Three token model has been proposed for some time, which essentially uses different tokens for different scenarios to explore different values. However, the application of this model still has a long way to go in China.

Tokens are the core pillar of decentralization, based on the new economic incentive mechanism of blockchain. The problem that token economics needs to solve is how to let global decentralized network participants collaborate around a common goal in a decentralized network.

Before the popularity of token economics, Web2 internet companies needed a lot of manpower and financial resources to unilaterally capture users and create value for themselves. Nowadays, Web3 applications can directly use tokens to incentivize users to improve network utility and create transferable value in ecosystem networks.

For example, the BTC network is designed to solve a point-to-point payment system and digital value storage problem, allowing network participants from all over the world to obtain value incentives by jointly maintaining nodes and supporting the network.

- The Rationality of the Three-Generation Token Model from the Perspective of Tokenization Theory

- Long Push: Value Assessment of DeFi Dual Token Model

- Singapore’s Monetary Authority of Singapore (MAS): Comprehensive explanation of the Purpose Binding Monetary (PBM) technology white paper.

This is the best use case for Web3 projects: design incentive mechanisms to coordinate the actions of decentralized parties to achieve a common goal.

With the development of the industry, the incentive model of the “single-token model” of blockchain basic protocols such as BTC and ETH can no longer meet the needs of multi-form scenarios and diversified participants in Web3 applications. Therefore, Dr. Xiao Feng of HashKey Group published a closing speech on “Three-Generation Token Model for Web3 Applications” at the 2023 Hong Kong Web3 Carnival, pointing out that there must be multi-party demands in Web3 applications, and the token model of the application layer of Web3 is different from that of the basic protocol. The basic protocol is a single-token model, which should be unified globally. The application layer should be a three-generation token model, and the application scenarios have their own characteristics.

“Three-Generation Token Model for Web3 Applications” summarizes the problems encountered in the operation of token economics in the past and provides valuable paths for the compliant development of the Web3 virtual asset industry, such as (1) compliance issues of the three tokens; (2) multiple incentive issues of the three tokens; and (3) value capture issues of the three tokens.

This article first sorts out the concept of the three-generation token model of Web3’s new economy, and then breaks down the value dimensions of the three tokens from the perspective of Web3 value capture. Finally, it explores a feasible path for the landing application of the three-generation token model in China through the landing practice of chain game projects.

The Three-Generation Token Model of Web3 New Economy

Source: Dr. Xiao Feng’s closing speech at 2023 Hong Kong Web3 Carnival

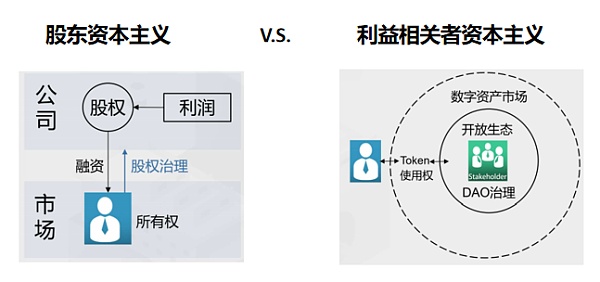

Whether in the economic model of Web1 or Web2 (monitored capitalism), the assets and data information of the digital world are owned by the platform, and the platform generates huge commercial value after monetizing them, giving rise to platform-level business giants such as Facebook and Google, but this has nothing to do with ordinary user participants.

Based on the blockchain network, Web3 is an economic model based on a value network (stakeholder capitalism), emphasizing data credibility, data sovereignty, and value interconnection. Under the premise that all values can be tokenized, value includes not only ownership but more importantly, usage rights.

Ownership is exclusive and difficult to divide. The organizational form (usually a company) under the ownership system aims to maximize shareholder interests, which is the embodiment of shareholder capitalism. Ordinary users are difficult to participate in and share value.

