Bitcoin broke through 31,000 two weeks ago and then fell back to around 29,000. It seems difficult to earn high returns by speculating in cryptocurrencies, but new projects are emerging and project teams are still working hard. At this time, we need to change our perspective and shift our focus to the new projects themselves. BlockBeats has compiled a list of recent DeFi projects worth paying attention to, and there may be the next Alpha among them:

Pound Swap

Pound Swap is a community-driven ve(3,3) liquidity book DEX built on zkSync, providing a powerful trading platform for DeFi liquidity and token swaps. As a branch of Trader Joe Liquidity Book, Pound Swap is similar to Traderjoe LB in design and functionality, providing users with a zero-slippage, capital-efficient AMM solution. Pound Swap is the first DEX to combine ve(3,3) with Liquidity Book, and it is also the first attempt to combine LB with ve(3,3), hoping to provide a fairer and more efficient solution for liquidity management and token incentives. Pound Swap is not yet online, and you can follow its progress.

The features of Pound Swap are:

- Understanding Community Culture from an Awakening Individualism Perspective

- Flashbots Open-source MEV-Share Node

- Rook DAO Dissolution Incident Review What Lessons Can Be Learned?

– Zero Slippage: Traders can swap tokens with zero slippage on the platform.

– Surging Pricing: LPs earn additional dynamic fees during market volatility.

– High Capital Efficiency: The liquidity book can support large-volume trades with low liquidity requirements.

– Flexible Liquidity: LPs can build flexible liquidity allocations according to their own strategies.

Mori Finance

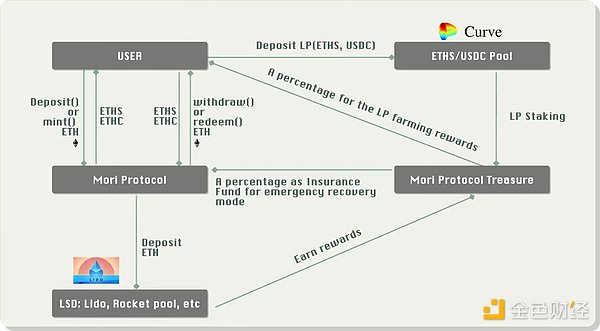

Mori Finance is a next-generation native stable asset DeFi protocol on Ethereum. It generates low-volatility stable assets by collateralizing ETH without causing any loss. In addition, users can choose to create asset derivative tokens (ETHS, ETHC) as hedging assets against ETH price fluctuations, allowing them to hold long positions in ETH for free without facing liquidation risks. It is currently in the testnet stage.

Previously, there were stablecoins pegged to ETH, such as LUSD, but these stablecoins had limitations in capital efficiency and scalability, lagging behind fiat-backed stablecoins in terms of volume. Mori Finance divides the volatility of ETH into low-volatility stable assets and high-volatility derivative assets. Taking ETH as an example, users can choose to hold high-volatility ETHC (ETH Coin) assets and low-volatility ETHS (ETH Stable) assets based on their risk preferences.

ETHS is a stablecoin token backed by ETH, which minimizes asset volatility and is a low-volatility token. In addition, it can earn additional LP (ETHS/USDC) income. ETHC, on the other hand, is designed as a leveraged long ETH perpetual token, which can be used for leveraged long positions in ETH without forced liquidation. This token also has an emergency control mode that can reduce the leverage multiplier of ETHC.

The current protocol only supports stETH as collateral. Users can decide the ratio of splitting your ETH into ETHC and ETHS. The price of ETHS fluctuates by 10% of ETH’s price. For example, if ETH increases by 10%, then ETHS increases by 1%.

Zephyr Protocol

Zephyr Protocol is a stablecoin protocol that combines the privacy of Monero and the 3-token model. The 3 tokens are:

– ZEPH (base token)

– zephUSD (algorithmic stable token)

– zephRSV (reserve token)

ZEPH can be obtained through mining and is used to over-collateralize zephUSD (with a factor of 400%) with a supply limit. The disadvantage of ZEPH is its “low availability” and can only be purchased on Seven Seas. To some extent, this is also part of its “privacy”. The protocol is currently in the testing phase. Zephyr inherits the privacy features of Monero and highlights decentralized, privacy-focused stablecoins. The concept of this protocol is inspired by “Djed, the first decentralized stablecoin on Cardano”. To bridge the gap between privacy and stability, Zephyr utilizes the mechanism of Djed Protocol while combining the powerful privacy features of Monero. It is also the industry’s first privacy-focused over-collateralized stablecoin, representing a major leap in the development of cryptocurrencies.

Galador

Galador is a DEX built on the Mantle network. Its goal is to provide the most liquid market for DeFi infrastructure, traders, LP, DAO treasury, and developers based on the Mantle network. Unlike traditional DEXs, this protocol focuses on providing customized methods for liquidity types with a priority on composability.

The features of Galador after its mainnet launch include:

– Dual AMM models, supporting volatile (UniV2) and stable asset (Curve-like) swaps

– Concentrated liquidity to achieve higher capital efficiency

– LPs provide liquidity and earn platform token GLDR

– Earn mining rewards and platform revenue by staking platform tokens

Currently, Galador supports the Mantle testnet and is preparing to launch as one of the DEXs on the upcoming Mantle mainnet Alpha. The token has not been issued yet, but users can prepare in advance to swap and provide liquidity on its network for potential future benefits.

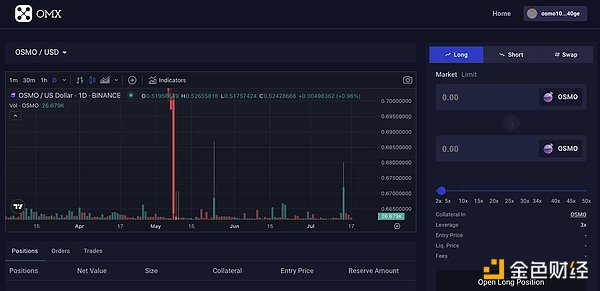

OmxLab

OmxLab is one of the newer projects. Its social media was launched in July. Similar to GMX, Omx is a fork of GMX. Its notable features include supporting up to 50x leverage trading with zero slippage. The reason worth paying attention to is that this DEX is built on Osmosis and aims to transform Osmosis into a comprehensive “universal trading hub” to improve capital efficiency and provide a seamless trading experience for Osmo users.

The trading functions are as follows:

Trading: Zero price impact on trades, up to 50x leverage, zero interest differential on blue-chip assets, and no counterparty risk environment;

Integration: OMX seamlessly routes liquidity between margin trading, IBC-supported DEX, and EVM-based DEX, ensuring optimal asset utilization;

Liquidity: Experience unified liquidity depth in various multi-chain networks in the Cosmos and EVM ecosystems, including support for wallets like Metamask;

Chains: OMX will initially be deployed on Osmosis and Polygon, with potential expansion to more chains in the future.

In addition, OmxLab is also the winning project in the first Delphi Labs hackathon and currently supports the Keplr wallet, with DEX supporting 4 tokens: BTC, ETH, ATOM, and OSMO.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!