Author: Jaden, LD Capital

August 14th marks the 10th anniversary of Telegram. In his 10th anniversary letter, founder and CEO LianGuaivel Durov proposed that Telegram’s next step is to go beyond information transmission and lead innovation in social media. Due to its information encryption and privacy, Telegram has become one of the most popular communication apps.

This year’s Telegram Bot craze has also attracted market attention. However, Telegram bots only use the Telegram application as an interface for the Ethereum protocol, and do not directly interact with the TON chain. The TON chain was transformed from the Telegram Open Network blockchain platform. Telegram Open Network was launched by Telegram in 2017 but had to halt development due to SEC charges. Subsequently, the Telegram community organized spontaneously and renamed the network as the Open Network (TON), continuing network development and ecosystem growth. Currently, the market value of TON governance token exceeds that of Polkadot and Polygon, ranking 12th and 6th in the public chain space, respectively. Although Telegram is no longer involved in the development of the TON network, the TON network still has the potential to gain significant traffic through its association with Telegram. Telegram bots have also brought about a paradigm shift in user experience, allowing low-cost and low-threshold entry into Web 3 based on Web 2 applications.

1. Network Architecture

TON has a multi-layer and multi-chain structure, including the masterchain, workchain, and shardchain. The masterchain acts as the central manager, while the workchain supports smart contracts and decentralized applications (DApps). Different workchains only need to meet unified interoperability standards, similar to Polkadot. Within each workchain, shardchains are implemented to enhance scalability and parallel transaction processing, with each shard responsible for a subset of accounts.

The TON network currently adopts a PoS consensus mechanism. There are three roles in the network:

1) Validator Nodes: Maintain network security by staking TON tokens.

2) Fisherman: Detect whether validator nodes have fulfilled their verification duties by sending invalid proofs. Validator nodes will be penalized if found guilty based on invalid proofs.

3) Collators: Verify the state of the shard and adjacent shards and send them to validator nodes. Collators are usually rewarded by validator nodes for their work.

2. Roadmap

1) Strengthen detection and punishment of non-performing validator nodes.

2) Create cross-chain bridges between Ethereum and BNB smart chains.

3) Allow stakers to participate in global voting on the chain.

4) In terms of payments, support the establishment of payment channels between any two participants for instant micropayments, free of charge except for network fees during channel creation and closure.

3. Token Situation

After the launch of Telegram Open Network testnet 2, 5 billion tokens were minted, with 1.45% allocated to developers and testers. However, SEC quickly banned Telegram from issuing tokens to investors, leading Telegram to halt its work on the TON ecosystem. Testnet 2 tokens were placed in smart contracts. All available Toncoin (TON) tokens are released through mining. These tokens are placed in a special Giver smart contract, allowing anyone to participate in mining. The mining deadline is June 28, 2022.

After the initial coin allocation, TON entered the PoS stage. According to the white paper, the reward tokens in the PoS network account for about 20% of the staked tokens, with an annual inflation rate of around 2%. The total token supply is expected to double in 35 years. Currently, the total token supply is 5.093 billion, and the circulating supply is 3.441 billion.

Use cases:

1. Payments: domain names (DNS), data storage, TON agents, on-chain gas, cross-chain fees, etc.

2. Staking: maintaining network security, and a portion of the tokens confiscated from validating nodes will be burned (specific ratio not specified).

3. Governance.

Four, Network Data

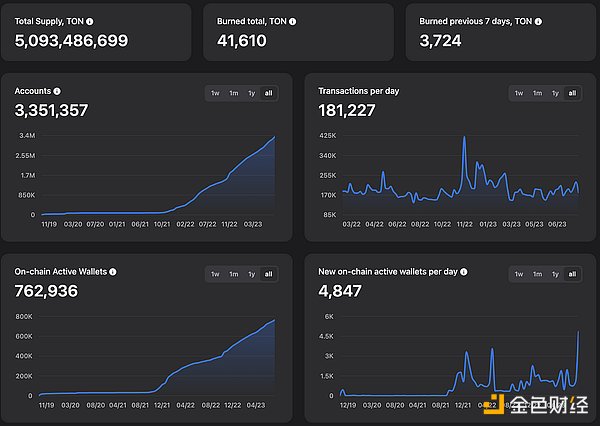

The current number of nodes in the TON network’s validation stage is 343, with a staked token amount of 486 million, accounting for 9.5% of the total token supply and 14.12% of the circulating token supply. The amount of tokens burned is 41,600. Since January 2022, the number of network accounts and active addresses has been steadily increasing. The current total account number is 3.351 million, with approximately 765,000 daily active addresses, a daily average of 160,000 transactions, and approximately 700-900 new on-chain addresses added daily.

