This week’s highlights

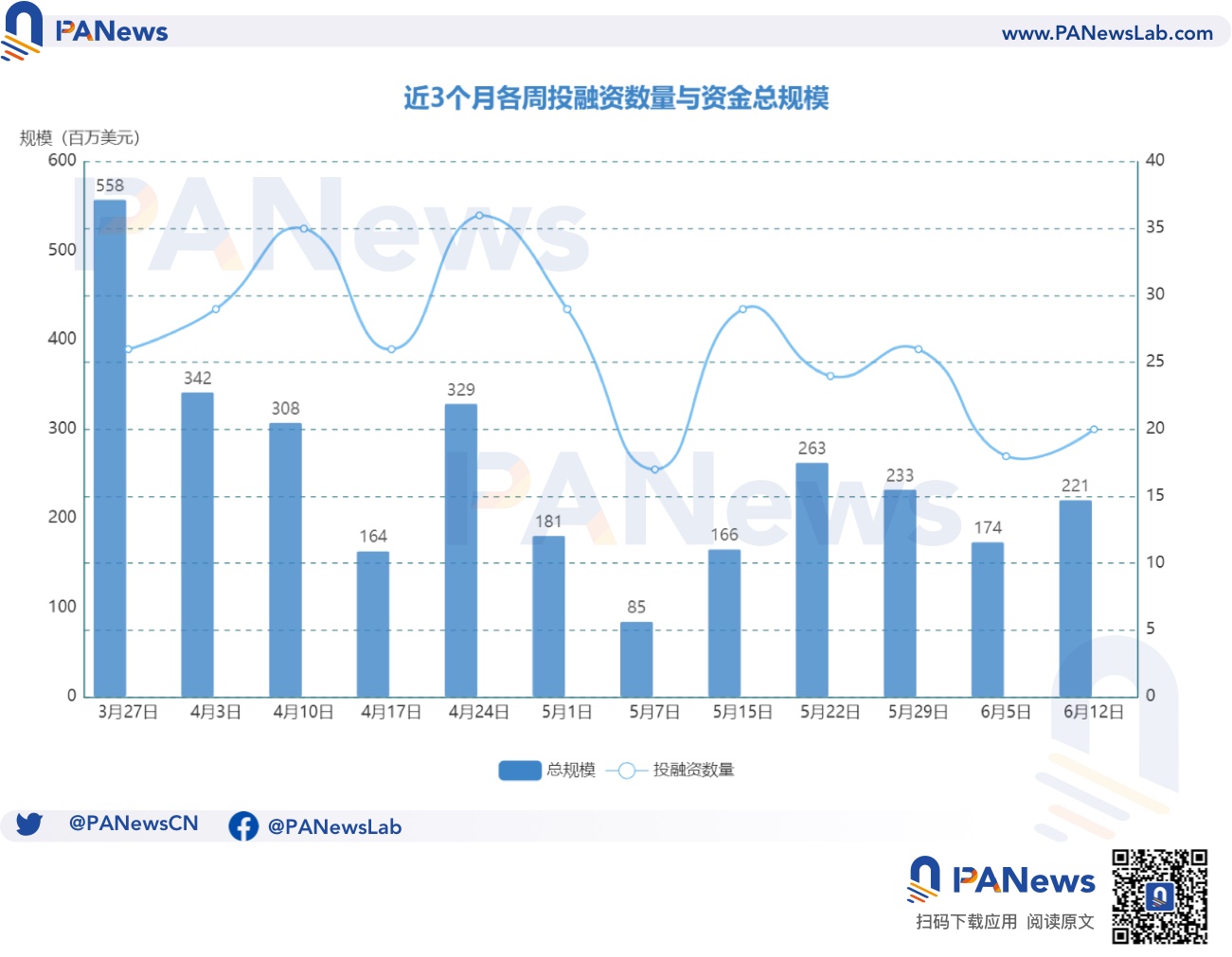

According to BlockingNews incomplete statistics, there were 20 financing events in the global blockchain from June 5th to June 11th, with a total fund size of about 220 million US dollars, and an increase compared to the previous week. Overview is as follows:

- DeFi announced 2 financing events, including Singapore’s private debt platform Kilde completed a $1.115 million seed round financing with participation from Big Sky Capital;

- Chain Games announced 2 financing, of which Web3 game launcher HyperPlay completed a $12 million financing led by Griffin Gaming Blockingrtners and Bitkraft Ventures;

- NFT and Metaverse announced 4 financings, including NFT number storage platform Dew Drops announced the completion of a $1.5 million seed round financing led by Dream Ventures;

- Infrastructure and Tools announced 4 financings, including digital payment infrastructure platform Thunes announced the completion of a $60 million Series C financing led by Marshall Wace;

- Other Web3/Encryption related projects announced 6 financings, including blockchain-based electronic bill provider WaveBL announced the completion of a $26 million financing led by NewRoad Capital Blockingrtners;

- Centralized Finance announced 2 financings, including stock and cryptocurrency game application TradingLeagues completed a $3.5 million Pre-A round financing led by Leo Capital.

