Recently, Cosmos is on the rise. Not only is the ecosystem growing day by day, but its performance is also much harder than BTC and ETH . Delphi Lab’s recently published “Find a Home for labs” is equivalent to a direct brand. I voted for Cosmos. You must know that Delphi Labs was the main designer of the economic model behind the god-level project Axie last year. It was also the first batch of card holders in the Luna and Solana ecosystems. It has a very sharp and unique insight into the development of the industry.

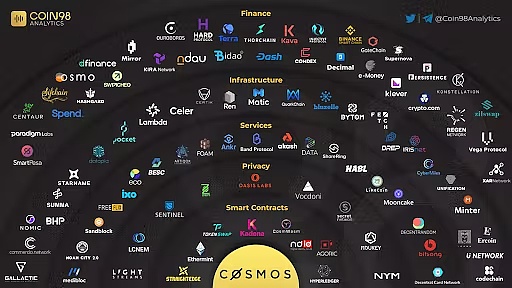

Of course, you can easily find pictures like this on the Internet?

To show how huge the whole ecology is, but these pictures are too “big and comprehensive”, it is impossible for ordinary users to read all the above items, so we will pick the most important tracks and items, come Introduce the main ecology of Cosmos.

Public chain – ATOM, Juno, EVMOS, Celstia

- Atom

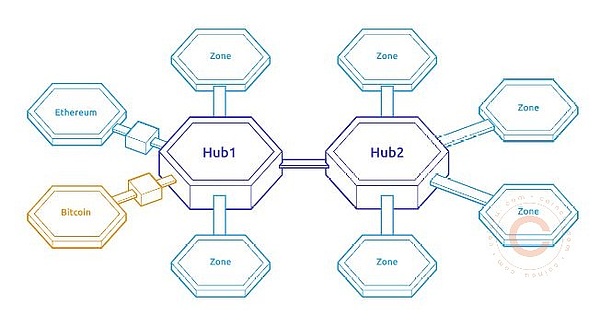

Atom itself does not act as a general-purpose smart contract chain like ETH, so you can’t find any Dapp running directly on the “ATOM chain”, it is just a Hub.

Its original intention is to let all other chains involved in the IBC protocol go through the Atom Hub.

(Note: The IBC protocol is the core interface protocol in Cosmos, which can realize credible and reliable forwarding of cross-chain messages between blockchains, and effectively perform functions such as flow control and multiplexing.)

like this?

But there are two points that are slightly embarrassing. One is that many Zones have communicated with each other through IBC and did not go to the Atom Hub for transfer. Second, the inherent value capture of this model is relatively poor, which is why the Atom model is purely based on the Token model. It was a complete defeat to Polkadot.

Fortunately, the upcoming Cosmoverse conference (September 26th) of Cosmos will announce the new version of the Token model of Cosmos 2.0, and introduce the mode of sharing security between the application chain and Atom Hub, so that Atom Hub directly has the ability to capture value. It is said that Token supply will also be introduced. The upper limit, in short, the Token and the model are no longer the weakest shortcoming!

- Juno

Juno is a general-purpose smart contract chain similar to ETH. It can run Dapps on it. When it was launched last year, it will be well-hyped. It is called the Cosmos version of Solana.

But Juno also faces two slightly awkward problems:

One is that it is not EVM compatible. Except for Solana, there is no public chain that has done a good job in the ecology without EVM compatibility.

Second, the Cosmos ecosystem itself mainly focuses on the App-chain application chain model. It always feels weird to build a general-purpose Dapp chain under this model. I want a clockwork chain to come to Cosmos, I just want to be a Dapp, I am going to the ETH ecosystem for EVM, and I can go to the Solana ecosystem for non-EVM. Why do you want to come here?

For the time being I can’t think of a good breakthrough point.

- Evmos

If Juno is Solana on Cosmos, Evmos can be regarded as ETH on Cosmos. There was a lot of demand before the launch, but the first launch failed, leaving a lot of stains. Later, after the second launch was successful, the experience on the chain was also very general. RPC service) is also the reason of the chain itself, and the ecology is also very small. In short, people feel that the strength is not in line with the reputation. What is more amazing is that the annualization of single B pledge has been hundreds of thousands, and the price has not fallen but risen. It is a bear market. The price performance is a ray of light.

Evmos is facing a similar problem as Juno temporarily. I want to make an EVM Dapp, so many ETH L2 are left unselected, why do I want to come to you?

- Celestia

I have written a lot of introductions about Celestia before, and it is also a very promising project at present. It is a completely different way of playing, neither App-chain nor smart contract chain. Simply doing the DA layer of Rollup can be regarded as a new school in the public chain field.

Celestia almost single-handedly stoked the concept of modular public chain. This kind of project that comes to mind directly when a concept is mentioned is usually top-notch. The problems faced by Celestia are mainly the following two points?

