Compilation: GaryMa Wu on Blockchain

Nowadays, everyone who manages funds is conducting in-depth research on comparing the way the Federal Reserve dealt with inflation in the early 1980s with the current situation. Powell believes that he is the Paul Volcker of this moment (Paul Volcker, who is considered the Federal Reserve Chairman who ended inflation in the 1970s), so we can expect him to try the same approach (bold rate hikes) to get rid of inflation in the United States. Since the end of 2021, when the Federal Reserve first revealed that it would begin tightening monetary policy through rate hikes and tapering, he has said this in almost every interview.

The problem is that the current economic and monetary conditions in the United States are very different from those in 1980. The methods that worked under ideal conditions in the past will not succeed in today’s difficult and fiercely competitive era.

Through this article, I want to show readers the reasons why the Federal Reserve is destined to fail, and the more they try to use Volcker economics to correct the “course”, the more they will push the United States in the opposite direction of their expected goals. The Federal Reserve hopes to reduce domestic inflation in the United States, but the more they raise interest rates and reduce their balance sheet, the more incentives they provide to wealthy asset holders. The U.S. federal government will demand a change in strategy from the Federal Reserve. I will quote a paper written by Dr. Charles Calomis, an economics professor at Columbia University, which was published by the St. Louis Federal Reserve Bank. The Federal Reserve System is quietly telling the market that it has made mistakes and outlining the path to redemption. As we know, the path to redemption always requires more financial repression and money printing. Good news for Bitcoin!

- Coinbase releases Principle of Neutrality plan

- First Republican primary debate What is the candidates’ stance on encryption?

- Adam Cochran Why Coinbase’s L2 won’t violate US laws

Controlling the Quantity or Price of Money?

The Federal Reserve currently wants to control both the quantity and price of money, but it is having trouble with the order.

The Federal Reserve controls the quantity of money by changing the size of its balance sheet. The Federal Reserve buys and sells U.S. Treasury bonds (UST) and U.S. mortgage-backed securities (MBS), which causes fluctuations in its balance sheet. When the balance sheet increases, they call it quantitative easing (QE); when it decreases, they call it quantitative tightening (QT). The trading desk of the Federal Reserve Bank of New York manages these open market operations. With the Federal Reserve holding and trading trillions of dollars worth of U.S. Treasury bonds and MBS, I believe the U.S. fixed income market is no longer free, as there is an entity that can print money at will and unilaterally change banking and financial rules, always trading in the market and keeping interest rates at politically convenient levels. Unless you want to suffer, do not confront the Federal Reserve.

When Volcker became the Chairman of the Federal Reserve, he proposed what was considered a crazy policy at the time: targeting the quantity and allowing the price of money (the federal funds rate “FFR” or short-term interest rate) to fluctuate with market desires. Volcker didn’t care if short-term interest rates soared; all he wanted was to withdraw money/credit from the financial system. It is crucial to understand this; in the 1980s, the Federal Reserve could raise or lower its policy rates, but it did not attempt to force the market to trade at those levels. From the perspective of the Federal Reserve, the only thing that changed was the size of its balance sheet.

Recently, the Federal Reserve has been seeking to ensure that short-term market rates match its policy rates. The Federal Reserve achieves this goal by setting rates between its reverse repurchase agreement (RRP) and interest on reserve balances (IORB), which serve as the upper and lower bounds for its policy rates.

Approved participants such as banks and money market funds (MMF) are allowed to deposit dollars with the Federal Reserve on an overnight basis and earn the reverse repurchase (RRP) rate set by the Federal Reserve. This means that retail and institutional depositors will not earn yields on dollar-denominated bonds lower than this rate. Why take on more credit risk for less interest than depositing with the Federal Reserve risk-free?

To keep a certain amount of bank reserves at the Federal Reserve, the Federal Reserve bribes banks by paying them interest on these balances. The interest on reserve balances (IORB) rate is another limiting factor which prevents banks from lending to individuals, companies, or the US government at rates lower than those they receive risk-free from the Federal Reserve.

