From June 20th to 24th, I was invited by the Monetary Authority of Singapore (MAS) to attend the first “Inclusive FinTech Forum” held in Kigali, the capital of Rwanda, and stopped in Singapore and Dubai for a few days on the way back and forth, for a total of two weeks, which happened to turn a half circle along the northern edge of the Indo-Pacific region. Before I went, I heard people analyze that the real opportunity for blockchain in the real economy, or in other words, the true opportunity for blockchain, is not in the United States, Europe, or East Asia, but in Africa, the Middle East, and Southeast Asia, which is precisely the Indian Ocean Rim region, also known as the Indo-Pacific region. Although these analyses are also well-founded, for me, they are just hearsay and I am skeptical of these views. As the saying goes, “it is better to travel ten thousand miles than read ten thousand books,” I have gained some intuitive feelings by running a trip in person, and have also thought more about the development prospects of blockchain in the Indo-Pacific region, so I would like to share my main views through this article. Of course, a short two-week trip is not enough to draw any profound conclusions, and is only for industry reference, and criticism and different opinions are welcome.

1. Background

The reason why I was able to participate in the “Inclusive FinTech Forum” this time is that Solv Protocol and our ecological partner Unizon Blockchain Technology (UBT), which was incubated in Australia, were invited by MAS to sponsor and participate in the forum. As a representative of Solv, I departed from Melbourne, Australia, and arrived in Kigali, the capital of Rwanda, on the morning of June 20th, via Singapore and Dubai. During my time in Kigali, I co-hosted a sub-forum on the application of ERC-3525 in the real world asset (RWA) industry with Belle Lou and Chong Ren from UBT, gave an exhibition speech, participated in two roundtable forums, and communicated with the Deputy Governor of the National Bank of Rwanda, the Chief Financial Technology Officer of MAS, as well as central bank officials and entrepreneurs in countries such as Ghana, Cambodia, Nigeria, and Kenya, and visited the Kigali Genocide Memorial, and spent a whole day visiting Akagera National Park in Rwanda, walking around the rural areas of this country, which can be said to be quite a harvest.

The Inclusive FinTech Forum is a government and industry summit initiated by the Monetary Authority of Singapore (MAS). In my opinion, the main purpose is to bring together financial officials, bankers, and entrepreneurs from developing countries to explore how financial technology innovation can provide financial services to SMEs and ordinary people in these countries and help them achieve rapid and sustainable economic development. Participants from Southeast Asia, South Asia, and African countries, especially sub-Saharan African countries such as Nigeria, Kenya, Tanzania, Zambia, Uganda, Ghana, and South Africa, almost all have representatives attending. The reason why this conference has such a pattern of participants is mainly due to the brand appeal of Singapore and Rwanda. As a small and resource-poor developing country, Singapore has grown into a high-income advanced economy in just a few decades, and its achievements in financial services, social governance, and technology industries have established a good image among developing countries in the Indo-Pacific, making it a model for them to learn from. After the tragedy of the Rwandan genocide in 1994, Rwanda rose from the ashes and became a model of social governance and economic development for sub-Saharan African countries in less than 30 years. The joint efforts of the governments of these two countries are indeed very attractive.This is my first trip to Africa, and I didn’t expect Rwanda to be my first destination. More than a decade ago, when I was at IBM, the company had proposed that I go to Kenya to support the African expansion strategy, but it never happened. At that time, I learned about the basic situation in Africa and felt that if I ever went to Africa, it should be to more “developed” areas like Kenya or Nigeria, and I never thought that my first landing in Africa would be in Rwanda.