DeFi

Web3 index investment company nealthy completes $1.3 million financing

Web3 index investment company nealthy completed a $1.3 million Pre-Seed round financing, and the investor was not disclosed. It is reported that Nealthy provides index tokens that replicate the structure of classic exchange-traded funds (ETFs). By storing a variety of digital assets in an on-chain vault, building a diversified investment portfolio, and issuing underlying index tokens.

Kilde, a blockchain fund management platform, completes $1.115M seed round with participation from Algorand Foundation and others

Singaporean private debt platform Kilde has completed a $1.115M seed round with participation from Big Sky Capital, Borderless Capital, AXL Ventures, the Algorand Foundation, and a number of angel investors. Kilde plans to develop a blockchain-based fund management system called “SafeBay” to help blockchain companies manage short-term financial assets and provide a range of compliant on-chain credit products. SafeBay has already partnered with the Algorand Foundation and plans to launch in the third quarter of this year.

Blockchain Gaming

Web3 gaming launcher HyperPlay raises $12M with lead investment from Griffin Gaming Blockingrtners and Bitkraft Ventures

Web3 gaming launcher HyperPlay has raised $12M with lead investment from Griffin Gaming Blockingrtners and Bitkraft Ventures. Other investors include ConsenSys, Ethereal Ventures, Delphi, Game7, Mirana Ventures, Monoceros Ventures, and more. HyperPlay was launched in November last year and is a game store aggregator that offers the Epic Games and Guild of Guardians stores in its interface. HyperPlay is compatible with the MetaMask wallet and works with WalletConnect, supporting over 40 different crypto wallet providers.

Web3 game studio Argus Labs raises $10M seed round with lead investment from Haun Ventures

Web3 game studio Argus Labs has raised $10M in seed funding with lead investment from crypto investment firm Haun Ventures, as well as participation from Robot Ventures, Anagram, Dispersion Capital, Web3 backend developer Alchemy, and former Coinbase CTO Balaji Srinivasan. Additionally, Argus has announced the launch of World Engine, a blockchain game software development kit (SDK) that enables developers to create their own Web3 game ecosystems.

NFTs & Metaverse

NFT collection platform Dew Drops completes $1.5M seed round with lead investment from Dream Ventures

NFT collection platform Dew Drops has announced the completion of a $1.5M seed round with lead investment from Dream Ventures. Other participants include VaynerFund, Polygon Technology Fund, Ruttenberg Gordon Investments, and Slow Ventures. Dew Drops is a digital collectibles company operating in the art and tech fields, founded by Jeremy Levitan and Martin Holzner. Dew Drops aims to reduce technological barriers and improve the efficiency of exploring and discovering NFT digital collectibles.

NFT API platform BlockSBlockin completes $1.4 million pre-seed round, with Innovation Works participating

NFT API platform BlockSBlockin has announced the completion of a $1.4 million pre-seed round, with Innovation Works participating. BlockSBlockin can help users quickly access current and historical NFT data stored on various blockchains, as well as help software companies create Web3 and blockchain-based applications more easily.

Web3 music platform Spinamp raises $1.2 million, with PTC Crypto leading

Web3 music platform Spinamp has announced the completion of a $1.2 million funding round, with PTC Crypto leading the way, and Coop Records, Archetype, NOISE, Fire Eyes DAO, and 1kx participating. Currently, Spinamp has aggregated and indexed NFT music from Sound, Catalog, Nina, Zora, NOIZD, Lens, Arpeggi, Decent, OpenSea Collections, Songcamp, HedsDAO, Manifold, and over 30 other smaller platforms and artists.

NFT social e-commerce platform developer Oxalus raises $1.1 million in seed round, with IDGCVB and Kyber Ventures leading

Vietnamese NFT social e-commerce platform developer Oxalus has raised $1.1 million in seed round, with IDGCVB and Kyber Ventures leading. Oxalus’ NFT social e-commerce platform allows users to interact online, keep up-to-date with market news, and buy and sell NFT collections. Users can also comment, like, follow, and share directly on the platform, express themselves through creative content, manage their investment portfolios, and more. The platform also provides an NFT aggregator and analysis tools.

Infrastructure & Tools

Digital payment infrastructure platform Thunes raises $60 million in Series C funding, with Marshall Wace leading

Digital payment infrastructure platform Thunes has announced the completion of a $60 million Series C funding round, with Marshall Wace leading the way, and Bessemer Venture Blockingrtners and Southeast Asia private equity firm 01Fintech participating. This round of funding will be used to open up new markets and improve the efficiency of its payment network. Since 2021, the coverage of its mobile wallet network has doubled to 3 billion accounts, connected to 4 billion bank accounts globally and processed transactions worth around $50 billion, 90% of which were instant transactions.