There is also an argument that the Federal Reserve must pay interest to RRP and IORB depositors in order to reduce money supply. In total, these facilities hold nearly $5 trillion. Imagine the level of inflation if these funds were actually used to create loans in the real economy. The Federal Reserve has created so much money through its quantitative easing (QE) program after the 2008 financial crisis that it pays billions of dollars in interest each month to isolate these funds and prevent them from fully entering the monetary system. Whatever the reasons, by repeatedly “rescuing” the fiat banking system from destruction, they have created a terrible situation for themselves.

Currently, the Federal Reserve sets short-term interest rates and manages the size of its balance sheet. Powell has diverged from his idol Volcker in a very important aspect. In order to effectively manipulate short-term rates, the Federal Reserve must print money and hand it over to depositors of RRP and IORB. However, the problem with doing so is that if the Federal Reserve deems it necessary to raise rates and reduce the size of its balance sheet to curb inflation, it is tantamount to cutting off one’s nose to spite one’s face.

First, let’s isolate the banking system to understand why the current policies of the Federal Reserve are counterproductive. When the Federal Reserve engages in quantitative easing (QE), it purchases bonds from banks and credits them to reserve accounts held at the Federal Reserve (i.e., IORB increases). The opposite occurs during quantitative tightening (QT). If the Federal Reserve only engages in QT, then IORB will steadily decline. This means that banks must reduce loans to the real economy and demand higher rates to obtain any loans or securities investments because they hold billions of dollars in high-yielding bonds purchased from the Federal Reserve. This is one aspect.

On the other hand, banks still hold about $32 trillion in IORB, which they do not need and is stored at the Federal Reserve, earning interest. Every time the Federal Reserve raises interest rates, it gives billions of dollars to the same banks every month.

The Federal Reserve constantly adds (QE) and reduces (QT) reserves to banks in an attempt to control the quantity and price of money. Later, I will show mathematically how futile this is, but first I want to provide some background before presenting some tables.

Quantitative tightening (QT) does not directly affect ordinary individuals and corporate depositors; however, the Federal Reserve also influences these groups by giving billions of dollars to RRP depositors every month. The reason the Federal Reserve distributes cash to these people is because they want to control the price of money. This also directly offsets the contractionary effects of QT, as the Federal Reserve distributes free funds to wealthy speculators (individuals, companies, and banks). If you have a large amount of cash and want to conduct zero financial analysis and take zero risks, you can deposit it at the Federal Reserve and earn an almost 6% return. Every time the Federal Reserve raises interest rates, I cheer because I know I will receive more free funds in my money market fund account.

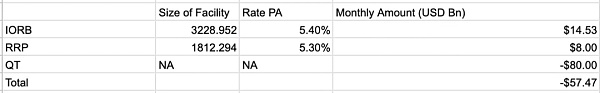

To summarize how the Federal Reserve contradicts itself, here are some convenient tables.

From these two tables, you would conclude that the Federal Reserve is still tightening because a total of $57.47 billion in liquidity is being extracted each month. However, I omitted an important source of free funds release: interest payments on U.S. government bonds. In the next section, I will explain how the Federal Reserve’s actions affect the U.S. government’s fundraising through bond sales. When this factor is taken into account, Mr. Powell’s efforts seem even more unrealistic.

The era of simple interest rate hikes to solve inflation is over

One historical background to Paul Volcker’s ending of inflation through interest rate hikes in the 1970s is that in 1980, U.S. debt as a percentage of GDP was 30%, compared to 118% today. Such a large debt would greatly impact the effectiveness of interest rate hikes, as the U.S. Treasury needs to issue more new debt to repay old debt, provide funds for interest payments on the current debt, and pay for government expenditures, ultimately leading to the Treasury having to pay huge amounts of interest.