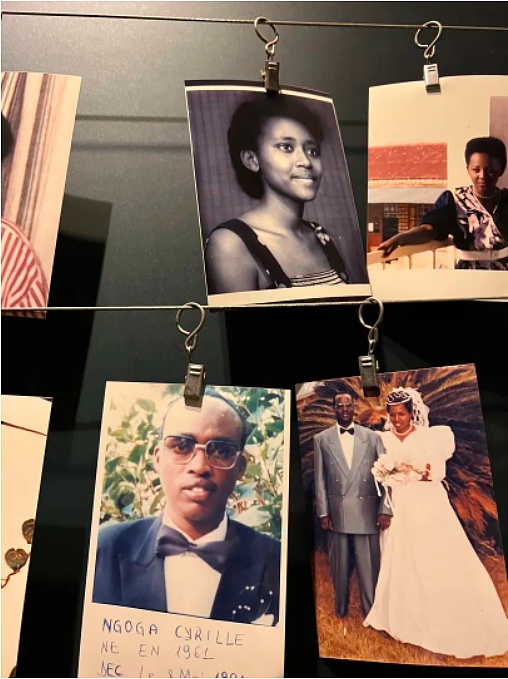

Like most people, my only impression of Rwanda was the horrific genocide 29 years ago. The Rwandan genocide occurred between April and July 1994, but by the time news of the genocide had reached my country, it was already July. Therefore, my memory of the genocide is linked to the 1994 US World Cup. In my memory, one minute the TV news program was showing exciting footage of the World Cup match, and the next minute was the gruesome sight of the bodies of the victims of the genocide. I remember that at that time, my strongest feeling about this news was not horror or sadness, but shock and disbelief. I felt that the 21st century was just around the corner, Maradona had already taken banned drugs, Baggio had already missed a penalty kick with a cannon shot, the United States had already opened an information superhighway, so how could there still be a country in the world that was engaged in racist genocide? And they killed more than one million people! It was simply unthinkable. How backward and barbaric must that place be? Many years later, I watched the movie Hotel Rwanda, which gave me some understanding of the cause and effect of the genocide, but I still didn’t feel any connection to Rwanda.

- Grayscale announces the component weights of its various funds for the second quarter of 2023.

- Zuckerberg launches Threads to take on Musk, gains 30 million registered users in 16 hours

- Analysis of Starknet’s Mid-Term Roadmap: What Will be Released in v0.12 and v0.13?

However, before I went to Rwanda this time, I had already heard many people tell me that Rwanda was the most successful country in Africa in the past 20 years, known as the “Switzerland of Africa” or the “Singapore of Africa”. But when I checked on Wikipedia, it was still a poor country with a per capita GDP of less than $1,000. How could it compare with Switzerland and Singapore?

After spending four days in Rwanda, I must say that it had a huge impact on me. I have a preliminary understanding of the reasons why Rwanda has been praised by the outside world. A comprehensive introduction to my impression of Rwanda would be a multi-thousand-word article, so here I will just briefly introduce a few points related to the theme of this article.

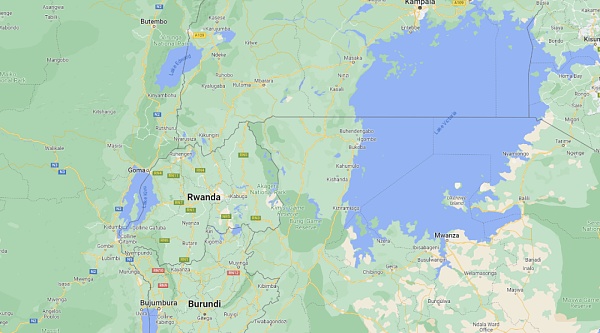

Natural conditions: Rwanda covers an area of 27,000 square kilometers and is mountainous, known as the “Thousand Hills Country”. Our most profound impression of Rwanda’s natural conditions is its excellent climate. Rwanda is close to the equator, but it is summer and the temperature is only in the teens to twenties, with a humidity of about 40, dry and cool, extremely comfortable, in sharp contrast to the humid and hot Singapore and the hot Dubai. Moreover, Rwanda has only two seasons a year, dry season and rainy season. The dry season is generally dry and cool, and the rainy season is humid and warm. In terms of climate alone, it is indeed a very suitable area for human habitation. Of course, as far as we know, large areas of nearby Kenya, Uganda, and Tanzania have similar climate characteristics, which are completely different from our impression of equatorial regions, which may be due to the climate regulation effect of the nearby Lake Victoria.

Figure 3. Rwanda is located southwest of Lake Victoria, the second largest freshwater lake in the world, close to the equator.

