Money is gone, operating costs are high, and financing is difficult. No one seems to be doing well in the bear market of the cryptocurrency industry.

By: Sharon

Editor: Jack

Although the recent Token2049 conference was lively, the current situation in the crypto industry seems to be stuck in a quagmire, unable to escape the overall low sentiment.

On September 21st, DeFi project Fuji Finance announced the cessation of operations, and users can withdraw funds through the user interface by 2024. This is the fourth project announced to cease operations in September this year. Previously, there were also DeFi projects Gro Protocol on September 20th, DeFi and NFT trading robot None Trading on September 20th, and NFT platform Voice founded by BM, the founder of the public chain EOS.

According to incomplete calculations by BlockBeats, there were 9 projects, exchanges, and communities that ceased operations in the cryptocurrency industry in 2021, 17 in 2022, and the number increased to 27 in 2023. At the same time, in 2023, the rate of project shutdowns is increasing, from an average of 1 per month to a maximum of 5 per month. Behind these events, every participant in the crypto industry, from community operations to project financing, has felt the chill of the bear market.

Increasing frequency of project shutdowns

Fuji Finance, as the “first DeFi aggregator” on Ethereum, has closed down due to lack of funds, just like Gro Protocol, another DeFi project.

In its press release, Fuji Finance stated, “Since February of this year, the Fuji team has been raising funds to continue developing the protocol and building the future of cross-chain DeFi operations. We couldn’t find a product that suits the market. As our funds continue to decrease, we have decided to start closing the company and ending operations, and there are no signs of the fundraising activities ending at the moment.”

Gro Protocol on September 20th also stated, “Although all Gro DAO contributors and members have put incredible dedication, time, and resources into this community and protocol over the past three years, Gro DAO finds itself facing significant challenges. The difficult market, poor performance of Gro Protocol, and key deviations of Groda Pod put Gro DAO in a critical moment and need to make decisions about its future.”

The decision is to cease operations and dissolve, which also received a support rate of 70.95% within the community and will focus on dissolving the DAO and stopping the operation of Gro Protocol from October 3rd to January 3rd, with a budget of 180,000 USDC. Users can withdraw assets at any time (without a time limit) from GVT, PWRD, and Pools.

The Gro DAO official website details the reasons for the project’s shutdown: first, the performance of the protocol—the flagship product of the DAO, the risk and return-graded Gro protocol, has performed poorly for a long time; second, the departure of key management personnel (“leadership vacuum”), coupled with the failure of other product Pods (LianGuainda) to expand, has triggered broader survival issues for the DAO.

Source: Gro DAO Governance

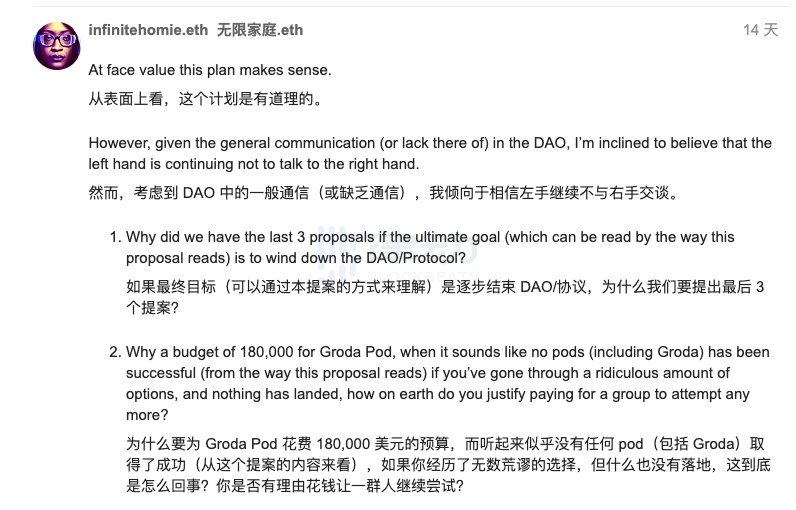

The departure of “4 key figures of Gro DAO, contributors, and community members” has also accelerated the dissolution process of the project. In response, there are doubts in the community about the allocation of funds in the proposal: “Why pay $170,000 to 2 people to simplify the product?” On the other hand, some people question the allocation of time and budget: “This is the worst time and budget reduction proposal I have ever seen.”

