Author: DocTom; Translator: Sissi

Translator’s Note:

The rise of Web3 not only signifies technological progress, but also a reimagining of human collaboration, innovation, and value creation. In the context of Web3, communities are no longer just gathering points for shared interests, but have become platforms for value exchange and innovation. You can refer to previous articles “Web3 Community: The Fusion of Personal Sensibility and Collective Belonging” and “Community First: Building Sustainable Growth for Web3” for more information.

Decentralization, as the technological foundation of Web3, reshapes our understanding of organization and collaboration on a deeper level. DAO, as a combination of technology and ideology, presents a multi-dimensional governance system through blockchain, tokens, and smart contracts.

In this context, tokenized communities in Web3 are facing a choice: whether to transition to DAO and expect to consolidate the power and wisdom of the community, achieving transparent and effective decision-making and value creation. This is not only a technological revolution, but also represents a significant cultural and mindset shift, emphasizing collaboration, transparency, and co-creation of value.

Token-based communities can take various forms, and not all communities need to transition to DAO

Although community building and participation are one of the killer applications of Web3, and token mechanisms can stimulate reciprocity and agency within the community, no matter how groundbreaking the technology is, it is only a means to an end. Therefore, when studying DAO and understanding its early attempts, the main focus is: where can DAOs play a role? How can they better address specific community issues and use cases?

Diversity of tokenized communities

In tokenized communities, it is expected that community tokens will become the primary means for members to gain access to the community, participate in community activities, and coordinate community efforts, turning members into active participants and stakeholders. Community tokens combine elements of fan culture (belonging and connection), sponsorship (membership and support), and investment (transferable ownership and economic gains). Depending on the purpose and scope of the community, not all elements need to come into play. The value of community tokens is related to both direct community value (member access, benefits, and privileges; social capital and status) and long-term community scope and influence (financial value driven by community profits and token demand and supply).

This is a form of ownership economy that allows member stakeholders to experience the growth potential of the community and have the opportunity to shape that potential. By holding community or social tokens as equity, members can directly benefit from the growth of the community, thereby incentivizing them to actively help and contribute. These same tokens may ultimately be used as governance tokens for decision-making, thus becoming a means of controlling the direction, resources, and outcomes of the community.

Tokenized Communities vs DAO

However, this does not mean that every tokenized community is a fully decentralized autonomous organization (DAO). While there may be some degree of collective governance and decision-making, token holders do not need to vote on every decision in the community. Even though token categories often overlap, the intrinsic community value and specific status conferred by community tokens distinguish them significantly from pure governance and ownership tokens.

Before delving into how DAOs function and where they are effective, let us first understand their differences from other tokenized communities. The core of DAOs lies in how they utilize blockchain, tokens, and smart contracts to decentralize and automate community governance, decision-making, and value distribution.

DAOs advocate for the core philosophy of decentralization and pursue innovation in autonomy, democracy, and collective decision-making. To achieve this, they coordinate through a set of shared rules executed on the blockchain, driven by code embedded in smart contracts and controlled by token ownership, to allocate decision-making power and financial capital. Ownership and decision-making are distributed more equally and fairly among token holders, with no single participant or party holding disproportionate shares. Community activities are often coordinated by transparent mechanisms in smart contracts, which essentially run as programs on publicly accessible blockchains and trigger actions when certain conditions are met, without the need for human intervention (i.e., automation and trustlessness).

Importantly, DAOs also have their own treasury. In its simplest form, a DAO is an internet community with a shared fund account that formulates its own rules for operation, i.e., how to allocate community resources and distribute financial rewards. In summary, compared to ordinary tokenized communities, DAOs are more decentralized, autonomous, and financialized.

Tokenized communities and DAOs share the common goal of using blockchain to gather like-minded individuals and accomplish a shared mission. Both aim to incentivize and maximize member participation and proactiveness using Web3 technologies. They typically do this by issuing tokens based on participation, contribution, and investment. These tokens often come with certain rights, such as exclusive privileges for members or the ability to vote on certain decisions.

Building and Optimizing DAOs

Basic Principles and Concepts

The key to a community becoming a DAO lies in whether it is genuinely owned and managed by its members. This ownership is achieved through tokenization, representing a true cooperative membership system. In this system, members or token holders actively participate in decision-making and profit sharing. They supervise resource allocation by submitting proposals, voting on decision execution, collectively managing funds, sharing profits, and other means, thereby maximizing the collective long-term value.

Tokens can be encoded to automatically receive sponsorship dividends when there is income flow. This gives cooperative members or token holders the ability to capture the value they create. From the perspective of decentralization, democratization, and economic participation, DAO is the purest form of community in Web3, embodying the key principles of the new ownership economy.

Building a DAO

Purity comes at a cost. Due to its decentralized nature, DAOs require extra effort to build and cultivate successful foundations. Like any influential community, DAOs need to articulate their Community 6P clearly and transparently: Purpose, People, Principles, Processes, Platform, and Proceeds.