CPI Index: Services Component is a Large Proportion

Why is the U.S. economy growing rapidly while regional banks are struggling, and various indicators show that small businesses driving the U.S. economy are in trouble? This is because the wealthy are consuming heavily in the service sector.

Although logically, when people receive subsidies, they would purchase daily necessities under the guidance of the government’s thinking, thus driving inflation in goods. However, the wealthy already have all these things. When you give money to the wealthy, they spend more on services and buy more financial assets.

Service projects account for a large part of the Consumer Price Index (CPI) basket. The Federal Reserve has proposed a “super core” inflation measure, which basically refers to services.

Powell and his team are focused on significantly reducing this inflation measure. However, if every time they take action (raise interest rates), it actually makes the largest service consumers wealthier, then how can this inflation decrease?

Differentiation of asset returns

Before I look into the future, let’s take a look at some recent developments.

We need to know that even though the Federal Reserve is injecting liquidity into the market, it doesn’t mean that all assets will rise.

Using March 8, 2023 as a benchmark (the day Silvergate Bank filed for bankruptcy), I observed the performance of the US Regional Bank Index (white), Russell 2000 Index (green), Nasdaq 100 Index (yellow), and Bitcoin (magenta).

Aside from the too-big-to-fail banks, regional banks performed poorly, falling by 24%.

If the regional banks themselves are struggling, then the companies that employ workers and drive the US economy, relying on regional banks for credit, will also be unable to obtain credit due to the damage to their balance sheets. Therefore, these companies will continue to be unable to expand and in many cases go bankrupt. This is what the Russell 2000 Index tells us, as it consists mainly of smaller companies. In the past quarters, this index has barely risen.

Tech giants do not heavily rely on banks, and the recent AI hype has also benefited them. If the US banking system is unhealthy, tech companies don’t care either. People with idle capital are willing to chase after tech stocks again and again. This is why the Nasdaq 100 Index has risen by 24% since the banking crisis erupted.

One of Bitcoin’s value propositions is that it is a remedy for a broken, corrupt, and parasitic fiat currency banking system. Therefore, as the banking system collapses, Bitcoin’s value proposition becomes even stronger. As a result, as the denominator of fiat currency increases, Bitcoin’s value in terms of fiat currency also increases. This is why Bitcoin has risen by 18% since March.

In a predicament

Inflation has always been a top concern for any population. If people can work hard and buy more with less money, they actually don’t care about the personal characteristics of those in power. However, when gasoline or beef prices soar, politicians who must run for re-election will find themselves in a predicament. Good politicians know that if there is inflation, they must control it.

The Federal Reserve will continue this absurd strategy of trying to control the quantity and price of money because of political needs. Powell cannot stop until politicians give him the signal to fix everything. As the 2024 US election approaches, the Federal Reserve is more paralyzed than ever before. Powell does not want to change the Fed’s policy between now and November next year because he is afraid of being accused of supporting a certain political party.

But the math doesn’t add up. There must be a change. Look at the chart below – depositors continue to withdraw funds from banks with low deposit rates and put them into MMFs, essentially depositing funds into the Fed. If this continues, small banks in the United States will continue to go bankrupt one after another, which will be a direct impact of Fed policy.

In addition, due to declining tax revenues and soaring fiscal deficits, the US Department of the Treasury is increasing the amount of bond issuance. With the rise in currency prices (provided by the Fed) and the increase in debt issuance, interest expenses will become larger and larger. There must be a way to solve this problem…

The best thing about those in charge of affairs now is that although they may be intellectually dishonest, they won’t lie to you. Fortunately, they will also tell you what they will do in the future. You just need to listen.

Fiscal Dominance

For those who want to understand how the Federal Reserve and the US Department of the Treasury are doing well in both mathematics and politics, there is a great read: the most important paper published earlier this year by the St. Louis Federal Reserve Bank. They have a research institution that allows renowned economists to publish papers. These papers influence the policies of the Federal Reserve. If you take investment seriously, you must read this paper in its entirety. I will only quote some parts of it.

