Author: Gabriel Bearlz; Translation: Luffy, Foresight News

friend.tech (FT) is not an interesting use case of SocialFi, but a Ponzi economy disguised as a “social experiment,” whose rapid development is driven by the irresponsible behavior of KOLs in a market full of scams.

The reasons are as follows:

1. The project founder has a history of initiating “financial experiments” and then abandoning them

The founder of friend.tech, @0xRacerAlt, is also the founder of TweetDAO and Stealcam, both of which claim to be “social experiments.”

TweetDAO was created in 2022, and its NFT holders can post content on the project’s Twitter account (yes, that’s it). However, shortly thereafter, the Twitter account was deactivated.

Stealcam was launched in March of this year, proposing an auction mechanism where users can pay to view “secret photos” of certain accounts. Currently, the project’s Twitter account is deactivated, and the website has almost zero usage.

All three projects share the following characteristics:

- They promise to conduct “social experiments.”

- They have a pyramid economic structure.

- They lasted for a few months and then were deactivated.

2. Few use cases and no economic incentives to keep creators on the platform

What makes me skeptical of the long-term vitality of friend.tech is that its use case has very little intrinsic value.

You are not buying “shares” in any X account, and you have no right to monetize the account or any type of future income. Interacting with X is just a way to quickly attract users.

What you are purchasing is the permission to have private chats with the account owner, and surprisingly, very few FT users are using this feature.

In addition, the way FT generates income is not sustainable—most users’ opportunities to make money appear only in the initial stage of exponential growth.

This may attract many users at the beginning, but it cannot retain them.

3. The economic model of friend.tech is a pyramid scheme

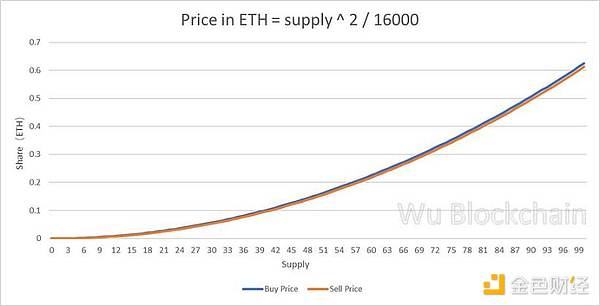

The pricing curve of shares is not based on supply and demand, but on a quadratic function: the more people want to buy, the price grows exponentially.

The problem here is that the decline in price is also exponential. In other words, from the moment when the number of buyers is no longer greater than the number of sellers, the price begins to face the risk of collapse.

What do you call an economy that relies on more users entering to sustain itself? The answer is a Ponzi scheme.

4. Lack of privacy policy, access to your X account, and custody of your assets

The three risks associated with interacting with friend.tech indicate that the team is not so concerned about the sustainability of the product:

- The platform currently has no privacy policy. If you don’t want your data to be stolen or your public key to be exposed, please stop using it.

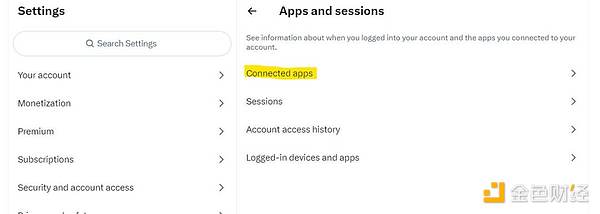

- The application requests access to your X account. I suggest you remove this permission in the settings.

- You have no control over the shares you purchased; they are held on the platform.

5. The Market is Filled with Scams

Due to being in a long-term bear market, the market is filled with scams and temptations. BALD, PEPE… have become all too common.

It is frustrating that there are less than 10,000 users playing the gambling game in the market, and they are putting their remaining bets on Ponzi schemes, trying to make money from different Ponzi schemes every week. This is the only thing those who make a living from speculation can do.

Conclusion

Just like all the hype and narratives in the past few months: those who took the lead will leave with fruitful gains, and then mock the ordinary users who have lost everything.

If you are an expert who entered the pyramid scheme at the beginning and knew when to exit, then congratulations.

If not, please proceed with caution and do not invest too much capital.

The speculative nature of airdrops and Ponzi economics may continue to drive the growth of friend.tech, and no one knows when the game will stop.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!