Population: During the Rwandan genocide, the country had a total population of 7 million. The genocide, which lasted for three months, resulted in the deaths of more than 1 million people, with another 1 million becoming refugees. The country lost more than 2 million people in just a few months. However, with the end of the war, national reconciliation, political stability, and economic development, Rwanda’s population has grown rapidly in the past 29 years, making it the main destination for immigrants from neighboring countries. Today, there are 13 million people in Rwanda. The genocide was perpetrated by the Hutu against the Tutsi. After the genocide, the Rwandan government no longer allowed the distinction between Hutu and Tutsi, and everyone became part of the unified Rwandan people. In terms of appearance, Rwandans do have some distinctive features, including a relatively high number of tall people, with men over 190 cm not uncommon. They have slender and beautiful figures, three-dimensional features, and lighter skin tones than people from southern Africa. There are many beautiful women and handsome men.

Figure 4. Photos of some of the victims in the Kigali Genocide Memorial

Economy and Infrastructure: Rwanda is an inland mountainous country with relatively scarce resources. Its main products are coffee and tea, and its GDP per capita is just over $900, roughly equivalent to China’s level in 2000. However, the actual standard of living and infrastructure are roughly equivalent to China’s in the early 1990s. The quality of roads is still good, but they are often narrow, with two lanes for two-way traffic, and a slow car can block the road for a long time. During my time in Rwanda, I experienced a power outage once, but I don’t know if it was accidental or normal. The living conditions of urban residents are roughly equivalent to those of fourth- or fifth-tier towns in China, while rural areas still have many earth houses. However, the government has launched a plan to build and provide free housing for all poor people, which is quite good. Basic medical insurance is universal. There are many cars, and the brands are not bad, but the quality of fuel is poor, and the air is filled with the choking smell of exhaust, as if I had gone back to the early 1990s in one breath.

Media, Communications, and Financial Infrastructure: Television sets are not yet widespread in Rwandan households, and desktop computers are rare, but almost every adult has a smartphone. The most popular smartphone brand in the area is Techno, a brand of Chinese smartphone manufacturer Transsion in Africa, followed by Samsung. Only a few wealthy people use Apple iPhones. The currency is the Rwandan franc, with an exchange rate of 1,160 to 1 US dollar, and it usually depreciates several points each year. In terms of payment, cash is still the primary method, followed by mobile payments. If payment is only possible by card, it may be difficult to pay in many places. ATMs can be found, but their popularity needs to be improved. The most popular mobile payment brand in the area is MoMo, and there are some competitors, such as BK launched by Bank of Kigali. M-Pesa, a famous mobile payment system in Kenya, is also popular in Rwanda. The entire country is basically covered by a 4G network, and many public places provide free WIFI. In our experience, the network speed is good.

Figure 8. Mobile payment app advertisement on the streets of Kigali

The above is my impression of Rwanda. Although it seems irrelevant to the theme, understanding its social background is essential for understanding my main points below. Of course, due to the short time, there may be bias and errors, and I hope friends who know more can point them out.

3. A Leap into Blockchain

To be honest, before the conference, I thought that the ERC-3525 digital bill technology based on blockchain that we brought with us might be a bit advanced for these Indo-Pacific countries. I thought they might as well popularize electronic payments first. But what surprised me was that our solution received a warm response. During the conference, I introduced to the audience our digital invoice pilot project developed for the Australian central bank’s CBDC. An entrepreneur from Rwanda raised his hand and said that this is what we need in Africa. A technology VC from Nigeria directly asked to establish contact with us to discuss investment intentions. An official from the Ghana central bank in West Africa asked me if the ERC-3525 technology can help African countries solve the problem of interoperability of central bank digital currencies across countries. A representative from the technology innovation department of the Cambodian central bank also invited us to discuss in-depth how to apply ERC-3525 technology in cross-border supply chains. All of these surprised me and aroused a strong interest: why are Indo-Pacific countries so keen on this cutting-edge technology?

I discussed this matter with some newly introduced African friends and Singaporean friends who know more about the Indian and Pacific markets. We reached a very important conclusion, that is, the latecomer countries in Southeast Asia and Africa are not satisfied with “catching up” in the construction of digital economic infrastructure. They do not want to repeat the path of the United States and China, but hope to directly step into the 3.0 era, which is the blockchain-based digital economy.

Why do they have such a general attitude?