Usage rights are non-exclusive and have multiple sharing characteristics. They can be authorized and licensed multiple times, and even achieve unlimited circulation of open source and CC0, which is conducive to ordinary users participating and sharing value. The core of the usage rights system is stakeholder capitalism, and the original organizational form may not be suitable. Decentralized autonomous organizations (DAOs) based on open source organizations and non-profit organizations naturally fit stakeholder capitalism and have become the main organizational form of the Web3 new economic model.

Source: Web3 New Economy and Tokenization

Under the usage rights system, all participants in a decentralized organization collaborate on a large scale as stakeholders, make their own contributions, and share the value of the organization. In this context, the shareholder ownership represented by centralized project shareholders is no longer meaningful, and the real value is the usage rights of the project.

Usage rights cannot be securitized, but they can be tokenized. Combined with blockchain distributed ledger technology, usage rights can be standardized and securitized in the form of tokens, which is related to the interests of every participant in the project network. This type of token is called a utility token.

Value Capture of the Three-Generation Token Model

The three-generation token model proposed by Dr. Xiao Feng is not a completely new concept, but a summary of the current market token economic activities. Since the chain game leader Axie Infinity adopted the three-generation token model (double token + NFT) in 2020, the three-generation token model has almost become a standard in the GameFi field. Especially recently, in the case of SEC v. Coinbase, the US Securities and Exchange Commission (SEC) directly defined AXS (the governance token launched by Axie) as an equity token. Regardless of right or wrong, this makes the definition of the three-generation token model clearer.

The SEC believes that AXS constitutes an investment contract and is therefore defined as a “security”. The logic is as follows: (1) the investment of money, Sky Mavis, the development company of Axie Infinity, sells AXS through Private Sale and Public Sale; (2) common cause, investment in the jointly constructed Axie Infinity, which is still in the development stage; (3) expected benefits, making investors believe that AXS can appreciate under the leadership of Sky Mavis through various public channels; (4) the efforts of others, Sky Mavis has a full-time team of nearly 40 people and holds nearly 21% of AXS tokens, clearly responsible for the development and maintenance of Axie Infinity.

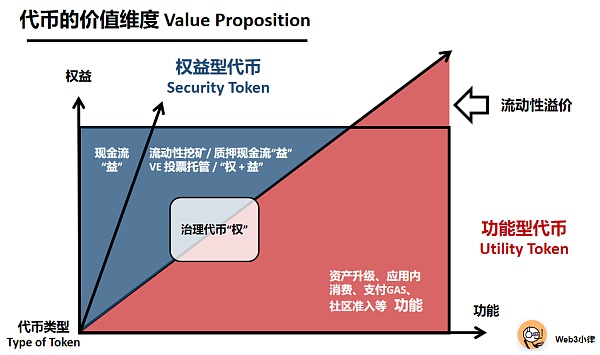

Understanding the classification of tokens from the perspective of value capture of Web3 investment helps to understand the essence of the three-generation token model. Tokens are essentially carriers of value, and the most important thing for Web3 project investment is to determine where the value is realized.

When valuing equity projects, more attention is paid to the company’s ability to generate future cash flow, because shareholders have the legitimate right to distribute company profits. In the case of Axie Infinity, because the early project has not yet been completed, investors are looking forward to the future value of the project after it is developed, similar to early equity investments, so the public sale of AXS will be regarded as a “security”.

When valuing token-based projects, the traditional cash flow valuation model may not be applicable, and more attention is paid to the network scale effect after the project is developed and decentralized, the demand between the network and the token, the actual effectiveness of the token, and the liquidity of the token, etc. Therefore, compared with token financing projects, token economics is extremely important.

From the perspective of capturing investment value from Web3, the specific value of equity tokens and utility tokens is extracted here to better understand the essence of the three-generation token model. As NFT is a digital mapping of underlying assets, its value capture depends on the value of the underlying assets it anchors, and the source of value can be diverse, which is not discussed here for now.

