Liquid Collective

Liquid Collective is a protocol developed in collaboration with leaders from different industries to meet the demand for enterprise-grade liquidity collateral standards. Once widely adopted, it will improve the liquidity and composability of the web3 economy while meeting the highest level of security and compliance requirements for enterprises and institutions.

Liquid Collective is governed by an independent industry alliance, with initial members including Liquid Foundation and other web3 industry participants. The protocol will eventually offer multi-chain functionality and be managed in a decentralized manner by a broad and decentralized community of industry participants.

When users deposit into the Liquid Collective protocol, they receive an equivalent Token. This is mainly used to prove their legal and ownership rights to the underlying collateral assets and any network rewards generated, including even penalty protocol service fees and network fines, etc.

Features:

Secure and compliant: validation technology from enterprise-grade infrastructure to support customer secure collateral; mandatory KYC/AML for users and operators to support compliance.

Cross-protocol: partnering with top teams on other blockchains to provide native liquidity ownership solutions on each network.

Loss protection: providing substantial loss protection to each participant through the protocol.

Focus on providing liquidity: industry-leading integrators (i.e. exchanges and custodians) to support liquidity.

Ecosystem Structure:

Liquid Collective is an ecosystem composed of software components and service providers.

1. Software Components:

The core component of the protocol is a set of Ethereum-based smart contracts that support institutional liquidity collateral, including:

▪ ERC20 cToken contract for LsETH.

▪ Allowlist contract containing a list of addresses of whitelisted users who can make deposits and withdrawals.

▪ Operator Manager allowing node operators to manage validator keys.

▪ Oracle contract allowing arbitration reports from Oracle operators to consensus layer data.

Off-chain components:

▪ CLI command-line tool that can be used by node operators.

▪ Daemon service for Oracle operators.

▪ Various APIs to facilitate access to the protocol by whitelisted users, access various data monitoring on the protocol and notify agents, etc.

2. Service Providers:

▪ Nodes operating the validator infrastructure, Liquid Collective does not operate validator infrastructure, but delegates the task to a group of operators.

▪ Oracle operators report data from the consensus layer to the execution layer.

▪ Integrators perform KYC checks and submit user whitelist addresses, as well as provide paths for deposits and withdrawals.

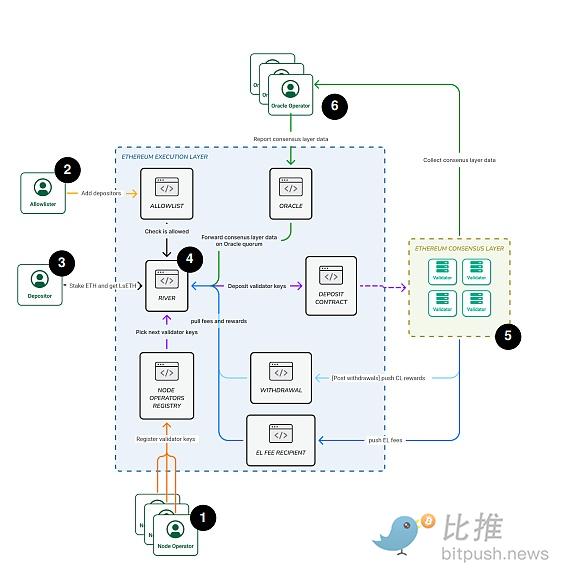

Operating Process:

1. Approved validators register validator keys with the protocol.

2. Allow listers are approved integrators, such as trading venues and custodians that perform KYC/AML checks on their users, who submit approved user addresses to the protocol’s allow list.

3. Approved user addresses listed as allowed can deposit tokens into the Liquid Collective protocol and receive LsETH as a reward.

4. The Liquid Collective protocol sends the deposited tokens to the Ethereum deposit contract and allocates approved validator keys to the collateralized tokens.

5. Validators perform validation duties and earn network rewards.

6. Oracle operators report the balance of the underlying collateral token plus any accumulated staking rewards minus any major fines, which notifies the deposit and withdrawal conversion rates of the receipt tokens, when withdrawal support is enabled on Ethereum.

Token Model:

LsETH is an ERC-20 cToken model-based receipt token on Ethereum. When a user deposits ETH into the Liquid Collective protocol, they receive LsETH, which proves their legal and beneficial ownership of the deposited ETH, as well as any network rewards, penalty protocol service fees, and network fines (if any) associated with the deposited ETH.

LsETH implements the cToken model, which uses a floating conversion rate (also known as the protocol conversion rate) between receipt tokens and collateral tokens to reflect the value of accumulated network rewards, penalties, and fees associated with collateral tokens. The conversion rate refers to the amount of ETH that LsETH can be converted into. The conversion rate is independent of the market price at which ETH or LsETH is traded on the open market.

The Oracle network reports a new ETH balance from accumulated network rewards or fees at least once every 24 hours. The conversion rate is calculated by dividing the total balance of ETH by the total supply of LsETH. If the accumulated network rewards are greater than penalties and fees, the protocol conversion rate will increase to reflect the net network rewards collected by the protocol. Due to the design of the cToken, the conversion rate of LsETH may fluctuate.

Conclusion

Due to multiple cryptocurrency company defaults in 2022, the trust in CEX and CeFi lending services is at an all-time low both inside and outside the industry. Market participants are becoming increasingly cautious and are more inclined towards stable and conservative financial products. Therefore, encrypted financial services need to release more structured products that guarantee principal protection to meet these needs and maintain their current level of operations.

LSD is a good option, especially with the development and release of more enterprise-level liquidity collateralization protocols in 2023. Alluvial, the developer of enterprise-level LSD protocol, has just caught this trend and received a total of $18.2 million in seed and Series A funding for protocol and team development.

The rapid growth of cbETH and rETH this year indicates that there is significant room for growth in liquidity collateralization businesses, and the new enterprise-level protocol, Liquid Collective, may also benefit from Lido’s share of the market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!