Is a DA chain solely used to serve other Rollups really necessary, or just needed?

The second is When? ? The concept, which has been fired for almost a year, is that mules and horses have to be pulled out and yoked. When can everyone see it, or really start serving a certain Rollup, it is the kingly way. The current news is that the mainnet will be launched in 2023. . It is common for such relatively technologically innovative projects in the circle to lag behind Roadmap, so for Celestia, we still have to wait patiently.

Defi Three Axes and Oracles – Dex, Borrowing, Stable Token + Oracle

- DEX – Osmosis

Basically, the Dex on Cosmos is dominated by the Osmosis family, which is stronger than the Uniswap family on the ETH side.

It is very interesting that Cosmos officially made a Gravity Dex, but it is far inferior to Osmosis in terms of interface, function and various aspects. In addition, considering the neutrality and flexibility of Cosmos Hub, this project was closed. , transferred out to become a separate chain Cresent Network, but the ending is the same, still no one uses it, almost everyone is playing on Osmosis.

- Metonymy – Kava,Umee,Mars

Borrowing is a relatively strange phenomenon in Cosmos, that is, there are no popular projects at all, there are no god-level projects such as AAVE and Compound, and it is not like the direct Osmosis family on Dex . Ecology, especially the lack of USDT and USDC, a stable token.

Kava was the first to do borrowing, but it started early in the morning to catch up with a late episode, and it has been slow to connect to IBC. As a result, an absolute head project of the original Cosmos ecosystem has been reduced to a second-tier project. Now it has become a collection Dex. , Defi Hub, which is a stable token, can only be connected to IBC in 2022!

UMEE is a borrower of the new generation , and it is also natively connected to IBC. The investment institutions include big capital such as Coinbase , and it was raised by Coinlist . A cool state may also be related to the launch of the bear market.

Mars was originally the main borrowing project on Terra. Later, after Terra collapsed, it turned to Cosmos. Seeing that Delphi Labs has written about Mars, I feel that it may be promoted by Delphi in the future to compete for the status of the first brother of the Cosmos ecosystem. Mars is currently in a stage where V1 has collapsed and V2 has not yet been launched. According to Twitter, it seems that the V2 plan rooted in the Cosmos ecosystem will be announced at the Cosmoverse Conference on the 26th, so you can keep an eye on it.

- Stable Tokens – UST, USK, CMST, USDK, Note…

The Cosmos ecosystem originally did not have a stable Token, which led to the fact that Atom was used as a currency in Osmosis at the earliest.

Later, UST came into being. After all, Terra was made with the Cosmos SDK, but it was not close to Cosmos. It was quite the feeling that his son overwhelmed Lao Tzu. Later, he finally connected to IBC, which brought a stable Token to the entire Cosmos ecosystem.

As a result, the good times did not last long, UST collapsed, and by the way, it gave a heavy blow to the Cosmos ecosystem . Then there is the chaos of the now stable Token.

Kava has made USDK based on collateral, but the application scenarios are very limited, and it can basically be used by itself, with a market value of more than 40 million.

Previously, Kujira on Terra also came to Cosmos after the collapse of Terra, and made a stable Token USK based on Atom. It has just started, and its market value is only 200,000.

Comdex imitated MakerDAO to make CMST, this market value has not been found…

Canto made a Note, which is just starting, and has not left his own project.

Therefore, although the stable Token is chaotic, there is basically no leader after the collapse of UST. At present, there are USDC and DAI on Osmosis, which basically rely on the Axelar cross-chain bridge, but I feel that the current momentum of Cosmos, It would not be too surprising to see USDT or USDC choose to issue directly on Cosmos in the next few months.

Oracle – Oracle has always been a very important part of the Defi field, and unlike Dex or borrowing, which has to be rebuilt for each chain, oracles are basically a winner-take-all situation in a multi-chain ecosystem.

In the Defi Summer of 2020, it seems that various oracles are still actively competing for market share, such as Tellor, API3, DIA, DOS, Nest, etc…. By 2021-2022, it has become the dominance of Chainlink and uses other oracles As long as there is an oracle error or problem, the project must switch to Chainlink immediately.

Cosmos actually has its own ecologically native Band Protocol, but it is completely suppressed by Chainlink. It seems that there is hope to fight Chainlink in the future. It seems that only Pyth of the Solana ecology has nothing to do with the Cosmos ecology. It is visible to the naked eye. In the future, the Cosmos ecosystem is likely to be the rhythm of Chainlink’s domination of the world.

Let’s talk about the main ecology of the public chain and Defi first. In the next article, we will talk about the bridge, NFT, derivatives, and some interesting projects unique to Cosmos, so stay tuned!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!