Starting from the end of June, Binance has “suddenly” accelerated its investment pace and has “bet” on more than 10 Web3 projects in just two months. Let’s take a look at which projects have been included in Binance’s investment layout:

-

On June 21st, Binance Labs announced a $10 million financing for leading the investment in Neutron, an intelligent contract infrastructure company; on June 29th, Mind Network, a decentralized zero-trust data lake, completed a $2.5 million seed round financing with participation from Binance Labs;

-

On July 5th, Web3 data intelligence company Web3Go completed a $4 million seed round financing with Binance Labs as the lead investor;

-

On July 13th, Xterio received a $15 million investment commitment from Binance Labs, aiming to develop AI and Web3 game development capabilities;

-

On July 20th, cross-chain DeFi lending protocol Radiant Capital received a $10 million investment from Binance Labs;

-

On July 24th, there were reports that UniSat Wallet was in communication with Binance Labs for a $50 million financing;

-

On August 3rd, zkLianGuaiss completed a $2.5 million seed round financing with participation from Binance Labs, Sequoia China, and others;

-

On August 4th, Binance Labs announced investments in four outstanding MVB VI projects, including Ethereum scaling project AltLayer, perpetual contract DEX KiloEx, DeFi lending protocol Kinza, and AI game Sleepless AI;

-

On August 10th, Binance Labs announced a $5 million investment to purchase CRV and support the deployment of Curve on BNB Chain;

-

On August 11th, Binance Labs invested $10 million in Helio Protocol to support its transformation into a liquidity staking platform;

-

On August 21st, Binance Labs announced an investment in zkWASM infrastructure provider Delphinus Lab;

-

On August 22nd, Binance Labs invested $2.2 million in zkWASM infrastructure provider Delphinus Lab;

-

On August 23rd, Binance Labs invested in DeFi yield protocol Pendle Finance.

Is Binance trying to save the sluggish cryptocurrency market?

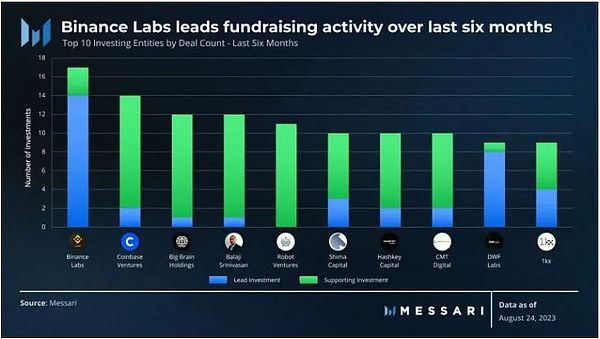

It is an undeniable fact that the cryptocurrency market has been sluggish recently, and Binance’s series of “stand-out” actions seem to express its confidence in the future potential of Web3 to the industry. According to disclosed data from Messari, Binance is the most “prolific” investor in the past six months, and more than 80% of its investment transactions are participated as “lead investors”.

As shown in the above chart, among Binance’s 17 investment transactions, 14 of them played the role of “lead investor”, which is nearly twice as many as the second-place DWF Labs. In contrast, among Coinbase Ventures’ 14 investment transactions, only 2 of them are “lead investors”.

Binance Labs was founded by Binance founder CZ in 2017. It is the venture capital department of Binance and aims to promote the development of blockchain and cryptocurrency. By tracking the projects it has invested in, it may potentially obtain astonishing returns. Currently, it has invested in more than 200 projects in over 25 countries, with a total funding of approximately $7.5 billion. Its investment portfolio covers almost all major tracks related to Web 3, including public chains, protocols, infrastructure, NFTs, blockchain games, metaverse, DeFi, and CeFi, etc.

For such a large-scale cryptocurrency investment institution, the sudden acceleration of investment in a short period of time cannot simply be regarded as an attempt to “rescue the market”. The reasons are obviously not sufficient. So why did Binance do this? Let’s continue to analyze it.

Can BNB take advantage and boost?

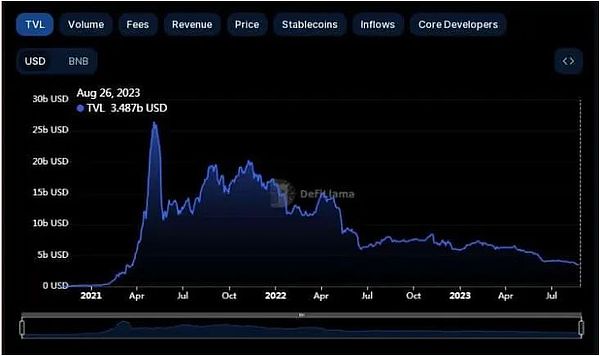

In fact, since the US regulatory agencies filed a lawsuit against Binance and concerns about the increasing number of hacking incidents, investors have been withdrawing assets from the Binance network. Although Binance continues to inject funds into other protocols, the liquidity of its native blockchain has been decreasing since 2023. According to data from DeFiLlama, the total locked value (TVL) on the BNB network has plummeted by 42% year-to-date (YTD).

As of the time of writing this article, CoinMarketCap data shows that the price of Binance Exchange’s token BNB has also dropped to the range of $217, with a loss of more than 10% in asset value compared to the previous month.

In such a background, choosing “strategic investment” may be a good solution, because the greatest effect brought by investment is that these verified Web3 projects can quickly expand to the BNB chain. Binance not only helps the invested projects to expand their business and provide financial support, but also provides professional knowledge analysis, thereby achieving a win-win situation.

In the current sluggish market environment, can Binance become a white knight in the cryptocurrency field? Let’s wait and see.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!