Source: Gro DAO Governance

If we go back in time, Voice, the NFT social platform founded by EOS founder BM, announced its shutdown on September 14th, citing “high uncertainty in the cryptocurrency and NFT market.” Voice was launched in June 2019, backed by Block.one, initially as a decentralized social platform, comparable to Twitter (X) and Facebook. BM called it “an application that will change the industry landscape.”

At that time, Voice can be said to have been born with a silver spoon. In order to facilitate the launch and better promote Voice, on the one hand, Block.one paid a $24 million fine to the SEC to prepare for the upcoming Voice compliance; on the other hand, BM spent $30 million to purchase the domain name Voice.com, making it the largest publicly disclosed domain name sale record in history. BM believed it was “expensive but valuable.”

Despite high expectations, Voice had poor user experience and a mediocre response from the community after its launch. In May 2021, Block.one announced that Voice would undergo an upgrade and transformation to become an NFT-based creation and social platform targeting emerging creators, but now it cannot escape the fate of being shut down.

In addition, Nifty, a Web3 creator platform that announced its shutdown on August 3rd, also cited “insufficient funding” as the reason. They stated on social media, “Earlier this year, considering our limited resources in a difficult market, we turned to develop a platform for Web3 creators. Since then, we have been committed to developing new products and seeking opportunities to obtain the necessary funding for continued development. Unfortunately, despite our best efforts, the investment opportunities we have been working hard on have not been successful, and we now find ourselves at the end.”

It can be seen that most of the projects that have announced their shutdown in the past month have been due to insufficient funding, which is also related to the current bear market situation. Recently, the PolkaWorld community has also temporarily suspended operations due to issues with fund allocation in proposals and new governance frameworks.

These projects rose during the bull market but exited during the bear market. Behind the chaos lies the root cause of money.

Has all the money been burned?

Founder of IOSG, a top-tier cryptographic industry venture capital firm in China, Jocy recently wrote that for many teams, if the bear market does not end, this (referring to Token2049) will be their last public appearance.

“LPs continuously support early-stage VCs that foster growth in the industry, and VCs constantly support founding teams in emerging sectors. Teams continue to expand and scale, seemingly moving in a better direction. But in reality, many teams are essentially hoping that Token2049 will be their last few rounds of financing. If the bear market does not end, this may be their team’s last brand exposure because most early-stage teams have exhausted their runway due to their expansion over the past two years. Some teams have a very high burn rate and in this market, they only have 5 to 10 months left, even resorting to buying overpriced tickets/sponsorships at Token2049 to pitch to potential investors.”

This also suggests to some extent that perhaps behind the recent announcements of multiple projects shutting down is the fact that the funds they raised have now been depleted. And looking at the fundraising history of several projects in recent times, this may indeed be the case. During the previous bull market, project financing was relatively easy, and VCs were generous with their money.

In March 2021, Gro Protocol announced the completion of a $7.1 million seed round, with Galaxy Digital and Framework Ventures leading the round and participation from Variant, Northzone, Nascent, and others. In July 2021, Nifty’s announced the completion of a $10 million seed round, with participation from Polychain Capital, Ethereal Ventures, Coinbase Ventures, A&T Capital, and others. Voice even raised $150 million in funding from Block.one.

2021 was during the bull market, and now that 2 years have passed, perhaps, as Jocy said, the money that was raised has been burned through. However, in the current bear market period, these projects face greater obstacles in raising funds, which is also one of the reasons for their shutdown and dissolution. But perhaps, just like what Nifty and Fuji said in their announcements, they have unwavering confidence in the industry’s development, but the current situation and conditions certainly have significant “uncertainty.” Perhaps in the next cycle, these project teams will revive and usher in a new summer.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!