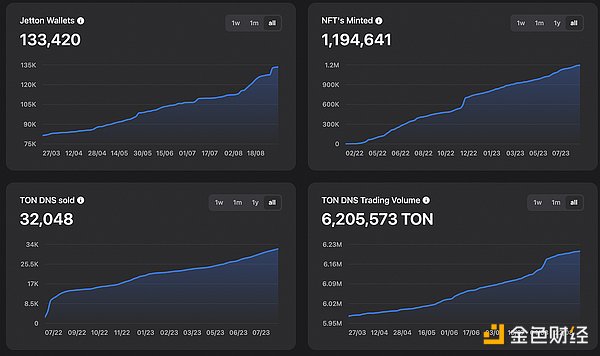

Although the number of account addresses exceeds 3 million, there are only 133,000 Jetto wallets, and only a small number of users are deeply involved in the TON ecosystem.

(Note: Jetto is the standard token of the TON network, and a Jetto wallet is a wallet that contains any Jetto tokens.) The number of forged NFTs is 1.194 million. The number of DNS domains sold is 32,000 (the number of forged ENS domains on Ethereum is 2.574 million). The sales revenue is 6.205 million TON, which is estimated to be 10.67 million US dollars at the current price, with an average price of 333 US dollars per DNS, which is relatively high.

Five, Ecosystem

Currently, the TON network ecosystem is led by the TON Foundation, which is 100% community-led.

Since the beginning of 2023, the main activities of the TON Foundation include:

1) Regular liquidity funding rewards;

2) Universal accelerator program. Launched in May 2023, the accelerator program has a funding amount of $25 million. The TON Foundation has announced the projects funded in the second and third quarters of 2022 and 2023. According to the report, a total of 31 projects were funded in 2022, 10 projects were funded in the second quarter of 2023, and 5 projects were funded in the third quarter, mainly focusing on infrastructure.

3) Development plans for Telegram. In August, the TON Foundation launched the tApps Center, a platform that includes any app that supports the Telegram ecosystem. In September, the web3 Grant program for Telegram was launched, with the specific amount not specified, but each project is expected to receive between $20,000 and $50,000.

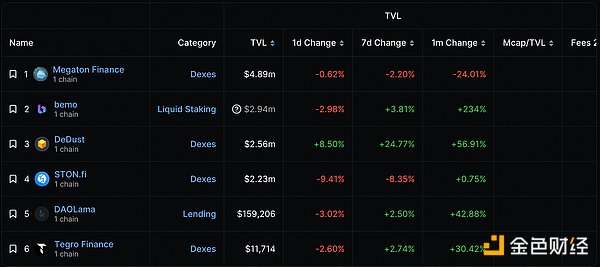

According to Defillama, TON’s current TVL is $9.85 million, and its historical high is only $21.04 million. The TON ecosystem is still in its early stages of development.

DEX

Megaton Finance

AMM DEX, developed by South Korean blockchain technology company OZYS, was originally built on the Klaytn platform as Klayswap. Currently, the TVL has reached $4.89 million, accounting for about 50% of the TON TVL and dominating the TON DeFi track. Megaton Finance raised $1.5 million in seed funding in March this year, led by TON Coin Fund, with participation from Cypher Capital, First Stage Labs, Orbs, MEXC Ventures, and other institutions. The project token $MEGA is listed on MEXC, with 54% of the tokens allocated to liquidity providers.

DeDust

Developed by Scaleton, it now supports almost all available wallets in the TON blockchain. Recently, DeDust 2.0 was launched. DeDust DEX currently supports token bridging, allowing users to seamlessly transfer tokens between the TON blockchain and Ethereum using its cross-chain bridge. The current TVL is $2.56 million.

STON.fi

AMM DEX. The transaction fee is 0.3%, with 0.2% paid to liquidity providers and 0.1% paid to the STON.fi protocol. The current TVL is $2.23 million.

Lending

DAOLama

A lending platform with NFT as collateral, with a current TVL of only $160,000.

NFT Marketplace

TON Diamonds

TON Diamonds is the main NFT trading market on the TON chain, and regular users are charged a 5% market fee when trading NFTs on TON Diamonds. However, users can reduce transaction fees by purchasing diamond NFTs of different levels offered by the platform.

Others

Fanzee

A fan participation platform that has raised a total of $2 million in pre-seed funding, led by the TON Foundation and First Stage Labs, with participation from MEXC Global, Huobi Global, KuCoin Exchange, VLG Capital, Orbs, 3Commas.io, and Hexit Capital.

Summary

Although the Telegram team is no longer involved in The Open Network development, there is still some level of cooperation between the two parties, and The Open Network is actively embracing the Telegram ecosystem. The Open Network is suitable for leveraging high performance as its cornerstone and utilizing Telegram as a massive traffic entrance to provide low-threshold use cases to gain its core competitiveness. However, the TON ecosystem is still in its very early stages, with infrastructure projects being the main focus and a lack of innovative and highly playable projects.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!