Author: GabyGoldberg, Substack; Translation: Yvonne, Marsbit

In 2018, USV’s Dani Grant and Nick Grossman published “The Myth of The Infrastructure Phase,” arguing that applications drive the development of infrastructure, rather than the other way around. Five years later, this debate is more prevalent than ever.

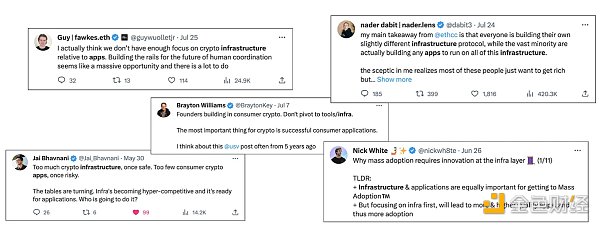

Tweets in the past six months

- Outside of Engineering In Search of the Cryptographic Aesthetics Rabbit

- Exploring Fully Homomorphic Encryption III Constructing GSW Fully Homomorphic Encryption System

- Lido monopoly may bring big trouble to Ethereum, V God proposed a solution

If you want a quick summary, both sides have their merits. Infrastructure teams believe that better tools can improve user experience and allow developers to build applications faster, while application teams argue that breakthrough applications (such as light bulbs, airplanes, or AOL) emerge first, followed by infrastructure (electric grids, airports, or web browsers) to support widespread adoption of these applications in major technological shifts.

Although I would like to take sides in this debate, I believe that the conversation has been too binary from the start. Infrastructure and applications need to constantly drive each other’s development. Just like the transition from dial-up internet to broadband to Wi-Fi, or from calling for deliveries to DoorDash, the path to success is not linear – it is bidirectional. In the cryptocurrency field, we often like to focus on existing technologies or use cases, but to build in this space, we need to accept the fact that everything can change fundamentally.

In this debate, there is a heuristic concept that seems to be distracting attention, which is “mass adoption” in cryptocurrency – building products for consumer scale. What does “scale” look like in cryptocurrency? On one hand, there are companies that resemble traditional consumer goods companies in appearance and feel, but have traces of blockchain technology behind them, which is usually used for payments (such as Beam or Sphere) or loyalty (such as Medallion or Blackbird). Consumers of these products often lack interest or understanding of cryptocurrencies, so as much technology as possible is abstracted to achieve a more seamless user experience. At the same time, on the other hand, you launch crypto-native products for crypto-native consumers – a growing user base who like to try new products and spend a lot of money on them.

Image source: @WilsonCusack

Although both user roles are attractive from a business perspective, they are often fundamentally inconsistent. Existing tools may “fit” the users and applications that have existed so far – but if we want to grow users, we must also develop infrastructure. This is not a binary opposition (“we need a killer app!”), but a push and pull based on consumer demand. Let’s take wallets as an example, which serve as the consumer gateway for all activities in the ecosystem:

The first iteration of the encrypted wallet (let’s call it Wallet 1.0) was largely limited in terms of use cases. Many early adopters of cryptocurrencies were very concerned about the fundamental pillars of this technology, such as decentralization, transparency, and immutability. It is worth noting that if users want to participate in this technology, they need to pay attention to or at least understand the concept of self-regulation. A good example of Wallet 1.0 is MetaMask, created by ConsenSys in 2016. In July 2020, MetaMask had 545,000 monthly active users. In August 2021, due to the arrival of “DeFiSummer,” the number of active users soared to over 10 million, with liquidity mining becoming a significant factor in the user surge. At that time, for consumers, using MetaMask to access DeFi yields was an obvious choice because MetaMask was easier than its competitors to help users access protocols (with broad support).

This means that during this period, successful applications were built with existing MetaMask users in mind—users who had wallets and wanted to use them. Consumer applications were essentially crypto-native based on the market opportunities provided by available infrastructure, which makes sense.

Today, many popular wallets are still primarily self-custodial and serve similar user groups. However, in the past few years, we have seen a complete swing in the opposite direction as consumer demands continue to evolve. Specifically, we have seen a proliferation of tools that allow for easy login to encrypted wallets, enabling new users to participate in blockchain-based applications (such as NBA Top Shot or Starbucks Odyssey) without worrying about mnemonic phrases. Infrastructure like Magic and Web3Auth has brought us into the era of “Wallet 2.0.” In many ways, this solves the problems of Wallet 1.0, allowing users to seamlessly create wallets and enabling traditional consumer companies to add crypto-native elements to their businesses. But in other ways, it creates new problems: users have to set up a new wallet for each application instead of using a few self-custodial wallets for all dapps, which is almost like getting a co-branded credit card for every store. These application-specific wallets confine consumers to vertical brand ecosystems and eliminate the potential for portability because the keys are no longer held by the users. If you can’t truly own your assets and carry them with you, why use cryptocurrencies?

“While wallets and applications are the first touchpoint for users to interact with cryptocurrencies, we have put usability and interoperability at odds.” – Nitya Subramanian (Former Head of Product at Celo)

Consumer interest has largely driven this change. Wallet 1.0 catered to crypto-native users, primarily focused on transactions, while Wallet 2.0 reversed this trend by introducing consumer experiences for brands and the mass market. Now, the pendulum seems to have landed somewhere in the middle – we can call it Wallet 3.0, which combines the interoperability (true self-custody) of the first iteration and the powerful consumer user experience of the second iteration. This is achieved by service providers like Capsule, which leverages distributed multi-party computation to enable developers to build applications that can interact with user assets based on their conditions without sacrificing interoperability.

With the continuous matching and improvement of applications and infrastructure, wallets have become expressive building modules of consumer identity, empowering more parts of the ecosystem.

However, now the situation is quite the opposite. In the ever-changing ecosystem, it is often reassuring to rely on existing use cases, but in order to succeed, we must be open-minded about the development of these cases from the ground up. This is precisely why we are excited.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!