If we regard the electronic payment system pioneered by the United States based on POS machines, credit cards, interbank clearing and settlement networks as digital finance 1.0, and regard the mobile internet payment system that has gained a lot of popularity in China as digital finance 2.0, then it can be said that the general state of Indian and Pacific countries is that 1.0 and 2.0 are both at a very primitive stage. As I mentioned earlier when introducing the network and financial infrastructure of Rwanda, many shops there do not have POS machines, bank cards are not popular, and payments are mainly made in cash. How should we move forward? Obviously, they do not plan to spend precious funds on “catching up” with 1.0, because most of these countries do not have enough economic volume and banking systems, and do not want to waste funds on laying POS and ATM machines, which is understandable to most people.

At the same time, although the centralized mobile payment system, which is the digital finance 2.0 mentioned above, is already very mature, there are also some problems that make these countries hesitant.

First of all, the centralized Internet payment system has a natural tendency to monopolize data. The operation center of this system can easily peek, use and control all the private data of users, and easily obtain the main operating information of an economic entity. In this case, these Indian and Pacific countries obviously do not want a centralized payment system operated by foreign companies to monopolize the domestic market. Therefore, they generally hope to support their own centralized payment system.

Secondly, the fragmented Internet payment system with many factions brings huge integration friction, which reduces the efficiency of regional cooperation. In African and Southeast Asian countries, regional economic cooperation is very active. In Rwanda, the Africans I met, whether from Rwanda, Nigeria, Kenya or Ghana, always mentioned Africa. Therefore, they have very high requirements for interoperability of payment and financial systems among each other. Throughout the entire forum, any topic or session involving the interoperability of financial systems is the most crowded, with the most active speeches, and the most enthusiastic discussions, which shows their high degree of attention to this. However, except for a few countries with a population of over 100 million, these dozens of countries are low-income economies with a population of tens of millions. If each country does well with several mini Alipay, there will be more than one hundred payment companies. Not only will it be repeated waste, but each one will not grow up, fail to form a scale effect, and will not be conducive to the deep development of digital finance. In addition, this flexible and efficient centralized payment system poses severe challenges to financial and data privacy supervision, which have not been solved in developed countries, let alone allowing Indian and Pacific countries to solve them independently.

Thirdly, blockchain makes currency programming an everyday tool. Due to the relatively simple and complete security model based on cryptography, blockchain systems can achieve a high degree of openness compared to centralized systems. In a centralized system, some operations that require multiple authorizations and layers of checks can be directly released to ordinary users on the blockchain. Currency programming is an example. In China’s Internet payment industry, even after so many years, the functions that are really released to users, such as “grabbing red envelopes” and “group collection,” are still basic applications that the platform needs to cautiously launch. Users themselves do not have the ability to program payments. However, blockchain allows anyone to program currency and payments through smart contracts, which is an openness that Internet payments cannot match and is a very attractive ability for Indo-Pacific countries. When the audience saw the ERC-3525 automatic share calculation, automatic account splitting, payment status refresh UI, payment limit and time setting functions that we demonstrated, they were very excited and hoped to customize programming and control their assets and currency flows based on this foundation.

Fourthly, blockchain can support the establishment of new regulatory mechanisms. In centralized financial technology systems, since regulators cannot directly implement supervision from the system level, all regulatory rules are some kind of gentleman’s agreement, and regulatory methods can only be targeted spot checks, glimpses into the system, which are not only expensive and slow to respond, but also very ineffective. Many people complain about the current financial regulation in developed countries, which restricts upright innovators, but is helpless against lawless behemoths. Once a trusted digital identity, digital account, and digital certificate system is established on the blockchain, regulators can implement substantive controls through smart contract code, whether it is preventive legislation, mid-term adjustment responses, or post-event evidence collection and execution. The efficiency is at least two orders of magnitude higher than today’s regulatory technology. Therefore, in this forum, digital accounts and digital certificates have also become hot topics. I talked with a Nigerian FinTech expert and asked him about his views on Nigeria’s issuance of central bank digital currency. He said that the main significance of central bank digital currency is not in payments. Those who always question the value of blockchain by grasping payment efficiency have a narrow mindset. The focus is on the popularity of central bank digital currency, which will prompt every enterprise and individual to establish a digital identity and digital account and use a digital wallet. This is the most important public infrastructure for the next generation of digital economy and financial regulation. I deeply agree with this insight.