In this process, the goals of the DAO are broken down into 1) “Big P” (grand, transformative vision), 2) “Medium P” (the role and scope the community plays in achieving the grand vision), and 3) “Small P” (the benefits to each contributor). As DAOs will be operated by their members, recruiting members who identify with and are committed to the DAO is crucial. This is especially true when documenting operating principles and governance processes, as most of these principles and processes will be encoded into automated programs through smart contracts: from the token economics of the DAO, to member roles and incentives, to its decision-making and voting systems, and how value (proceeds) is created and distributed.

Building the operational architecture of a DAO can be complex and challenging. Before reaching a state of self-regulation and harmonious cooperation, DAOs are likely to undergo multiple adjustments and repositioning, making numerous iterations to reach a basic healthy state (or “Minimum Viable Community”). Like startup companies pursuing minimum viable products, DAOs can also use a basic, evolving canvas plan to define and optimize all key processes of the DAO. This community canvas should guide the design, testing, and optimization of all core processes of the DAO to create the conditions necessary for the DAO to achieve maximum impact and self-sustainability. This includes the required tools and predefined rules that determine everything from member screening and onboarding to how many tokens each member can receive today, how tokens will be allocated in the future, the economic and governance rights granted by token ownership, and the actual proposal and voting processes.

Optimizing DAOs

Decentralization is a process that means leadership shifts from a tightly-knit core with shared purpose and principles to community authorization and delegation. Therefore, many Web3 projects and communities follow a progressive decentralization process, adopting more centralized control in the initial stages to achieve community-market fit with a small, focused team before fully transitioning or exiting to a DAO structure. When transitioning from more centralized to fully decentralized structures, a balance needs to be struck between the rewards for the core incubation team (and early adopters) and incentives for broader community participation and ownership. Some teams may consider a hybrid DAO model where the core team retains control over high-risk returns or time-sensitive business and community decisions, but the DAO makes decisions on other aspects of the community through voting.

Regardless of the ultimate purpose and scope of DAO, its success depends on its sincere recognition of the power of the people and its ability to utilize this collective energy to achieve the correct results. Additionally, the underlying value model needs to have community scalability rather than extractive, that is, 100% by the community and for the community. True grassroots empowerment and ownership begin with identifying and incorporating members who are truly aligned and committed to the community. DAOs require high levels of member participation and vibrant communities to ensure good ideas are developed and refined, so optimizing incentives for participation will be another governance challenge. This will require ongoing information dissemination and community engagement to ensure everyone fully aligns with the core mission and roadmap of the DAO and provides conditions for inclusive sharing and constructive discussions among community members. It will rely on effective token incentive mechanisms to ensure DAO members follow a more contribution-based “play-to-earn” model rather than the traditional restrictive “pay-to-play” membership model. But most importantly, introducing innovative, fair, and inclusive voting paradigms to optimize democratic participation and high-quality results.

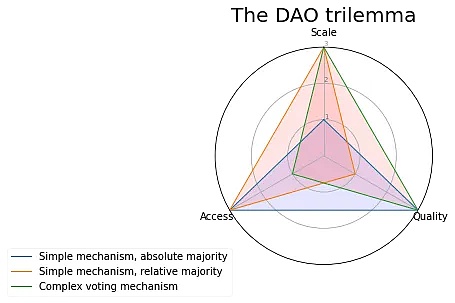

In a DAO, your voting power depends on whether you have voting rights and the weight of your voting rights. Typically, the voting rights you receive are based on the number and type of tokens you own, either purchased or earned. Ideally, you contribute to the DAO in exchange for ownership represented by tokens, which in turn grants you governance rights to participate in proposal voting and other privileges as a token holder. The submission, review, and voting methods for proposals need to be optimized for accessibility (or inclusiveness), scalability (allowing large-scale participation), and quality (value and influence).

While there is no single correct formula, a suitable combination can be found by adjusting multiple parameters to fit the specific goals and scope of the DAO. Before the formal vote, a preliminary screening can be conducted to review or check the proposal submission process. In actual voting, a minimum participation threshold (i.e., quorum) and a minimum threshold for obtaining a majority vote can be set. However, most custom adjustments will need to be applied to the way token ownership maps to voting rights. Equity-based voting has multiple variants: from 1 token = 1 vote (1T1V) to 1 person = 1 vote (1P1V) to more complex equity-based voting (such as quadratic). Other options include weighting based on the reputation or community role of token holders or allowing delegated voting, i.e., transferring voting rights to other (more professional) community members.

In summary, DAOs require a lot of adjustments and tools to achieve true decentralized ownership and self-regulation. Not all tokenized communities need to fully transition to DAOs to create a stronger sense of member participation, ownership, or active involvement. Many communities may prefer to adopt a hybrid approach, decentralizing governance and financial power only for a subset of community activities, to achieve a win-win result by continuing to build and activate the community while delegating some control and ownership to members. Alternatively, as mentioned earlier, activate your members to become executors and let your most active and contributing executors become co-owners and key members.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!