2.1 Benefits of Equity Tokens – Equity Interest

Equity tokens include both “equity” and “benefits”.

First of all, let’s talk about “benefits”, which can be understood as the equity of future cash flows of Web3 applications, representing the value of future cash flows. Since this “benefit” is basically the same as the “benefit” represented by securities such as stocks, bonds, and real estate tools that generate interest, this type of equity token public offering (Security Token Offering, STO) will be subject to strict supervision by securities regulators.

On November 16, 2018, the U.S. SEC issued a “Statement on the Issuance and Trading of Digital Asset Securities”, emphasizing the securities nature of some virtual assets, and requiring the issuer to “register the issuance of securities in accordance with the Securities Act unless exempted”.

Due to the complexity, high compliance costs, and supervision of STO, it is not suitable for most early and mid-term projects. Therefore, many project parties divide the cash flow “benefits” in equity tokens as much as possible, and try to avoid designing equity dividend tokens directly as equity tokens to avoid falling under securities regulation.

This leads to a variant of equity tokens, which indirectly obtain cash flow “benefits” through methods such as liquidity mining, staking, and VE voting custody (veToken Model).

For example, Synthetix users can not only get a certain amount of SNX tokens when staking, but also receive sUSD (Synthetix’s native stablecoin) rewards every week. SushiSwap uses the protocol-generated cash flow to repurchase its token Sui to reward staking users, and MakerDAO uses the cash flow generated by the protocol to repurchase and burn its token MKR.

Some people may say that such pure governance tokens have no value, but having an impact on the protocol itself is valuable. These tokens may eventually vote on the economic rights of the protocol in the future, such as discussing whether the business is charged and how much profit is taken from liquidity suppliers.

From the perspective of value capture, functional tokens capture more of the network effects of the network after the project is developed and decentralized, the demand between the network and the token, the actual effectiveness of the token, and the liquidity of the token, etc.

The compliance path of the three-token model in China

Tokens are essentially carriers of value. After understanding the value nature of the token model, the project party needs to cater to the corresponding regulatory supervision according to the value attributes of the token. Only on the basis of meeting regulatory requirements, friends who participate in token economic activities can participate in the distribution of this huge cake and promote the long-term development of the virtual asset market.

3.1 Compliance of equity tokens

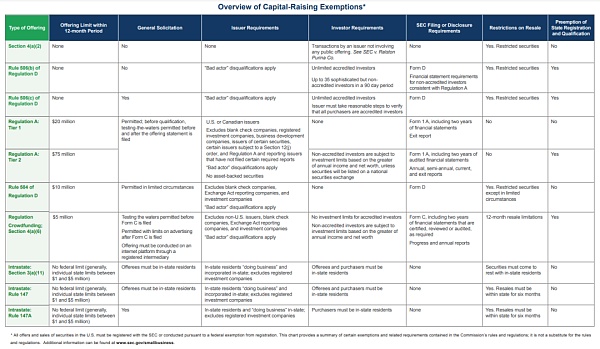

In 2017, due to the lack of compliance regulatory framework globally, the ICO boom has led to many fraudulent scandals, causing regulatory agencies in many jurisdictions to crack down on ICOs. However, at the same time, some jurisdictions have also begun to explore regulatory compliance for asset tokenization under the existing securities regulatory framework. Basically, the current regulatory rules for equity token issuance (STO) in various jurisdictions are derived from 2018.

Recently, we have seen that crypto mining companies have put their equity tokens-HAG on the US encrypted securities market INXI through the STO process, which provides a more accessible, lower-risk and fully compliant investment option for investors seeking to participate in Bitcoin mining. The HAG token is a permanent equity token anchored to Bitcoin mining computing power, providing holders with Wrapped Bitcoin (WBTC) as a monthly Bitcoin dividend. For investors, holding HAG tokens means holding the corresponding Bitcoin mining computing power, and they can benefit from the growth of the Bitcoin mining industry without directly investing in mining equipment.

