatively small impact on the secondary market prices. The tokens of both protocols are mainly used for governance and incentives for protocol users. The difference is that Compound distributes tokens to users who actively participate in lending activities to attract liquidity, while Aave incentivizes token holders to pledge their tokens. This serves as a backstop for protocol debt and reduces token inflation. Currently, there are approximately 4.68 million tokens pledged in the safety module, so the actual circulating supply of AAVE is around 61.3%.

III. Protocol Revenue and Expenses

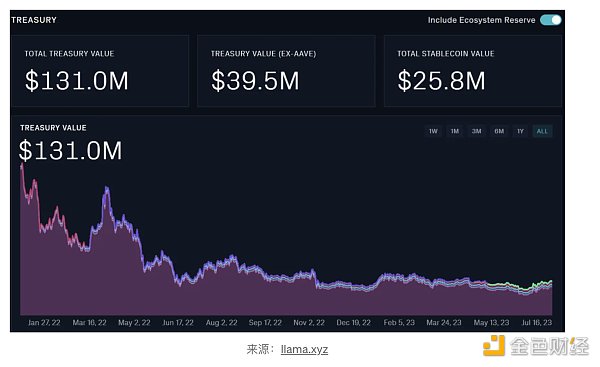

The Aave treasury consists of system reserves and treasury collectors. The sources of revenue for the Aave protocol are as follows: 1) The interest rate spread between borrowing and lending, which varies depending on the market rates; 2) Flash loan fees, which are typically 0.09% of the borrowed amount, with 30% going to the protocol treasury and the remaining 70% distributed to depositors; 3) GHO coin minting revenue; 4) In V3, instant liquidity fees, liquidation fees, and portal fees paid through bridging protocols will also be charged, but the latter two have not been activated yet.

The Aave treasury currently has an accumulated value of $130 million, with $91.5 million (1.2 million tokens) in the form of AAVE tokens as ecosystem reserves, and the remaining $25.8 million in stablecoins.

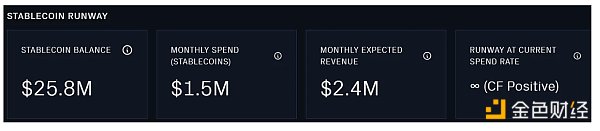

The above data is from llama.xyz, which is an officially recognized data source by Aave. However, the data on the website is only available from January 2022. Taking the revenue and expenses in June 2023 as an example, the monthly expenditure (token incentives) is $1.5 million, the monthly revenue is $2.4 million, and the surplus is $900,000. This data is consistent with the data from Token Terminal.

The source of income for the Compound protocol comes only from the interest rate spread on borrowing and lending, as there is no official statistical website provided. In order to maintain consistency, Token Terminal data is used as a reference.

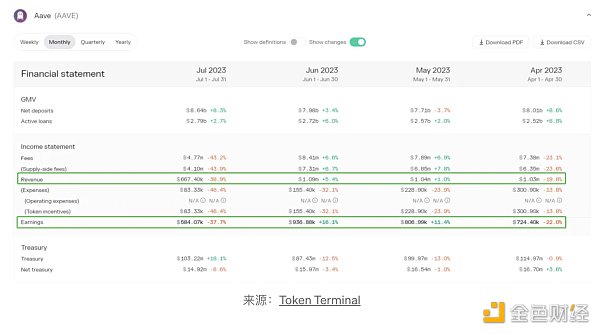

In the calculation by Token Terminal, protocol revenue = fees paid for borrowing – interest paid on deposits (supply-side fees), and earnings are protocol revenue minus liquidity incentives.

The revenue of the Aave protocol has been gradually increasing since May 2021, with the peak period from September to November 2021. After that, the revenue gradually declined, and by April 2022, the monthly revenue had significantly decreased to $1.9 million. By October 2022, the monthly revenue was only $860,000, which is 12.6% of the peak period revenue (calculated as (86/680)*100%), and it continues to decline. From March 2023, the protocol revenue started to recover, reaching $1.3 million per month.

Earnings are related to token price and the amount of tokens issued. The higher the token price, the lower the earnings. By December 2022, the protocol revenue was able to cover token incentive expenses. The main influencing factor was the decline in the price of the AAVE token. As of December 2022, the protocol has been profitable.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!