Dr. Calomiris explains in detail what fiscal dominance is and its practical implications, and I would like to give readers a brief summary:

● Fiscal dominance, that is, the accumulation of government debt and deficits may have an inflationary impact that “dominates” the central bank’s intention to maintain low inflation.

● Fiscal dominance occurs when the central bank must formulate policies not to maintain stable prices, but to ensure that the federal government can raise funds in the debt market. At this time, the government’s bond auction may “fail” because the market demands very high interest rates for the issuance of new bonds, to the point that the government withdraws the auction and chooses to print money as an alternative.

● Since the government needs the yield on debt to be lower than nominal GDP growth and/or inflation, investors are not interested in buying these debts. This is the definition of negative real yield.

● In order to find a “fool” to buy these debts, the central bank needs to require commercial banks to deposit a large amount of reserves with it. These reserves do not earn interest and can only be used to purchase government bonds. (So the “fool” here refers to commercial banks)

● As the profitability of commercial banks declines, they are unable to attract deposits for lending because the deposit rates they are allowed to offer are much lower than the nominal GDP growth and/or inflation.

● Since depositors are unable to obtain real returns in banks or government bonds, they turn to financial instruments outside the banking system, such as cryptocurrencies. In many cases, commercial banks themselves actively participate in transferring funds to different jurisdictions and/or asset classes to obtain fees from their clients. This is known as financial disintermediation.

● A mystery is whether commercial banks have enough political power to protect their clients and drive this financial disintermediation.

So why go through all this trouble instead of just telling the Federal Reserve to lower interest rates directly? Because, as Dr. Carol Mires puts it, it is an “invisible” tax that most Americans will not notice or understand. It is politically more convenient to keep interest rates higher when inflation is still destroying the American middle class, rather than openly instructing the Federal Reserve to start lowering rates and stimulate the market again, or worse, cutting government spending.

Dr. Carol Mires’ paper proposes a very solid “solution” to the problems of the Federal Reserve and the U.S. Treasury, that weakening the banks is the best policy choice if we move towards fiscal dominance.

Therefore, the Federal Reserve may require a large portion of reserves to be held as reserves, eliminate the payment of reserve interest, and terminate the payment of RRP balances, etc. Government agencies should not offer yields higher than long-term government bonds. Given that the whole purpose of this action is to keep long-term government bond yields below inflation and nominal GDP growth, it will no longer attract investors to deposit funds in money market funds (MMFs) and/or buy U.S. Treasury bonds. Therefore, the current lucrative yields obtained from cash will disappear.

Essentially, the Federal Reserve will end its attempt to control currency prices and instead focus on the quantity of money. The quantity of money can be changed by adjusting bank reserve requirements and/or the size of the Federal Reserve’s balance sheet. Short-term interest rates will be significantly reduced, possibly to zero. This helps regional banks become profitable again because they can now attract deposits and earn profitable interest rate spreads. It also makes financial assets outside of big tech companies attractive again. As the stock market rises overall, capital gains taxes increase, which helps fill the government’s coffers.

Why is weakening banks the best policy choice?

First, compared to new taxes enacted through legislation (which may be blocked by legislative bodies), reserve requirements are regulatory decisions made by financial regulatory authorities. They can be implemented quickly, assuming that regulatory agencies under pressure from fiscal policy have the power to change policies. In the case of the United States, whether to require reserves to be held against deposits and whether to pay interest on them depends on the decisions of the Federal Reserve Board.”

The Federal Reserve is not accountable to the public like elected representatives. It can act at will without the approval of voters. Democracy is good, but sometimes dictatorship is faster and stronger.

Second, because many people are unfamiliar with the concept of inflation tax (especially in societies that have not experienced high inflation), they do not realize that they are actually paying it, which makes it very popular among politicians.