From these four points, it is clear that the Indo-Pacific region is very conducive to the development of the blockchain industry. Therefore, it is likely that this region will become an important market for the blockchain industry in the next few years, and may even lead the development of blockchain in some aspects.

Of course, they also have obvious disadvantages, mainly the weak infrastructure, many poor people cannot use smartphones and cannot connect to the Internet. Another disadvantage is the extreme shortage of relevant talents, and there is basically no ability to develop related systems on their own, and they need to be introduced from external sources.

5. Singapore’s strategy

If there is demand, there will be supply. An organization has seen these analyses early, and that is the Monetary Authority of Singapore (MAS). Recently, the MAS has released a series of projects and white papers, which are clearly aimed at cross-border blockchain infrastructure, mainly including three plans:

The first is Project Guardian, a cross-border digital asset network, which is a digital asset network composed of multiple blockchains and traditional centralized networks as the infrastructure of the entire system.

The second is Project Orchid, which is Purpose Bound Money, a programmable digital currency. I have introduced this technology twice in the past few days. I think it is a very important technology. MAS promotes this PBM mainly to provide a new technical framework for currency payment supervision while maintaining several important attributes of the currency.

The third is Project Savanah and other digital certificate projects, which aims to provide reliable expression and confirmation of user subject identities, accounts, qualifications, transaction records, etc.

The latter two projects are actually solving regulatory issues. In fact, the reason why industrial blockchain cannot be done for a long time is not as many people say, too many restrictions, no room for hype, and no speculation. The fundamental reason is two: the account is not on the chain, and the funds are not on the chain. Once these two problems are solved, various enterprises and individuals will flock to it. In order to make the government feel at ease to guide enterprises and individuals to go on the chain, and to make traditional institutions feel at ease to move assets, funds, and business to the chain, the problem of controllability must be solved first. Because in modern mainstream economies, anti-money laundering, anti-terrorism financing, and implementation of economic and financial sanctions are all needs that cannot be bypassed, and it can also be said to be the biggest difference between crypto infrastructure and industrial blockchain. If these two plans of MAS can be promoted, on the one hand, the management ability of accounts will be established, and on the other hand, the management ability of money will be established. Basically, the short board of industrial blockchain will be made up, and there will be hope for account and fund on-chain.

It is clear that this whole plan by MAS is not designed for itself. Singapore has a population of 6 million, while the scale and scope of this plan is based on a billion people. I believe that Singapore has learned from the lessons of the past decade of failed attempts to develop industrial blockchain, and has taken the lead in developing a systematic, structured strategy for the development of blockchain and digital economic infrastructure in the Indo-Pacific region.

It makes me think that if China could implement a similar strategy in 2019, taking advantage of policy winds to lead the orderly construction of infrastructure, account systems, programmable currencies, and regulatory technology, China’s industrial blockchain applications might have already taken shape and could be exported abroad. For infrastructure of this level, such as the Internet and industrial blockchain, government strategies and support can play a positive role in early system construction. Looking back at the early development history of the Internet, we can see that market mechanisms are more effective in finding innovative directions, but once the innovative direction is established, appropriate government strategies and industrial policies can accelerate industrial development.

Of course, I’m not saying that MAS will definitely succeed this time, because it takes a lot of time to make all the conditions right. Even if the infrastructure is built, it will take a lot of time to establish market liquidity. But I think MAS has found the right direction and demand in the market, and it is possible to quickly establish a value closed loop and feedback loop between technological innovation, infrastructure construction, and application markets, leading the industry to achieve rapid development through rapid iteration and leading other regions in the world.

I have communicated with many Singaporean friends and learned about Singapore’s positioning as the center of the future digital economy world. Because of its small land area, Singapore’s physical economy has little room for further development. However, in the digital economy, Singapore’s physical space will no longer be a limitation, but an opportunity to become a major player in the global digital economy, which is Singapore’s ambition.

With a clear demand and Singapore taking the lead, I now believe that the Indo-Pacific region will become a hot spot for the development of the blockchain industry. This market should bring rare opportunities for industry colleagues who are committed to using blockchain to create real economic value.

The selected text is an HTML code which contains an empty paragraph tag.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!