Unibot is currently a very hot project that will unlock the next wave of cryptocurrency investment.

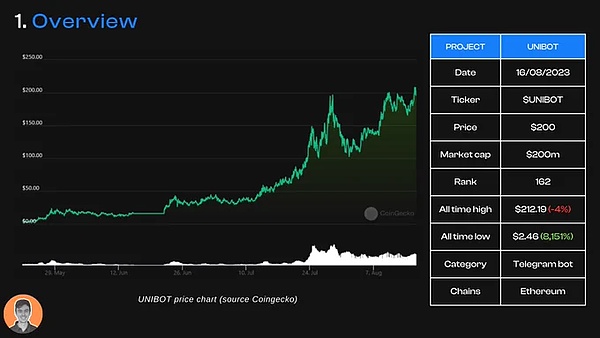

Project Overview

Unibot is a trading bot that allows you to automate DEX trading through the Telegram app.

- Which one, SEI or CYBER, has more potential for tonight’s Binance listing?

- How to view the Web5 proposed by the former CEO of Twitter?

- Coinbase establishes non-profit organization to promote cryptocurrency legislation

It simplifies the trading experience on Uniswap by providing the following features:

-

Clearer user interface

-

MEV protection

-

Reduced transaction failure risk

-

Faster transactions (6 times faster than Uniswap)

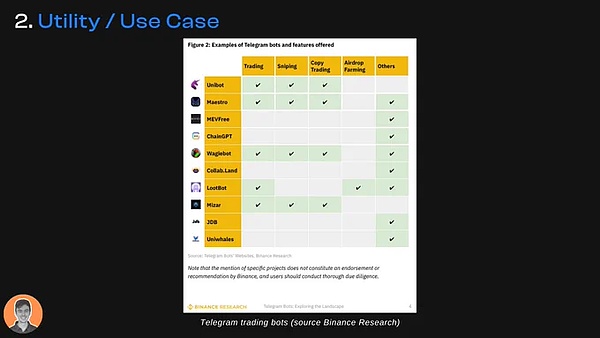

Actual Use Cases

If you have used Uniswap before, you know that the experience is average.

Telegram trading bots are popular in the cryptocurrency community because they provide a cleaner and faster way to trade, especially for new users.

They have the following advantages:

-

Faster transaction speed

-

Improved user experience

-

Automation

-

Easier for new users to use

-

Security (MEV protection and RUG prevention)

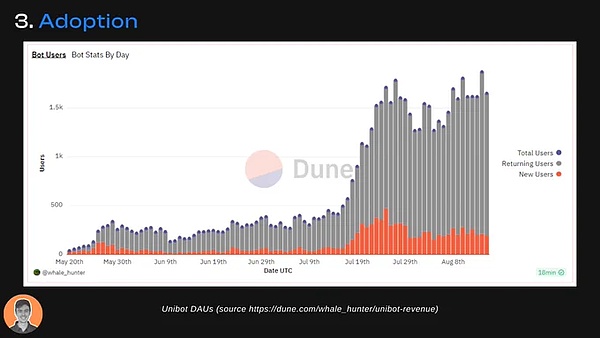

User Adoption

Unibot has dominated the market and currently holds about 71% of the market share.

I believe this is just the beginning of this field, as Telegram bots will help more users and investors enter the web3 space.

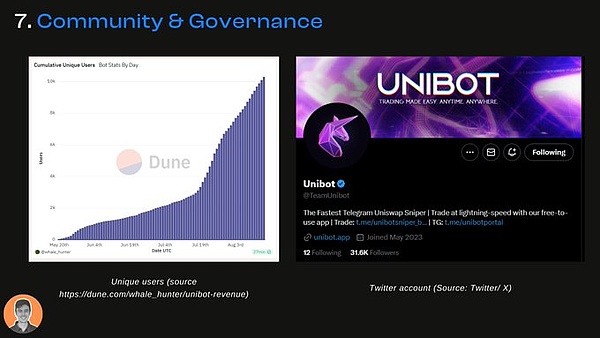

Since its launch in May 2023, the user base of Unibot has been growing steadily, with a daily active user base now stable at 1500 and a total user base just surpassing 10,000.