Financial Disintermediation

Financial disintermediation refers to cash flowing out of the banking system into alternatives due to negligible interest rates. Bankers have come up with various novel ways to offer products with higher yields to customers, as long as the fees are substantial. Sometimes, regulatory agencies are not satisfied with this “innovation”.

Fiscal dominance has occurred in the United States during the Vietnam War. In order to maintain stable interest rates in the face of high inflation, US regulatory agencies imposed a cap on deposit rates at banks. In response, US banks established branches outside of London, mostly in London, beyond the control of US banking regulators, which could freely offer market rates to depositors. As a result, the Eurodollar market was born, becoming the world’s largest financial market in terms of trading volume, along with its related fixed-income derivatives.

Interestingly, efforts to control something often lead to the emergence of a larger and more difficult-to-control monster. Even today, the Federal Reserve and the US Treasury Department can hardly fully understand all the nuances of the Eurodollar market that US banks were forced to create to protect their profitability. Similar situations can also occur in the field of cryptocurrencies.

The leaders of these large traditional financial intermediaries, such as banks, brokerage firms, and asset management companies, are among the smartest people on the planet. Their entire job is to predict political and economic trends in advance and adjust their business models to survive and thrive in the future. For example, Jamie Dimon has long emphasized the unsustainability of US government debt burdens and fiscal spending habits. He and his peers know that a reckoning is imminent, and the result will be the sacrifice of their financial institution’s profitability to fund the government. Therefore, they must create something new in today’s monetary environment, similar to the Eurodollar market of the 1960s and 1970s. I believe that cryptocurrency is part of the answer.

The continuous suppression of cryptocurrencies by the United States and Western countries mainly targets the operators in the non-traditional financial circle, making it difficult for them to conduct business. Please think about this: the Winklevoss twins (two tall, handsome, Harvard-educated, tech billionaires) – why can’t they get approval for a Bitcoin ETF in the United States, but it seems that Larry Fink, the aging leader of BlackRock, is sailing smoothly? In fact, cryptocurrencies themselves have never been the problem – the problem lies in who owns them.

Now do you understand why banks and asset management companies suddenly became interested in cryptocurrencies shortly after their competitors collapsed? They know that the government is about to encroach on their deposit base (the weakening of banks mentioned earlier), and they need to ensure that the only available antidote to inflation, namely cryptocurrencies, is under their control. Traditional finance (TradFi) banks and asset management companies will offer cryptocurrency exchange-traded funds (ETFs) or similar types of managed products that allow customers to exchange their fiat currency for cryptocurrency derivatives. Fund managers can charge high fees because they are the only players that allow investors to easily convert fiat currency into cryptocurrency financial returns. If cryptocurrencies have a greater impact on the monetary system than the Euro market in the next few decades, traditional finance can recover the losses caused by unfavorable bank regulations by becoming the gateway to the trillion-dollar deposit base of cryptocurrencies.

The only problem is that traditional finance has created a negative impression of cryptocurrencies to the point where politicians actually believe it. Now, traditional finance needs to change the narrative to ensure that financial regulatory agencies provide them with the space to control capital flows, as the federal government needs to do so when implementing this implicit inflation tax on bank depositors.

Banks and financial regulatory agencies can easily find common ground by restricting any physical redemption of cryptocurrency financial products. This means that anyone holding these products will never be able to redeem and receive physical cryptocurrencies. They can only redeem and receive US dollars, which will immediately be reinvested into the banking system.

The deeper question is whether we can maintain Satoshi Nakamoto’s values in the face of the influx of trillions of dollars worth of financial products within the traditional financial system. Larry Fink doesn’t care about decentralization. What impact will large asset management companies like BlackRock, Vanguard, and Fidelity have on Bitcoin improvement proposals? For example, proposals to enhance privacy or resist censorship? These large asset management companies will be eager to offer ETFs that track the indexes of publicly listed cryptocurrency mining companies. Soon, miners will find that these large asset management companies will control a significant voting power of their stocks and influence management decisions. I hope we can remain loyal to our founders, but the devil is waiting, offering many irresistible temptations.