Cryptocurrency startup Taiko Labs raises $22 million in two funding rounds, with Sequoia China and Generative Ventures leading respectively

Startup Taiko Labs has raised $22 million in two seed funding rounds, with $10 million in the first round led by Sequoia China and $12 million in the second round led by Generative Ventures. Other investors in the two rounds include IOSG Ventures, OKX Ventures, GSR, and GGV Capital. The specific valuation has not been disclosed. Taiko enables developers and users to securely experience Ethereum with lower transaction fees and without having to consider any changes. It is the most promising project in the current zkEVM field and one of the ZK-EVM five players named by Vitalik on Twitter.

Web3 social graph protocol Lens Protocol completes $15 million financing round, led by IDEO CoLab Ventures

Web3 social graph protocol Lens Protocol has completed a new round of financing of $15 million, led by IDEO CoLab Ventures, with participation from General Catalyst, Varian, Blockchain Capital, and others. Angel investors include Uniswap CEO Hayden Adams, OpenSea co-founder Alex Atallah, and Polygon co-founder Sandeep Nailwal. It is reported that the protocol was built by Aave and allows users to lend and borrow crypto tokens from each other.

Cosmos development company Informal Systems completes $5.3 million financing round, led by CCMC Global

Cosmos development company Informal Systems has completed a financing round of $5.3 million, led by CCMC Global, with participation from Nascent, Maven11, and individual investors from Celestia and EigenLayer. This round of financing will support the work of the core development team of the Cosmos ecosystem and will be used to promote the development of the company’s security audit department, Informal Security.

Other

Cryptocurrency mining startup WOW EARN completes $30 million financing round

According to Investingcube, cryptocurrency mining startup WOW EARN has announced the completion of a $30 million Series A financing round, with participation from Pinnacle Innovations Capital, Blue Horizon Ventures, Ascendant Growth Partners, Nexus Pioneers Capital, and Quantum Leap Ventures. The newly raised funds will be used to expand the business, develop the platform, and strengthen its community-based business strategy. It is reported that the mining platform WOW EARN requires no professional experience or expensive mining equipment.

Blockchain e-bill provider WaveBL completes $26 million financing round, led by NewRoad Capital Partners

Blockchain-based e-bill provider WaveBL announced the completion of a $26 million financing round, led by NewRoad Capital Partners, with participation from ZIM, Marius Nacht, Contour Venture Partners, Frank Sica and Techstars Central LLC, Reefknot Investments, and others. WaveBL uses proprietary blockchain technology to electronically transmit trade documents, and its solutions enable the instant, encrypted, and authenticated transmission of e-bills and related trade documents.

Meanwhile, a life insurance provider priced using Bitcoin, has raised $19 million in seed funding across two rounds. The first was led by OpenAI CEO Sam Altman and former head of Stripe Issuing Lachy Groom, while Gradient Ventures led the second round. Meanwhile plans to use the funds to hire a development team for its first product. The funding will allow it to obtain a license and regulation from Bermuda’s regulatory body for insurance, and hire an initial team to launch its first product: a Bitcoin (BTC) priced life insurance policy.

Nori, a blockchain-based carbon removal marketplace, has raised $6.25 million in funding. Existing investors M13, Toyota Ventures, Placeholder, and Cargill led the round. Nori completed a $7 million Series A funding round in March last year, bringing the total amount raised to $17.25 million. Nori has built an end-to-end carbon removal market based on blockchain that aims to remove 1.5 trillion tons of carbon dioxide from the atmosphere to address climate change.

Bitcoin Startup Lab has announced that it has raised $1.5 million in seed funding at a valuation of $20 million, with Sora Ventures leading the investment. Bitcoin Startup Lab is a part-time entrepreneurship training programme and founder community in the crypto industry, and will begin its comprehensive mentor-guided entrepreneurship programme at the end of June. The programme, which is now open for applications, will end on June 15. Bitcoin Startup Lab aims to train founders by providing them with the necessary tools, skills, and knowledge to turn their ideas into web3 Bitcoin startups.

Oamo, a decentralized data broker, has raised $1.25 million in pre-seed funding led by White Star Capital. Oamo is about to launch its beta version, and the current waiting list is open, allowing users to gain early access to the first batch of products published on Oamo. Oamo aims to help internet users profit from the value of their own data, allowing them to earn rewards by anonymously sharing data in areas such as DeFi, NFTs, games, wallets, and more. The main components of the Oamo stack include DID, data pools, and CamBlockingigns (marketing campaigns).

Decentralized Finance

Stock and Crypto Gaming App TradingLeagues Completes $3.5M Pre-A Funding Round

Stock and crypto gaming app TradingLeagues has completed a $3.5M Pre-A funding round, with participation from Leo Capital, the Jeejeebhoy Family Office, and KPB Family Trust Fund, which is backed by Sequoia India and Westbridge Capital founder KP Balaraj. TradingLeagues helps users learn about stocks and cryptocurrency markets and develop skills such as building investment portfolios and trading through four games. TradingLeagues plans to complete a $10M Series A funding round in the next few months.

Cryptocurrency trading platform Ouinex raises $2M in Pre-Seed round

Digital asset exchange Ouinex has raised $2M in a Pre-Seed round, aiming to provide an institutional-grade trading experience for beginners and experts alike, prioritizing transparency, liquidity, and complexity.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!