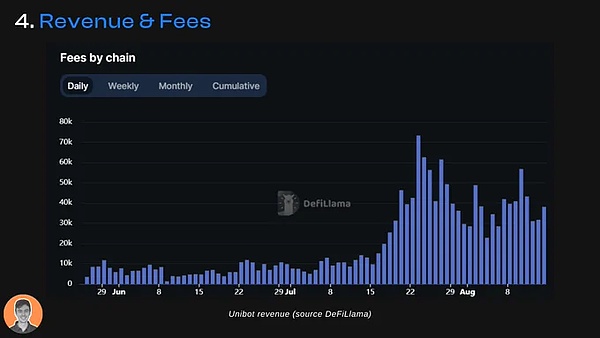

Project Revenue

Unibot distributes revenue shares to token holders through its protocol. As long as you hold at least 10 $UNIBOT tokens, you will receive ETH rewards (no staking or locking required).

The income allocated to token holders includes:

-

40% of all robot trading fees

-

1% of UNIBOT trading volume (2% for those who participated in token migration before September)

According to data from DeFi Llama, Unibot ranks 26th in terms of revenue among all protocols and generates $40,000 in revenue every day.

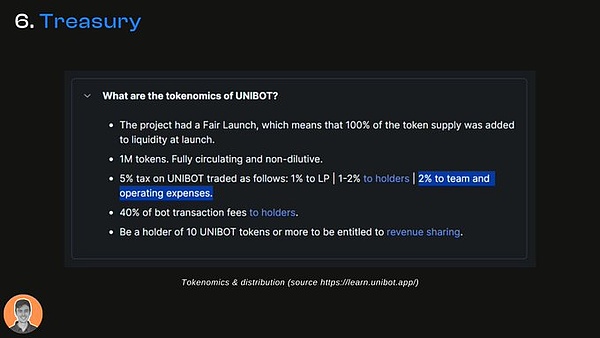

Economic Model

Unibot’s token economic model is quite simple:

-

Fair launch on May 17, 2023;

-

Issuance of 1 million tokens, fully circulating;

-

5% tax on each $UNIBOT transaction (1% goes to LP, 1-2% is returned to token holders, 2% goes to the team).

Here is the current token supply data:

-

Circulating supply and maximum supply = 1 million

-

Market cap = $200 million

-

FDV = $200 million

-

Market cap / FDV = 1

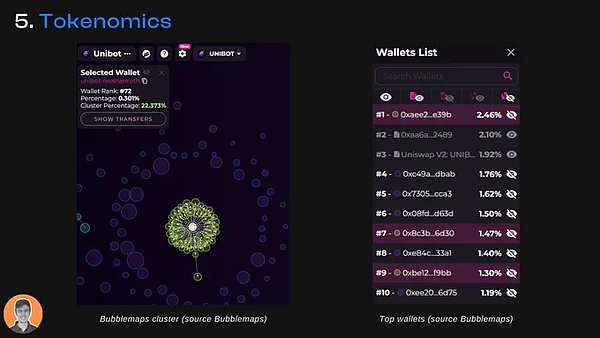

The green bubbles in the chart reflect the distribution of profit shares. It can be seen that the largest wallet holds only 2.46% of the tokens in total (24.7k UNIBOT = $4.7 million).

Treasury

Unibot’s documents do not mention the treasury situation of the protocol. However, they mention that 2% of UNIBOT’s revenue will go to the team and operations.

Since the project is still in its early stages, I expect that they may consider this issue as they grow.

Community and Governance

Although there is no official decentralized governance forum, if you hold 10 UNIBOT tokens, you can access Unibot’s private Telegram channel for token holders.