Transaction Plan Related

The current issue is how to adjust my investment portfolio, sit tight, and wait for the policy prescription described by Dr. Carlo Milis to take effect as the driving force of finance.

Currently, cash is a good choice because, broadly speaking, only tech giants and cryptocurrencies have beaten it in terms of financial returns. I have to make a living, unfortunately, holding tech stocks or most cryptocurrencies basically won’t generate income for me. Tech stocks don’t pay dividends, and there are no risk-free Bitcoin bonds to invest in. It is very good to earn a return of nearly 6% on my statutory reserves because I can cover my living expenses without having to sell or borrow against my cryptocurrencies. Therefore, I will continue to hold my current investment portfolio, which includes fiat currency and cryptocurrencies.

I don’t know when the US Treasury market will collapse, forcing the Federal Reserve to take action. Given the political demand for the Federal Reserve to continue raising interest rates and reducing its balance sheet, it is reasonable to assume that long-term interest rates will continue to rise. The yield on 10-year US Treasury bonds recently broke through 4%, reaching a local high. This is why risk assets like cryptocurrencies have been hit. The market views higher long-term interest rates as a threat to perpetual assets such as stocks and cryptocurrencies.

Felix predicted various market adjustments about to happen, including cryptocurrencies, in his recent note. His views are worth paying attention to. I must be able to earn income and be able to cope with market fluctuations in cryptocurrencies. My investment portfolio is prepared for this.

I believe I have the right future forecast because the Federal Reserve has already indicated that bank reserve balances must increase, and it can be foreseen that the banking industry is not happy about this. The rise in long-term US Treasury yields is a symptom of deep structural corruption in the market. China, oil-exporting countries, Japan, the Federal Reserve, etc. are no longer buying US Treasury bonds for various reasons. In the case of the usual buyers’ strike, who will buy tens of trillions of dollars of debt that the US Treasury Department must sell in the coming months at low yields? The market is moving towards the scenario predicted by Dr. Carlo Milis, and there may eventually be a failed auction that forces the Federal Reserve and the Treasury Department to take action.

The market has not yet realized that the faster the Federal Reserve loses control of the US Treasury market, the faster it will return to rate cuts and quantitative easing. Earlier this year, the Federal Reserve abandoned monetary tightening by expanding its balance sheet by hundreds of billions of dollars over several trading days to “save” the banking system from the impact of regional bank defaults, which has already proven this. An abnormal US Treasury market is beneficial for risk assets with limited supply, such as Bitcoin. But this is not the way investors traditionally train themselves to think about the relationship between risk-free sovereign bonds and risk assets denominated in fiat currency. We must go downhill to go uphill. I don’t plan to fight the market, I just sit tight and accept this liquidity subsidy.

I also believe that at some point, more investors will do the math and realize that the Federal Reserve and the US Treasury are distributing billions of dollars every month to wealthy depositors. This money has to go somewhere, and part of it will flow into tech stocks and cryptocurrencies. Despite the mainstream financial media’s catastrophic soundbites related to the significant drop in cryptocurrency prices, there is a lot of cash looking for suitable investment opportunities in limited supply financial assets like cryptocurrencies. While some people believe that the price of Bitcoin will fall below $20,000 again, I tend to think that we will hover around $25,000 in the early third quarter. Whether cryptocurrencies can withstand this storm will be directly related to the number of new interest earners and their interest income.

I’m not afraid of the weaknesses of cryptocurrencies; I will embrace them. Because I don’t use leverage in this part of my investment portfolio, I don’t care about significant price drops. By using algorithmic strategies, I will patiently buy several “altcoins” that I believe will perform well when the bull market returns.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!