According to information on the SEC official website, HAG has obtained an exemption for SEC securities issuance, which means that HAG can legally and compliantly conduct public sales while complying with US securities laws. For specific STO procedures and securities exemption procedures, please refer to the guidelines provided by the SEC below.

Image source: SEC official website

In addition to the United States, the regulatory paths for STOs in Switzerland, Singapore, and Hong Kong are also at the forefront. We have seen recent news: BOC International (BOCI) announced the successful issuance of RMB 200 million of tokenized notes on the Ethereum blockchain (without involving the central securities depository agency), becoming the first Chinese financial institution to issue tokenized securities in Hong Kong. This tokenized security product was initiated by UBS and provided to its clients in the Asia-Pacific region. It is the first regulated STO product issued under the laws of Hong Kong and Switzerland in the Asia-Pacific region.

Although we cannot see more information, it is understood that the legal structure, asset packaging, and issuance on the chain were done under the legal framework of UBS in Switzerland, and then sold to clients in the Asia-Pacific region through Hong Kong’s securities regulatory system based on personal understanding.

Image source: Bank of China Embraces Digital Innovation: Issues $28 M in Ethereum-based Digital Structured Notes

3.2 Compliance of Functional Tokens

In addition to the regulatory compliance of equity tokens, we see that many jurisdictions have started or have established regulatory frameworks for non-equity tokens, such as the EU’s cryptocurrency market regulatory bill MiCA, Hong Kong’s VASP system for virtual asset service providers, and the UAE The VARA virtual asset activity market regulations in Dubai, etc.

These regulatory frameworks are aimed at regulating virtual asset markets that are mainly for retail investors and whose main trading objects are non-equity tokens, protecting investors’ rights and interests based on KYC/AML/CTF.

3.3 Compliance status of the three-token model in China

The issuance and trading of tokens have laws to follow in foreign countries, but not in China.

Both the “Announcement on Preventing Risks of Token Issuance and Financing” (the “94 Announcement”) during the 2017 ICO era and the “Notice on Further Preventing and Disposing of Risks Associated with Virtual Currency Trading Speculation” (the “924 Notice”) in 2021 clearly state that virtual currency-related business activities belong to illegal financial activities. Therefore, it basically puts an end to the tokenization of domestic assets (whether equity tokens or utility tokens), End of Story.

In addition, for virtual currencies used in games (similar to utility tokens), which are still subject to the regulations on virtual currencies in the “Interim Measures for the Administration of Online Games,” which has expired, it is prohibited to exchange virtual currencies for real money or goods. At the same time, it should be ensured that the circulation and transaction of virtual currencies within the game comply with relevant regulations.

Therefore, the equity tokens and utility tokens in the three-token model have no legal framework to rely on in mainland China, leaving only NFTs in the three-token model.

The regulation of NFTs in China is still based on red-headed documents from multiple ministries and commissions, such as the “Initiative on Preventing Financial Risks Associated with NFTs” jointly issued by the China Internet Finance Association, the China Banking Association, and the China Securities Industry Association on April 13, 2022, with the core being: Resolutely curb the tendency of NFT financialization and securitization, and strictly prevent the risks of illegal financial activities.

Exploration of the Compliant Application of the Three-Token Model in China

Through the above analysis, we can clearly see that there is only one exploration path for tokens left in China, which is NFTs. So how can project parties explore NFT applications under the legal framework in China?

An article from W Labs of Guatian Experiment Lab, “Is a Tokenless Chain Game Economic Model Feasible?” substantially provides a compliant path for chain games in China, which is worth referring to by various project parties.

Image source: https://www.treehouse.finance/treehouse-academy/the-role-of-defi-in-gamefi-tokenomics

Chain games can be said to be the application of Web3 projects that rely most on the three-token model. So is it feasible to directly cut off the most exciting and exciting part of the token economic model?