Here are some social and user data related to Unibot:

-

Twitter – 31.6k followers

-

Telegram – 8,700 members

-

Independent users – 10.3k

Team and Funding

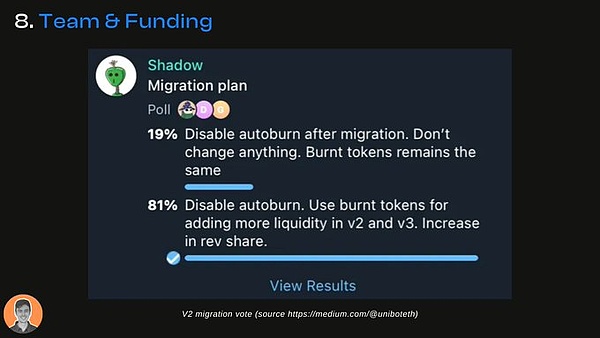

Unibot launched in May 2023 with a “fair launch,” but very limited information is available about the anonymous team behind the project.

The project recently migrated from V1 to V2 (tokenomics upgrade, adding previously burned tokens to its liquidity pool), with a vote in the token holder’s Telegram channel passing with 81% (not a formal DAO vote).

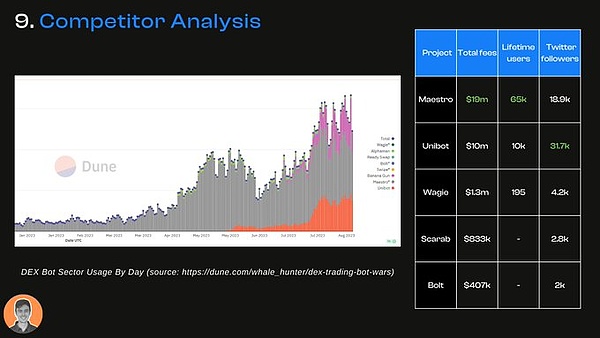

Competitive Analysis

There are actually several competitors in the field of Telegram bots, with Maestro being the longest-standing one, which is why it is ahead of Unibot in terms of transaction fees and cumulative user count.

However, since the launch of Unibot, it has been in a dominant position, and now Unibot occupies about 71% of the market cap share in the bot space (data from Coingecko).

It is believed that it won’t be long before Unibot surpasses Maestro in all aspects of data.

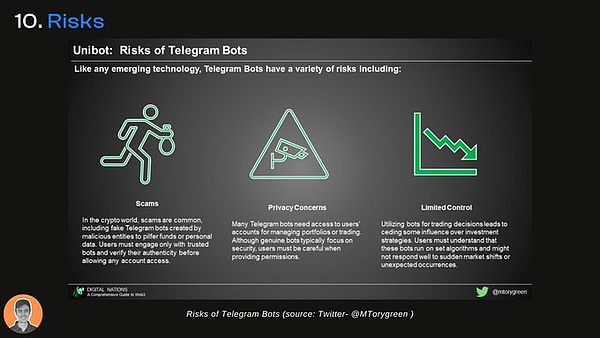

Risks

My biggest concern about Telegram trading bots is privacy and the security of wallet private keys.

Unibot states in its documentation:

-

Private keys are encrypted or decrypted using industry-standard symmetric keys (no one can access your keys);

-

Unlike centralized exchanges, users can access the private keys of the trading wallets generated by Unibot;

-

You can import the keys into Metamask and have full control over the funds in Unibot at any time;

-

Users can always consider the wallet as a hot wallet;

-

Other risks include smart contract vulnerabilities, exploits, and hacker attacks.

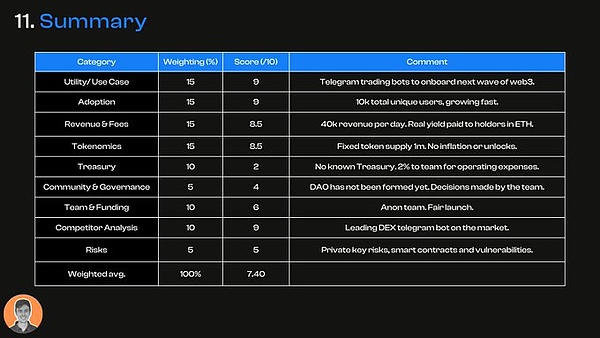

Summary

Overall, Unibot has left me with a great impression. It has unique use cases and simplifies DEX trading in an innovative way.

However, there is room for improvement in governance and treasury aspects, and further clarification is needed on privacy issues. As shown in the above picture, I would give it a weighted score of approximately 7.4, which is my evaluation of the project.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!