A willful researcher in the wild chain game industry, Guage, first proposed to directly use NFT as a medium for in-game and out-of-game links, and add game coins as soft tokens in the chain game, and directly or indirectly upgrade NFT through game coins – NFT development mode, thereby achieving the appreciation of NFT assets;

Secondly, the economic model should be designed to Win to Earn as much as possible, and try to avoid the traditional idea of using new funds to allow old players to Play to Earn;

Finally, it is necessary to strengthen the chain value capture function of NFT, and hope that players can Play to Own, by connecting the islands between the game and the game/project/platform, to give NFT greater empowerment to link positive externalities. This idea has already begun to be applied in the “platform + multiple chain games” model, and can be added to the “platform points” system.

That’s right, there is no need for Tokens, a complete point system + NFT with chain value capture can meet the compliance applications of most Web3 projects in China.

Through the summary and analysis of three chain game cases, Big Time, Legend – Flame Judgment Number Collection Edition, and BitstarWar, Guage felt that the no-Token model is not a niche option in the chain game, but rather some game teams have chosen the no-Token model with their feet. All three cases use NFT as the main value carrier, and provide freely tradable cash-out channels, while the soft tokens in the game serve as auxiliary, lubricating various economic activities in the game.

Such an economic system removes the common complex pledge and Token market-making elements of Web3 applications, and is a kind of liberation for players and project parties. It is more direct and closer to the essence of “this is a game, let’s play first”. It conveys the most authentic soul of the game to players.

Image Source: https://odyssey.starbucks.com/

In addition, we also see that many Web2 consumer brands are beginning to explore the path of Web3. Considering the compliance issues of equity-type tokens and function-type tokens at home and abroad, NFT seems to have become a must-have option for these Web2 consumer brands. Especially the combination of NFT + Loyalty (brand loyalty) projects may bring a new wave of growth flywheels for Web2 consumer brands.

The Starbucks Odyssey project’s NFT + Loyalty model deeply explores the value of NFTs, providing a new commercial paradigm for Web2 brands to enter the NFT space.

First, the Odyssey project enhances the participation and emotional connection of its members through gamification, by integrating online and offline NFT stamps (Journey Stamps) collection through Odyssey Journeys mini-games (similar to a coffee version of Pokémon GO), making users enjoy the process and strengthening the connection with the Starbucks brand. This step turns the traditional Shop to Earn model into a BlockingrticiBlockingte to Earn model.

Secondly, using NFTs as carriers (value carriers and value circulation), further upgrade BlockingrticiBlockingte to Earn to Collect to Earn, that is, collecting to generate both fun and income, to increase user stickiness and repurchase rate.

Finally, after NFT membership data is put on the chain and connected with the commercial world, the Airdrop to Earn model is superimposed, such as Pizza Hut directly giving Starbucks NFT holders precise airdrop pizza vouchers, empowering NFT members and driving their stickiness and repurchase rate, thereby achieving a multi-layer growth flywheel for the brand’s commercialization.

Source: Twitter @starzq.eth

Conclusion

Since Dr. Xiao Feng “officially” defined the three-generation token model for Web3 applications in the closing speech of the 2023 Hong Kong Web3 Carnival, the most critical issue now is whether the existing regulations (mainland and Hong Kong) have given the third-generation tokens a clear legal status and cooperated with the legal regulatory framework of virtual assets to avoid various market fraud issues.

We see that Hong Kong has officially implemented a new VASP system since June 1, 2023, providing a compliant legal and regulatory framework for three types of tokens. It is believed that more specific regulations will be introduced in the near future to inject a “strong heart” into Web3 applications or the entire virtual asset market. Further guidance for the virtual assets to move from virtual to real and empower entities is also a circular economic concept under the existing system background in mainland China.

Tokens are essentially value carriers. Only by deeply understanding the value nature of tokens can the optimal economic model be designed for Web3 applications, achieve a multi-layer growth flywheel, and incentivize all participants.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!